TIRX Buys 15.000 BTC: Stock Surges 190%!

BTC/USDT

$21,201,579,335.94

$68,086.00 / $64,290.71

Change: $3,795.29 (5.90%)

-0.0009%

Shorts pay

Contents

Tian Ruixiang Expands BTC Treasury with 15,000 BTC

Tian Ruixiang Holdings Ltd (Nasdaq: TIRX) signed a strategic share-for-Bitcoin agreement with an anonymous global digital asset investor for 15,000 Bitcoin. At Bitcoin's approximate $75,000 price, this contribution is worth about $1.1 billion. The agreement also encompasses a strategic AI and crypto-focused partnership; a joint innovation lab will be established to develop AI-based trading and risk management tools, blockchain infrastructure, layer-2 networks, DeFi, and NFT products.

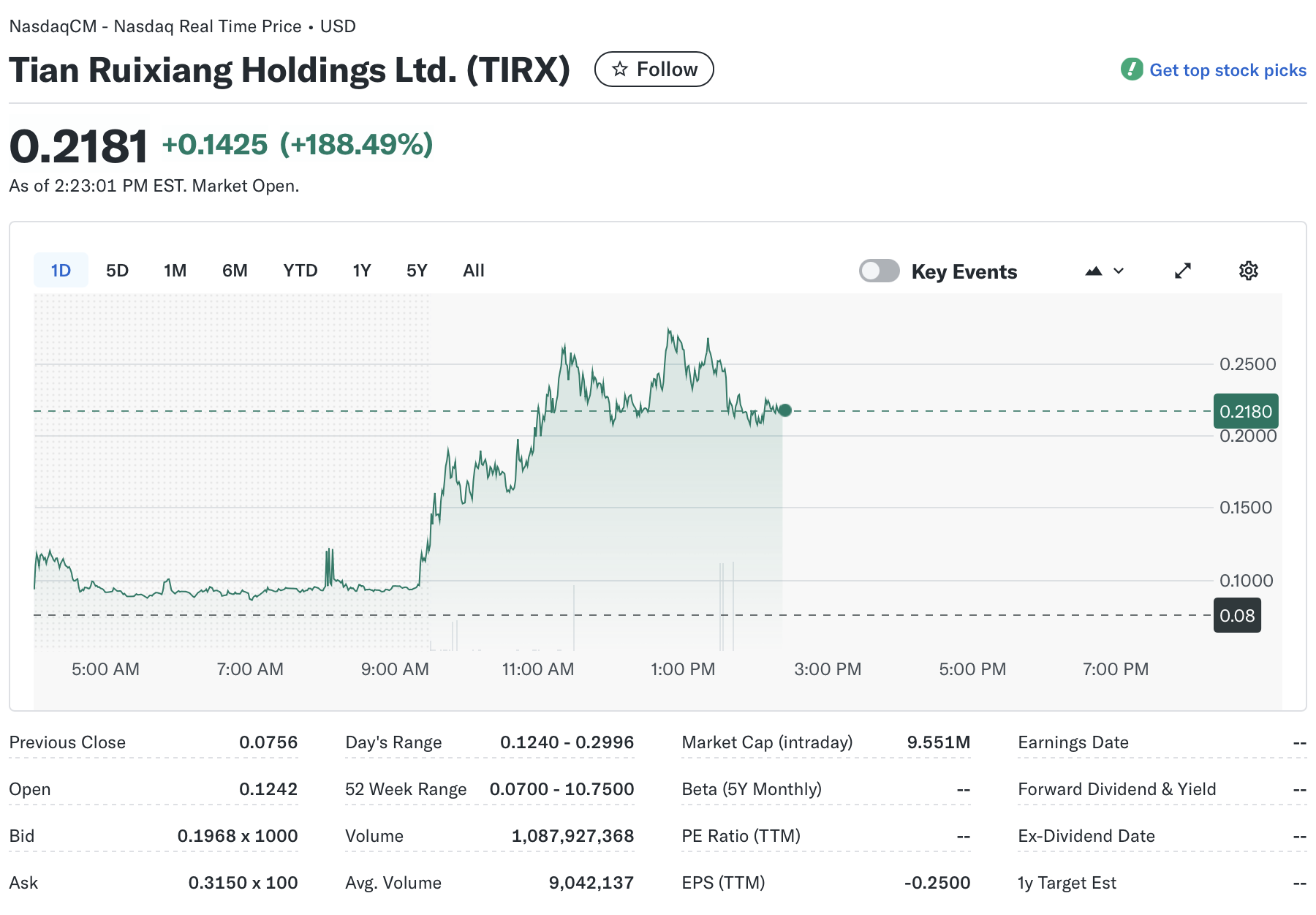

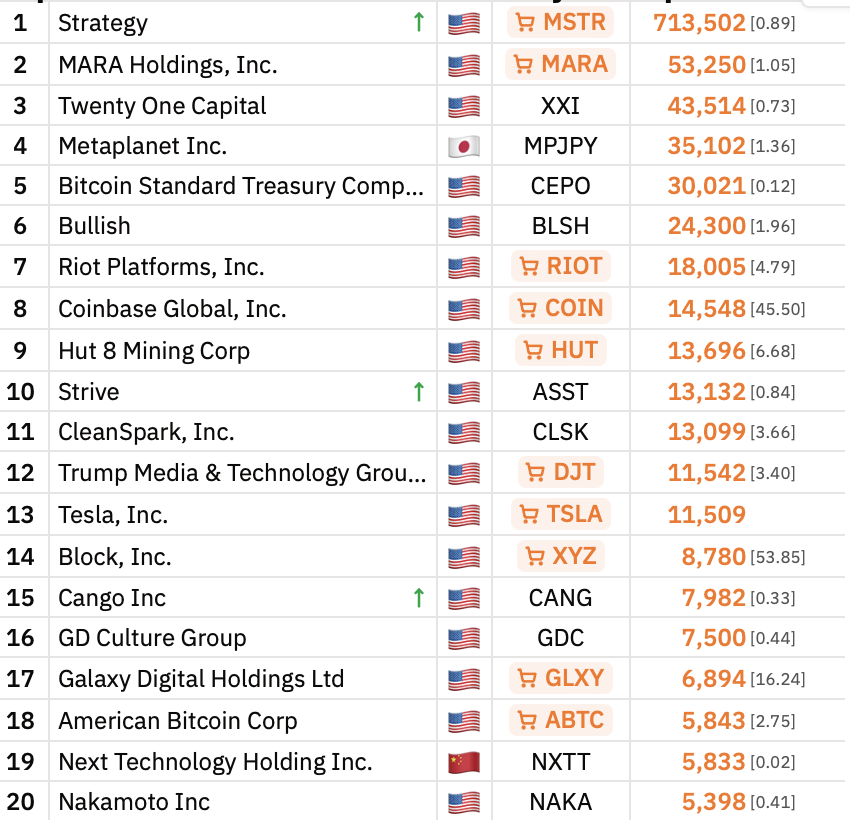

Shares of Tian Ruixiang, the China-based insurance agency founded in 2010, surged approximately 190% in early trading after the announcement, boosting its market cap to $9.5 million. If completed, the deal will make the company the world's eighth-largest publicly traded Bitcoin treasury holder with 15,000 Bitcoin; comparable to Coinbase's 14,548 BTC and Riot Platforms' 18,005 BTC. The company had also stated it was in talks to acquire an AI and crypto-focused Hong Kong insurance agency.

Source: Yahoo Finance

Top 20 Bitcoin treasury companies. Source: Bitcointreasuries.NET

BTC Technical Analysis: Supports Nearby

Current BTC price at 76.822$, 24-hour change -%1.92. RSI at 26.82 in oversold territory, overall trend bearish and Supertrend bearish. EMA 20: 85.494$. Strong supports: S1 72.945$ (score 73/100, -%5.10 distance), S2 76.332$ (score 62/100, -%0.69). Resistances: R1 78.738$ (+%2.44), R2 82.244$ (+%7). Click for detailed BTC analysis. These data are critical during the period when the TIRX deal strengthens BTC treasuries.

BTC Institutional Adoption Accelerating

The TIRX move reflects the growing BTC treasuries led by companies like MicroStrategy. Manage risks with detailed BTC futures analysis. BTC spot market trends should also be monitored.