Tokenized Gold Outperforms Bitcoin as RWAs Gain Traction in 2025

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

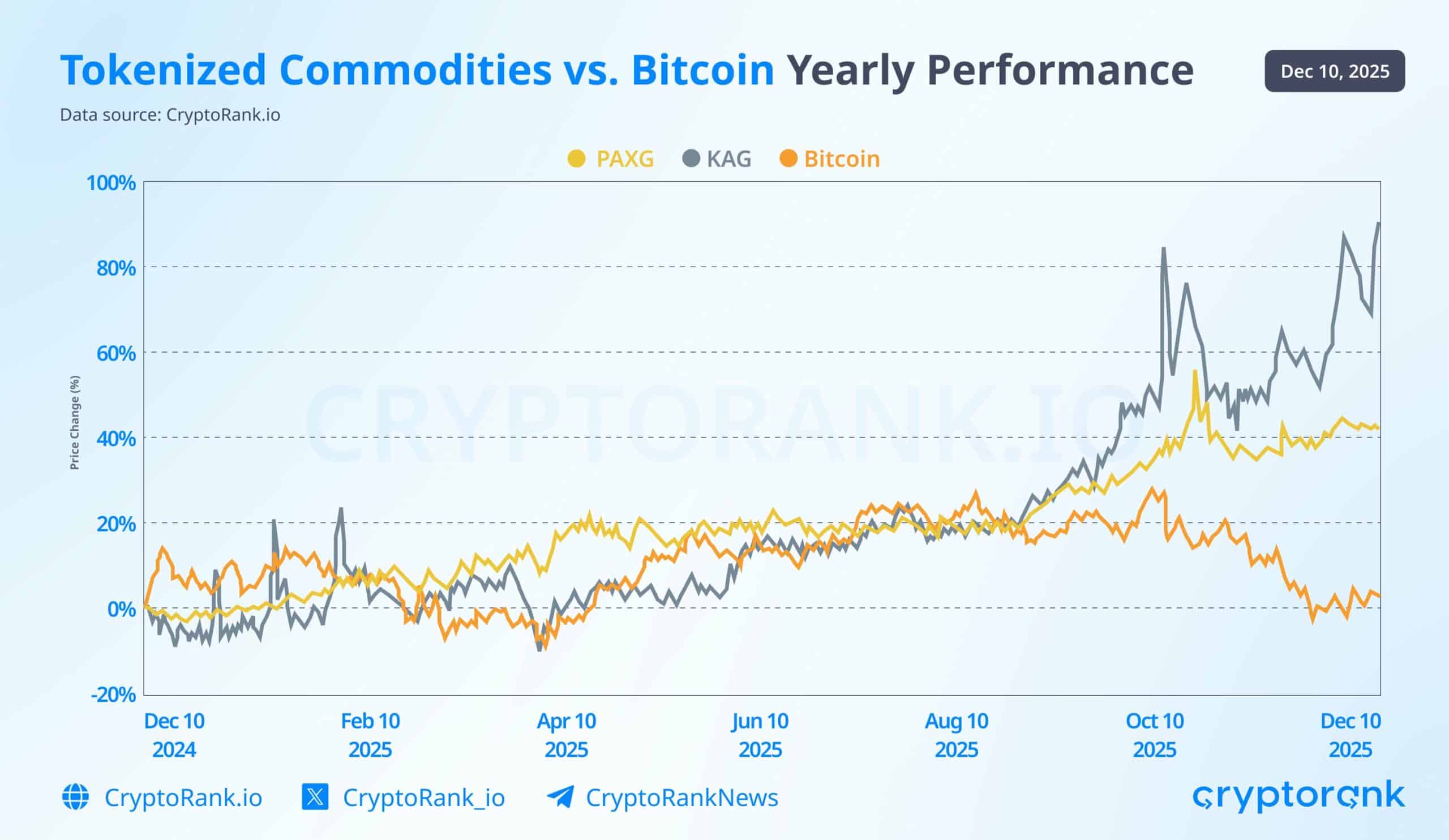

Tokenized gold and silver have outperformed Bitcoin in 2025, with PAXG and KAG reaching new all-time highs amid market volatility. Investors are rotating into these real-world assets as crypto-native hedges, boosting their market caps from $1.8 billion to over $4 billion for tokenized gold.

-

Tokenized gold (PAXG) and silver (KAG) have surged past Bitcoin’s performance this year.

-

Bitcoin has declined 4-5% year-to-date after hitting $125,000, pressured by macroeconomic factors.

-

Tokenized metals’ market caps reflect real inflows, with gold rising from $1.8 billion to over $4 billion, per CoinGecko data.

Discover how tokenized gold and silver outperform Bitcoin in 2025 amid volatility. Explore RWA trends and investment strategies for crypto-native safe havens. Stay informed on digital asset shifts today.

Source: CryptoRank

How Have Tokenized Gold and Silver Outperformed Bitcoin in 2025?

Tokenized gold and silver have delivered superior returns compared to Bitcoin this year, with assets like PAXG and KAG achieving multiple all-time highs despite ongoing crypto market turbulence. According to data from CryptoRank, these tokenized precious metals have attracted significant investor interest as reliable hedges within the blockchain ecosystem. This outperformance highlights a shift toward real-world assets (RWAs) during periods of heightened uncertainty, allowing capital to remain on-chain rather than fleeing to traditional markets.

Bitcoin, once the dominant force in digital assets, peaked at $125,000 earlier in 2025 but has since retreated into negative territory, down approximately 4-5% year-to-date. Factors such as macroeconomic uncertainty and geopolitical tensions have weighed on riskier assets, prompting a reevaluation of portfolio strategies among institutional and retail investors alike.

What Drives the Rise of Tokenized Precious Metals in Crypto Markets?

The surge in tokenized gold and silver stems from their ability to offer stability in volatile environments, backed by physical commodities stored in secure vaults. Tokenization processes, often facilitated by protocols on blockchains like Ethereum, enable fractional ownership and seamless trading without the need for physical delivery. CoinGecko reports show tokenized gold’s market capitalization climbing from $1.8 billion at the start of the year to over $4 billion by late 2025, a more than twofold increase driven by steady inflows.

Source: CoinGecko

Tokenized silver, though on a smaller scale with a market cap in the hundreds of millions, follows a parallel trajectory, underscoring broad demand for these assets. Experts note that this trend coincides with fear indices in crypto reaching levels not seen since 2022, particularly from October through December. “Investors are increasingly viewing tokenized metals as a digital equivalent to traditional safe havens,” observes a report from CryptoRank, emphasizing how these assets maintain liquidity while preserving value.

The mechanics of tokenization involve smart contracts that peg digital tokens to underlying physical reserves, audited regularly by third-party firms. This transparency has bolstered confidence, especially as regulatory frameworks in the United States evolve to support RWA integration. For instance, clearer guidelines on stablecoins and tokenized securities have encouraged institutional participation, with major platforms listing these assets for easy access.

Unlike Bitcoin’s correlation with tech stocks during risk-off periods, tokenized gold and silver exhibit inverse behavior, akin to their physical counterparts. Historical data from CoinGecko illustrates this: during the third quarter of 2025, as Bitcoin dropped 15% from its peak, PAXG gained 12%, providing a counterbalance for diversified portfolios.

Frequently Asked Questions

What Are the Benefits of Investing in Tokenized Gold and Silver Over Bitcoin?

Tokenized gold and silver offer stability as hedges against volatility, backed by physical assets, while remaining tradable on blockchain platforms. In 2025, they have outperformed Bitcoin by delivering positive returns amid market downturns, with lower correlation to equities and access to fractional ownership for broader investor participation.

How Do Tokenized Precious Metals Function as Crypto-Native Safe Havens?

These assets allow investors to shift capital within the crypto ecosystem without converting to fiat, maintaining on-chain efficiency. Backed by audited reserves, they mimic gold’s historical role as a store of value, providing liquidity and security during uncertain times like those seen in late 2025.

Key Takeaways

- Outperformance Confirmed: Tokenized gold and silver have reached multiple all-time highs in 2025, surpassing Bitcoin’s year-to-date decline of 4-5%.

- Real Capital Inflows: Market cap growth, from $1.8 billion to over $4 billion for tokenized gold per CoinGecko, indicates sustained investor commitment rather than fleeting speculation.

- RWA Adoption Insight: This trend signals maturity in crypto markets, urging investors to diversify into RWAs for enhanced portfolio resilience.

Conclusion

The outperformance of tokenized gold and silver against Bitcoin in 2025 underscores the evolving role of real-world assets in digital finance, providing on-chain alternatives to traditional hedges. As regulatory clarity expands and adoption grows, these tokenized commodities are poised to play a central part in balanced crypto strategies. Investors should monitor macroeconomic shifts closely and consider integrating RWAs to navigate future volatility effectively.

Tokenized commodities have gained traction as investors seek refuge from Bitcoin’s fluctuations. Data from CryptoRank highlights how PAXG and KAG have not only held value but also appreciated, reflecting a broader rotation toward stable assets. This movement, accelerated by geopolitical tensions, demonstrates the resilience of blockchain-based precious metals.

Bitcoin’s slip into negative performance, despite its earlier highs, has spotlighted the limitations of pure cryptocurrency exposure. In contrast, tokenized versions of gold and silver enable seamless portfolio adjustments without exiting the crypto space. Their repeated all-time highs in the second half of 2025 align with heightened market fear, offering a digital safe haven.

The rise of RWAs, including tokenized treasuries and now commodities, marks a pivotal adoption theme. This on-chain rotation preserves liquidity and reduces counterparty risks associated with off-chain transfers. As per CoinGecko charts, inflows have been consistent, with tokenized silver mirroring gold’s upward momentum on a smaller scale.

The debate between Peter Schiff and Changpeng Zhao encapsulates this shift. Schiff argues that tokenized gold’s success validates traditional stores of value over Bitcoin, stating it “proves the superiority of real assets in turbulent times.” CZ, however, views tokenization as ecosystem expansion, noting that “rotating between assets on-chain shows market maturity and innovation.”

This perspective aligns with expert analyses from sources like CryptoRank, which emphasize how RWAs bridge traditional finance and blockchain. With United States regulations fostering tokenization, expect continued growth in this sector, potentially influencing broader crypto dynamics in the coming years.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026