SUI Token Unlock May Pressure Price Amid Bearish Sentiment

SUI/USDT

$453,037,566.90

$0.9058 / $0.8262

Change: $0.0796 (9.63%)

-0.0067%

Shorts pay

Contents

The SUI token unlock releases $80.41 million worth of tokens, or 1.11% of total supply, into circulation on December 28, 2025, likely pressuring prices lower from $1.41 amid bearish market sentiment and rising supply.

-

SUI down 63.9% in current bearish phase, with sentiment poised for further decline.

-

Token unlock impacts 1.48% of circulating supply, amplifying selling pressure from early contributors.

-

$5 million net outflows from spot investors over 48 hours, per CoinGlass, signaling caution.

SUI token unlock looms with $80.41M influx, threatening price drop amid bearish trends. Discover impacts, outflows, and TVL signals for informed decisions—stay ahead in crypto volatility.

What is the SUI Token Unlock and Its Market Impact?

SUI token unlock refers to the scheduled release of locked SUI tokens into circulation, totaling $80.41 million on December 28, 2025, according to DeFiLlama data. This represents 1.11% of the total supply and 1.48% of the circulating float, likely increasing selling pressure and pushing prices down from the current $1.41 level. Early contributors receiving 0.25% or $12.58 million may accelerate exits in this bearish environment.

How Will the SUI Token Unlock Affect Price?

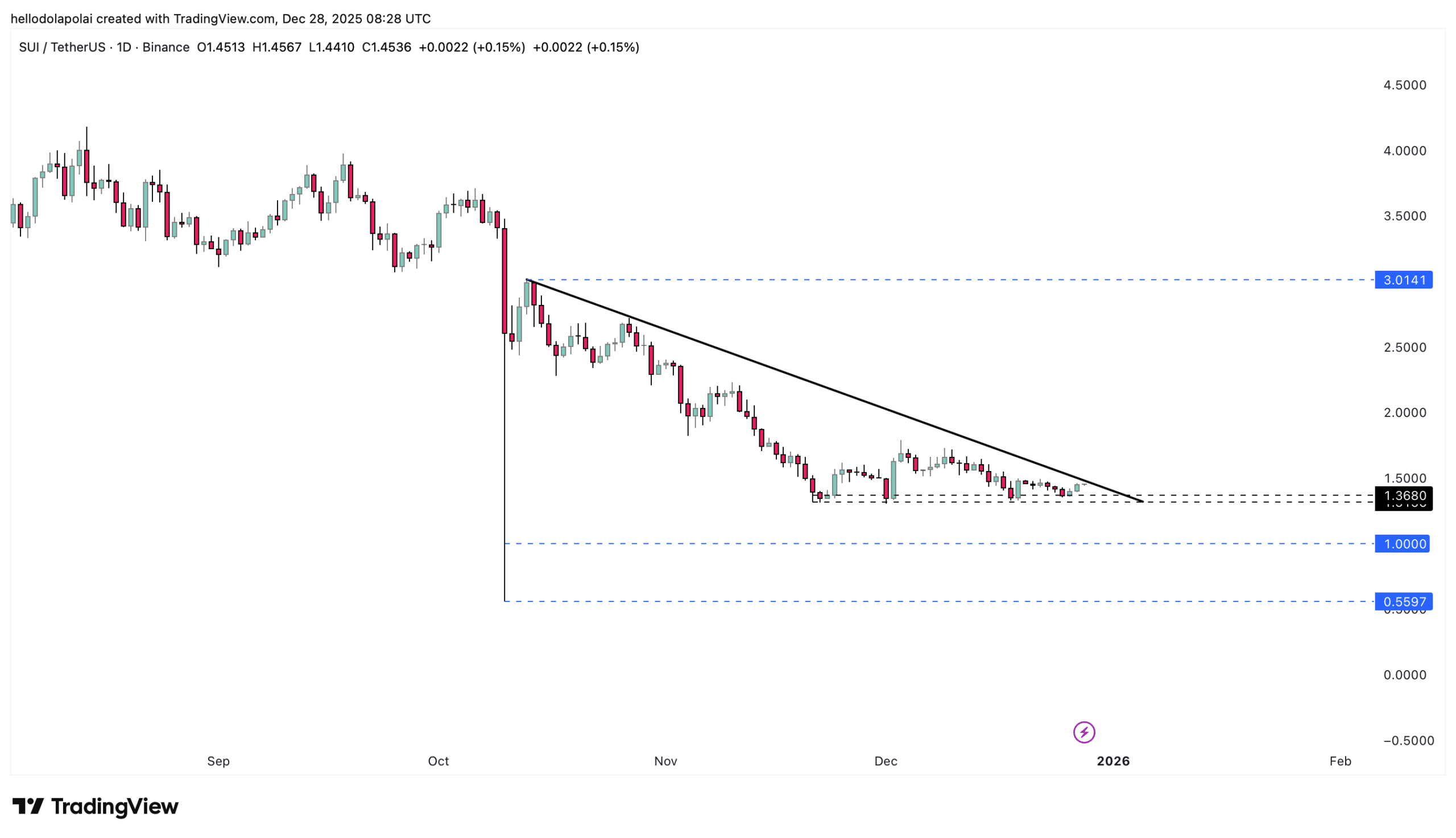

DeFiLlama indicates the unlock could amplify downward momentum, as early contributors often sell upon vesting. SUI has declined 63.9% in its bearish phase, with bears dominating. Trading volume fell 8.99% to $291.41 million despite a 3.45% daily gain, signaling weak momentum. Technicals show resistance at current levels; failure to break could target $1 support, while a breakout eyes $3.1.

Source: DeFiLlama

CoinGlass data reveals $5 million in net outflows from spot positions over 48 hours, peaking on December 27. This shift marks the first major outflow in over a week, reflecting investor caution.

Source: TradingView

Frequently Asked Questions

When is the next SUI token unlock scheduled?

The next SUI token unlock occurs on December 28, 2025, releasing $80.41 million in tokens, per DeFiLlama. This includes allocations for early contributors, potentially increasing market supply and influencing price dynamics in the short term.

Is SUI experiencing bearish pressure ahead of token unlock?

Yes, SUI faces bearish pressure with a 63.9% decline, $5 million spot outflows via CoinGlass, and declining volume. However, rising TVL to $922.25 million suggests some ecosystem strength despite unlock risks.

Key Takeaways

- SUI Token Unlock Scale: $80.41 million release equals 1.11% of total supply, heightening sell-off risks.

- Investor Outflows: $5 million net exits in 48 hours indicate growing caution among holders.

- Mixed Signals: TVL up $24.8 million to $922.25 million, but monitor resistance for breakout potential.

Source: DeFiLlama

Layer-1 blockchain Sui remains bearish, down 63.9% overall. Positive funding rates and long volumes on perpetuals suggest some bullish interest, but dominance of sellers and unlock loom large. CoinGlass notes rising long positions, yet spot caution prevails.

Conclusion

The SUI token unlock of $80.41 million underscores near-term bearish risks for Sui price, compounded by outflows and resistance challenges. While TVL growth to $922.25 million highlights ecosystem resilience, traders should watch volume and breakouts closely. Position strategically as market bias shifts post-unlock in this volatile landscape.

Comments

Other Articles

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Bitwise Seeks SEC Approval for 11 Altcoin Strategy ETFs Including Bittensor

December 31, 2025 at 05:21 PM UTC

Bitwise Seeks SEC Approval for 11 Crypto ETFs Targeting AAVE, UNI, TAO

December 31, 2025 at 01:17 PM UTC