Stablecoin Outflows Slow Down: Binance Dominance

BTC/USDT

$15,625,149,390.75

$70,126.67 / $68,000.00

Change: $2,126.67 (3.13%)

-0.0011%

Shorts pay

Contents

Stablecoin Outflows Slowing Down: Capital Consolidation

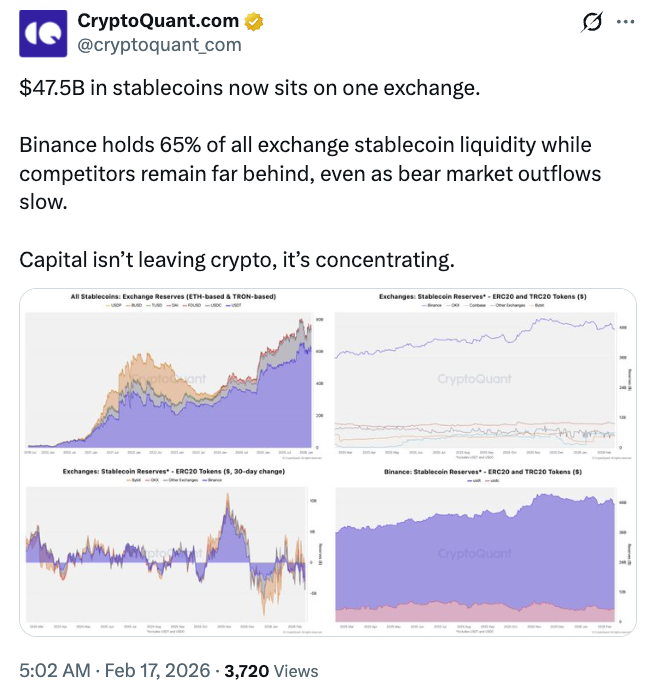

According to CryptoQuant data, stablecoin outflows from centralized exchanges (CEX) have sharply slowed down, dropping to just 2 billion dollars in the last month; compared to 8.4 billion dollars at the start of the bear market, a moderate picture has formed. The market data provider states that investor capital is consolidating rather than leaving the crypto sector, particularly concentrating on Binance alongside BTC detailed analysis. Binance holds 65% of the total USDT and USDC reserves, which is 47.5 billion dollars; this figure has increased by 31% compared to a year ago.

Source: CryptoQuant

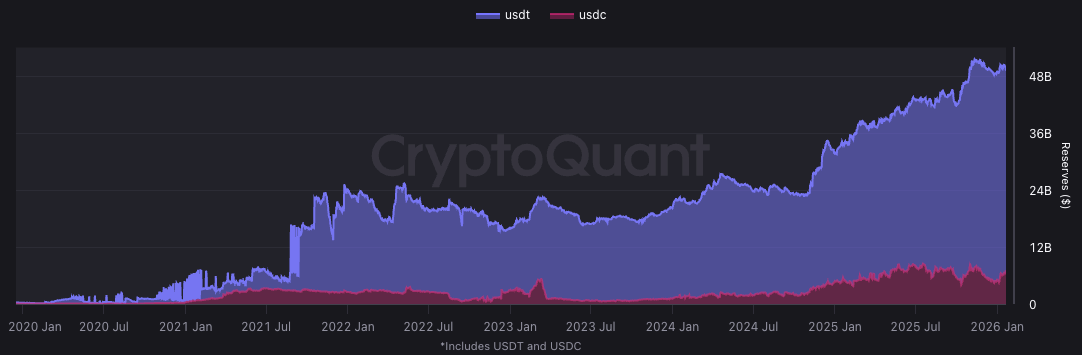

Binance's reserves are predominantly USDT: 42.3 billion dollars USDT against 5.2 billion dollars USDC, with USDT liquidity rising 36% annually. OKX is second with 13% and 9.5 billion dollars, Coinbase with 8% and 5.9 billion dollars, and Bybit follows with 6% and 4 billion dollars. CryptoQuant emphasizes that capital is not leaving crypto but concentrating. Bitcoin (BTC) is currently trading at 67.230 dollars, with the bottom level indicated around 55,000 dollars.

Binance USDT and USDC reserves since January 2020. Source: CryptoQuant

BTC Technical Outlook: Supports and Resistances

- Price: 67.230 USD (-1.79% 24h)

- RSI: 35.06 (Oversold)

- Trend: Downtrend, Supertrend: Bearish

- Supports: S1 65.423 USD (Strong, 70%), S2 60.000 USD

- Resistances: R1 70.139 USD (Strong, 80%), R2 83.623 USD

Consolidation signals are strengthening in the BTC futures market.

BTC Sector News: Mining and Institutional Moves

Bitcoin mining company Hive reported a net loss of 91 million dollars due to accelerated depreciation but increased its hash rate. Metaplanet recorded a 619 million dollar loss in BTC valuation but raised its assets to 35.102 BTC. These developments confirm that capital remains focused on BTC detailed analysis.