US Lawmaker Proposes Bitcoin Tax Payments to Bolster Strategic Reserve

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Americans could soon pay federal taxes in Bitcoin under the Bitcoin for America Act, introduced by Representative Warren Davidson. This bill would direct such payments into the US strategic Bitcoin reserve without triggering capital gains taxes for taxpayers, helping build national holdings efficiently.

-

Tax-Free Bitcoin Payments: Transferring BTC for taxes avoids capital gains and is not counted as a gain or loss for the payer.

-

The proposal channels Bitcoin tax revenue directly into the US strategic reserve, supporting long-term asset growth.

-

Projections from the Bitcoin Policy Institute estimate significant reserve expansion if even 1% of taxes are paid in BTC over 20 years.

Discover how the Bitcoin for America Act lets you pay federal taxes in Bitcoin, boosting the US strategic reserve. Learn benefits, details, and implications for crypto adoption today.

What is the Bitcoin for America Act?

The Bitcoin for America Act is a legislative proposal introduced by US Representative Warren Davidson to enable Americans to settle their federal tax obligations using Bitcoin. This initiative would route all such Bitcoin payments straight into the nation’s strategic Bitcoin reserve, ensuring no taxable event occurs for the taxpayer. By doing so, it promotes Bitcoin’s integration into mainstream finance while strategically amassing digital assets for the government without market disruptions.

A US lawmaker introduced this bill in the House of Representatives, aiming to modernize tax payments with cryptocurrency. Under the act, Bitcoin transferred for tax purposes would bypass capital gains taxation and remain neutral in the taxpayer’s financial records.

The first page of the Bitcoin for America Act. Source: Warren Davidson

The proposal allows the US government to expand its strategic BTC reserve organically, sidestepping the need for direct open-market purchases that could inflate Bitcoin’s price. This approach minimizes market volatility while steadily building reserves through everyday tax collections.

A projection of the US government’s tax revenue if 1% of taxes are collected in BTC over 20 years. Source: Bitcoin Policy Institute

Related: New Hampshire approves first-of-its-kind $100M Bitcoin-backed municipal bond.

How Does the US Strategic Bitcoin Reserve Function?

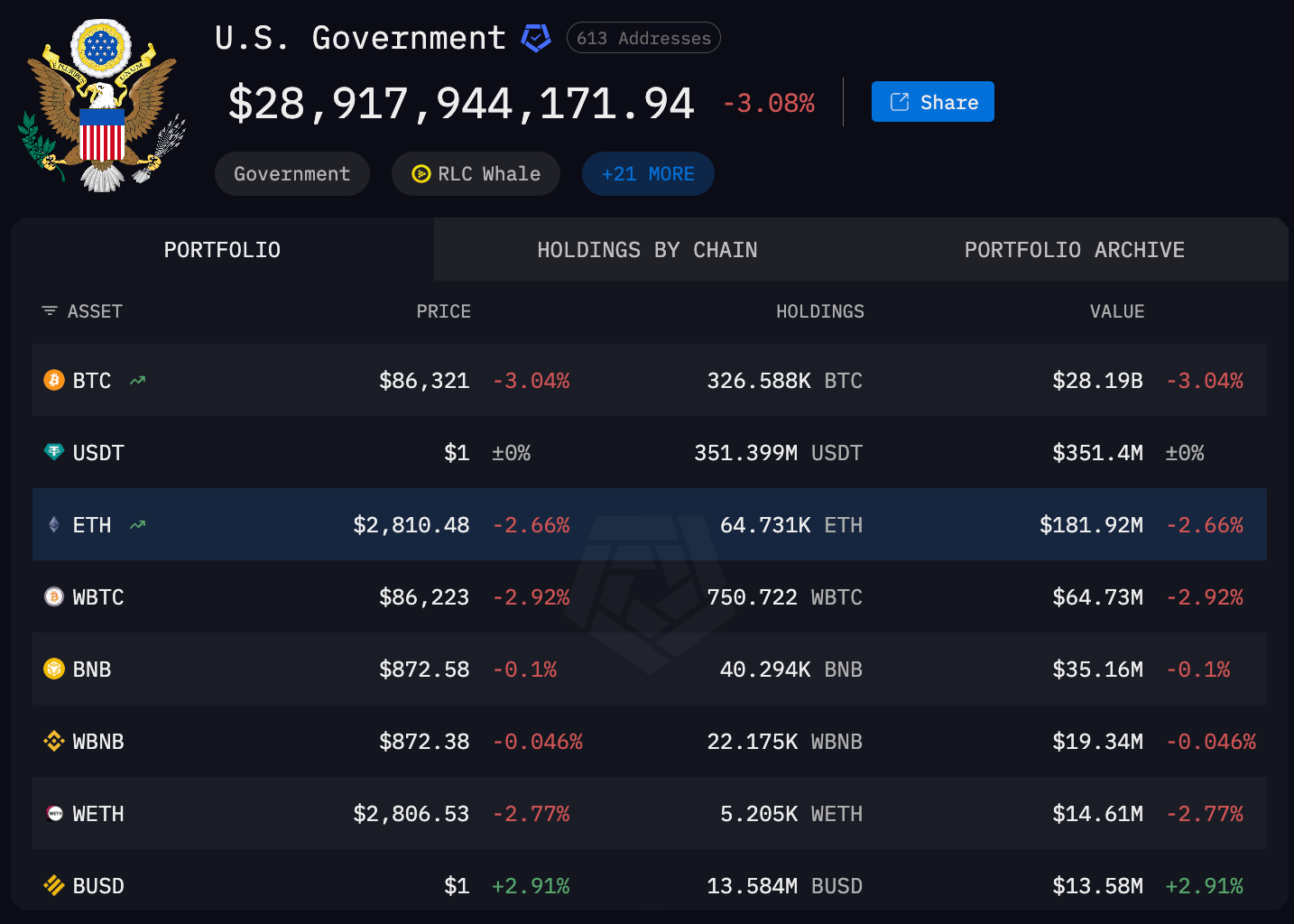

The US strategic Bitcoin reserve, established via an executive order signed by President Donald Trump in March, focuses on holding Bitcoin acquired through seizures and forfeitures rather than active buying. This reserve prohibits the sale of such assets, aiming to preserve value amid growing global interest in digital currencies. According to data from Arkham Intelligence, the government’s current crypto holdings provide a foundation for this strategy, emphasizing long-term retention over short-term trading.

While the order mandates budget-neutral growth, it has sparked debate within the Bitcoin community. The BTC price dipped 6% post-announcement, as enthusiasts anticipated more aggressive accumulation methods. Experts like Lola Leetz, a journalist and Bitcoin advocate, criticize the reliance on forfeited assets, calling it a “perverse” incentive that undermines civil liberties. “Civil asset forfeiture should be reformed, not celebrated. If you are cheering this on, you should be ashamed of yourself,” Leetz stated.

The US government’s crypto holdings at the time of this writing. Source: Arkham Intelligence

In contrast, Matt Hougan, chief investment officer at Bitwise, views the reserve positively. He argues it significantly reduces the risk of a government-imposed Bitcoin ban and spurs international adoption, as nations compete to secure digital assets. The Bitcoin for America Act aligns with this by offering a practical, non-disruptive funding mechanism through tax payments.

Representative Davidson highlighted the bill’s merits in a statement: “By allowing taxpayers to pay federal taxes in Bitcoin and having the proceeds placed into the Strategic Bitcoin Reserve, the nation will benefit by having a tangible asset that appreciates over time, unlike the US dollar, which has steadily lost value under inflationary pressures.” This reflects broader efforts to position Bitcoin as a hedge against inflation, drawing on analyses from institutions like the Bitcoin Policy Institute.

The reserve’s structure ensures fiscal responsibility, avoiding new expenditures. It builds on existing government practices of holding seized cryptocurrencies, which total substantial amounts as reported by blockchain analytics firms. This method could accelerate reserve growth if tax payments in Bitcoin gain traction, potentially transforming how the US engages with digital assets.

Frequently Asked Questions

Can Americans legally pay federal taxes with Bitcoin under current law?

No, current US tax regulations do not permit direct Bitcoin payments for federal taxes, but the Bitcoin for America Act seeks to change this. If passed, it would treat such transfers as non-taxable events, directing BTC to the strategic reserve while maintaining neutrality for payers. This aligns with IRS guidelines on crypto as property, avoiding capital gains calculations.

What impact could the Bitcoin for America Act have on Bitcoin’s price?

The act could stabilize Bitcoin’s price by enabling reserve growth without large-scale government purchases on exchanges. According to projections from the Bitcoin Policy Institute, collecting just 1% of taxes in BTC over 20 years might add billions to holdings, fostering steady demand. This organic accumulation may reduce volatility compared to direct buying, benefiting long-term market health.

Key Takeaways

- Tax Innovation: The Bitcoin for America Act introduces a way to pay federal taxes in Bitcoin, funneling funds into the strategic reserve without tax implications for individuals.

- Reserve Growth: It supports budget-neutral expansion of US Bitcoin holdings, relying on voluntary tax payments rather than market interventions.

- Community Debate: While praised for adoption potential, critics urge reforms to address concerns over asset forfeiture incentives.

Conclusion

The Bitcoin for America Act represents a pivotal step in integrating Bitcoin into US fiscal systems, allowing tax payments in BTC to bolster the strategic Bitcoin reserve efficiently. By eliminating taxable events for payers and leveraging existing revenue streams, it addresses inflationary challenges with a appreciating asset. As discussions evolve, this could signal broader cryptocurrency acceptance, encouraging taxpayers and investors to explore Bitcoin’s role in national finance—stay informed on legislative updates for future opportunities.