TRUMP Faces Downside Risk After Whale’s $7.8M Loss on Binance Deposit

Contents

A cryptocurrency whale deposited 3 million TRUMP tokens valued at $14.88 million into Binance after holding them for about 50 days, realizing a loss of roughly $7.8 million from an initial withdrawal worth $22.68 million. This move indicates capitulation amid weak price momentum.

-

Whale’s deposit locks in substantial $7.8 million loss on TRUMP tokens.

-

Tokens originally acquired when valued at $22.68 million 50 days prior.

-

TRUMP price held above $4.80 despite the large sell-off, absorbing supply pressure with 24-hour trading volume exceeding $500 million.

TRUMP whale deposits 3M tokens worth $14.88M to Binance, realizing $7.8M loss. Analyze price action, CVD, and liquidity risks for informed trading decisions today.

What does the TRUMP whale deposit to Binance mean for the token’s price?

TRUMP whale deposit refers to a large holder transferring 3 million tokens valued at $14.88 million into Binance after approximately 50 days of holding. The address had withdrawn these tokens earlier for $22.68 million, resulting in a realized loss of about $7.8 million. This action points to capitulation rather than profit realization, as the exit price was significantly below entry.

Source: Lookonchain

Despite this significant deposit, TRUMP price did not experience a sharp decline. It maintained support above $4.80, suggesting the market absorbed much of the increased sell-side pressure. On-chain data from Lookonchain confirms the transaction details, highlighting the whale’s capitulation without triggering broader panic selling.

How is TRUMP price action performing after the breakout attempt?

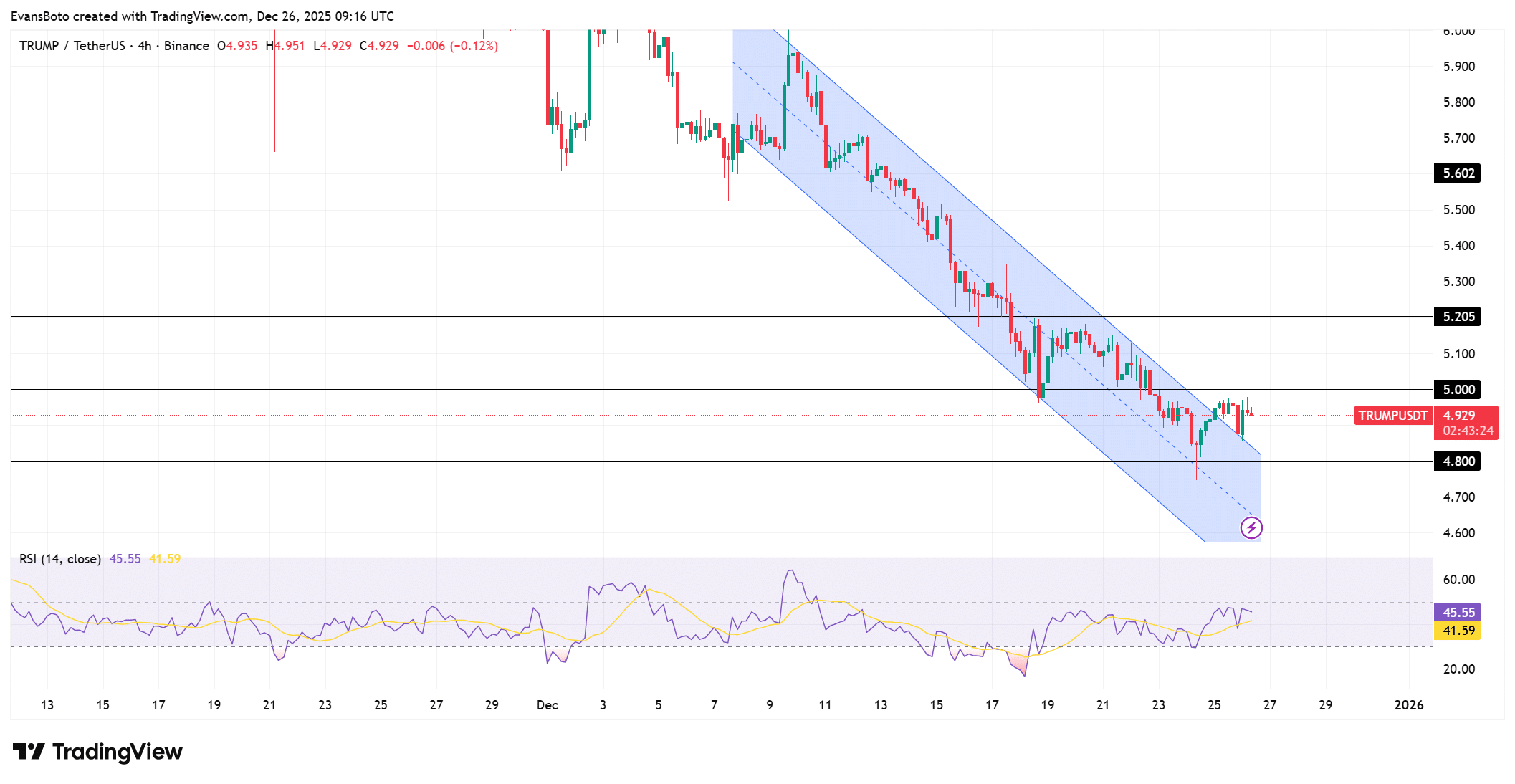

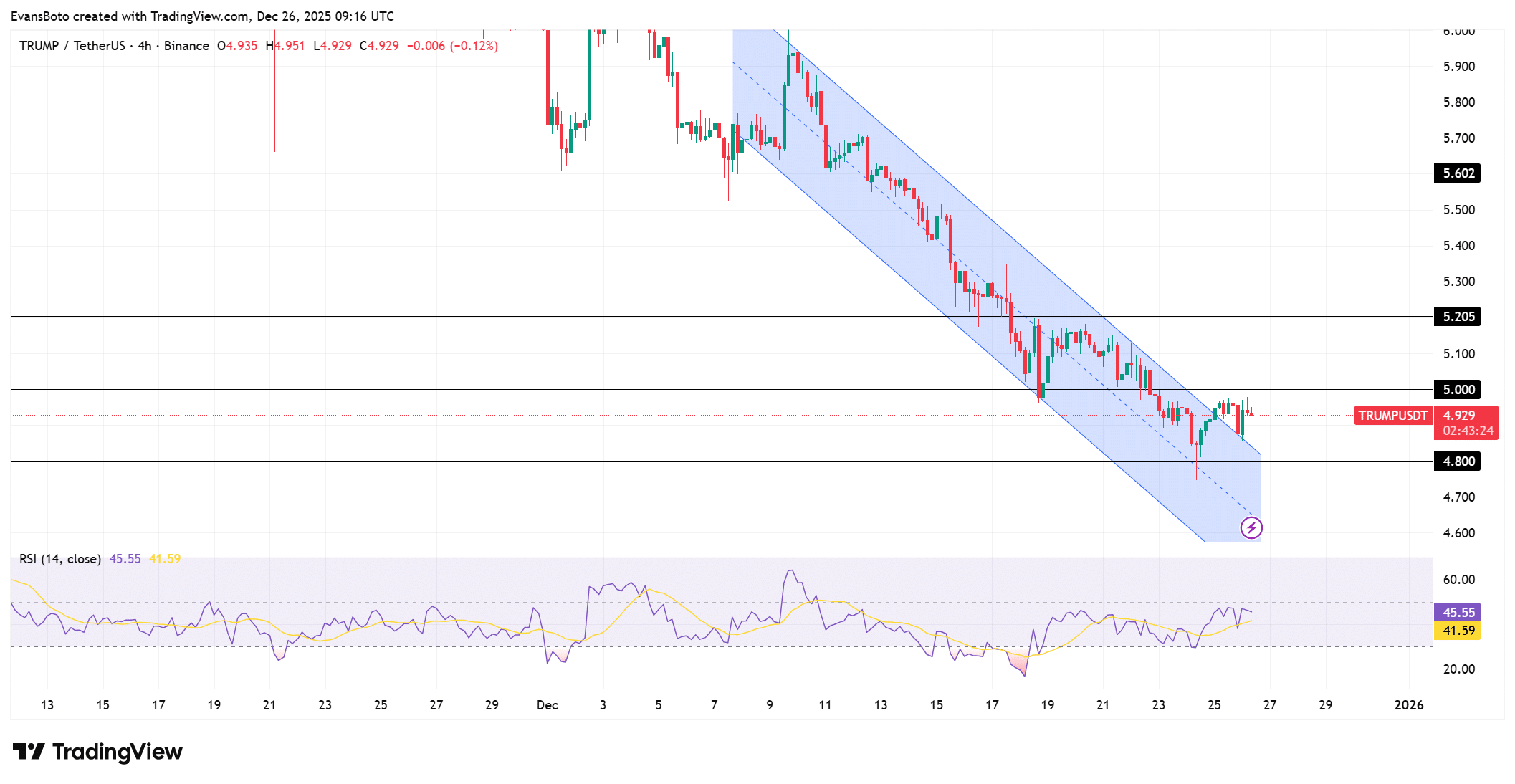

TRUMP price recently broke above a descending channel but failed to hold gains beyond $5.20–$5.25 resistance. It retested this area and encountered rejection, reverting toward $5 as a pivot point. Downside risks emerge below $5 toward $4.80, where prior lows cluster.

At press time, the Relative Strength Index (RSI) stood at 46, below neutral levels, indicating subdued bullish momentum. Yet, it remained above oversold territory near 30, reflecting orderly selling rather than distress. Data from TradingView charts illustrates this failed continuation, requiring bulls to recapture $5.20 for bullish invalidation.

Source: TradingView

Frequently Asked Questions

What caused the TRUMP whale to deposit 3 million tokens into Binance?

The whale deposited the tokens after holding for 50 days, exiting at a lower price than acquisition. Lookonchain tracked the address, showing an initial withdrawal at $22.68 million and deposit at $14.88 million, confirming a $7.8 million realized loss due to market conditions.

Will the TRUMP whale deposit lead to further price declines?

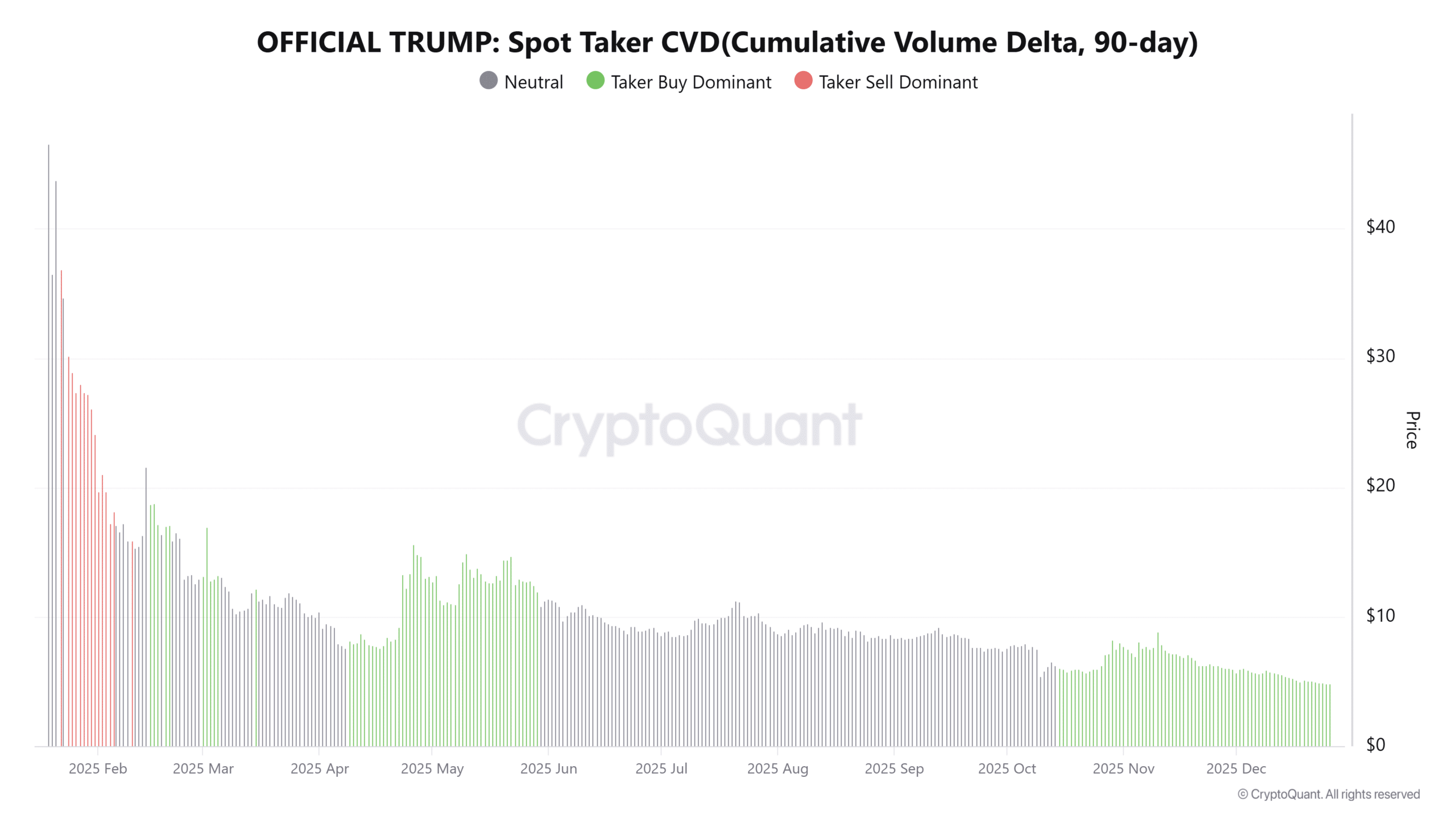

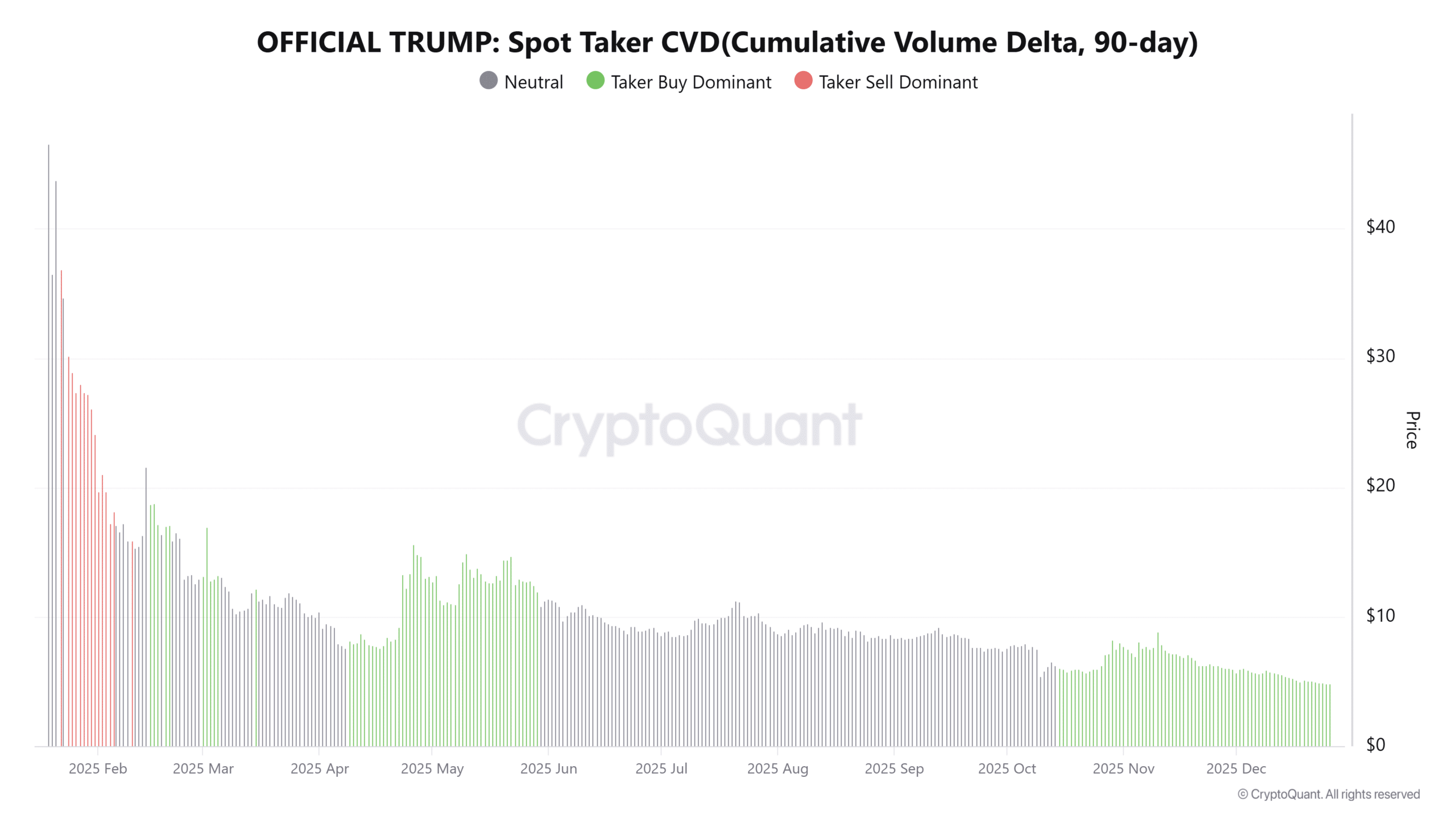

The deposit increased short-term supply, but price held above $4.80, indicating absorption. Metrics from CryptoQuant show positive spot CVD over 90 days, suggesting buyers counterbalance sellers without strong upside conviction yet.

Source: CryptoQuant

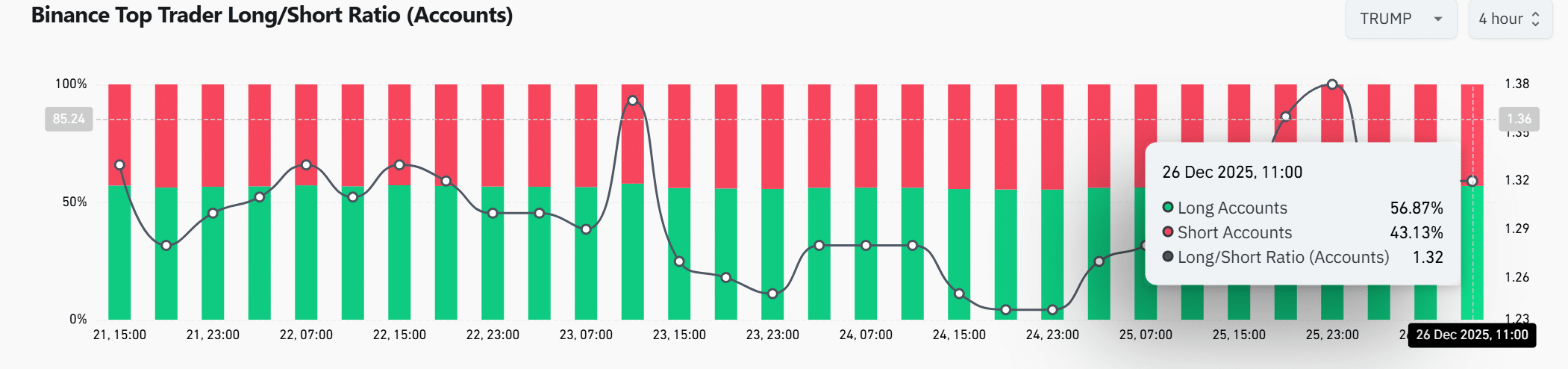

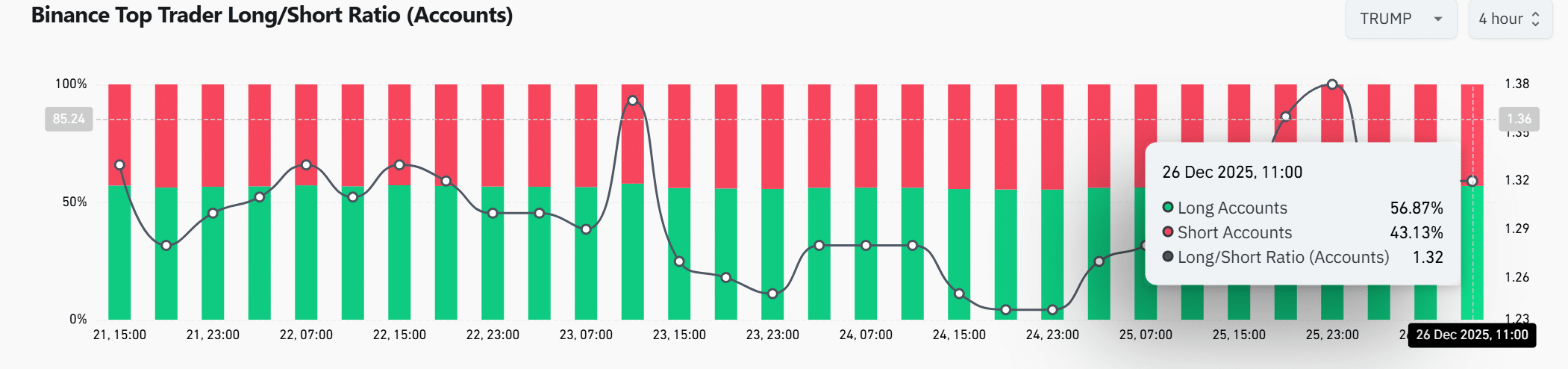

Source: CoinGlass

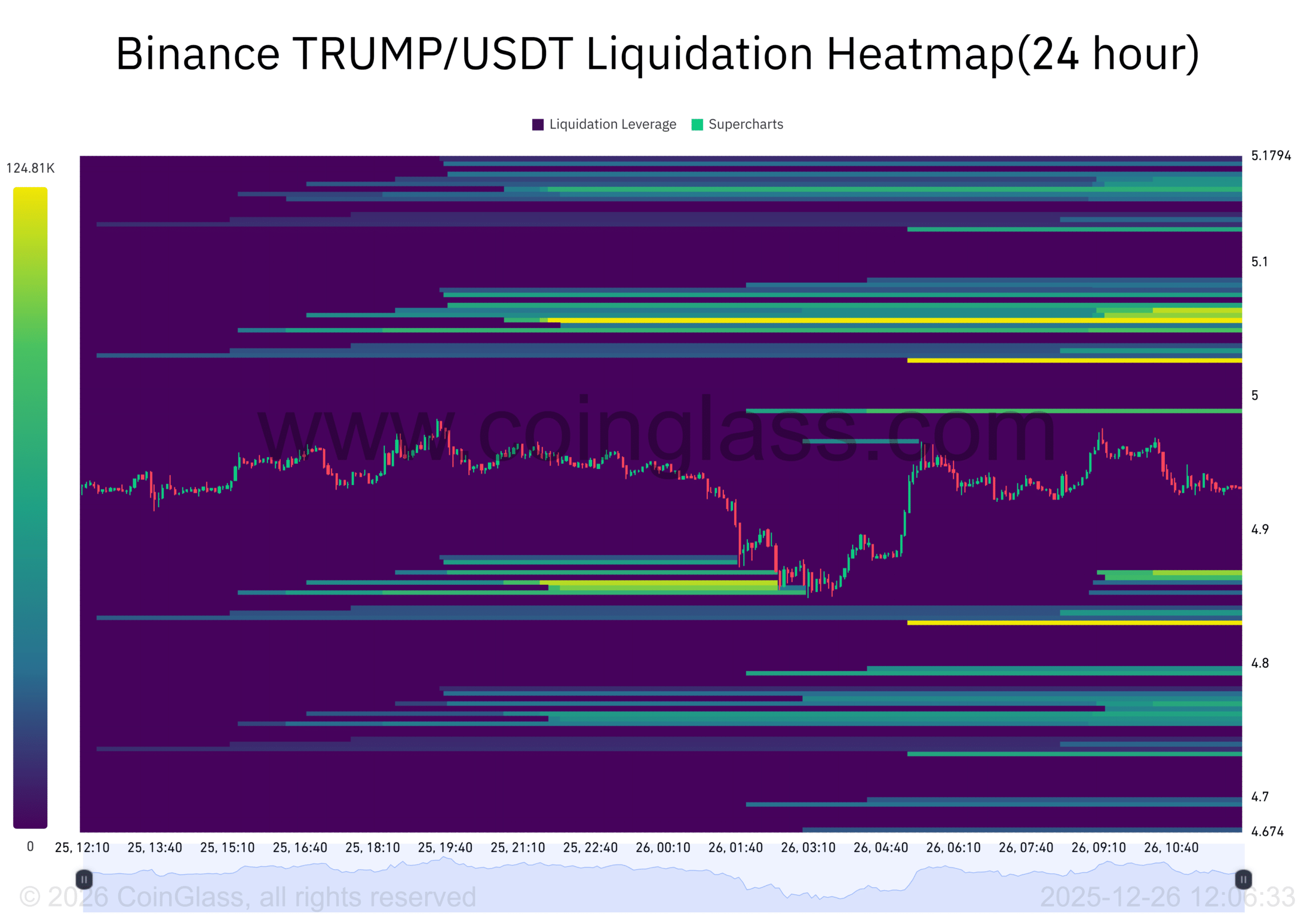

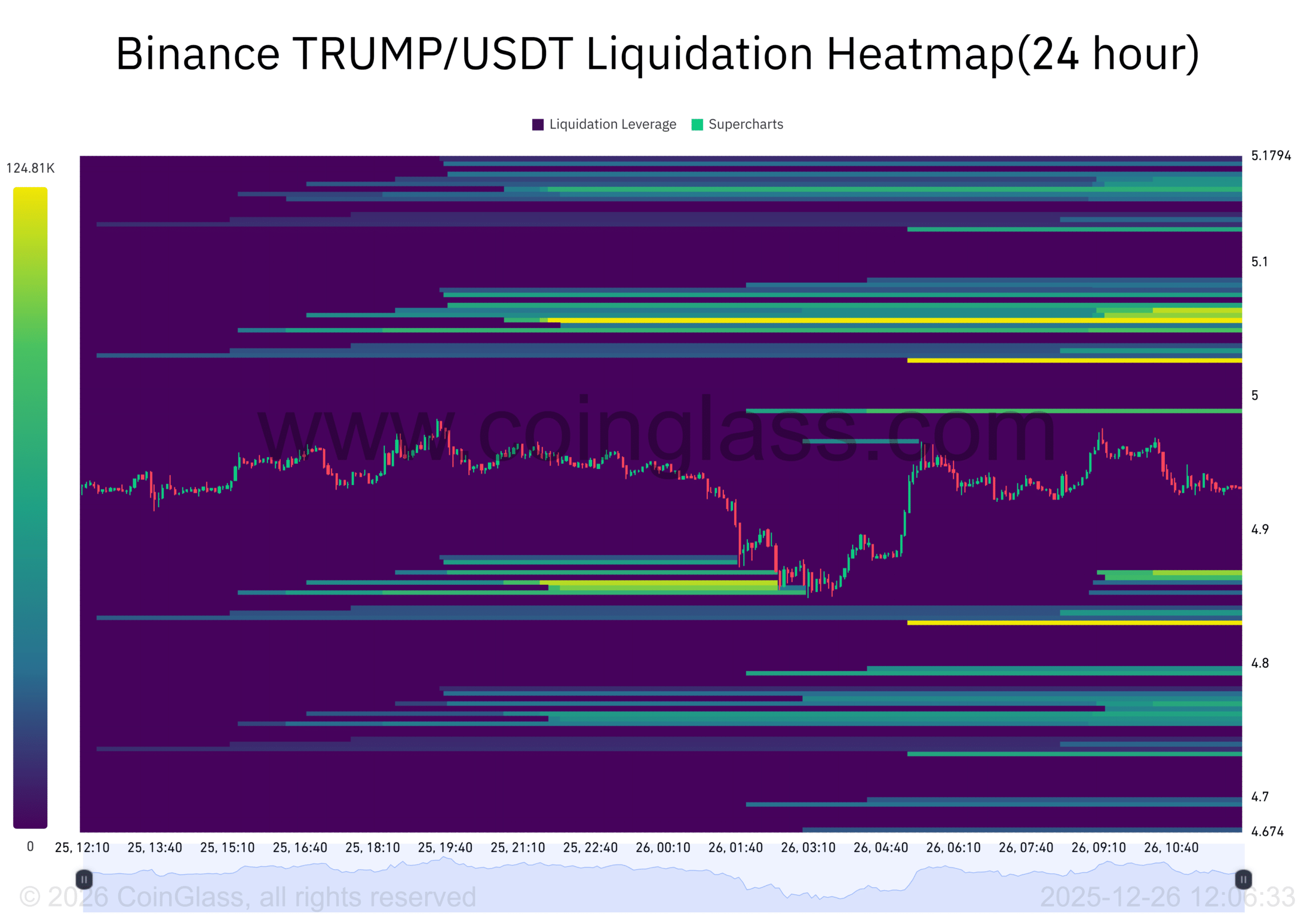

Source: CoinGlass

On Binance, top traders showed 56.87% long positions versus 43.13% shorts, yielding a 1.32 long/short ratio on the four-hour chart per CoinGlass. This mild long bias reflects cautious positioning amid volatility. Spot Cumulative Volume Delta (CVD) from CryptoQuant over 90 days remains buyer-positive, but lacks price expansion, pointing to absorption rather than breakout demand. Liquidation heatmaps indicate dense clusters at $5.10–$5.20, raising odds of upward probes before directional clarity.

Key Takeaways

- Whale Capitulation Confirmed: 3 million TRUMP tokens deposited at a $7.8 million loss, per Lookonchain, signaling exit without market crash.

- Price Structure Weak: Failed $5.20 hold confirms resistance, with RSI at 46 showing limited momentum.

- Monitor Liquidity: Overhead clusters at $5.10–$5.20 may trigger tests; watch for $5 pivot break.

Conclusion

The TRUMP whale deposit underscores ongoing supply pressures, with price action failing to sustain above key resistance at $5.20 amid neutral RSI and positive yet non-expansive CVD. Data from TradingView, CryptoQuant, and CoinGlass highlight balanced but cautious trader sentiment. Investors should track $5 support for near-term direction, staying vigilant on liquidity-driven volatility in the TRUMP market.