Tom Lee: Ethereum Will Recover Quickly

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

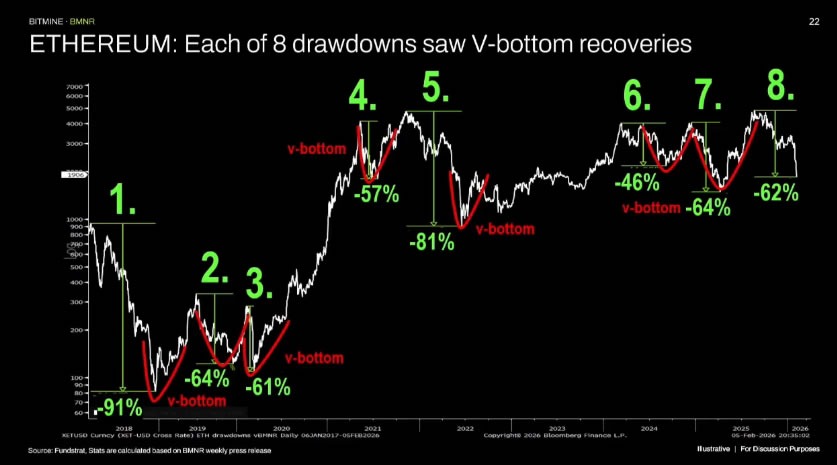

Fundstrat Research Head Tom Lee predicts that Ethereum (ETH) will recover quickly after recent declines. He noted that ETH, which has lost more than 50% value eight times since 2018, has always bottomed out in a V-shape and recovered at the same speed each time. Speaking at a conference in Hong Kong, Lee emphasized that ETH is close to the bottom level and offers investors an ETH detailed analysis opportunity. He added that the $1,890 level pointed out by BitMine analyst Tom DeMark could be a perfect bottom.

Ethereum's Historical V-Shaped Recoveries

The previous eight drawdowns saw V-shaped recoveries for ETH. Source: Fundstrat

The previous eight drawdowns saw V-shaped recoveries for ETH. Source: FundstratETH price fell to $1,760 on Coinbase on February 6, experienced a 37% decline over the last 30 days but stayed above the 2025 low of $1,400. Current price is at $1,969, with 24-hour change of +0.19% signaling a slight recovery. RSI at 29.95 level in oversold territory, strong supports at 1.748 (S1, 75% score) and current 1.964 (S2) levels. Resistances awaiting at $2,021 and $2,157.

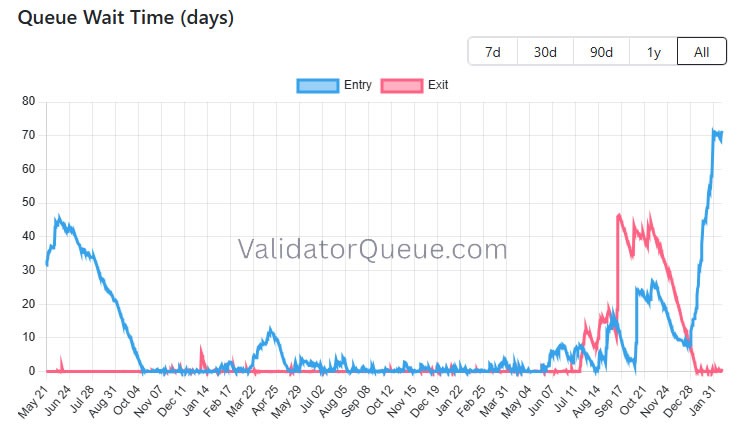

Record Staking Demand Restricts ETH Supply

Ethereum staking entry queue at peak wait times. Source: ValidatorQueue

Ethereum staking entry queue at peak wait times. Source: ValidatorQueueNevertheless, staking demand is breaking records: According to ValidatorQueue data, 71-day waiting time, 4 million ETH in the entry queue, and 30.3% of supply, i.e., 36.7 million ETH staked. This situation significantly restricts supply.

Institutional Inflows and ETF Flows Support ETH

Goldman Sachs' $1 billion ETH purchase, Interactive Brokers' 24/7 ETH futures launch, and $57 million net inflow to ETH ETFs on February 9, are increasing institutional demand. These developments strengthen Tom Lee's recovery thesis and reinforce the buying opportunity from bottom levels.

ETH Technical Outlook: Supports Nearby

- Supertrend: Bearish, but RSI oversold.

- Supports: $1,748 (strong), $1,964 (near current).

- Resistances: $2.021, $2.157.

Source: Fundstrat, ValidatorQueue.