TRUMP Coin Faces Potential Decline Toward All-Time Low Amid Weak Bitcoin Correlation and Bearish Sentiment

BTC/USDT

$17,366,629,629.18

$71,554.95 / $68,531.50

Change: $3,023.45 (4.41%)

-0.0023%

Shorts pay

Contents

-

TRUMP coin, currently trading at $9.76, is showing signs of a potential crash, with its all-time low of $7.14 looming as a realistic target amid weakening market support.

-

The diminishing correlation between TRUMP and Bitcoin suggests the meme coin’s price movements are becoming increasingly independent, raising concerns about further declines.

-

According to COINOTAG sources, bearish sentiment and volatile funding rates underscore growing trader uncertainty, pushing TRUMP closer to critical support levels.

TRUMP coin faces a potential crash as weakening Bitcoin correlation and bearish trader sentiment threaten a fall to its all-time low of $7.14.

Declining TRUMP Demand Amid Weak Bitcoin Correlation

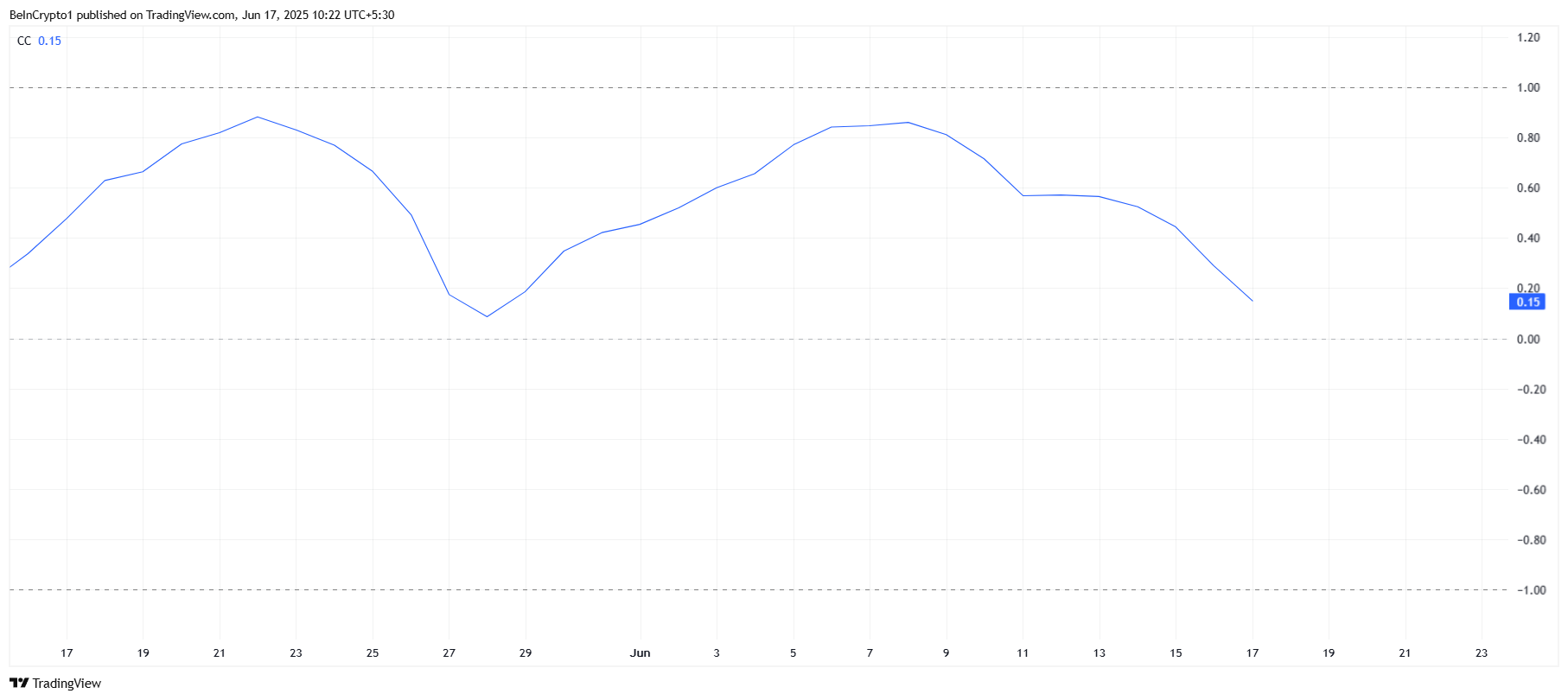

The TRUMP coin’s price trajectory is diverging notably from Bitcoin, with a current correlation coefficient of just 0.15. This weak linkage indicates that TRUMP is no longer benefiting from Bitcoin’s bullish momentum, despite Bitcoin trading near $106,500 and eyeing new all-time highs. The meme coin’s inability to mirror Bitcoin’s upward trend reflects a deteriorating demand and signals a bearish outlook for TRUMP holders.

Investors are increasingly recognizing that TRUMP’s price may continue to fall independently, as the altcoin fails to capitalize on broader market rallies. This decoupling from Bitcoin’s performance reduces the likelihood of a swift recovery, especially in a market environment where investor confidence is fragile.

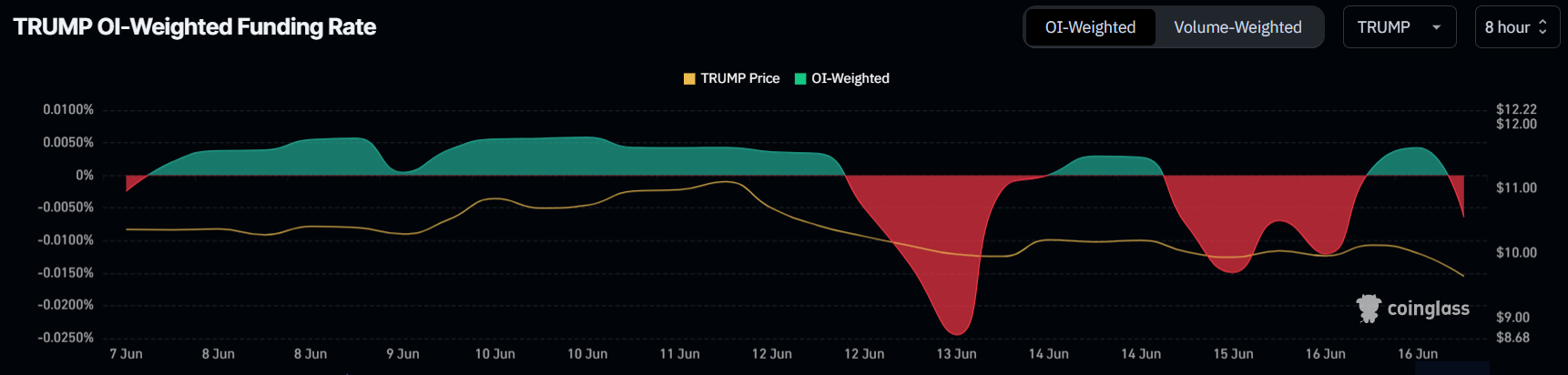

The macroeconomic indicators for TRUMP further emphasize this bearish sentiment. The funding rate—a key metric reflecting trader positioning—has shown significant fluctuations, indicating heightened uncertainty and a shift toward short positions. This volatility suggests that traders are increasingly pessimistic about TRUMP’s near-term prospects, accepting losses and betting on further declines.

TRUMP Price Faces Imminent Crash Risk

Currently priced at $9.76, TRUMP is under substantial bearish pressure. The coin is testing critical support levels, with $9.68 serving as the immediate threshold. A breach below this level could accelerate the downtrend toward the next support at $9.11, intensifying selling momentum.

If TRUMP falls below $9.11, the all-time low of $7.14 becomes the next significant support target. This represents a 26% decline from the current price, a scenario that is increasingly plausible given the prevailing negative sentiment and weakening demand. The outlook remains firmly bearish as traders brace for potential further losses.

Nonetheless, any unexpected developments or announcements related to former President Donald Trump could temporarily boost demand for the coin, potentially triggering a short-term rebound. A bounce from the $9.68 support level might drive TRUMP toward resistance near $10.97, offering some relief to investors. However, such a recovery would depend heavily on external factors rather than underlying market strength, making it uncertain and speculative.

Conclusion

In summary, TRUMP coin is navigating a precarious phase marked by weakening correlation with Bitcoin, fluctuating funding rates, and declining investor confidence. The risk of a price crash toward its all-time low of $7.14 is tangible, driven by persistent bearish sentiment and technical vulnerabilities. While external catalysts could provide temporary relief, the overall market dynamics suggest caution for TRUMP holders as the meme coin faces significant downside risks.