UNI Whales Capitulate with Major Sell-Offs, Hinting at Further Price Declines

UNI/USDT

$127,846,437.75

$3.771 / $3.537

Change: $0.2340 (6.62%)

+0.0046%

Longs pay

Contents

UNI whale capitulation has intensified following the recent Unification proposal, with major holders selling off holdings amid a price drop from $10.2 to $6.4, signaling bearish sentiment in the Uniswap ecosystem.

-

Dormant whale sells 512k UNI after 4.5 years, booking $11.65 million loss.

-

Whale activity surged post-proposal, shifting from buys to heavy sells.

-

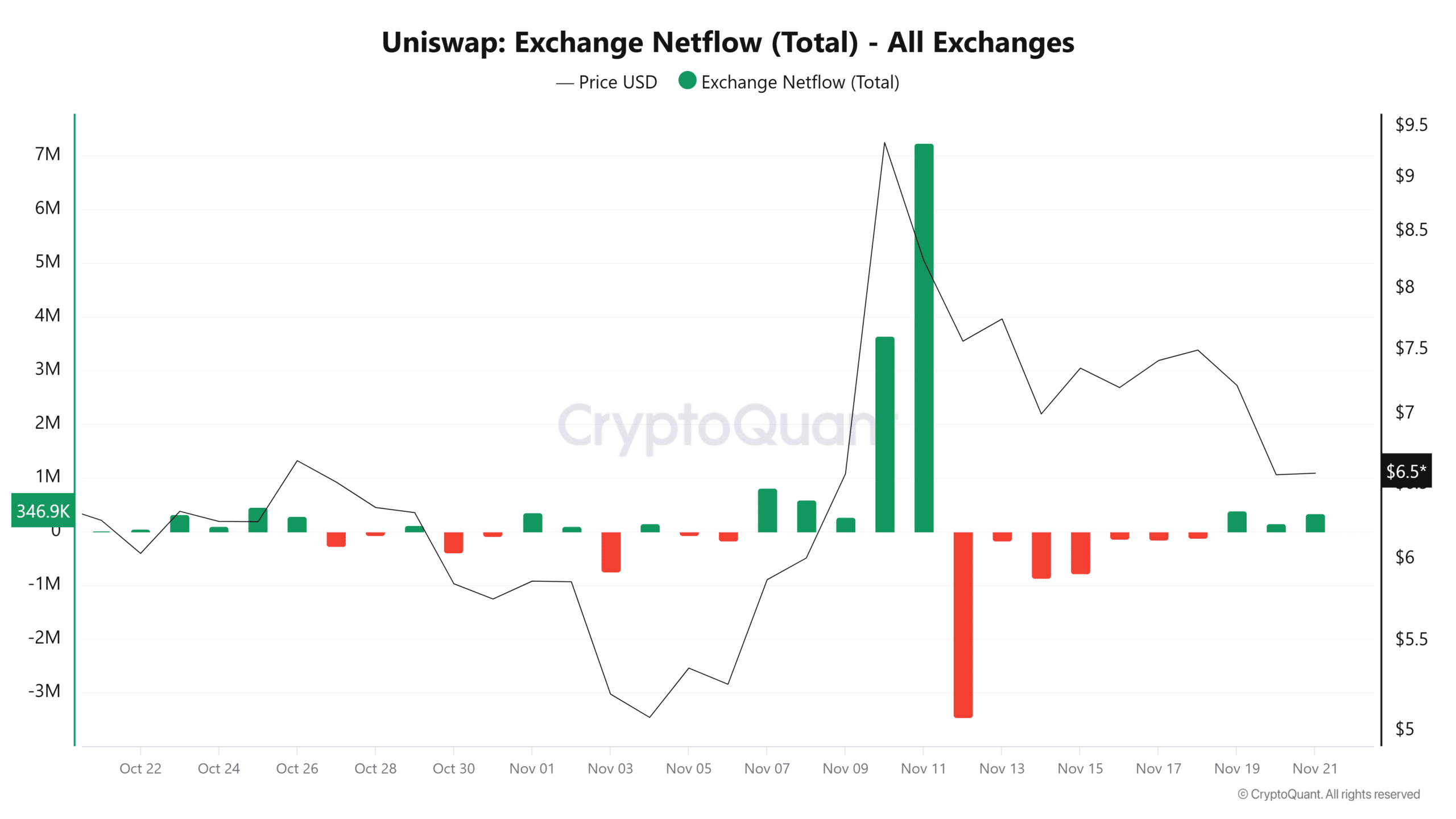

Exchange netflows show 5.6 million tokens offloaded in three days, with UNI down 9.14% daily.

Explore UNI whale capitulation and its impact on Uniswap price after the Unification proposal. Learn about massive sells, losses, and bearish signals. Stay informed on crypto trends and make strategic decisions today.

What is driving UNI whale capitulation?

UNI whale capitulation refers to large holders selling their Uniswap tokens at significant losses amid market downturns, often triggered by failed rallies. Following the Unification proposal, whales accumulated UNI but quickly reversed to offloading as prices fell from $10.2 to $6.4. This behavior highlights fear of further declines in the decentralized exchange token.

How has recent whale activity affected Uniswap’s market?

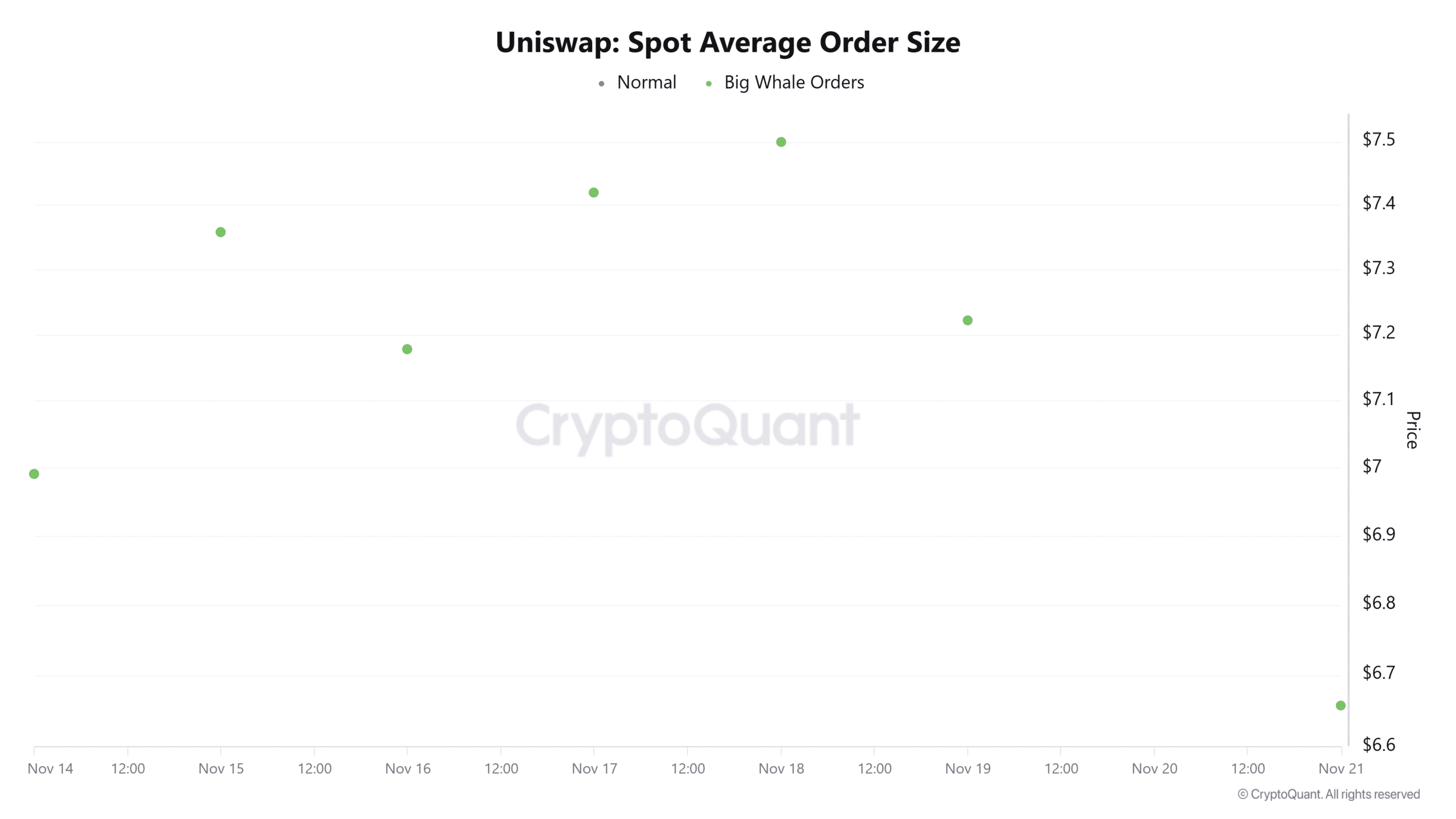

Whale involvement in Uniswap has escalated since the Unification proposal, initially boosting buying interest before turning to sales. Data from CryptoQuant indicates sustained large orders on spot markets, reflecting active participation from big players. On November 10 and 11, whales bought in, but post-peak, sentiment flipped to selling, with one entity dumping 1.71 million UNI worth $15 million, incurring $1.4 million in losses per Lookonchain analysis. This shift underscores a bearish outlook, as sustained selling pressure dominates.

Source: CryptoQuant

These actions contribute to increased volatility, eroding investor confidence. Market experts note that such capitulation often precedes deeper corrections, as whales’ moves influence retail traders. Short paragraphs like this aid readability, with key metrics emphasizing the scale of the downturn.

Frequently Asked Questions

Why did a dormant UNI whale sell after 4.5 years?

A long-dormant whale holder liquidated 512,000 UNI tokens accumulated in 2021 at $29.8 each, now valued at under $7. This move realized an $11.65 million loss, representing 76% depreciation, likely due to capitulation fears amid the ongoing bearish trend and recent price rejection.

What could happen to UNI price if whale selling continues?

If whale selling persists, UNI might slide further to $5.8, potentially wiping out November gains. However, a recovery above $7.6 on the Fibonacci Bollinger Bands could target $8.4 resistance, offering bulls a chance to regain control in this volatile market.

Key Takeaways

- Heightened Whale Activity Post-Proposal: Initial buys on November 10-11 turned to sells, with 1.71 million UNI dumped for $1.4 million loss, per Lookonchain data.

- Dormant Whale Capitulation: A 4.5-year holder sold 512k UNI at 76% loss, totaling $11.65 million, signaling deep market fear.

- Bearish Technical Signals: Positive exchange netflows for three days and a bearish DMI crossover suggest potential drop to $5.8 unless $7.6 is reclaimed.

Source: CryptoQuant

Source: Tradingview

Conclusion

The recent UNI whale capitulation following the Unification proposal has amplified bearish pressures on Uniswap, with sales from long-term holders like the dormant whale underscoring market unease. Exchange netflows and technical indicators point to potential further declines unless key supports hold. As the crypto landscape evolves, monitoring whale movements remains crucial; investors should assess risks and consider diversified strategies for long-term stability in decentralized finance.