Tether Considers Tokenizing Equity to Boost Investor Liquidity in Valuation Talks

IMX/USDT

$9,624,905.15

$0.1666 / $0.1505

Change: $0.0161 (10.70%)

+0.0023%

Longs pay

Contents

Tether is exploring tokenization of investor equity and share buybacks to provide liquidity options for stakeholders in its stablecoin operations, aiming for a $500 billion valuation while negotiating a $20 billion funding round for a 3% stake.

-

Tether halted a shareholder’s $1 billion stake sale that implied a $280 billion valuation to prioritize upcoming funding talks.

-

Tokenized equity enhances transferability and allows use as collateral in decentralized finance platforms.

-

U.S. regulators approved tokenization of traditional assets like stocks and bonds, signaling broader adoption with nearly $700 million in tokenized public equities currently.

Discover how Tether’s tokenization of equity boosts liquidity for investors amid $500B valuation goals. Explore regulatory shifts and DeFi impacts in this in-depth analysis. Stay informed on stablecoin innovations—read now for key insights.

What is Tether doing to improve liquidity for its investors?

Tether tokenizing equity represents a strategic move by the stablecoin issuer to address liquidity needs for its investors as it pursues ambitious growth targets. The company, known for its USDT token pegged to the U.S. dollar, is evaluating options like converting investor stakes into digital tokens and implementing share buyback programs. This approach follows the blockage of a recent attempt by an existing shareholder to offload a significant portion of their holdings, ensuring stability during critical funding discussions.

In detailed reports from Bloomberg, sourced from individuals close to the negotiations, Tether is in advanced talks to secure $20 billion in new capital, which would equate to a 3% ownership slice in its core stablecoin business. This infusion values the firm at an extraordinary $500 billion, underscoring its dominant position in the cryptocurrency ecosystem. By opting for tokenization, Tether aims to make equity more accessible, allowing holders to trade fractions of shares or leverage them in blockchain-based financial services without disrupting overall company control.

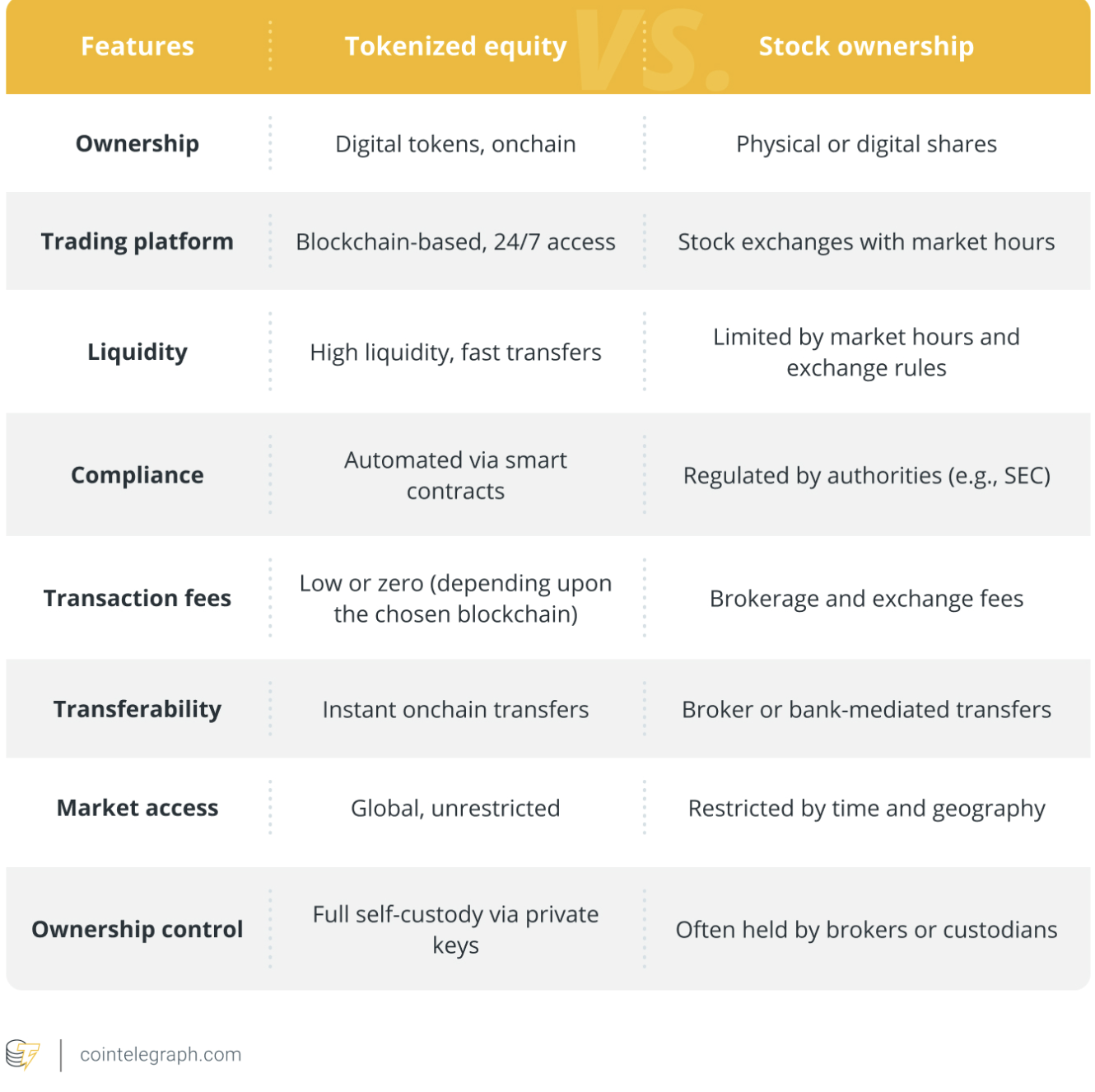

The differences between tokenized equity and shares issued through the traditional financial system. Source: Cointelegraph

Tokenization fundamentally transforms how equity is handled by digitizing ownership on blockchain networks, which facilitates faster settlements and global accessibility. Unlike traditional shares that rely on centralized exchanges and intermediaries, tokenized versions can integrate seamlessly with decentralized applications, enabling investors to borrow against their holdings or participate in yield-generating protocols. This innovation is particularly appealing for private companies like Tether, where secondary markets for shares are often illiquid.

How does regulatory approval impact tokenized assets like Tether’s equity?

The U.S. Securities and Exchange Commission recently authorized the Depository Trust and Clearing Corporation, a key player in post-trade services, to begin tokenizing a range of traditional securities including stocks, exchange-traded funds, and bonds. This development marks a pivotal shift toward integrating blockchain technology into established financial infrastructure, potentially accelerating the adoption of solutions like Tether tokenizing equity.

SEC Chair Paul Atkins emphasized the benefits, stating on Thursday, “U.S. financial markets are poised to move onchain. Onchain markets will bring greater predictability, transparency, and efficiency for investors.” This endorsement comes at a time when tokenized finance is gaining momentum, with data from RWA.xyz indicating that approximately $700 million worth of public equities have already been tokenized. Such regulatory clarity could reduce barriers for stablecoin issuers exploring similar paths, fostering innovation while maintaining investor protections.

Source: Paul Atkins

Complementing this, major financial institutions are actively participating. For instance, J.P. Morgan executed a $50 million tokenized bond issuance for Galaxy Digital Holdings on the same day as the SEC’s announcement, demonstrating practical applications in the real world. Crypto platforms are responding swiftly; Coinbase, a leading U.S. exchange, is set to reveal expansions into tokenized stocks and prediction markets, as hinted in their upcoming product livestream. These moves collectively signal a maturing landscape where tokenized assets bridge traditional finance and blockchain, potentially benefiting Tether’s liquidity strategies by increasing market confidence and participation.

From an expertise perspective, industry analysts note that tokenization addresses longstanding liquidity challenges in private markets. According to reports from CoinShares, concerns over Tether’s solvency are overstated given its substantial surplus reserves, which bolsters the case for innovative equity structures. Experts like those at financial research firms highlight that onchain equity not only streamlines transactions but also enhances compliance through immutable ledgers, aligning with evolving regulatory frameworks.

Frequently Asked Questions

What valuation is Tether targeting through its funding round?

Tether is aiming for a $500 billion valuation in negotiations for a $20 billion investment representing 3% of its stablecoin issuer business. This reflects strong investor interest in its USDT operations, with the company prioritizing controlled liquidity to support long-term growth without immediate stake sales.

How can tokenizing equity benefit stablecoin investors like those in Tether?

Tokenizing equity allows investors to easily transfer, fractionalize, and use shares as collateral in decentralized finance, improving liquidity in private markets. For Tether stakeholders, this means maintaining positions while accessing new financial opportunities, all while the company stabilizes its capital structure during expansion phases.

What role does the SEC play in advancing tokenized finance?

The SEC’s approval for the DTCC to tokenize assets like stocks and bonds paves the way for efficient, transparent onchain markets. Chair Paul Atkins has voiced support for these changes, which could integrate stablecoin innovations like Tether’s equity tokenization into broader financial systems seamlessly.

Key Takeaways

- Tether’s Liquidity Strategy: By considering tokenization and buybacks, Tether addresses investor needs amid a blocked $1 billion stake sale, valuing the firm at $280 billion pre-funding.

- Regulatory Momentum: SEC’s nod to DTCC tokenization and Atkins’ comments highlight efficiency gains, with $700 million in tokenized equities signaling early adoption.

- Industry Expansions: Moves by J.P. Morgan and Coinbase into tokenized products could enhance liquidity options, encouraging stablecoin firms to innovate responsibly.

Conclusion

Tether’s exploration of tokenizing equity and share buybacks underscores a forward-thinking approach to investor liquidity in the stablecoin sector, particularly as it eyes a $500 billion valuation. With regulatory advancements from the SEC enabling tokenized assets and institutions like J.P. Morgan leading practical implementations, the path for onchain finance appears increasingly viable. As these developments unfold, stakeholders should monitor how such innovations balance growth with stability, positioning Tether and similar entities at the forefront of the evolving cryptocurrency landscape—consider evaluating your portfolio’s exposure to these opportunities today.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026