US Proposal Eyes Bitcoin ETF for Overnight Trading Strategy

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

The new Bitcoin overnight ETF proposal seeks SEC approval to buy Bitcoin at the U.S. market close and sell at open, holding positions only during non-trading hours to capture potential upside in global crypto activity. This innovative strategy targets historical patterns of stronger Bitcoin performance overnight.

-

Unique Timing Strategy: The ETF would trade exclusively during overnight hours, avoiding U.S. market exposure.

-

Historical Data Support: Bitcoin has shown disproportionate gains during Asian and European trading overlaps when U.S. markets are closed.

-

Market Context: Amid $118 billion in Bitcoin ETF assets, this filing reflects evolving strategies in a maturing institutional landscape.

Discover the Bitcoin overnight ETF proposal revolutionizing crypto investments by targeting non-U.S. hours for potential gains. Explore implications for ETF flows and Bitcoin prices—stay ahead in 2025 crypto trends.

What is the Bitcoin Overnight ETF Proposal?

The Bitcoin overnight ETF is a novel investment product filed with the U.S. Securities and Exchange Commission (SEC) that would acquire Bitcoin exclusively when American stock markets close and liquidate holdings upon their reopening. This approach aims to exploit observed patterns where Bitcoin exhibits stronger performance during global trading sessions outside U.S. hours. According to Bloomberg senior ETF analyst Eric Balchunas, the fund would maintain positions only in overnight trading periods, providing investors with targeted exposure to this specific market dynamic without full-day risk.

A new ETF proposal has surfaced in the U.S., aiming to buy Bitcoin only when American markets close and sell it when they open.

If approved, the product would represent one of the most unusual timing-based strategies yet seen in the rapidly expanding Bitcoin ETF ecosystem.

Source: X

Bloomberg senior ETF analyst Eric Balchunas highlighted the filing, noting that the product would hold Bitcoin exclusively during overnight trading, then exit positions before U.S. market hours each day.

How Does the Overnight Bitcoin ETF Strategy Work?

The strategy leverages Bitcoin’s 24/7 trading nature against the traditional 9:30 a.m. to 4:00 p.m. ET U.S. equity market schedule. Upon market close, the ETF would purchase Bitcoin, holding it through the night when activity shifts to Asian and European exchanges. Sales would occur at open to lock in gains from any overnight movements. Data from historical analyses, including those referenced by market researchers, indicate Bitcoin averages higher returns in these periods—up to 60% of daily volatility occurring outside U.S. hours, per studies from crypto analytics firms. This setup minimizes exposure to U.S.-driven sell-offs while capitalizing on global liquidity peaks. Experts like Balchunas emphasize that such timing could diversify returns in the Bitcoin ETF space, which has seen over $118 billion in assets under management as of late 2025. Short sentences highlight the mechanics: Buy at close. Hold overnight. Sell at open. Repeat daily. Supporting statistics show overnight sessions contributing positively to Bitcoin’s long-term uptrend, with average gains of 0.5-1% per session in bull markets.

Why build an overnight ETF?

The key idea behind the filing appears straightforward: Bitcoin historically shows stronger performance during non-U.S. trading hours.

Several past analyses have highlighted the disproportionate upside that occurs when traditional U.S. equity markets are offline, particularly during periods of overlap between Asia and Europe, when crypto liquidity remains active.

If those patterns persist, an overnight approach could theoretically capture a unique return stream without full-day exposure.

Bitcoin ETF flows remain huge despite recent weakness

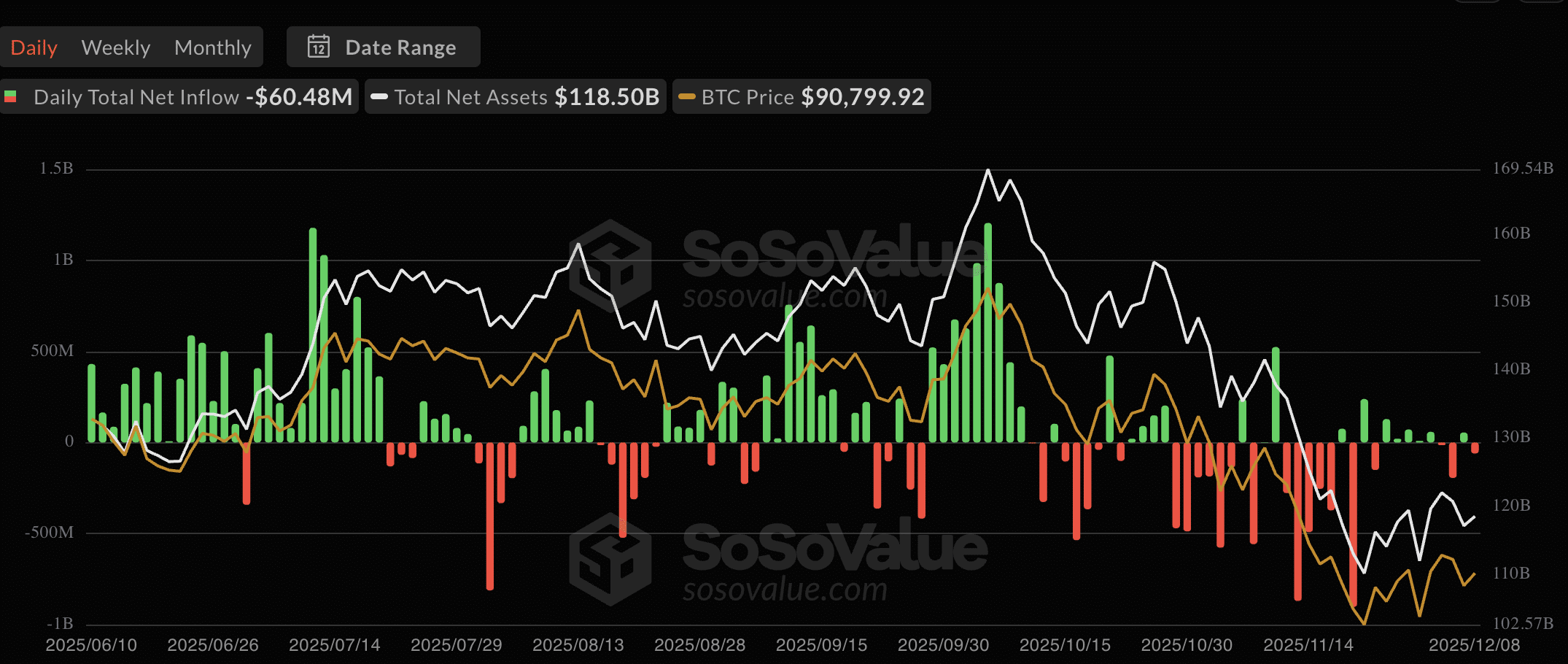

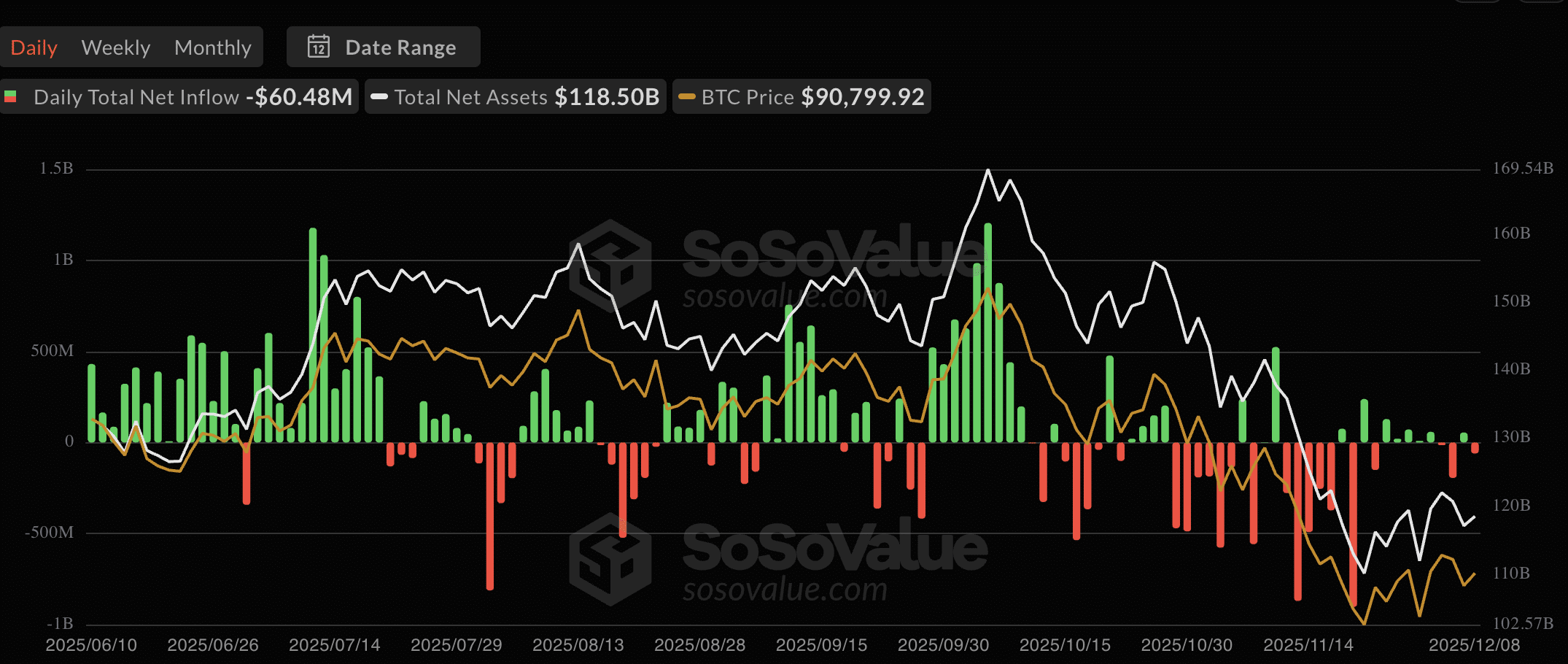

The proposal arrives during a period of slowing inflows across the broader Bitcoin ETF landscape. Data from SoSoValue shows total ETF net assets still sitting above $118B, despite weaker inflows in recent weeks and mixed daily flows.

Source: SoSoValue

Earlier flows in June through September helped push BTC higher. Still, recent price declines have coincided with red outflow bars—suggesting hesitation, not abandonment.

That backdrop may encourage issuers to explore more specialized strategies, including timing-specific products like this one.

A new phase: from access to strategy

Since early 2024, Bitcoin ETFs have primarily focused on providing regulated spot exposure. Now, filings are shifting into thematic products, hedging tools, and timing-based approaches.

If that trend continues, Bitcoin ETFs could begin to resemble traditional equity ETF design—offering factor strategies, volatility overlays, and time-based rotation models.

BTC price overview

Bitcoin traded around $92K at the time of writing after a period of extended downside pressure through October and November.

The broader outlook appears tied to whether ETF flows stabilize, with recent charts showing a mixed but still net-positive institutional backdrop.

Frequently Asked Questions

What Makes the Bitcoin Overnight ETF Different from Standard Bitcoin ETFs?

The Bitcoin overnight ETF stands out by limiting holdings to non-U.S. trading hours, buying at market close and selling at open to target global session gains. Unlike standard spot ETFs that maintain continuous exposure, this reduces daytime volatility risk. Data from analytics platforms like SoSoValue indicate potential for isolated return streams, appealing to tactical investors in the $118 billion Bitcoin ETF market.

Will the Overnight Bitcoin ETF Impact Bitcoin Prices in 2025?

Hey there, if you’re wondering about the overnight Bitcoin ETF’s effect on prices next year, it could add targeted buying pressure during global hours, potentially stabilizing overnight trends. While not a massive shift yet, approval might encourage more institutional flows, supporting Bitcoin’s current $92K levels amid mixed ETF inflows. Keep an eye on SEC decisions for clearer signals.

Key Takeaways

- Timing Innovation: The Bitcoin overnight ETF proposal introduces a strategy focused on non-U.S. hours, leveraging historical data for potential enhanced returns.

- Market Maturation: With over $118 billion in assets, Bitcoin ETFs are evolving from basic access to specialized tools like timing-based products.

- Investor Opportunity: Monitor SEC approval to assess how this could diversify portfolios and influence Bitcoin’s price dynamics in 2025.

Conclusion

The Bitcoin overnight ETF proposal marks a significant evolution in the Bitcoin ETF landscape, blending traditional market timing with cryptocurrency’s global reach to potentially unlock new value streams during off-hours trading. As ETF assets surpass $118 billion and institutional interest persists despite recent outflows, such innovations underscore the maturing crypto investment ecosystem. Looking ahead, approval could pave the way for more factor-driven products, benefiting investors seeking precise exposure—consider integrating these strategies into your portfolio for optimized returns in the dynamic Bitcoin market.

Final Thoughts

- Overnight price behavior now appears influential enough to shape ETF design.

- Specialized Bitcoin products may signal a maturing institutional market rather than simple speculation.