Switzerland Delays Crypto Tax Data Sharing Implementation Until at Least 2027

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

Switzerland will enshrine the Crypto-Asset Reporting Framework (CARF) into law on January 1, 2026, but delay its implementation until at least 2027 to finalize partner countries for data sharing and ease compliance for local firms.

-

Key Delay: Switzerland postpones automatic crypto account information exchange with foreign tax authorities due to ongoing deliberations on partner jurisdictions.

-

Legislative Timeline: CARF rules become law in 2026, with first data exchanges potentially starting in 2027 or later, ensuring smoother adoption for domestic crypto businesses.

-

Global Context: Over 75 nations, including Switzerland, have committed to CARF, as per OECD records, to combat tax evasion through standardized reporting on crypto holdings.

Switzerland delays CARF crypto tax rules implementation to 2027: Learn how this global framework affects digital asset reporting and compliance for investors worldwide. Stay informed on key changes.

What is Switzerland’s Plan for Implementing the Crypto-Asset Reporting Framework?

The Crypto-Asset Reporting Framework (CARF) is an international standard developed to enhance transparency in crypto transactions by mandating the exchange of account information among participating countries. Switzerland plans to integrate CARF into its legal system on January 1, 2026, but has postponed actual implementation until at least 2027. This delay stems from the need to determine partner states for data sharing and introduce supportive amendments for local crypto firms.

How Will CARF Affect Swiss Crypto Firms and Taxpayers?

The CARF requires reporting entities, such as crypto exchanges and custodians, to collect and share details on users’ crypto holdings and transactions with tax authorities. In Switzerland, this could impact over 1,000 registered crypto service providers, based on estimates from the Swiss Financial Market Supervisory Authority (FINMA). Experts note that transitional provisions will simplify compliance, potentially reducing administrative burdens for smaller firms. For instance, a representative from the Swiss Blockchain Federation has stated, “These measures ensure that Switzerland remains a crypto-friendly jurisdiction while aligning with global standards.” Data from the OECD indicates that CARF aims to close gaps in tax enforcement, similar to how the Common Reporting Standard has facilitated over $1.5 trillion in recovered taxes since 2017. Short sentences highlight the framework’s focus: It covers assets like Bitcoin and Ethereum. Reporting starts with transaction values exceeding certain thresholds. Non-compliance could lead to penalties under Swiss law. Overall, this structured approach promotes fairness in international tax reporting without disrupting innovation.

Switzerland has delayed implementing rules that would automatically exchange crypto account information with overseas tax agencies until 2027 and is still deciding which countries it will share data with.

Crypto-Asset Reporting Framework (CARF) rules will still be enshrined into law on Jan. 1, 2026, as originally planned, but will not be implemented until at least a year later, the Swiss Federal Council and State Secretariat for International Finance said on Wednesday.

It added that the Swiss government’s tax committee “suspended deliberations on the partner states with which Switzerland intends to exchange data in accordance with the CARF,” as the reason for the delay.

The Organisation for Economic Co-operation and Development (OECD) approved CARF in 2022 as part of a global push to share crypto account data with partnered governments in a bid to curb tax evasion via crypto platforms.

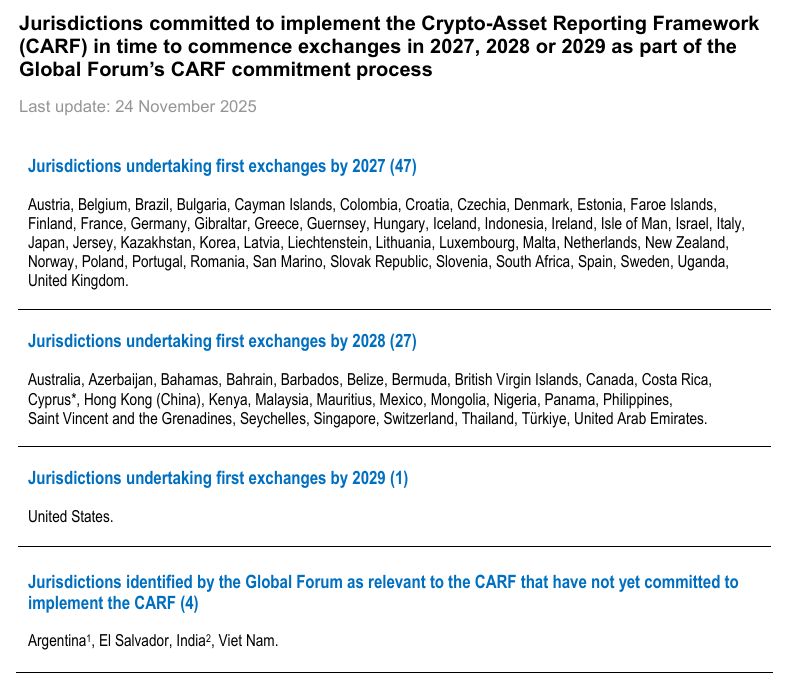

List of jurisdictions implementing CARF. Source: OECD

The Swiss government’s announcement also highlighted a series of amendments to local crypto tax reporting laws, and transitional provisions “aimed at making it easier” for domestic crypto firms to comply with CARF rules.

In June, the Swiss Federal Council had moved forward with a bill to adopt the CARF rules in January 2026, and said at the time that the first exchange of crypto account data would happen in 2027, but it’s now unclear when it plans to exchange information.

75 nations signed up to CARF

OECD documents show 75 countries, including Switzerland, that have signed on to enact CARF over the next two to four years.

Meanwhile, it has earmarked Argentina, El Salvador, Vietnam and India as countries that have yet to sign on.

Related: What happens if you don’t pay taxes on your crypto holdings?

Earlier this month, Reuters reported that the Brazilian government was weighing up a tax on international crypto transfers as part of push to align domestic rules with CARF standards.

Meanwhile, the US White House also recently reviewed the Internal Revenue Service’s proposal to join CARF as part of a push to enact more stringent capital gains tax reporting rules for American taxpayers using foreign exchanges.

Frequently Asked Questions

What Does CARF Mean for Crypto Investors in Switzerland?

The Crypto-Asset Reporting Framework requires Swiss crypto platforms to report user data to tax authorities starting in 2027, promoting transparency to prevent evasion. Investors should maintain accurate records of transactions, as this could lead to international audits. Compliance ensures alignment with global norms without immediate disruptions to trading activities.

Why Has Switzerland Delayed CARF Implementation?

Switzerland is taking extra time to select reliable partner countries for secure data exchange and to prepare local businesses through simplified rules. This measured approach, as outlined by the Federal Council, balances innovation with international commitments, making the process clearer for users worldwide.

Key Takeaways

- CARF Enactment Timeline: Laws take effect January 1, 2026, with delayed rollout to 2027 for better preparation.

- Global Participation: 75 countries join the effort, excluding nations like Argentina and India, per OECD data.

- Compliance Support: Amendments ease reporting for Swiss firms; investors should review tax obligations now for future readiness.

Conclusion

Switzerland’s decision to enshrine the Crypto-Asset Reporting Framework (CARF) into law while delaying implementation underscores a commitment to responsible crypto regulation amid global tax-sharing initiatives. By addressing partner jurisdictions and firm compliance, this move positions the country as a leader in balanced oversight. As CARF evolves, crypto investors and businesses should monitor updates from sources like the OECD to stay ahead of reporting requirements and ensure seamless international operations.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026