State Street: Is the Dollar Decline a Catalyst for BTC?

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

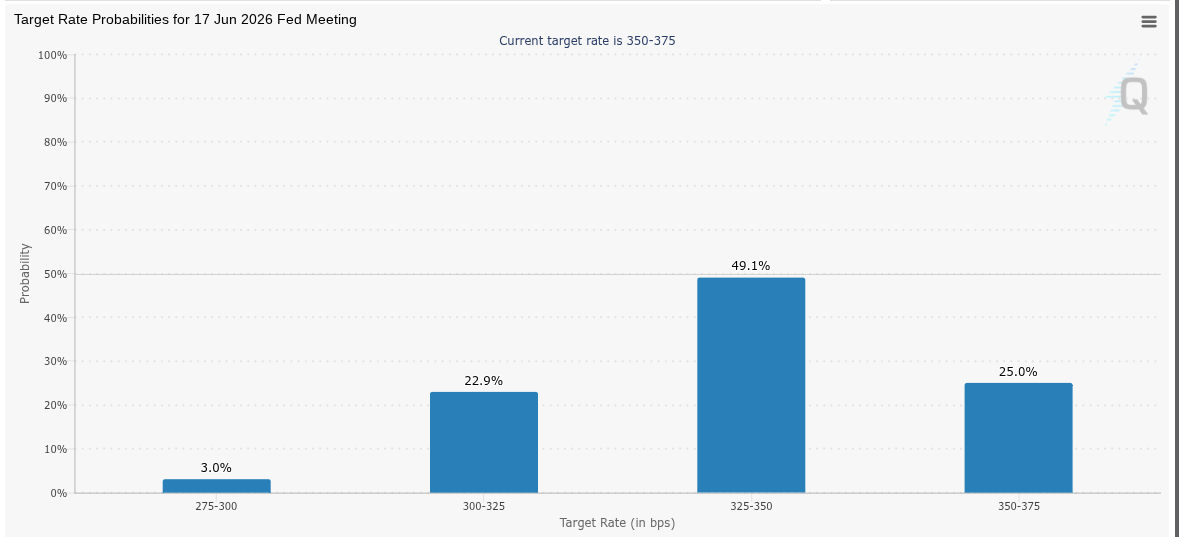

State Street strategists, as one of the world's largest asset managers, stated that the US dollar could deepen its worst period in the last decade if the Federal Reserve eases policy more aggressively than markets expect. State Street strategist Lee Ferridge, speaking at a conference in Miami, said the dollar could fall by up to 10% this year. While describing two rate cuts as a reasonable base scenario, he emphasized that risks are skewed toward more cuts and that three cuts are possible. Low interest rates could reduce the appeal of dollar-denominated assets, potentially triggering dollar sales by foreign investors through hedging. If Kevin Warsh, proposed by Donald Trump to replace Jerome Powell, becomes chairman, more aggressive cuts are expected. Markets are pricing in two cuts from the current 3.50-3.75 range according to the CME Group FedWatch Tool, with the first possibly in June.

Source: Walter Bloomberg

Critical Support and Resistance Levels for BTC

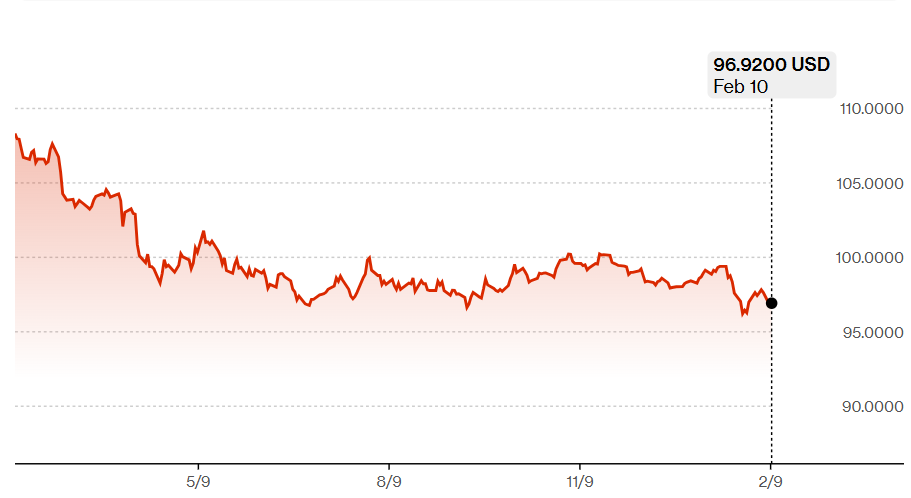

A weak dollar is seen as a catalyst for Bitcoin (BTC) and other risk assets; there is usually an inverse relationship between the US Dollar Index and BTC. The Dollar Index has recently fallen to its lowest level in four years. BTC is currently at $68,842, trading down -%2.77 in 24 hours. RSI at 31.90 is in the oversold region, downtrend continues.

- Supports: S1: $62,148 (⭐ Strong, -%9.69 distance), S2: $65,785 (⭐ Strong, -%4.40)

- Resistances: R1: $70,217 (⭐ Strong, +%2.04), R2: $73,808 (⭐ Strong, +%7.25)

June’s FOMC meeting is likely to see the first of two rate cuts this year. Source: CME FedWatch

The US Dollar Index recently touched a four-year low. Source: Bloomberg

Dollar decline can loosen financial conditions and increase global liquidity. On February 9 ETF flows, BTC ETFs saw 144.9 million dollars net inflows, ETH ETFs 57 million dollars. Goldman Sachs's holdings of 1.1 billion dollars BTC and 1 billion ETH confirm institutional demand. Click for detailed BTC analysis.

Why Does BTC Rise with a Weak Dollar?

The relationship is not automatic; profit-taking and risk sentiment can limit it. However, ETF inflows and BTC futures support upward momentum in a weak dollar scenario.

Frequently Asked Questions About Bitcoin and Dollar Relationship

How do the Fed's aggressive cuts affect BTC? Dollar weakness increases liquidity, accelerates flow to BTC.

Where is BTC's nearest support? $62,148 strong support, if broken $65,785 could be tested.

What do ETF flows say? 144.9M$ inflow shows institutional appetite.