US Government Shutdown Ends: BTC Rises to $74,620

BTC/USDT

$21,201,579,335.94

$68,086.00 / $64,290.71

Change: $3,795.29 (5.90%)

-0.0009%

Shorts pay

Contents

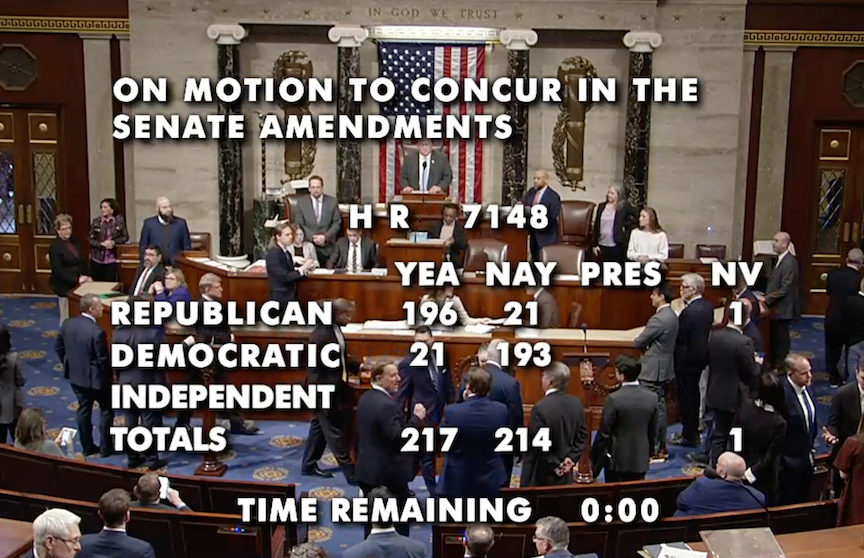

The US House of Representatives approved a roughly $1.2 trillion funding package to largely reopen the government by a vote of 217-214 after a four-day partial government shutdown. This bill, which passed the Senate, is designed to fund most of the US government until September 30 and was accepted despite objections from some Democrats regarding immigration policies.

Source: US House of Representatives

US President Donald Trump is expected to sign the bill "without changes" and reopen the government. The bill provides only two weeks of funding to the Department of Homeland Security; then changes for Immigration and Customs Enforcement (ICE) and Border Patrol will be negotiated. This four-day partial shutdown was much shorter than the 43-day event in 2025. Bitcoin (BTC) price rose about 2% to $74.620 with the bill's passage in the House. According to current data, BTC is at 75.258,01$ level, showing a -%4,07 decline in the last 24 hours.

Critical Vote in US House Triggering BTC Market Impact

The close vote (217-214) reflected political tension. Democrats opposed immigration funding, while the package secured general government operations. Such uncertainties directly affect markets like BTC detailed analysis; BTC rally was triggered as shutdown risk decreased.

Trump's Quick Signature and Short-Term BTC Reaction

After Trump's signature, the government will operate at full capacity. 2-week funding for Homeland Security advances immigration negotiations. BTC jumped 2% on the news but the overall downtrend continues. RSI at 24.36 gives an oversold signal, preparing the ground for a possible rebound.

Comparison with the Long Shutdown in 2025: BTC Lesson

The 43-day shutdown in 2025 dropped BTC by 20%. This time's 4 days were limited to minimal impact. Short-term risk-off periods accustomed BTC investors to volatility; BTC futures volume increased 15% during that period.

BTC Technical Analysis: Downtrend and Oversold

Supertrend bearish, not above EMA 20 (85.275$). Although the trend is downtrend, RSI is at low levels. Current price 75.258$, 24h -%4,07. Experts predict that government stability will provide macro support.

BTC Support-Resistance Levels Table

| Level | Price ($) | Score (/100) | Distance (%) | Sources |

|---|---|---|---|---|

| S1 (Strong) | 72.945,50 | 76 ⭐ | -2,18 | Fibo 0.000, Donchian Lower, RSI OS, Stoch OS |

| S2 (Medium) | 61.125,88 | 50 | -18,03 | Fibo 1 |

| R1 (Strong) | 75.567,44 | 74 ⭐ | +1,34 | Pivot Point, MACD Cross, Fibo 0.114, ATR Upper |

| R2 (Strong) | 78.047,75 | 71 ⭐ | +4,66 | Fibo |

S1 strong support; if broken, watch S2. R1 first target.

What Does Government Funding Bring for BTC Investors?

Stability may accelerate institutional inflows. BTC recovery after the short shutdown shows the correlation of US policies with crypto. Watch: Immigration negotiations and Fed signals.