Uniswap Patent Lawsuit Dismissed: UNI Impact

UNI/USDT

$127,846,437.75

$3.771 / $3.537

Change: $0.2340 (6.62%)

+0.0046%

Longs pay

Contents

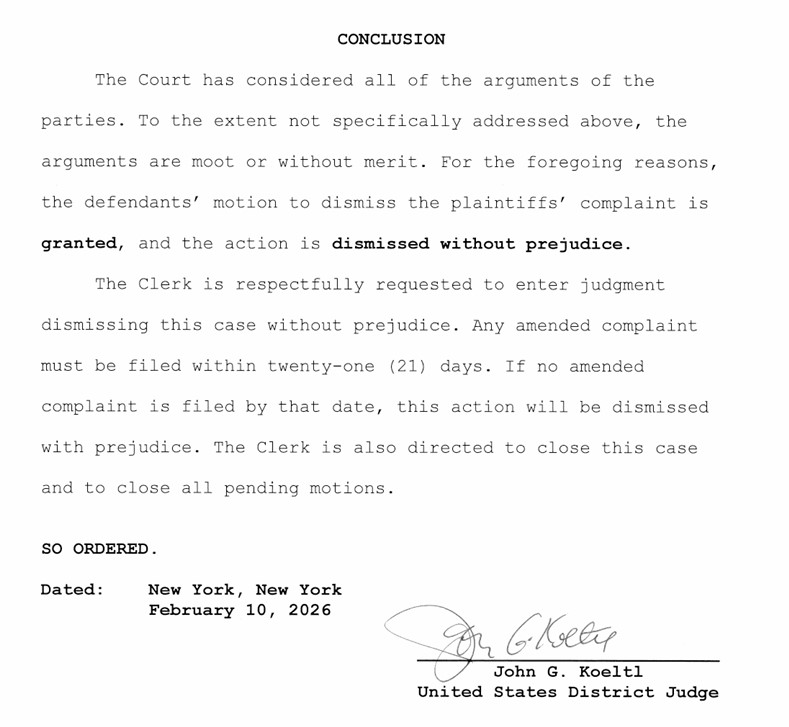

U.S. District Judge John G. Koeltl of the Southern District of New York dismissed the patent infringement lawsuit filed by Bprotocol Foundation and LocalCoin Ltd., affiliated with Bancor, against Uniswap Labs and Uniswap Foundation. The court ruled that the patents target abstract ideas such as calculating exchange rates for cryptocurrency exchanges and fail the U.S. Supreme Court's two-step Alice patent eligibility test, thus not eligible for protection.

Details of the Uniswap Patent Case Dismissal Decision

While the decision is a procedural victory for Uniswap, it is not final; the case was dismissed without prejudice, allowing plaintiffs 21 days to file an amended complaint. The court also stated that claims of direct infringement, inducement, and willful infringement were not sufficiently pled. This goes down in history as the first major hurdle in patent wars among DeFi protocols.

Alice Test and the Abstract Idea Problem of Crypto Patents

The two-step test defined by the Alice Corp. v. CLS Bank decision examines whether patents (1) are abstract ideas, and (2) contain an inventive application. Bancor's patents (e.g., US 10,902,456) covered ratio calculations in liquidity pools, but the court viewed them as 'mathematical formulas.' This is a critical precedent that complicates patenting Uniswap's AMM model (x*y=k).

Hayden Adams' X Post and Community Reaction

Uniswap founder Hayden Adams posted on the X platform, “A lawyer told us we won.” Cointelegraph requested comment but received no response. The DeFi community is celebrating the decision as a victory for open-source innovation while discussing the next moves of patent trolls. Click for detailed UNI analysis.

UNI Price and Technical Indicators: Supports in Downtrend

As of February 11, 2026, UNI price is $3.23, 24-hour change -%4.21. RSI 26.54 (oversold), Supertrend bearish, above EMA20 $3.9571. The table below shows key levels:

| Level | Price | Score | Distance | Sources |

|---|---|---|---|---|

| S1 (Strong) | $2.8450 | 76/100 ⭐ | -12.06% | Fib 0.000, Donchian Lower |

| S2 (Strong) | $3.1800 | 67/100 ⭐ | -1.70% | RSI Oversold, Prev Day Low |

| R1 (Strong) | $3.6949 | 66/100 ⭐ | +14.22% | Fib 0.114, Prev Day High |

| R2 (Strong) | $3.4393 | 64/100 ⭐ | +6.32% | Ichimoku Tenkan |

In the downtrend, S2 ($3.18) is the first test point; if broken, watch S1. Check UNI futures.

DeFi Patent Risks and Uniswap's Future

The decision weakens patent strategies of competitors like Bancor, but there is a risk of amended complaints. Experts predict this precedent will limit DEX patents. Related coins like ALT are also indirectly affected; check ALT price analysis. Investors may view the RSI oversold signal as an opportunity.

Strategic Recommendations for Uniswap Investors

- Short-term: Monitor S2 support, await RSI recovery.

- Long-term: Patent victory strengthens UNI's DeFi leadership.

- Risks: Refiling of the case, regulatory uncertainty.