Upexi Seeks SEC Nod for $1B Raise to Expand Solana Treasury Holdings

SOL/USDT

$5,338,162,454.18

$90.13 / $78.12

Change: $12.01 (15.37%)

+0.0064%

Longs pay

Contents

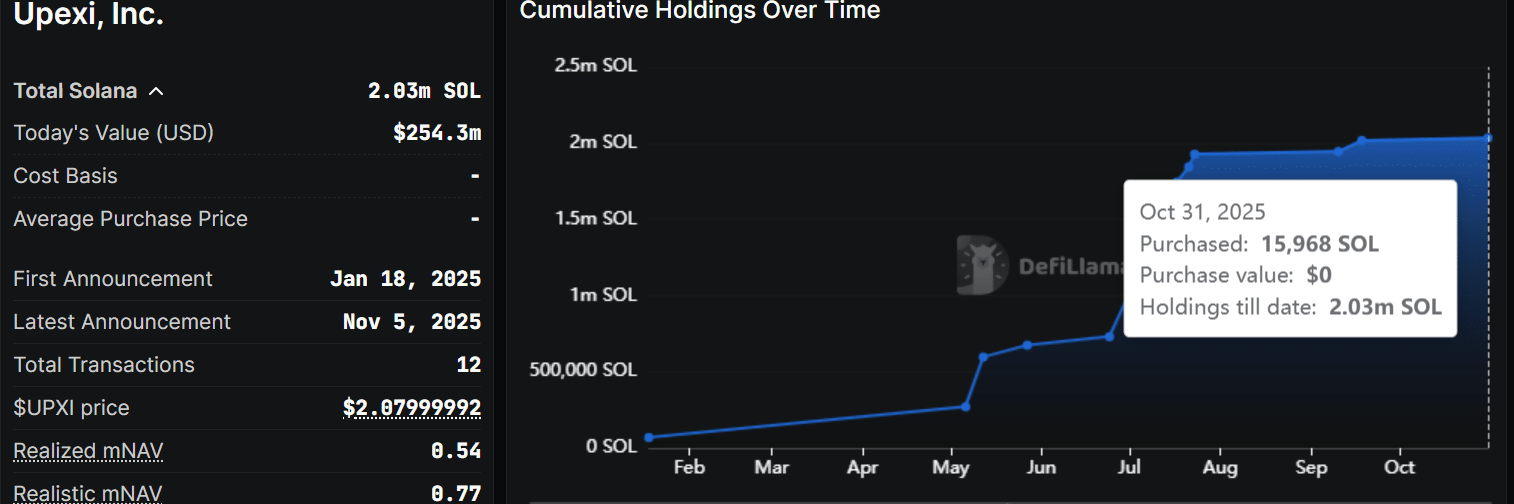

Upexi, an e-commerce developer, has filed with the U.S. Securities and Exchange Commission (SEC) to raise up to $1 billion through shares, preferred stock, and other securities to expand its Solana (SOL) digital asset treasury (DAT). This move aims to capitalize on current market discounts, building on its existing holdings of 2.03 million SOL valued at $254 million.

-

Upexi launched its SOL DAT strategy in January 2025, aggressively accumulating tokens to reach 2.03 million SOL by year-end.

-

Despite a late 2025 price correction reducing holdings value from over $500 million to $254 million, Upexi shows strong commitment to increasing exposure.

-

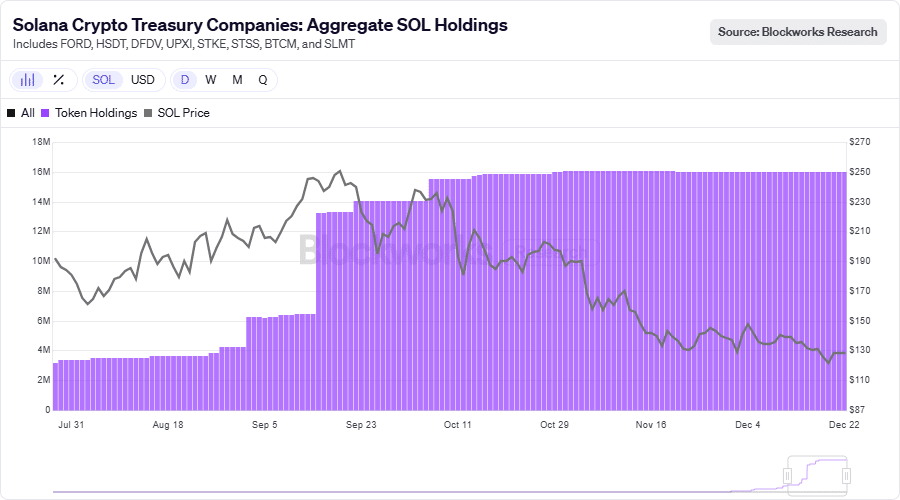

Overall SOL treasury demand grew fivefold in H2 2025, from 3 million to over 16 million tokens across companies, per Blockworks data.

Upexi seeks SEC approval to raise $1 billion for Solana treasury expansion amid market dips. Discover how this boosts SOL holdings and signals investor confidence in digital assets. Stay updated on crypto treasury trends.

What is Upexi’s Strategy for Expanding Its Solana Treasury?

Upexi’s Solana treasury expansion involves seeking SEC approval to issue up to $1 billion in shares, preferred stock, and other units to fund further acquisitions of SOL tokens. The company initiated its digital asset treasury strategy in January 2025 and has since built a substantial position of 2.03 million SOL, currently valued at $254 million based on recent market prices. This aggressive accumulation, primarily in the second half of 2025, underscores Upexi’s belief in Solana’s long-term potential as a high-performance blockchain.

Upexi has sought the U.S. SEC’s green light to issue $1 billion worth of shares, preferred stock, and other units to raise capital to scale the Solana [SOL] digital asset treasury (DAT).

The e-commerce developer began its SOL DAT strategy in January and has aggressively increased its stash to 2.03 million SOL tokens, worth $254 million at current prices. The bulk of the holdings were added during H2 2025.

Source: DeFiLlama

However, Solana’s price correction in late 2025 devalued its holdings from over $500 million to $254 million.

As such, the latest move would signal conviction and plans to grab the current discounted window to increase its SOL exposure.

How Has Solana’s Market Performance Impacted Corporate Digital Asset Treasuries?

Solana’s price experienced a significant correction in late 2025, dropping from a high of $295 to around $120, resulting in a 58% drawdown that affected corporate treasuries like Upexi’s. This devaluation reduced the worth of aggregated SOL holdings across companies from peak levels, highlighting the volatility inherent in digital assets. Despite this, demand for SOL in treasuries surged in the second half of 2025, with total holdings jumping from 3 million to over 16 million tokens—a more than fivefold increase—according to data from Blockworks.

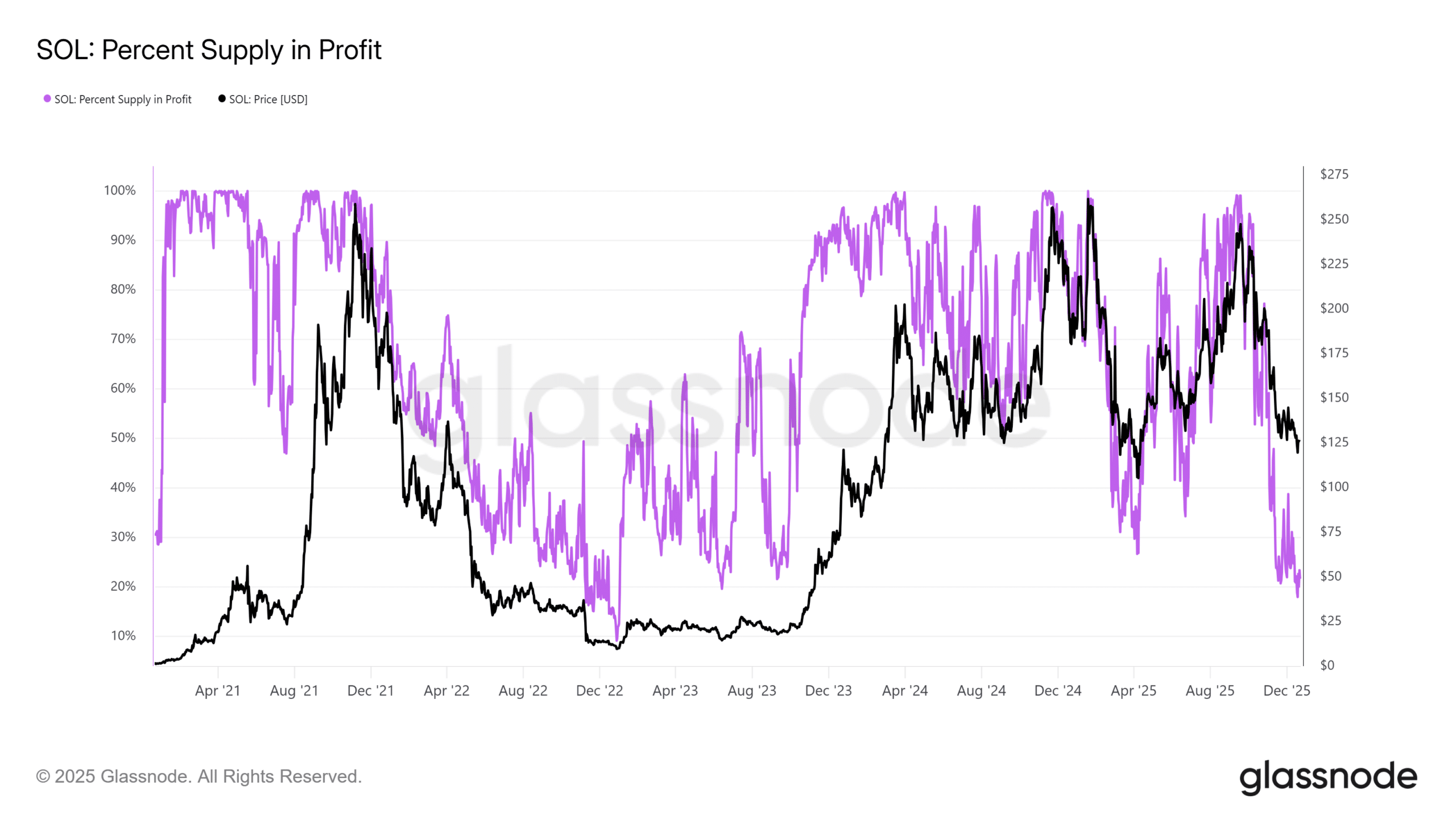

The correction has led to broader market distress, with the percentage of SOL supply in profit falling to a three-year low of 18%, reminiscent of the market turmoil following the FTX collapse in 2022, as reported by Glassnode. This low profit level indicates that many holders are underwater, potentially creating buying opportunities for long-term investors. Upexi’s decision to seek additional capital during this dip demonstrates strategic foresight, aiming to bolster its position when asset prices are depressed.

Expert analysis from on-chain metrics providers like Glassnode emphasizes that such periods of low profitability often precede recoveries, as reduced selling pressure from profitable holders can stabilize prices. For corporate treasuries, this environment tests resilience but also offers chances to accumulate at discounted rates. Upexi’s approach aligns with a growing trend among firms diversifying into blockchain assets, using them as a hedge against traditional market fluctuations.

SOL DAT Demand vs. ETF Flows

Most of SOL DAT’s momentum was built up in the second half of 2025. From July to December, total SOL treasury holdings surged from 3 million to over 16 million, representing more than five‑fold growth in demand.

Source: Blockworks

However, with no strong DAT demand in late 2025, the broader market correction accelerated SOL’s drawdown to 58% drawdown, from $295 to $120.

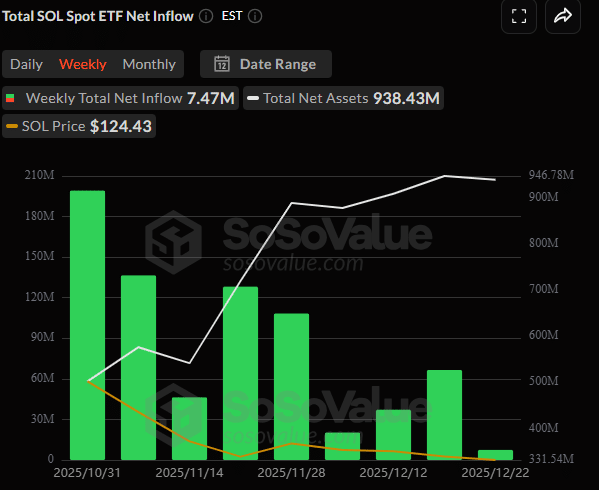

In contrast, U.S. spot Solana exchange-traded funds (ETFs), which launched in late October 2025, have seen robust inflows totaling $750 million over the subsequent weeks, even amid the market downturn. Data from SosoValue indicates consistent weekly net inflows, reflecting institutional interest in regulated exposure to SOL. This divergence between treasury accumulation and ETF flows suggests that while direct corporate buying slowed in the final months, investor appetite through financial products remains strong.

SOL ETF Demand Hits $750 Million

Surprisingly, this was contrary to recent U.S. spot SOL ETF demand. Since their debut in late October, the products have consistently recorded weekly inflows totaling $750 million, despite the broader market lull.

Source: Soso Value

Still, the deeper bearish sentiment failed to lift SOL’s price prospects. In fact, the Q4 pullback has shrunk supply in profit from nearly 100% to a three-year low of 18%.

This could rival the market distress level comparable to the FTX implosion in 2022, should SOL slip lower. By extension, the distress also suggested that current levels were major bargains for long-term investors.

Source: Glassnode

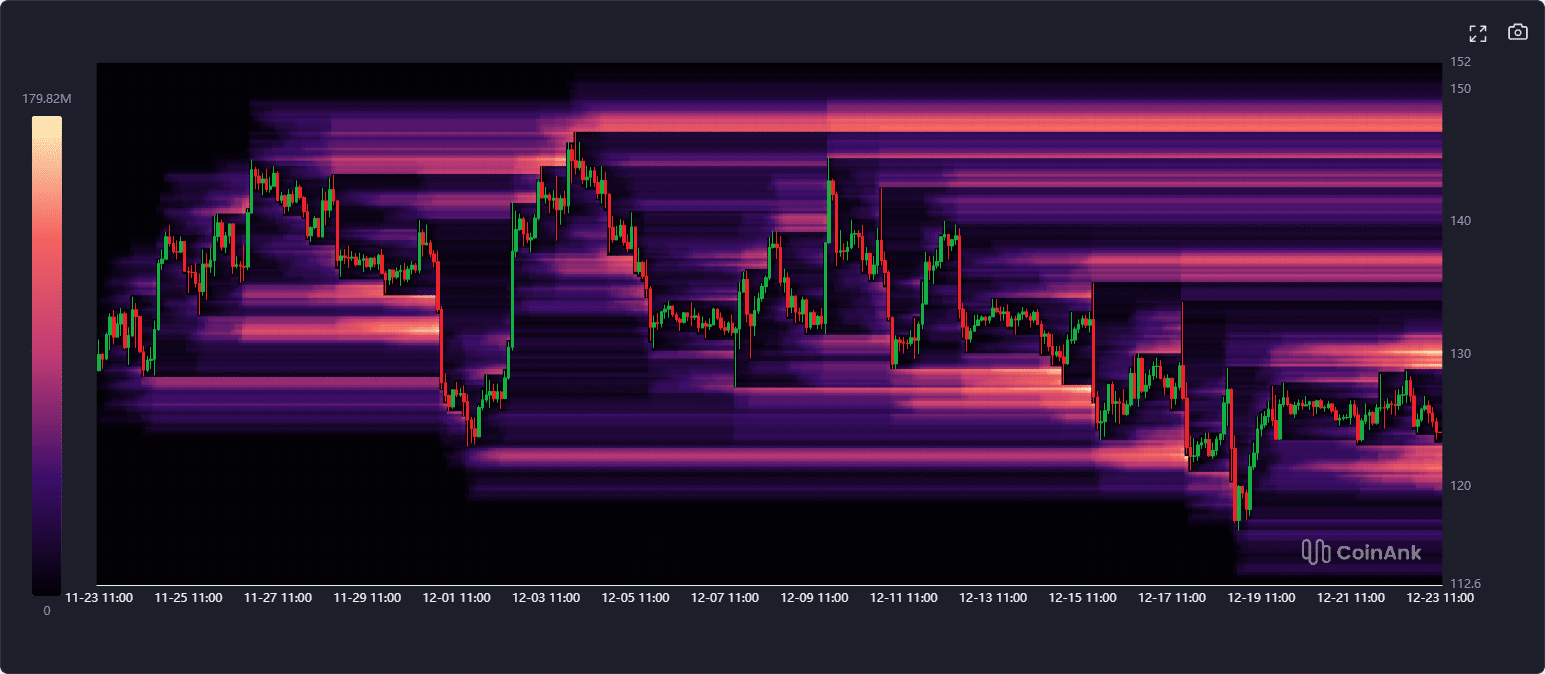

That said, the 1-month liquidation heatmap marked out $120 and $130 as key areas that could attract price action in the near-term. These were immediate liquidity pools of leveraged shorts and longs that could be swiftly hit during liquidity hunts.

Beyond $130, the $135-$137 could become a key upside target, while the downside floor to track was $100 if $120 support cracks.

Source: CoinAnk

Frequently Asked Questions

Why is Upexi seeking to raise $1 billion for its Solana digital asset treasury?

Upexi aims to raise the funds to acquire more SOL tokens during the current market correction, enhancing its treasury holdings that stand at 2.03 million SOL worth $254 million. This strategy, initiated in January 2025, seeks to leverage discounted prices for long-term growth in blockchain investments, following SEC regulatory guidelines for capital issuance.

What role do Solana ETFs play in the current market dynamics for SOL?

Solana ETFs, launched in late October 2025, have attracted $750 million in inflows despite price declines, providing regulated access for institutional investors. This steady demand contrasts with slower direct treasury accumulations and could support price stabilization, making SOL an appealing option for diversified portfolios in voice search queries about crypto investment vehicles.

Key Takeaways

- Upexi’s Commitment to SOL: The company’s push for $1 billion in funding highlights confidence in Solana’s ecosystem, building on its 2.03 million token holdings amid 2025’s volatility.

- Fivefold Treasury Growth: Aggregate SOL holdings in corporate treasuries rose from 3 million to over 16 million in H2 2025, per Blockworks, signaling robust demand despite corrections.

- ETF Inflows as a Buffer: $750 million in SOL ETF inflows since October 2025 offers a counterbalance to bearish sentiment, potentially aiding recovery for long-term holders.

Conclusion

Upexi’s pursuit of SEC approval for a $1 billion Solana treasury expansion reflects a calculated response to late 2025’s market correction, where SOL prices fell sharply but treasury demand earlier surged dramatically. With ETF inflows providing additional support and on-chain data from sources like Glassnode indicating bargain levels, this development positions Solana as a resilient asset in corporate strategies. As the digital asset landscape evolves, investors should monitor regulatory outcomes and price supports around $120 for potential upside toward $135-$137.

Final Thoughts

- Upexi pushes to increase its SOL holdings during this discounted window.

- ETF demand surged $750 million in the past three months, but broader bearish sentiment capped SOL’s recovery prospects.

Comments

Other Articles

Solana Leads 2025 Revenue as Bulls Test $130 Resistance

January 1, 2026 at 10:32 AM UTC

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Ethereum Whales Trim ETH Longs and Pivot to BTC in Dec 31 On-Chain Rebalance Update

December 31, 2025 at 01:27 PM UTC