Trump’s Potential Fed Chair Change Could Influence Bitcoin’s Path Toward $105,000 Amid Market Uncertainty

BTC/USDT

$17,366,629,629.18

$71,554.95 / $68,531.50

Change: $3,023.45 (4.41%)

-0.0023%

Shorts pay

Contents

-

US President Donald Trump has reignited speculation about replacing Federal Reserve Chair Jerome Powell, causing significant volatility in both traditional and cryptocurrency markets, with Bitcoin targeting a surge to $105,000.

-

The prospect of a Trump-nominated Fed Chair raises the possibility of aggressive monetary policy shifts, including rate cuts that could catalyze a major crypto market rally.

-

Analysts from COINOTAG emphasize that while Bitcoin may benefit from the ensuing uncertainty, altcoins could experience a substantial upswing as looser financial conditions take hold.

Trump’s move to replace Fed Chair Powell triggers market volatility; Bitcoin eyes $105,000 amid potential rate cuts and a bullish outlook for altcoins.

Trump’s Fed Chair Replacement Talk Sparks Market Turmoil and Crypto Volatility

On June 6, 2025, President Trump announced that his nominee for the next Federal Reserve Chair would be revealed imminently, despite Jerome Powell’s term not expiring until May 2026. This announcement has sent ripples through financial markets, igniting uncertainty about the future direction of US monetary policy.

The mere prospect of a “phantom” Fed Chair—someone nominated ahead of the official term expiration—has unsettled investors, as it signals potential political interference in the traditionally independent Federal Reserve. This development has already contributed to increased price swings in Bitcoin and other cryptocurrencies, reflecting heightened sensitivity to Fed-related news.

Historically, Trump’s earlier remarks about firing Powell led to a sharp decline in the US Dollar Index (DXY) and a corresponding surge in Bitcoin prices, underscoring the close correlation between Fed policy expectations and crypto market dynamics. The renewed narrative has reignited this pattern, with Bitcoin once again demonstrating pronounced volatility.

Legal and Political Complexities Surrounding Powell’s Potential Removal

Legally, the Federal Reserve Act restricts the President’s ability to remove a sitting Fed Chair except “for cause,” typically interpreted as misconduct or ethical violations. This limitation complicates any attempt by Trump to unilaterally dismiss Powell before his term ends.

Nonetheless, Trump could circumvent this by nominating a successor well in advance, effectively positioning a new Fed Chair-in-waiting whose policy stance could influence markets even before officially taking office. Scott Bessent of Key Square Capital highlights that such a nominee’s statements and policy outlook would carry significant weight in shaping investor expectations and market behavior.

While some legal interpretations suggest possible avenues for removal, the move risks triggering legal battles and market instability, making it a high-stakes gamble with far-reaching implications.

Implications of a Trump-Aligned Fed Chair for Bitcoin and the Broader Crypto Market

Geoff Kendrick, Head of Digital Asset Research at Standard Chartered, notes that Bitcoin’s role has evolved beyond a mere inflation hedge to become a safeguard against traditional finance and Treasury risks. The uncertainty surrounding Fed leadership amplifies this perception, positioning Bitcoin as a decentralized refuge amid political and monetary turbulence.

Trump’s public criticism of Powell centers on the belief that current monetary policies impose excessive borrowing costs, which he argues hinder economic growth. Should a Trump-aligned Fed Chair pursue aggressive rate cuts, it could lower interest rates substantially, easing financial conditions and potentially igniting a crypto bull market.

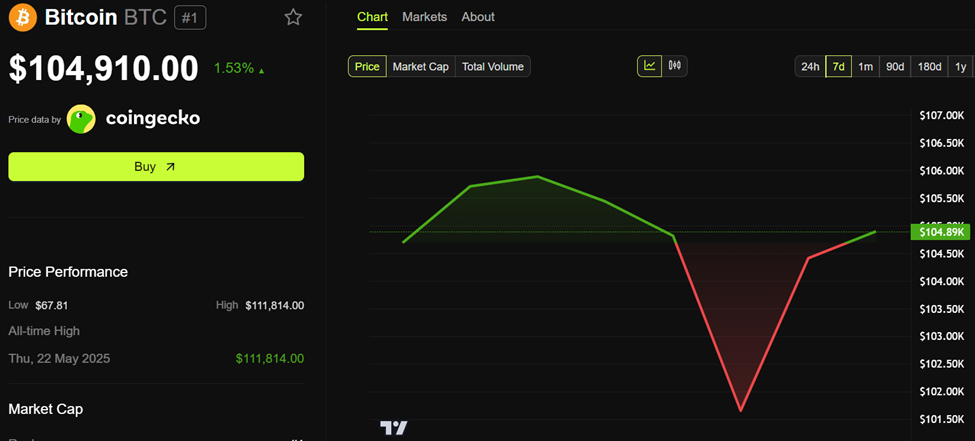

Bitcoin (BTC) Price Performance. Source: COINOTAG

Beyond Bitcoin, altcoins stand to benefit significantly from such a shift. The ongoing quantitative tightening (QT) and muted expectations for rate cuts have suppressed altcoin performance throughout 2025. Analyst Cas Abbé predicts that a new Fed Chair aligned with Trump’s agenda could reverse this trend, ushering in a long-awaited altseason.

However, market participants remain cautious. While looser monetary policy could fuel liquidity-driven rallies, the abrupt political interference in Fed governance might also precipitate systemic risks, described by some as a potential “black swan” event with unpredictable consequences.

Conclusion

The resurgence of Trump’s campaign to replace Fed Chair Powell has injected fresh uncertainty into both traditional and cryptocurrency markets. Bitcoin’s volatility and its push toward $105,000 reflect investor sensitivity to potential shifts in US monetary policy. Meanwhile, altcoins may finally gain momentum if aggressive rate cuts materialize under a new Fed leadership. Market watchers should remain vigilant, as the unfolding developments could either catalyze a robust crypto bull run or trigger broader financial instability. Staying informed and adaptable will be crucial for investors navigating this evolving landscape.