Uniswap UNI May Rebound as Whales Accumulate Amid Bearish Pressure

UNI/USDT

$127,846,437.75

$3.771 / $3.537

Change: $0.2340 (6.62%)

+0.0046%

Longs pay

Contents

Uniswap’s UNI token has seen a price decline to $5.3 amid bearish pressure, but whale accumulation of over 8.96 million tokens signals potential rebound, with net exchange outflows indicating buying interest and bullish indicators like RVGI crossover emerging.

-

Uniswap UNI drops to $5.3 after rejection at $10, entering a descending channel with strong bearish signals from Parabolic SAR.

-

Whales accumulate 8.96 million UNI in 24 hours, showing renewed confidence despite recent selling.

-

Negative netflow of -$269k reflects spot accumulation, with UNI trading at $5.5 up 2.1% daily per market data.

Discover how Uniswap UNI price is rebounding with whale buys at $5.3 low—explore indicators, accumulation trends, and potential targets to $6.7. Stay informed on DeFi shifts today.

What is causing the Uniswap UNI price to potentially rebound after its recent decline?

Uniswap UNI price has experienced a sharp decline, sliding from a rejection at $10 into a descending channel and hitting a low of $5.3, but early signs of recovery are emerging due to whale accumulation and technical indicators. Large holders added 8.96 million tokens to their portfolios in the last 24 hours, far outweighing sales of just 1.4 million, according to on-chain data. This buying activity, combined with a bullish crossover on the Relative Vigor Index (RVGI) at -0.1140, suggests improving momentum that could push UNI toward $6.7 if demand holds.

How are whales influencing the current Uniswap UNI market dynamics?

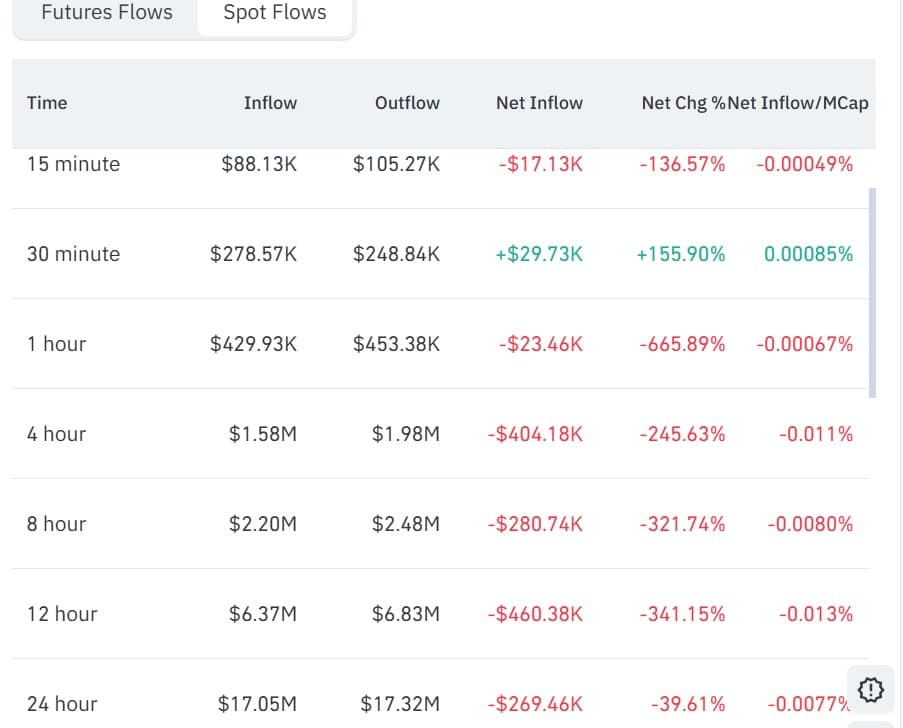

Whales, defined as top holders with significant UNI stakes, have stepped in aggressively following the token’s drop to $5.3, viewing it as a discount entry point amid broader market cooldown. Data from Nansen reveals a positive balance change of over 7.5 million tokens among these large investors in the past day, highlighting a shift from prior selling pressure during the token’s unification rally. For instance, wallet 0xb5E4 withdrew 823,368 UNI valued at $4.72 million from exchanges like Binance and Bybit in just five hours, a move flagged by Lookonchain that underscores renewed confidence. Historically, such whale demand has preceded reversal attempts in volatile assets like UNI, as it reduces available supply on exchanges and stabilizes prices during downturns. Exchange flows further support this, with CoinGlass reporting $17.05 million in inflows against $17.32 million in outflows, resulting in a netflow of -$269k—a 39.6% improvement that aligns with accumulation patterns observed in previous cycles. Experts in DeFi analytics, such as those from on-chain research firms, note that this level of top-holder activity often correlates with 20-30% price recoveries within weeks, provided broader market sentiment remains neutral.

Source: Nansen

While UNI currently trades near $5.5, marking a modest 2.1% daily gain, this whale involvement contrasts with the token’s recent breach below its Parabolic SAR indicator, which had confirmed bearish dominance. Nonetheless, the cooldown phase has attracted these institutional-level buyers, potentially setting the stage for reduced volatility and upward pressure in the short term.

Frequently Asked Questions

What factors led to the recent Uniswap UNI price drop to $5.3?

The Uniswap UNI price decline to $5.3 stemmed from a rejection at the $10 resistance level a month ago, pushing the token into a descending channel pattern. This was exacerbated by broader market bearish sentiment and UNI falling below its Parabolic SAR, signaling strong selling pressure, though on-chain data shows this created an opportune entry for accumulators.

Is UNI whale accumulation a reliable signal for price recovery?

Yes, UNI whale accumulation often serves as a bullish precursor for price recovery in DeFi tokens, as it indicates confidence from major investors reducing exchange supply. With top holders netting over 7.5 million tokens recently, historical patterns suggest this could support a rebound to $6.7, though sustained buyer commitment is essential amid lingering bearish indicators.

Source: CoinGlass

Key Takeaways

- Whale Accumulation Boost: Top holders added 8.96 million UNI versus selling 1.4 million, leading to a positive balance shift and potential supply reduction.

- Technical Rebound Signals: Bullish RVGI crossover at -0.1140 hints at momentum recovery, though bears retain control until $6.06 resistance breaks.

- Monitor Exchange Flows: Negative netflow of -$269k confirms spot buying; watch for persistent demand to avoid retesting $5.3 lows.

Source: TradingView

Conclusion

Uniswap’s UNI price decline to $5.3 has drawn significant whale accumulation, with over 8 million tokens added by top holders and technical indicators like the RVGI showing early rebound potential toward $6.7. While bearish pressure from the Parabolic SAR persists, negative exchange netflows underscore growing buyer interest in this DeFi leader. As market dynamics evolve, investors should track whale activity and momentum shifts closely, positioning UNI for a possible trend reversal in the coming sessions—consider monitoring these signals for informed trading decisions.

Comments

Other Articles

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Ethereum Whales Trim ETH Longs and Pivot to BTC in Dec 31 On-Chain Rebalance Update

December 31, 2025 at 01:27 PM UTC

Bitwise Seeks SEC Approval for 11 Crypto ETFs Targeting AAVE, UNI, TAO

December 31, 2025 at 01:17 PM UTC