Thailand’s Bitkub May Pursue $200M Hong Kong IPO Amid Local Market Turmoil

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Bitkub, Thailand’s leading cryptocurrency exchange, is eyeing a $200 million IPO in Hong Kong due to local market volatility. This move aims to capitalize on Hong Kong’s booming IPO scene amid Thailand’s stock index hitting a five-year low in 2025.

-

Bitkub’s daily trading volume stands at around $66 million, per CoinGecko data.

-

Thailand’s equity market has dropped 10% this year, influenced by political tensions and trade concerns.

-

Hong Kong raised $27.8 billion from IPOs in the first 10 months of 2025, up 209% from last year, according to Hong Kong Stock Exchange figures.

Bitkub IPO Hong Kong: Thailand’s top crypto exchange plans $200M raise amid local market slump. Discover how Hong Kong’s crypto-friendly boom attracts firms like Bitkub. Stay updated on global crypto trends—subscribe for insights!

What is Bitkub’s Potential IPO Plan in Hong Kong?

Bitkub, Thailand’s largest cryptocurrency exchange founded in 2018, is reportedly planning a $200 million initial public offering (IPO) in Hong Kong as Thailand’s stock market faces significant challenges. This strategic shift comes after postponing a domestic IPO targeted for 2025 due to ongoing volatility and uncertainty in the local equity landscape. The move highlights Bitkub’s adaptability in seeking stable international opportunities to fuel its growth in the digital assets sector.

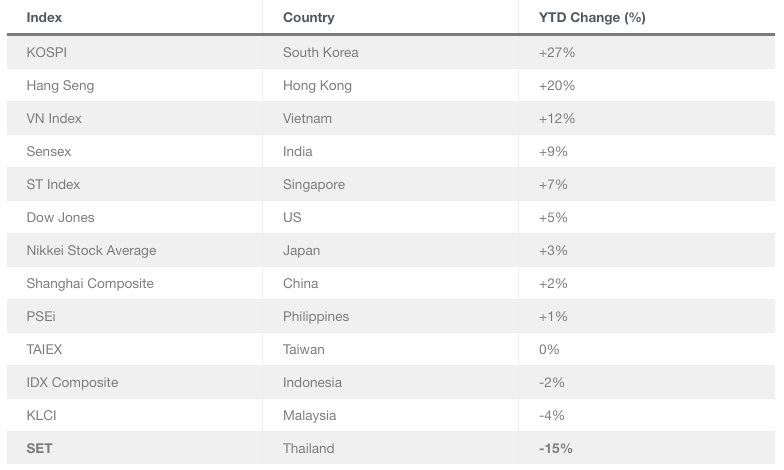

Performance of Asian stock exchanges in the first half of 2025. Source: Thailand Business News

How Has Thailand’s Stock Market Volatility Impacted Bitkub’s Strategy?

Thailand’s benchmark stock index, tracked by the Stock Exchange of Thailand (SET), has plummeted 10% in 2025, reaching a five-year low in the first half of the year amid escalating political disputes with Cambodia and emerging trade threats across Asia. This downturn has made the Thai market one of the region’s poorest performers, with foreign investors offloading equities worth over 100 billion Thai baht—equivalent to about $3 billion—in the first 10 months. Despite brief recoveries with two months of gains, the persistent sell-off has stalled plans for local listings like Bitkub’s, pushing the exchange toward more favorable venues. Experts note that such volatility underscores the risks in emerging markets, where geopolitical factors can rapidly erode investor confidence. For Bitkub, this environment has accelerated explorations into international markets that offer greater stability and access to capital.

The contrast with other Asian markets is stark. While Thailand grapples with declines, South Korea’s index surged 27% and Hong Kong’s rose 20% in the same period, drawing capital and listings away from struggling neighbors. Bitkub’s daily trading volume of approximately $66 million, as reported by CoinGecko, positions it well for an overseas debut, but the decision reflects broader trends in the crypto industry toward jurisdictions with robust regulatory frameworks and investor enthusiasm.

Thailand’s top crypto exchanges by trust store/trading volumes. Source: CoinGecko

Hong Kong’s appeal lies in its evolving status as a digital assets hub. The region has licensed several crypto firms, including institutional trading platforms, and seen high-profile entries like Bitcoin Depot, the world’s largest Bitcoin ATM operator. This supportive ecosystem, combined with simplified listing processes for non-Chinese companies, makes it an ideal launchpad for Bitkub’s expansion.

Frequently Asked Questions

What Factors Are Driving Bitkub to Pursue a Hong Kong IPO Instead of Thailand?

Bitkub’s shift to Hong Kong stems from Thailand’s volatile stock market, which hit a five-year low in 2025 due to political tensions and foreign investor outflows exceeding $3 billion. Hong Kong’s IPO market, raising $27.8 billion in the first 10 months—a 209% increase year-over-year—offers a more stable and lucrative environment for the exchange’s $200 million capital raise.

Is Hong Kong Becoming a Key Destination for Crypto Company IPOs?

Yes, Hong Kong is emerging as a prime spot for crypto IPOs thanks to its progressive regulations and booming market. Firms like HashKey Group, owner of a leading licensed exchange, have filed for listings aiming to raise up to $500 million by 2026. This trend supports institutional adoption and positions Hong Kong ahead of other Asian financial centers for digital asset growth.

Key Takeaways

- Market Volatility in Thailand: The SET index’s 10% drop and $3 billion in foreign sell-offs have derailed local IPO plans, affecting platforms like Bitkub.

- Hong Kong’s IPO Surge: With $27.8 billion raised in 2025 so far, up 209%, the exchange is attracting global firms, including crypto players seeking stability.

- Strategic Pivot for Bitkub: Targeting a $200 million Hong Kong listing allows the exchange to leverage its $66 million daily volume for international expansion—monitor updates for investment opportunities.

Conclusion

Bitkub’s prospective $200 million IPO in Hong Kong amid Thailand’s equity market struggles exemplifies the crypto sector’s resilience and global mobility. As Hong Kong solidifies its role as a digital assets powerhouse, exchanges like Bitkub are poised to benefit from enhanced liquidity and investor interest. This development signals promising horizons for cryptocurrency firms navigating regional challenges—investors should watch closely for further announcements on Bitkub’s listing trajectory.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026