UK Crypto Ownership Dips to 8% but Holdings Rise, with Bitcoin Leading Poll Findings

BTC/USDT

$21,201,579,335.94

$68,086.00 / $64,290.71

Change: $3,795.29 (5.90%)

-0.0009%

Shorts pay

Contents

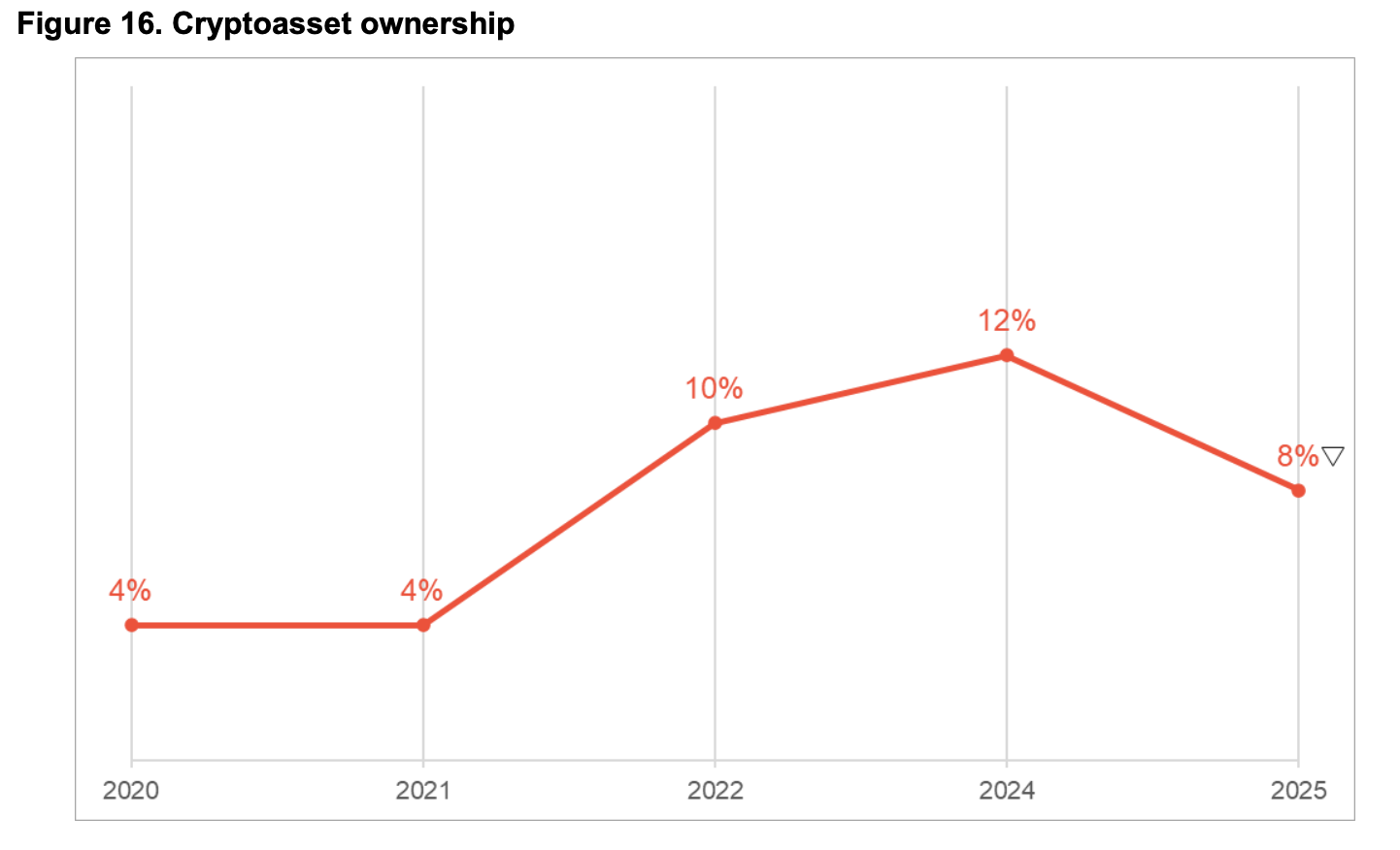

UK cryptocurrency ownership fell to 8% of adults in 2025 from 12% in 2024, according to an FCA poll, yet the total value of digital assets held has risen, with more holders opting for larger investments in Bitcoin and Ether.

-

Decline in ownership percentage: FCA data shows UK crypto holders dropped to 8% in 2025, down from 12% the prior year.

-

Shift to larger holdings: Small-value investments are decreasing while high-value ones grow, indicating maturing investor behavior.

-

Dominant assets: 57% of holders own Bitcoin, 43% hold Ether, and 21% possess Solana, per the survey of over 2,300 adults.

Discover the latest on UK cryptocurrency ownership in 2025: FCA poll reveals 8% adoption rate but rising asset values. Explore trends in Bitcoin, Ether, and regulations—stay informed on crypto’s UK evolution today.

What is the Current State of UK Cryptocurrency Ownership in 2025?

UK cryptocurrency ownership has experienced a notable decline in participation rates, with only 8% of adults holding digital assets in 2025, compared to 12% in 2024, according to a recent Financial Conduct Authority (FCA) poll conducted by YouGov. Despite this drop, the overall value of cryptocurrencies held by investors has increased, reflecting a trend where fewer but more committed holders are accumulating larger amounts. This shift underscores a maturing market in the UK, where small-scale ownership is waning while substantial investments are on the rise.

The FCA’s survey, which involved 2,353 interviews from August 5 to September 2, 2025, highlights that current ownership levels remain double the 4% recorded in 2021. This persistence suggests sustained interest in cryptocurrencies amid evolving regulatory scrutiny. Key factors include greater awareness of risks, as promoted by the FCA, influencing who enters or remains in the market.

Percentage of UK adult crypto ownership from 2021 to 2025. Source: FCA

The poll reveals a “continuing trend” in holdings: 21% of respondents with crypto assets hold between $1,343 and $6,708, while 11% possess between $6,709 and $13,416. The FCA notes, “More people are moving away from small holdings and are instead making larger investments.” This observation points to a more sophisticated investor base, with those engaging in advanced activities like lending and borrowing showing higher knowledge levels, comfort with risk, and awareness of regulatory warnings.

Among the surveyed holders, Bitcoin (BTC) dominates with 57% ownership, followed by Ether (ETH) at 43%. Altcoins trail significantly, though Solana (SOL) stands out with 21% adoption among UK crypto users. These figures align with global patterns where market leaders maintain strong positions even as overall participation fluctuates.

How Are UK Crypto Regulations Influencing Ownership Trends?

Regulatory developments play a pivotal role in shaping UK cryptocurrency ownership. The FCA’s ongoing efforts to establish a comprehensive framework are evident in the simultaneous launch of three consultations on rules for crypto exchanges, staking, lending, and decentralized finance (DeFi). These initiatives, announced alongside the poll results, seek industry feedback by February 2026 to refine oversight and protect consumers.

Supporting data from the FCA indicates that informed investors are driving the shift toward larger holdings. For instance, participants in lending and borrowing activities—now under closer scrutiny—demonstrate elevated risk tolerance and regulatory literacy compared to average users. This segment’s growth suggests that clearer rules could bolster confidence, potentially stabilizing or even reversing the ownership decline.

Expert insights reinforce this view. As noted in FCA reports, enhanced consumer protections, such as warnings on volatility and scams, have educated the public, leading to a more discerning market. Historical data from 2021 to 2025 shows ownership doubling initially due to hype, but recent corrections reflect a regulatory-driven consolidation. With priorities like pound stablecoin payments set for 2026, the UK aims to integrate crypto safely into its financial ecosystem, which could attract more institutional involvement.

The consultations emphasize sustainable practices, addressing risks in staking yields and DeFi protocols without stifling innovation. By structuring feedback around these areas, the FCA ensures regulations are evidence-based, drawing from poll insights on holder behaviors. This approach not only mitigates harms but also positions the UK as a leader in compliant crypto adoption.

Frequently Asked Questions

What Factors Are Causing the Decline in UK Cryptocurrency Ownership Percentages in 2025?

The drop from 12% to 8% in UK cryptocurrency ownership stems from heightened regulatory warnings by the FCA, increased market volatility, and greater public education on risks, as per the 2025 YouGov poll. This has led casual investors to exit, leaving a core group focused on long-term holdings, resulting in higher average values per owner.

Which Cryptocurrencies Are Most Popular Among UK Holders According to Recent Surveys?

Bitcoin leads with 57% of UK holders owning it, followed by Ether at 43%, and Solana at 21%, based on the FCA’s 2025 poll. These preferences mirror global trends, where established assets like BTC and ETH dominate due to their liquidity and market maturity, making them staples for UK investors seeking stability in digital assets.

Key Takeaways

- Lower Participation, Higher Value: UK crypto ownership hit 8% in 2025, but holdings shifted toward larger sums, with 11% of owners holding over $6,709.

- Bitcoin and Ether Lead: Over half of holders own BTC, and 43% have ETH, underscoring their role as entry points for UK investors.

- Regulatory Momentum: FCA consultations on exchanges and DeFi signal a push for safer markets—monitor updates to navigate evolving rules effectively.

Conclusion

In summary, UK cryptocurrency ownership in 2025 reflects a resilient yet selective market, with FCA poll data showing an 8% adoption rate amid growing asset values and dominant holdings in Bitcoin and Ether. Regulatory consultations on staking, lending, and DeFi further demonstrate the UK’s commitment to balanced oversight, as highlighted by authoritative sources like the Financial Conduct Authority. As these frameworks solidify, expect a more stable environment for investors; consider reviewing your portfolio against these trends to capitalize on emerging opportunities in the digital asset space.