TRON Network Shows Growing Transaction Activity in 2025 Amid Price Consolidation and Mixed Adoption Signals

TRX/USDT

$115,098,670.07

$0.2794 / $0.2751

Change: $0.004300 (1.56%)

+0.0047%

Longs pay

Contents

-

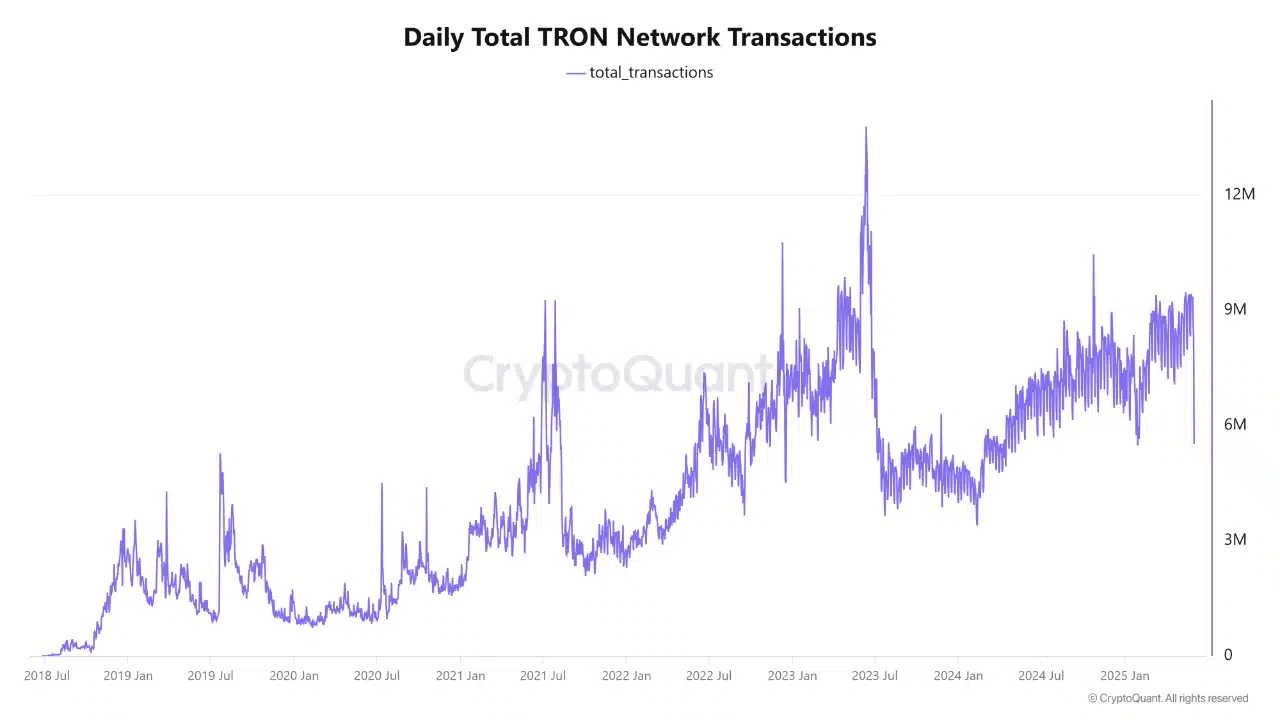

TRON network’s transaction activity surged in early 2025, signaling increased adoption despite TRX price consolidation.

-

While TRON’s daily transactions rose steadily, its Total Value Locked (TVL) experienced fluctuations, reflecting mixed investor sentiment.

-

According to CryptoOnchain via CryptoQuant Insights, TRON maintained an average of 6 to 9 million daily transactions from January to May 2025.

TRON’s rising transaction volume highlights growing network adoption, though TRX price remains in consolidation amid fluctuating TVL and market pressures.

TRON Network Sees Steady Transaction Growth Amid Mixed DeFi Metrics

In 2025, the TRON blockchain demonstrated a notable increase in transaction activity, with daily transactions consistently ranging between 6 to 9 million. This growth suggests a strengthening user base and expanding network utility. However, despite this uptick in activity, DeFi metrics tell a more nuanced story. Data from DeFiLlama indicates that TRON’s Total Value Locked (TVL) has been on a downward trajectory since December 2024, punctuated by a brief surge in mid-May that quickly reversed. This divergence between transaction volume and TVL highlights the complex dynamics within TRON’s ecosystem, where increased usage does not necessarily translate to sustained capital inflows into DeFi protocols.

Source: CryptoQuant Insights

Comparative Fee Analysis and Network Usage

Transaction fees on the TRON network have remained relatively high, comparable to Bitcoin’s fees, as reported by Token Terminal. This positions TRON in a unique spot where, despite high transaction volumes, the cost of network usage is significant compared to other blockchains like Solana, which not only offers lower fees but also surpasses TRON in transaction count. This fee structure could influence user behavior, potentially limiting TRON’s appeal for smaller transactions or micro-payments, and impacting the overall ecosystem growth trajectory.

Source: DeFiLlama

TRX Price Consolidation Reflects Market Uncertainty Despite Network Growth

Despite the encouraging network activity, TRX’s price has remained largely range-bound, consolidating around the $0.25 resistance level over recent weeks. This consolidation phase contrasts with the earlier bullish breakout seen in the first half of May, where TRX briefly tested higher price points. Technical indicators such as the Chaikin Money Flow (CMF) and Accumulation/Distribution (A/D) line suggest increased selling pressure and capital outflows, with the CMF currently at -0.08 indicating a net withdrawal of funds from the market. This bearish momentum underscores the challenges TRX faces in translating network adoption into sustained price appreciation.

Source: TRX/USDT on TradingView

Potential Catalysts for TRX Price Movement

The future trajectory of TRX’s price appears linked to broader market conditions, particularly Bitcoin’s momentum. Should Bitcoin regain bullish strength, it could catalyze renewed buying interest in TRX, potentially establishing the $0.28 level as a new support zone and targeting the $0.30 retracement level. Investors and traders are advised to monitor on-chain metrics alongside macro market trends to gauge TRX’s price potential accurately. The current consolidation phase may serve as a critical juncture, where sustained network growth could eventually translate into positive price action.

Conclusion

The TRON network’s increasing transaction volume in 2025 highlights robust adoption and growing utility, yet the mixed signals from DeFi TVL and TRX price consolidation illustrate the complexities of market dynamics. While high transaction fees and selling pressure currently temper bullish sentiment, TRON’s expanding user base and network activity provide a foundation for potential future growth. Market participants should watch key technical indicators and broader crypto market trends closely to navigate TRX’s evolving landscape effectively.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/9/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/8/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/7/2026

DeFi Protocols and Yield Farming Strategies

2/6/2026