Stablecoin Adoption Accelerates in 2025 as Illicit Activity Hits Lows

CROSS/USDT

$944,653.22

$0.10413 / $0.09857

Change: $0.005560 (5.64%)

+0.0050%

Longs pay

Contents

Stablecoin adoption in 2025 reached new heights, with transfer volumes exceeding $4 trillion amid a 60% drop in illicit activity, according to TRM Labs’ Crypto Adoption and Stablecoin Usage Report. This growth highlights a shift toward retail-driven usage in regulated environments, signaling a maturing market for everyday finance.

-

Stablecoin volumes surged to over $4 trillion in 2025, the fastest growth since 2021.

-

Illicit stablecoin activity declined by 60% year-over-year, driven by global regulations.

-

Retail users now lead adoption, with strong gains in emerging markets and U.S. returns, per TRM Labs data.

Discover how stablecoin adoption in 2025 is transforming global finance with surging volumes and declining illicit use. Explore retail-driven growth and regulatory impacts in this TRM Labs report analysis. Stay informed on crypto’s future today!

What is Driving Stablecoin Adoption in 2025?

Stablecoin adoption in 2025 has accelerated dramatically, fueled by retail investors and enhanced regulatory frameworks worldwide. Transfer volumes topped $4 trillion, marking the sector’s strongest expansion since 2021, as reported by TRM Labs in their Crypto Adoption and Stablecoin Usage Report. This surge reflects a transition from institutional dominance to widespread retail participation, particularly in emerging markets where stablecoins serve as reliable stores of value against inflation.

The report underscores how stablecoins are evolving from niche crypto tools into essential components of global payments and savings. With illicit activity plummeting to multi-year lows, the asset class is gaining trust among everyday users, enabling seamless cross-border transactions and hedging against economic instability.

How Has Illicit Stablecoin Activity Declined in 2025?

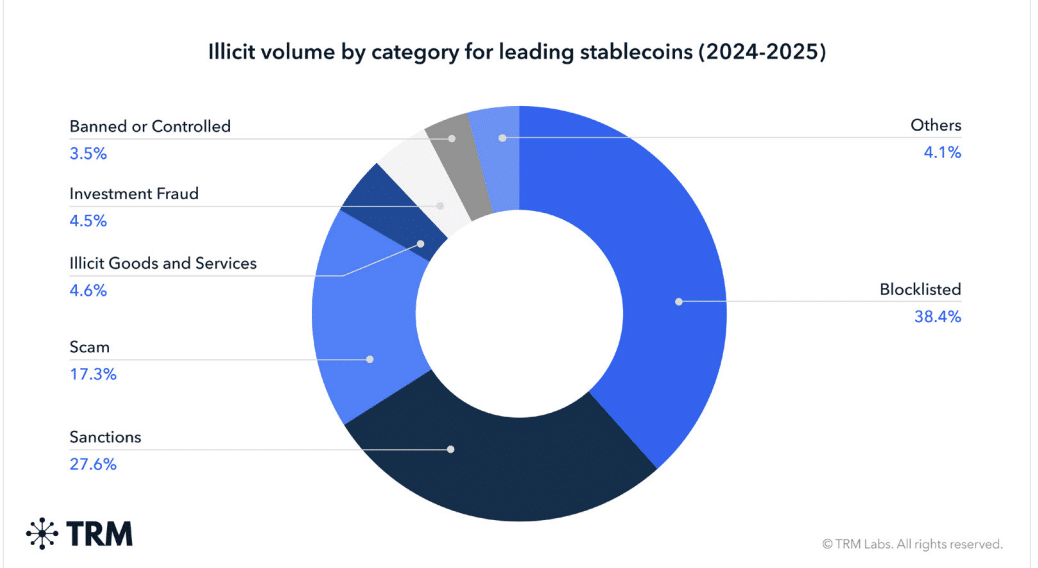

Illicit stablecoin activity dropped by approximately 60% year-over-year in 2025, even as overall volumes reached unprecedented levels. TRM Labs attributes this decline to two key factors: intensified global enforcement efforts and the proliferation of regulated issuers backed by reserves. In previous years, rising stablecoin usage often correlated with spikes in fraud, sanctions evasion, and money laundering; however, this cycle shows a clear divergence.

Regulatory advancements, such as the European Union’s MiCA framework and similar initiatives in Hong Kong, Singapore, the UAE, and the UK, have restricted illicit actors’ operational spaces. These measures ensure greater transparency and compliance, with stablecoins now primarily issued by entities adhering to strict oversight. For instance, TRM Labs’ analysis indicates that only a fraction of transactions—less than 0.15%—involved illicit flows in 2025, compared to higher rates in prior periods. This data supports a narrative of maturation, where enhanced blockchain analytics tools further deter misuse by improving traceability.

Source: TRM report

Experts like those at TRM Labs emphasize that this cleanup enhances the sector’s appeal to mainstream finance. As more jurisdictions implement stablecoin-specific rules, the ecosystem becomes less hospitable to bad actors, fostering legitimate innovation.

Frequently Asked Questions

What Factors Are Boosting Retail Stablecoin Adoption in 2025?

Retail stablecoin adoption in 2025 is propelled by U.S. investors re-entering the market after a two-year hiatus, alongside surging demand in emerging economies for savings and payments. TRM Labs reports highlight stablecoins replacing volatile local currencies in inflation-prone regions, with user acquisition on consumer platforms driving over 70% of the growth in trading volumes.

Why Are Stablecoins Becoming Essential for Everyday Finance?

Stablecoins are ideal for everyday finance because they offer price stability, low-cost transfers, and accessibility via blockchain networks. In 2025, their integration into fintech apps has simplified remittances and small payments, making them a practical alternative to traditional banking, especially in underserved areas.

Key Takeaways

- Accelerated Growth: Stablecoin transfer volumes exceeded $4 trillion in 2025, reflecting the fastest adoption pace since 2021 and positioning them as core crypto infrastructure.

- Decline in Risks: Illicit activity fell 60%, thanks to regulations like MiCA and advanced monitoring, creating a safer environment for users.

- Retail Leadership: Everyday users, particularly from emerging markets, are driving this expansion—consider integrating stablecoins into your financial strategy for efficient cross-border needs.

Conclusion

Stablecoin adoption in 2025 marks a pivotal shift toward a regulated, retail-powered ecosystem, with illicit activity at historic lows and volumes soaring past $4 trillion. As frameworks like MiCA solidify global standards, stablecoins are transitioning into vital tools for everyday transactions and value preservation. Looking ahead, this trajectory promises to integrate digital assets deeper into mainstream finance, offering opportunities for users worldwide to engage securely—explore how these changes could benefit your portfolio today.

Illicit Stablecoin Activity Collapses Even as Volumes Surge

Global stablecoin adoption hit an inflection point in 2025. According to TRM Labs’ latest Crypto Adoption and Stablecoin Usage Report, the asset class is now growing at its fastest pace since 2021—yet illicit activity tied to stablecoins has collapsed to multi-year lows. The findings reveal a market that is expanding rapidly, formalizing quickly, and increasingly powered by retail users rather than institutions.

Stablecoin transfer volume rose to more than $4 trillion in 2025, marking one of the strongest growth periods on record. Despite that surge, illicit use of stablecoins fell by roughly 60% year-over-year, according to TRM Labs. This trend contrasts sharply with prior cycles, when rising stablecoin usage often moved in lockstep with increases in fraud, sanctions evasion, and money-laundering flows.

TRM attributes the decline to two structural changes: enhanced global enforcement and the rise of regulated, fully backed issuers. As more jurisdictions bring stablecoin frameworks online—including the EU through MiCA and regions like Hong Kong, Singapore, the UAE, and the UK—illicit actors have fewer places to operate without scrutiny. This regulatory momentum not only curbs risks but also builds confidence among users, encouraging broader participation.

Retail—Not Institutions—Is Powering the 2025 Crypto Rebound

One of the report’s most striking findings is that retail traders drove most of the growth in crypto activity this year, reversing the institutional-first cycle of 2022–2024. TRM highlights strong user acquisition and rising trading volumes across consumer platforms, supported by U.S. retail returning to the market after two years on the sidelines, a sharp rise in emerging-market usage particularly for savings and payments, and stablecoins replacing local currencies in inflation-hit economies.

This shift places stablecoins at the center of a more grassroots revival, where individuals use digital dollars for daily commerce, cross-border transactions, and value storage—not just speculative trading. In regions facing economic volatility, such as parts of Latin America and Africa, stablecoins provide a stable alternative to depreciating fiat, enabling users to preserve wealth and conduct efficient payments without relying on slow banking systems.

The “Everyday Finance” Phase Arrives

Stablecoins now underpin much of global crypto activity, and their use cases are widening. Retail users increasingly prefer stablecoins for remittances, small payments, and as a hedge against unstable domestic currencies. Meanwhile, fintech platforms and payment intermediaries are integrating stablecoins at record speed, expanding legitimate on-chain transaction flows.

Because stablecoins operate across open networks, adoption in one region accelerates activity elsewhere—creating a reinforcing global feedback loop. TRM describes this moment as a “transition phase,” where stablecoins move from speculative crypto infrastructure into core financial infrastructure for everyday users. This evolution is evident in the rise of stablecoin-based apps for e-commerce and peer-to-peer transfers, democratizing access to reliable financial services.

A Cleaner Market Signals a More Mature Cycle

The combination of falling illicit flows and rising retail participation points to a market becoming structurally healthier. Stablecoins are no longer seen as opaque, high-risk liquidity tools. Instead, they are becoming regulated, traceable, widely used instruments that appeal to both consumers and compliant institutions.

The report suggests that this dynamic will shape the direction of crypto heading into 2026. If retail demand continues to expand and regulated issuers remain dominant, stablecoins could become one of the most important global payment rails of the next decade. Industry observers, including analysts from TRM Labs, note that this maturity could attract even more institutional interest once compliance barriers fully align.

Final Thoughts

- Stablecoin usage is accelerating on a global scale, while illicit activity is dropping sharply, signaling a more mature and regulated market.

- Retail demand—rather than institutional capital—is now driving the adoption of stablecoins, reshaping the growth trajectory of the crypto industry heading into 2026.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026