US Judge Probes Do Kwon’s Potential South Korea Sentence After Terra Fraud Guilty Plea

LUNA/USDT

$6,778,795.35

$0.0709 / $0.0600

Change: $0.0109 (18.17%)

Contents

Do Kwon, co-founder of Terraform Labs, faces up to 40 years in prison in South Korea following his guilty plea in the US for wire fraud and conspiracy. A US judge is questioning how South Korean authorities might handle his sentence, potentially impacting extradition and total prison time.

-

US Sentencing Scheduled: Do Kwon pleads guilty to two felony counts, with sentencing set for Thursday in New York federal court.

-

South Korean Charges: Kwon could face 40 years for financial crimes tied to the Terra collapse, after extradition from the US.

-

International Concerns: Judge examines if Montenegrin custody time credits toward US sentence and potential early release risks in South Korea, with losses exceeding those of major crypto fraud cases.

Do Kwon South Korea sentence looms large after US guilty plea in Terraform Labs fraud case. Explore judicial concerns, extradition details, and investor impacts in this in-depth analysis. Stay informed on crypto regulation developments. (148 characters)

What is Do Kwon’s Potential Sentence in South Korea?

Do Kwon South Korea sentence could reach up to 40 years in prison for charges related to the 2022 Terra ecosystem collapse, according to South Korean prosecutors. This follows his guilty plea in the United States to two counts of wire fraud and one count of conspiracy to defraud, where he is set to be sentenced on Thursday. The US judge is probing the interplay between US and South Korean penalties to ensure fair application amid extradition plans.

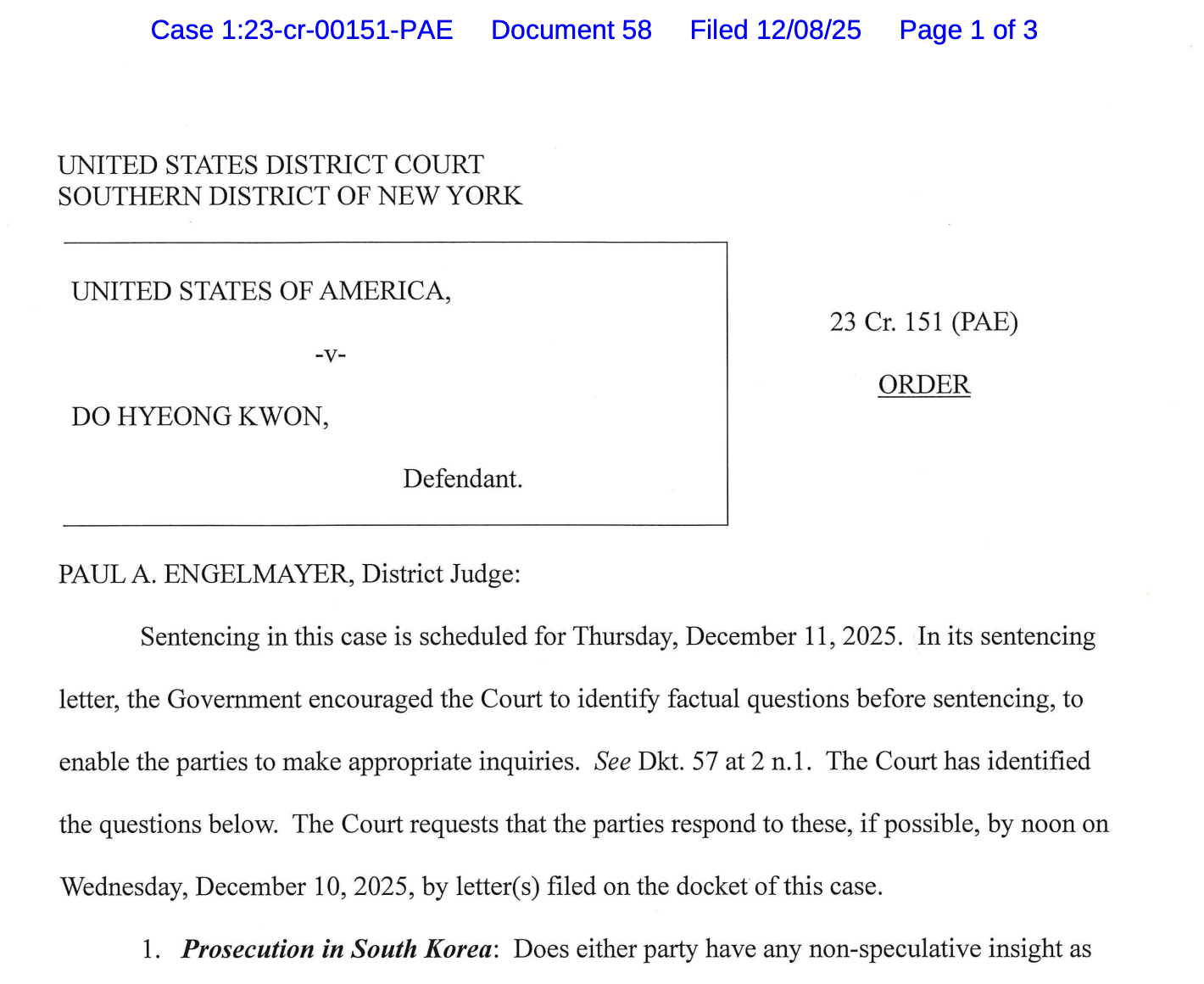

Source: Courtlistener

Will Do Kwon Serve Time Across Multiple Countries?

The Terraform Labs co-founder, Do Kwon, is at the center of a complex international legal battle. After pleading guilty in August to US charges stemming from the TerraUSD stablecoin failure, which wiped out billions in investor value, Kwon awaits sentencing in the Southern District of New York. US District Judge Paul Engelmayer has raised pointed questions in a recent court filing about Kwon’s outstanding charges in South Korea, his native country, and the implications for extradition.

Specifically, the judge inquired about the maximum and minimum sentences Kwon might face in South Korea—potentially up to 40 years—for violations including fraud and market manipulation linked to Terraform Labs. South Korean authorities issued an arrest warrant for Kwon in 2022 shortly after the Terra collapse, which experts widely attribute as a catalyst for broader market turmoil, leading to bankruptcies at firms like Three Arrows Capital and substantial retail investor losses estimated in the tens of billions.

Under US-South Korea extradition treaties, Kwon could serve his US sentence first—prosecutors seek at least 12 years, while defense attorneys argue for no more than five—before being transferred. However, Judge Engelmayer expressed concern that South Korean officials might disregard or shorten the US-imposed term, possibly releasing Kwon early despite the severity of the crimes. This uncertainty stems from differing judicial systems and priorities in prosecuting crypto-related offenses.

Adding another layer, the judge clarified that Kwon’s four-month detention in Montenegro for using falsified documents will not count toward any US sentence, as confirmed by both parties. Montenegro had become a focal point after Kwon’s arrest there in 2023, where he resisted extradition for over a year before being sent to the US. Court records indicate that both the US and South Korea pursued extradition from Montenegro simultaneously, highlighting the global reach of investigations into Terraform’s downfall.

Legal experts, including those familiar with international extraditions, note that such cases often involve diplomatic negotiations to align sentences. For instance, a statement from US prosecutors emphasized that Kwon’s actions caused financial harm surpassing that inflicted by figures like Sam Bankman-Fried of FTX, Alex Mashinsky of Celsius, and OneCoin’s Karl Sebastian Greenwood—each now serving lengthy federal terms. Bankman-Fried’s 25-year sentence for fraud sets a benchmark, but Kwon’s broader ecosystem impact amplifies the stakes.

In South Korea, where Kwon holds citizenship, the financial authorities have been aggressive in pursuing Terraform-related cases. Prosecutors there have charged multiple executives and are building a case centered on misleading investors about Terra’s algorithmic stability, which failed spectacularly in May 2022. Data from blockchain analytics firms shows over $40 billion in market value evaporated, affecting millions worldwide.

Frequently Asked Questions

What Charges Does Do Kwon Face in South Korea After US Sentencing?

Do Kwon faces multiple charges in South Korea, including fraud and breach of capital markets law tied to the Terra collapse. These could result in up to 40 years imprisonment, focusing on misleading promotions of TerraUSD and Luna tokens. Extradition post-US sentence is expected, as confirmed by South Korean warrant issued in 2022. (47 words)

How Does Do Kwon’s Case Impact Global Crypto Regulation?

Do Kwon’s ongoing legal proceedings highlight the need for harmonized international rules on crypto fraud. His case, involving cross-border extraditions from Montenegro to the US and potentially South Korea, shows how regulators are closing in on high-profile figures. This could lead to stricter compliance standards for blockchain projects worldwide, ensuring better investor protections through coordinated enforcement. (52 words)

Key Takeaways

- Guilty Plea Ramifications: Do Kwon’s admission to US wire fraud charges marks a pivotal shift, with sentencing influencing multi-jurisdictional penalties and underscoring accountability in crypto leadership.

- Extradition Complexities: Judges are scrutinizing sentence credits from Montenegrin detention and risks of early release in South Korea, revealing challenges in enforcing consistent global justice for financial crimes.

- Investor Lessons: The Terra fallout, with losses exceeding major fraud cases, emphasizes due diligence; stakeholders should monitor regulatory updates and diversify holdings to mitigate similar risks.

Conclusion

The Do Kwon South Korea sentence prospects, intertwined with his US conviction for Terraform Labs fraud, illustrate the evolving landscape of crypto accountability. As Judge Engelmayer weighs factors like international sentencing alignment and the magnitude of investor harm—far surpassing cases like FTX—Kwon’s fate could set precedents for future prosecutions. With extradition to South Korea likely after US imprisonment, this saga reinforces the importance of transparent blockchain practices. Investors and industry players should remain vigilant, preparing for enhanced regulatory scrutiny to foster a more stable digital asset ecosystem moving forward.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

3/1/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/28/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/27/2026

DeFi Protocols and Yield Farming Strategies

2/26/2026