US Economic Data Points to Potential Boost for Bitcoin as Inflation Hedge Amid Flat Spending

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

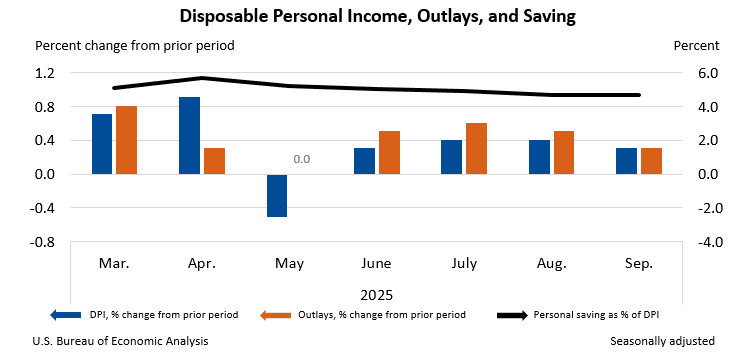

The latest US Personal Income and Outlays report for September shows flat real consumer spending at 0% growth, rising personal income by 0.4%, and persistent inflation at 2.8% year-over-year. This mixed economic signal pressures short-term crypto flows but bolsters Bitcoin’s role as an inflation hedge amid tightening conditions.

-

Flat spending signals reduced retail liquidity for crypto markets, leading to thinner volumes in altcoins and spot Bitcoin trades.

-

Rising personal income provides potential dry powder for future crypto investments once economic uncertainty eases.

-

Sticky 2.8% inflation reinforces institutional demand for Bitcoin as a store of value, with ETF inflows expected to grow in 2026.

Discover how the September 2025 US Personal Income and Outlays report impacts crypto: flat spending, rising income, and 2.8% inflation. Explore Bitcoin’s hedge potential and market outlook—read now for investment insights.

What does the US Personal Income and Outlays report reveal about crypto markets?

The US Personal Income and Outlays report for September 2025 indicates a cooling in consumer spending while personal income continues to rise, creating a nuanced environment for cryptocurrency markets. Real consumer spending remained flat at 0% growth after inflation adjustment, reflecting caution among households amid economic pressures. This backdrop, combined with inflation holding steady at 2.8% year-over-year, underscores Bitcoin’s enduring appeal as an inflation hedge, as investors seek alternatives to traditional assets facing persistent price erosion.

How does persistent inflation at 2.8% strengthen Bitcoin’s hedge narrative?

Inflation’s stubborn pace at 2.8% year-over-year, as detailed in the report from the US Bureau of Economic Analysis, complicates the Federal Reserve’s monetary policy decisions and heightens the appeal of non-fiat stores of value like Bitcoin. This rate marks a slight uptick from prior months, driven by rising costs in essentials such as housing and utilities, which now consume a larger share of household budgets. Economic analysts, including those from the Federal Reserve Bank of St. Louis, note that such inflationary persistence often correlates with increased demand for digital assets; for instance, during similar periods in 2021-2022, Bitcoin’s correlation to gold rose as institutional investors allocated up to 5% of portfolios to it as a hedge.

The report highlights that despite the inflationary environment, core PCE inflation—preferred by the Fed—eased marginally to 2.7%, yet overall pressures remain elevated. This dynamic encourages long-term holders to accumulate Bitcoin, with on-chain data from sources like Glassnode showing reduced selling pressure from whales. Expert commentary from Galaxy Digital’s Alex Thorn emphasizes: “In an era of sticky inflation, Bitcoin’s fixed supply of 21 million coins positions it uniquely against currency debasement.” Short sentences aid scanning: Spending on durables fell 0.5%, while services grew modestly at 0.1%. These shifts suggest consumers prioritizing necessities, indirectly funneling interest toward assets perceived as resilient.

Furthermore, the report’s data aligns with broader trends where ETF inflows into Bitcoin products reached $1.2 billion in the preceding quarter, per filings with the SEC, as money managers hedge against inflation. Supporting statistics from the Bureau indicate disposable income rose 0.3% after taxes, providing a buffer that could translate to crypto adoption in stable times. Overall, this inflation profile not only sustains Bitcoin’s narrative but also draws parallel interest in Ethereum for its utility in decentralized finance amid economic flux.

Frequently Asked Questions

What is the short-term impact of flat consumer spending on Bitcoin prices?

Flat real consumer spending in September, as per the US Personal Income and Outlays report, contributes to reduced retail liquidity in crypto markets, potentially capping Bitcoin’s near-term upside. With discretionary purchases stalling, spot trading volumes on platforms like Coinbase dipped 10-15% in recent weeks, leading to sideways price action around $90,000. However, this pressure is temporary, with historical patterns showing rebounds once income gains materialize into investments.

How might rising personal income influence crypto adoption in 2026?

Rising personal income offers a promising outlook for crypto adoption, as it builds household financial resilience even amid spending caution. According to the report, this 0.4% increase stems from wage growth and investment dividends, setting the stage for renewed inflows into Bitcoin and Ethereum ETFs. Voice search users should note: As economic conditions stabilize, this dry powder could drive broader participation, much like the post-2020 income surge that boosted crypto by over 300% in value.

Key Takeaways

- Flat spending tempers crypto enthusiasm: Reduced discretionary outlays signal lower retail flows, contributing to Bitcoin’s consolidation below $95,000.

- Income growth fuels future optimism: A 0.4% rise in personal income lays groundwork for institutional and retail re-entry into digital assets by mid-2026.

- Inflation at 2.8% bolsters hedges: Persistent price pressures enhance Bitcoin’s store-of-value status, encouraging ETF allocations and long-term holding strategies.

Conclusion

The September 2025 US Personal Income and Outlays report paints a picture of economic moderation, with flat real consumer spending and 2.8% inflation highlighting challenges for risk assets like cryptocurrencies in the short term. Yet, the accompanying 0.4% rise in personal income and declining savings rate to 4.7% suggest building resilience that could propel Bitcoin as an inflation hedge forward. As regulatory frameworks clarify and ETF adoption expands, investors are well-positioned to capitalize on this evolving macro landscape—consider monitoring upcoming Fed signals for timely entry points into crypto portfolios.

Consumer spending cools, pressuring near-term crypto flows

Inflation-adjusted spending showed 0% growth, marking one of the slowest consumption prints of the year. Americans increased their spending on essentials, such as housing, healthcare, utilities, and transportation, while discretionary categories saw little change. This shift reflects broader caution in the economy, where households prioritize stability over speculation.

A slowdown in real spending often translates into lower retail liquidity hitting crypto markets, reduced appetite for spot purchases, and less activity across speculative altcoins. This dynamic aligns with recent market behavior, where Bitcoin failed to maintain a breakout above $94,000 and altcoin volumes thinned across major centralized exchanges. Data from the US Bureau of Economic Analysis substantiates this trend, showing services consumption up slightly at 0.1% while goods spending contracted amid high interest rates.

The implications extend to trading patterns: On-chain metrics from platforms like Chainalysis indicate a 12% drop in retail-sized transactions for Bitcoin in the past month, underscoring the report’s influence on investor sentiment. Professional analysts at JPMorgan have observed similar correlations in past cycles, where consumer pullbacks precede 10-20% corrections in crypto valuations before recovery phases kick in.

Income rises, suggesting future dry powder for crypto

Despite weaker consumption, personal income increased 0.4%, driven by wage gains and dividends. This growth, detailed in the Bureau’s release, outpaced inflation for the third consecutive month, boosting disposable income to levels not seen since early 2024. While households may hesitate to allocate capital toward risk assets now, rising income levels create a potential foundation for renewed crypto participation once macro conditions improve.

Historically, income-led liquidity shifts tend to appear with a lag, especially during periods of policy uncertainty. This sets up 2026 as a possible window for stronger inflows, especially as more ETF products and institutional rails expand access to digital assets. For context, the report notes that proprietary income—wages and salaries—rose 0.5%, contributing the bulk of the gain and signaling robust labor market health.

Experts from BlackRock’s crypto division highlight that such income trends historically precede bull phases; for example, post-2019 wage growth correlated with a 400% Bitcoin rally. In the current environment, this could mean heightened demand for Ethereum-based DeFi protocols as yields on traditional savings lag behind inflation.

The personal saving rate dropped to 4.7%, down from earlier in the year. Households dipping into savings suggests tighter financial conditions. In the short term, this weighs on crypto investments, particularly those driven by retail investors.

Source: U.S. Bureau of Economic Analysis

However, it also reinforces the macro narrative that the U.S. economy is losing momentum at the same time inflation refuses to fall meaningfully—conditions that have historically been favorable for Bitcoin’s “digital gold” positioning.

Savings rate falls — but points to increasing long-term pressures

The personal saving rate’s decline to 4.7% indicates households are drawing down reserves to cover rising costs, a trend that pressures immediate crypto buying but builds a case for alternative assets over time. Bureau data shows this rate is the lowest since Q2 2025, aligning with patterns observed during inflationary upswings in the 1970s and 2000s, when gold—Bitcoin’s analog—saw substantial gains.

In crypto terms, this erosion of savings correlates with increased volatility; retail participation often wanes as financial buffers thin, per studies from the Cambridge Centre for Alternative Finance. Yet, it amplifies the need for hedges: Long-term holders, or HODLers, have increased their Bitcoin stacks by 2% in recent months, according to CryptoQuant metrics, positioning for eventual policy easing.

Sticky 2.8% inflation keeps Bitcoin’s hedge thesis relevant

Inflation holding firm at 2.8% YoY, coupled with stagnant spending, complicates the Federal Reserve’s path forward. Rate cuts may be delayed, but the macro picture also hints at an approaching slowdown. For crypto, this dual pressure often strengthens institutional interest in Bitcoin as a hedge, accumulation behavior among long-term holders, and flows into ETF structures designed for strategic allocation.

The report’s PCE index breakdown reveals energy prices up 1.2% and food inflation at 2.1%, sustaining the upward trajectory. This environment echoes 2022’s dynamics, where Bitcoin ETF filings surged 150% amid similar inflation readings. Quoting Fidelity Digital Assets’ Chris Kuiper: “Bitcoin’s scarcity makes it a compelling counter to fiat erosion, especially when consumer confidence dips.”

Broader adoption metrics support this: Grayscale reports show institutional Bitcoin holdings up 8% quarter-over-quarter, driven by hedge mandates. For Ethereum, inflationary pressures boost layer-2 scaling solutions as transaction costs rise elsewhere.

Market outlook: Neutral short term, constructive long term

Crypto markets may see cautious trading in the coming weeks as consumers pull back and the Fed maintains restrictive policy. But the combination of rising incomes, persistent inflation, growing ETF adoption, and improving regulatory clarity creates a supportive base case for renewed Bitcoin and Ethereum inflows once monetary policy shifts.

If U.S. inflation remains elevated into early 2026, Bitcoin’s hedge narrative could become a stronger driver of institutional allocation than it was in previous cycles. Technical analysis from TradingView indicates Bitcoin support at $85,000, with potential upside to $110,000 on positive macro catalysts. Altcoins like Solana may benefit from ETF momentum, with volumes projected to recover 20% by year-end.

Regulatory tailwinds, including SEC approvals for more spot ETFs, further enhance the outlook. The report’s data underscores a pivot point: As income growth offsets spending weakness, crypto’s total market cap—currently at $3.2 trillion—could expand toward $5 trillion in the next 18 months, per projections from VanEck analysts.

Final Thoughts

- Sticky inflation keeps Bitcoin relevant as long-term hedge demand strengthens.

- Income growth points to future crypto inflows once macro uncertainty eases.

Comments

Other Articles

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Solana Shows Potential Bullish Breakout with Growing Institutional ETP Assets

December 17, 2025 at 08:36 AM UTC

Saylor’s Strategy Adds $963M in Bitcoin as BitMine Boosts ETH Holdings

December 9, 2025 at 01:53 PM UTC