Tron (TRX) Faces Possible Correction Amid Overvaluation but Strong Demand Zone May Limit Decline

TRX/USDT

$115,098,670.07

$0.2794 / $0.2751

Change: $0.004300 (1.56%)

+0.0047%

Longs pay

Contents

-

Tron (TRX) is showing signs of potential correction after a significant price surge, with key indicators like the NVT ratio signaling possible overvaluation and sell-off risks.

-

A robust demand zone between $0.268 and $0.276, holding nearly $4 billion worth of TRX, offers critical support that could limit downside losses.

-

According to COINOTAG analysis, TRX’s inability to break the $0.286 resistance level may trigger a pullback to $0.275, but strong buyer interest in the demand zone could stabilize prices.

Tron (TRX) faces correction risks amid rising NVT ratio and resistance at $0.286, but a strong $4B demand zone between $0.268-$0.276 offers crucial support.

Tron’s Overvaluation Signals Potential Price Correction

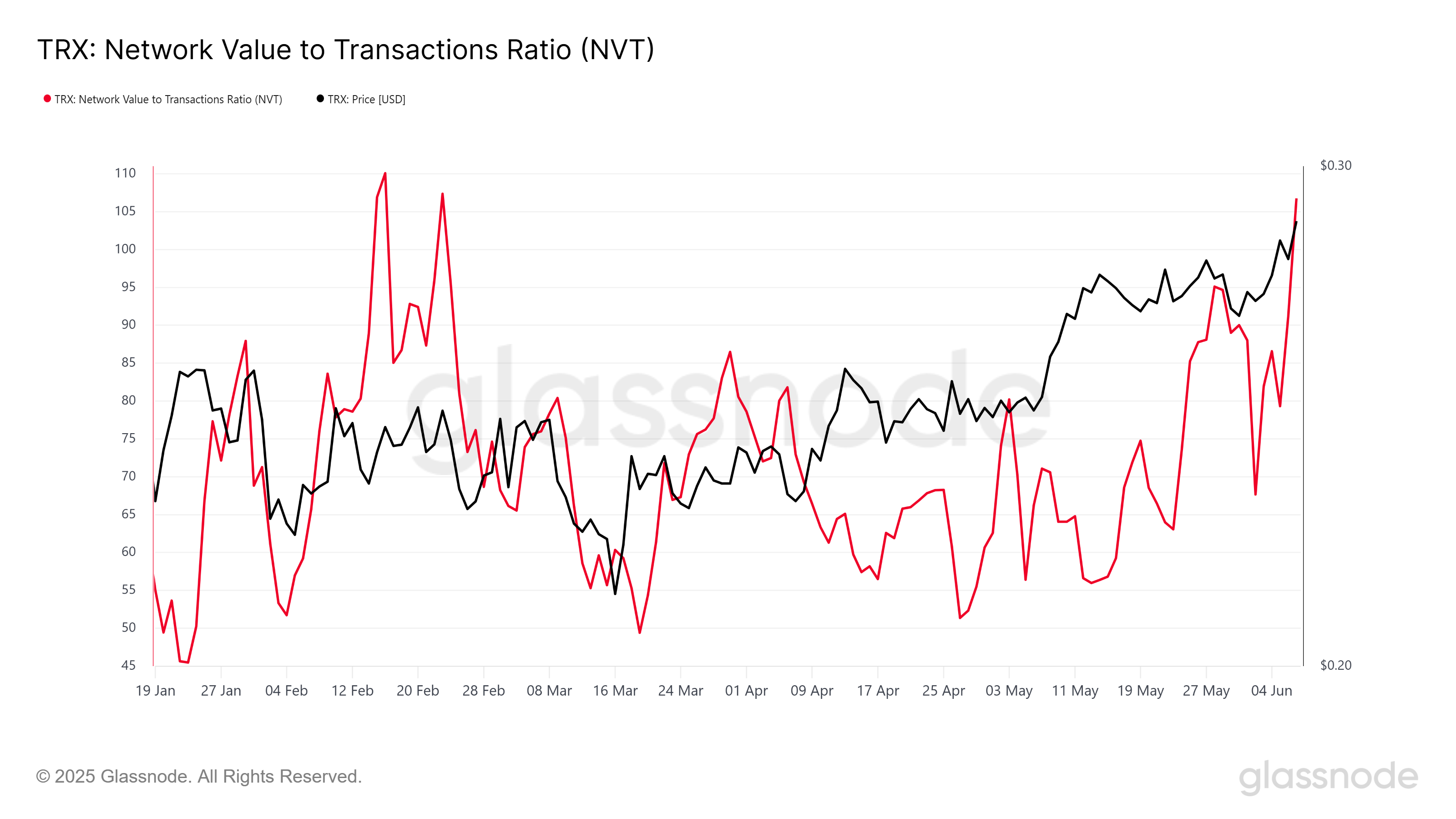

The Network Value to Transactions (NVT) ratio for Tron has surged to its highest point in over six weeks, highlighting a divergence between its market capitalization and transactional activity. This metric is a critical indicator in crypto markets, often used to identify when an asset’s price may be inflated relative to its actual usage.

A rising NVT ratio suggests that TRX’s market value is outpacing the volume of transactions occurring on its network, a classic sign of overvaluation. Investors should note that such imbalances can precede price corrections as market participants recalibrate expectations.

Given the current macroeconomic environment and the inherent volatility of cryptocurrency markets, TRX could experience downward pressure if investor sentiment shifts toward risk aversion. This makes the token vulnerable to a sell-off, especially if broader market conditions deteriorate.

Despite these warning signs, TRX’s price may not plummet sharply due to significant support levels identified by on-chain analytics.

Strong Demand Zone Provides Critical Support for TRX

IntoTheBlock’s IOMAP data reveals a substantial demand zone between $0.268 and $0.276, where approximately 13.89 billion TRX tokens—valued at nearly $4 billion—were previously acquired. This accumulation area acts as a price floor, where buyers are likely to defend their positions, limiting downside risk.

This demand zone is particularly important because it reflects a concentration of investor interest and capital commitment at these price levels. As a result, any price correction is expected to find strong buying pressure here, preventing TRX from falling significantly below $0.276.

Such zones are crucial in volatile markets, as they provide stability and reduce the likelihood of sharp declines. For TRX holders and potential investors, this support level offers a strategic entry point or a buffer against losses during market pullbacks.

TRX Price Faces Resistance at $0.286: What’s Next?

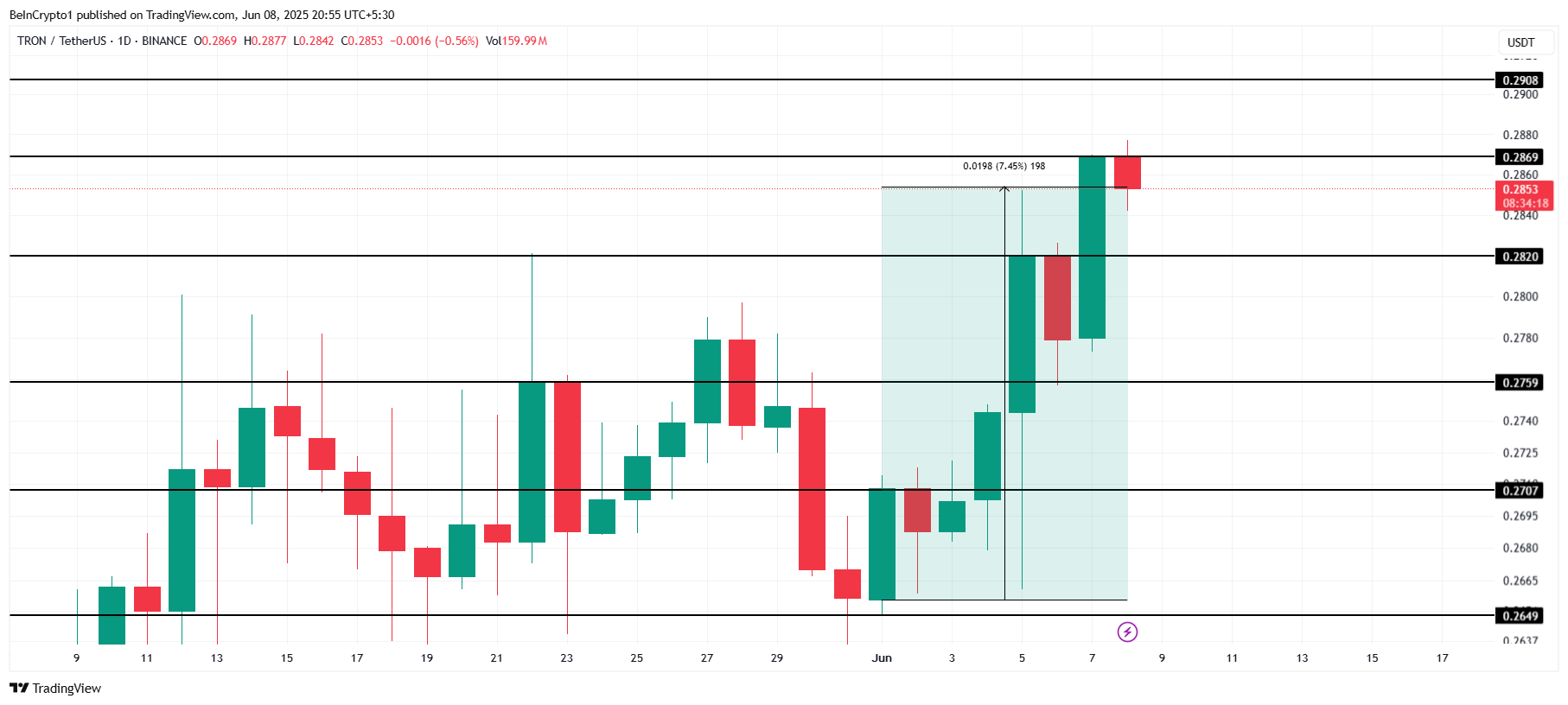

After gaining 7.45% over the past week, TRX is currently trading near $0.285 but struggling to surpass the $0.286 resistance level. This price ceiling has proven difficult to breach, indicating a potential short-term barrier to further gains.

If TRX fails to break above $0.286, profit-taking could intensify, leading to a pullback. The token might retrace to the $0.275 support level, which aligns closely with the strong demand zone previously identified. This scenario suggests a moderate correction rather than a steep decline.

However, if market conditions remain favorable and TRX successfully breaks through the $0.286 resistance, it could trigger renewed buying momentum. This breakout would likely propel the price toward the next target near $0.290, signaling a continuation of the bullish trend and invalidating the bearish outlook.

Market Sentiment and Broader Crypto Trends Impact TRX’s Trajectory

TRX’s price movement is not isolated; it is influenced by broader cryptocurrency market dynamics and investor sentiment. Positive developments in the crypto sector, including regulatory clarity or institutional adoption, could bolster TRX’s prospects.

Conversely, adverse macroeconomic factors or heightened market volatility may exacerbate selling pressure, increasing the likelihood of a correction. Traders and investors should monitor these external variables closely alongside technical indicators to make informed decisions.

Conclusion

Tron (TRX) currently faces a delicate balance between overvaluation risks and strong underlying support. The rising NVT ratio signals caution, suggesting a potential price correction is on the horizon. However, the significant demand zone between $0.268 and $0.276 provides a robust safety net that could limit losses and stabilize the token’s price.

Resistance at $0.286 remains a critical hurdle; failure to break this level may lead to a moderate pullback, while a successful breach could reignite bullish momentum. Investors should remain vigilant, leveraging both on-chain data and market trends to navigate TRX’s evolving landscape effectively.

Stay informed and consider these key levels when planning your TRX trading or investment strategy.