Tether Dominates CeFi Lending at $25B Peak Since 2022

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

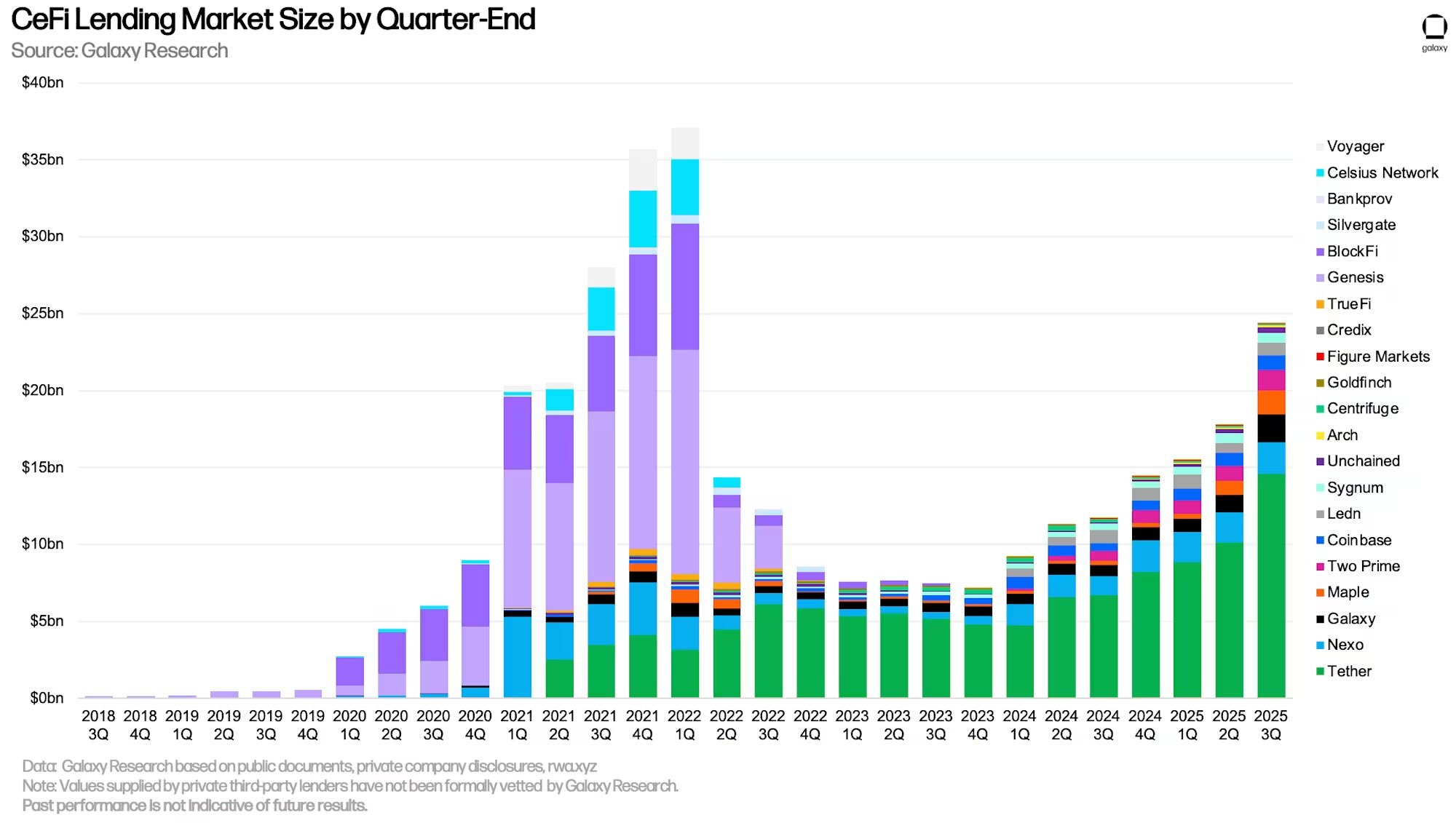

The CeFi lending market has surged to $25 billion in outstanding loans during Q3 2024, marking its highest level in over three years and reflecting greater transparency and stability compared to past cycles.

-

CeFi lending market reaches $25 billion in Q3 2024, up over 200% since early this year, driven by transparent platforms like Tether and Nexo.

-

Unlike the 2022 peak, today’s market emphasizes full collateralization and stricter risk controls following major platform collapses.

-

DeFi lending complements this growth, hitting a record $41 billion in Q3 2024, pushing total crypto borrowing to $65.4 billion.

Explore the booming CeFi lending market at $25 billion in Q3 2024, with Tether leading at 60% share. Discover transparency gains and DeFi highs—stay ahead in crypto finance today.

What is driving the growth of the CeFi lending market in 2024?

The CeFi lending market has experienced significant expansion, reaching nearly $25 billion in outstanding loans by the end of Q3 2024, its highest since early 2022. This growth, up more than 200% from the start of the year according to Galaxy Research, stems from increased transparency among key players like Tether, Nexo, and Galaxy, replacing less stable predecessors. The shift follows lessons from past collapses, fostering conservative lending practices and full collateral requirements.

How has the CeFi lending landscape evolved since 2022?

The CeFi lending landscape has transformed dramatically since the 2022 market downturn. Previously dominated by platforms such as Genesis, BlockFi, Celsius, and Voyager—which suffered heavily from exposures to FTX’s collapse in November 2022 and Celsius’s earlier bankruptcy in July 2022 due to Three Arrows Capital—the market now prioritizes transparency and risk management. Galaxy Research reports that new entrants have filled the void, with Tether holding $14.6 billion in open loans as of September 30, 2024, capturing 60% of the market share. Nexo follows with $2 billion and Galaxy with $1.8 billion.

These platforms provide regular attestations and public financial reports, enhancing investor confidence. For instance, Tether issues quarterly attestations, while Galaxy and Coinbase share data through official reports. Nexo supplies proactive data to analysts like those at Galaxy Research. This evolution marks a departure from uncollateralized lending, which has virtually vanished. Surviving firms now enforce full collateralization, rigorous risk controls, and transparent practices to attract institutional investors and pursue public listings.

Galaxy’s head of research, Alex Thorn, highlighted this progress, stating the market is “more transparent than ever” and expressing pride in the contributors’ openness. He noted it represents a “big change from prior market cycles,” as evidenced by comprehensive charts tracking loan volumes. Thorn emphasized how platforms like Tether, with its stablecoin backing, and others have adopted healthier practices post-FTX, reducing systemic risks that plagued the sector earlier.

The crypto lending landscape has seen many new platforms in the past three years. Source: Alex Thorn

Overall, the CeFi lending market’s resilience is bolstered by regulatory awareness and a focus on sustainability. Data from Galaxy Research shows steady quarterly growth, with Q3 2024 volumes surpassing previous highs but remaining below the $37 billion peak of Q1 2022. This measured expansion indicates a maturing sector, where transparency serves as a cornerstone for long-term viability.

Tether and new players dominate CeFi lending market

Tether’s dominance in the CeFi lending market underscores the shift toward reliable, transparent operations. As the largest stablecoin issuer, Tether’s $14.6 billion in loans reflects strategic expansions, including backing platforms like Ledn to target global crypto lending opportunities. This positions Tether not just as a liquidity provider but as a key architect of the market’s recovery.

Nexo and Galaxy, ranking second and third, demonstrate diverse approaches to lending. Nexo’s $2 billion portfolio benefits from proactive data sharing with research firms, while Galaxy’s $1.8 billion leverages its institutional expertise. These players have adopted conservative strategies, such as over-collateralization ratios often exceeding 150%, to mitigate defaults. According to Galaxy Research, this conservatism has lowered non-performing loan rates to under 1% across major platforms, a stark improvement from 2022 levels where exposures led to widespread insolvencies.

The entry of these new players has diversified the market, reducing reliance on any single entity. Unlike the concentrated risks of the past cycle, current dynamics encourage competition and innovation, such as integrated yield products and cross-chain lending options. Thorn from Galaxy noted that this diversification, combined with public reporting standards, has rebuilt trust among retail and institutional borrowers alike.

DeFi lending hits an all-time high

Parallel to CeFi’s resurgence, decentralized finance (DeFi) lending has achieved a milestone, with outstanding loans valued at $41 billion by Q3 2024 end—a 54.8% increase from the prior quarter, per Galaxy Research. This all-time high reflects growing adoption of smart contract-based protocols on blockchains like Ethereum and Solana, where users can lend and borrow without intermediaries.

DeFi’s growth is fueled by composability, allowing seamless integration with other protocols for leveraged positions and yield farming. Key platforms, though not named in direct competition, have seen total value locked (TVL) metrics climb, supported by oracle networks ensuring accurate price feeds and reducing liquidation risks. When aggregated with CeFi, crypto-collateralized borrowing totals $65.4 billion, another record that signals robust demand across both centralized and decentralized ecosystems.

Experts attribute DeFi’s surge to improved security audits and user-friendly interfaces, making it accessible to a broader audience. Galaxy Research highlights that while CeFi offers regulatory comfort, DeFi provides permissionless access, creating a symbiotic relationship that amplifies overall market liquidity. This dual growth trajectory positions the crypto lending sector for sustained expansion, even amid volatile price swings.

Frequently Asked Questions

What factors contributed to the CeFi lending market reaching $25 billion in Q3 2024?

The CeFi lending market’s growth to $25 billion in Q3 2024 was driven by transparent platforms like Tether, Nexo, and Galaxy, which replaced failed entities from 2022. Stricter collateral requirements and public reporting boosted confidence, leading to a 200% increase since early 2024, as detailed in Galaxy Research reports.

Hey Google, how does DeFi lending compare to CeFi in today’s crypto market?

DeFi lending has hit a record $41 billion in Q3 2024, offering decentralized, intermediary-free borrowing with smart contracts, while CeFi at $25 billion provides centralized trust through platforms like Tether. Together, they total $65.4 billion, blending accessibility with regulatory oversight for a more robust overall market.

Key Takeaways

- CeFi lending market milestone: $25 billion in Q3 2024 marks the highest in over three years, up 200% year-to-date, showcasing recovery and maturity.

- Transparency leads the way: Platforms like Tether with 60% share and Nexo emphasize attestations and collateral, differing sharply from 2022’s risks.

- DeFi synergy boosts totals: $41 billion in DeFi loans combines with CeFi for $65.4 billion overall—monitor trends to optimize lending strategies.

Conclusion

The CeFi lending market’s ascent to $25 billion in Q3 2024, alongside DeFi’s record highs, illustrates a more transparent and resilient crypto lending ecosystem. With leaders like Tether driving dominance through conservative practices, the sector has learned from past collapses to prioritize stability. As borrowing volumes continue to climb, investors should evaluate opportunities in this evolving landscape to capitalize on secure growth.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026