VanEck Removes Staking from BNB ETF Filing Amid Regulatory Risks

BNB/USDT

$669,473,373.58

$615.60 / $588.64

Change: $26.96 (4.58%)

-0.0013%

Shorts pay

Contents

VanEck has amended its spot BNB ETF filing to eliminate all staking plans, citing regulatory risks associated with BNB potentially being classified as a security. This decision contrasts with the firm’s Solana ETF, which includes staking yields, allowing investors to avoid direct staking complexities while tracking BNB price movements.

-

VanEck’s updated S-1 filing explicitly states the BNB ETF will not engage in staking activities at launch.

-

The move distances the ETF from BNB staking amid ongoing SEC scrutiny of cryptocurrencies.

-

Investors in the BNB ETF may forgo staking rewards, potentially impacting performance compared to direct BNB holdings, based on historical staking yields averaging 3-5% annually.

Discover why VanEck removed staking from its BNB ETF filing amid regulatory concerns. Learn the implications for investors and BNB’s future in traditional finance. Stay updated on crypto ETFs today.

What is VanEck’s Amended BNB ETF Filing and Why No Staking?

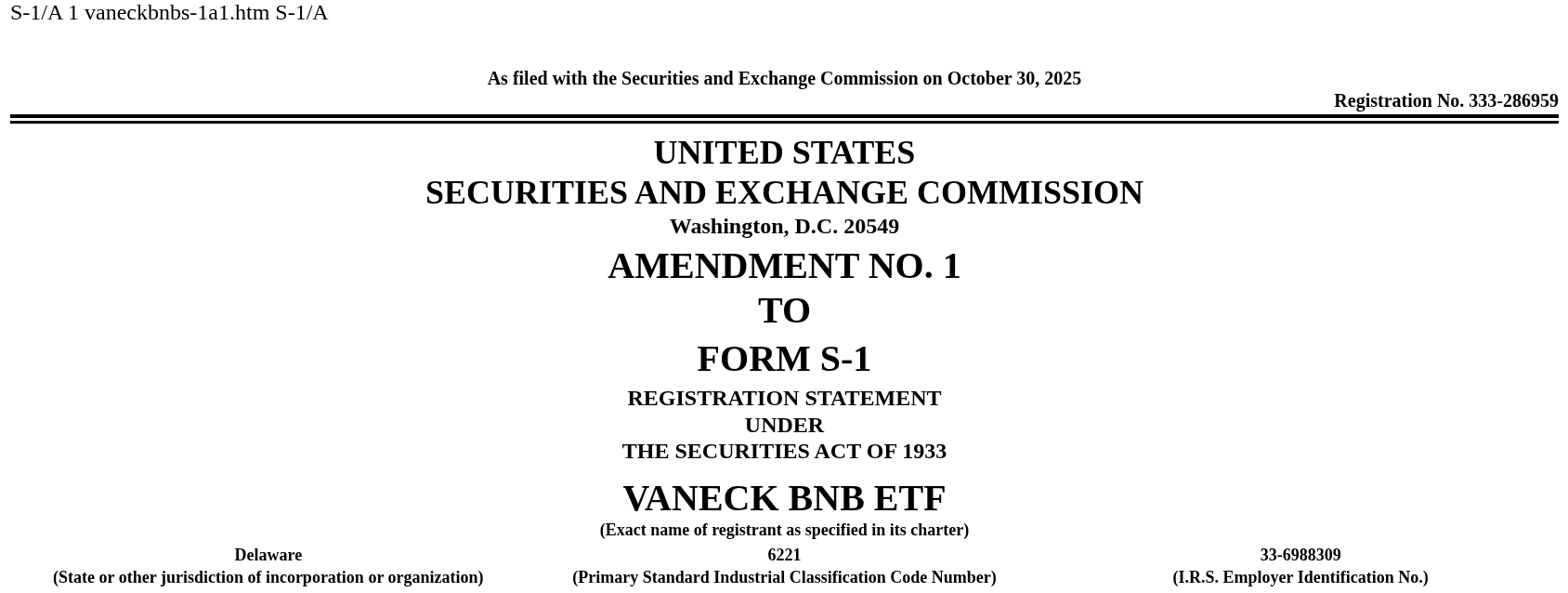

VanEck’s amended spot BNB exchange-traded fund (ETF) filing removes all provisions for staking BNB assets, a significant shift from its initial proposal. Submitted to the U.S. Securities and Exchange Commission (SEC) on November 21, the updated S-1 document declares that the trust will not employ BNB in staking activities at listing and provides no assurances for future staking. This cautious approach stems from regulatory uncertainties surrounding BNB’s classification, ensuring the ETF focuses solely on price exposure without additional income streams like staking rewards.

VanEck’s BNB ETF S1 filing. Source: SEC

How Does Regulatory Risk Influence VanEck’s BNB ETF Staking Decision?

Regulatory risk plays a pivotal role in VanEck’s decision to scrap staking from its BNB ETF. The filing highlights that the SEC could determine BNB to be a security, which might adversely affect the ETF’s shares and lead to its termination. According to the SEC’s historical actions, such as the 2023 lawsuits against major exchanges including Binance, where BNB was among 68 assets labeled as unregistered securities, this uncertainty persists. A U.S. federal court ruling in early July 2023 clarified that secondary sales of BNB do not qualify as security transactions, yet the broader debate on staking under securities laws remains unresolved.

VanEck’s document notes, “The test for determining whether a particular digital asset is a ‘security’ is complex and difficult to apply, and the outcome is difficult to predict.” This acknowledgment underscores the firm’s strategy to mitigate risks by avoiding staking, which could invite further regulatory scrutiny. In contrast, VanEck’s recently launched Solana ETF incorporates staking through trusted providers, yielding returns estimated at 5-7% annually based on network data. Experts like Matt Hougan, formerly of Bitwise, have noted in industry discussions that staking ETFs fill a critical gap for institutional investors seeking yield without operational hassles, but BNB’s ties to Binance amplify its regulatory exposure.

The filing further specifies that any future staking would require third-party providers and a new SEC prospectus, with no guarantees of implementation. This structure protects investors from potential disruptions while allowing the ETF to track BNB’s market performance. Data from blockchain analytics firms indicate BNB staking has historically provided consistent rewards, but VanEck prioritizes compliance over yield in this product. By distancing itself from staking, VanEck signals a broader trend in crypto ETFs toward regulatory conservatism, especially for assets with centralized exchange affiliations like BNB.

Frequently Asked Questions

What Changes Did VanEck Make to Its BNB ETF Staking Plans?

VanEck’s amended S-1 filing on November 21 explicitly removes all staking activities from the proposed spot BNB ETF. Initially filed in May, the application considered staking through providers, but the update confirms no staking rewards or income will be earned at launch, driven by regulatory concerns over BNB’s security status.

Why Is VanEck Offering Staking in Solana ETF But Not BNB ETF?

VanEck’s Solana ETF, launched earlier this month as the third such product in the U.S., includes staking to provide yields from Solana’s proof-of-stake network, appealing to yield-seeking investors. For the BNB ETF, regulatory risks tied to BNB’s history with the SEC prompted the exclusion of staking, ensuring the product avoids potential legal complications while still offering direct exposure to BNB’s price.

Could the BNB ETF Engage in Staking in the Future?

While the current filing states no staking at listing, VanEck notes there are no assurances for future activities. Any staking would involve third-party providers and require an updated SEC prospectus. The firm emphasizes that as long as BNB is not deemed a security, the trust will continue without dissolution, but staking remains contingent on regulatory clarity.

What Happens If the SEC Classifies BNB as a Security?

If the SEC or a federal court determines BNB is a security, VanEck may dissolve the ETF to comply with regulations. The filing explains this could negatively impact share values, but the sponsor intends to maintain the trust if good faith grounds suggest BNB is not a security, monitoring developments closely.

Key Takeaways

- Regulatory Caution Prevails: VanEck’s removal of staking from the BNB ETF highlights the firm’s focus on compliance amid SEC scrutiny of BNB’s security status.

- Performance Trade-Off: Investors forgo staking rewards, potentially 3-5% annually, but gain simplified exposure to BNB without direct custody risks.

- Future Flexibility: While no staking is planned now, VanEck leaves room for it post-regulatory approval, advising investors to watch SEC decisions closely.

Conclusion

VanEck’s amended filing for the spot BNB ETF marks a strategic pivot away from staking, prioritizing regulatory safety over yield generation in light of BNB’s complex history with the SEC. This decision, contrasted with the staking-inclusive Solana product, reflects evolving dynamics in crypto ETFs where compliance shapes innovation. As regulatory landscapes clarify, such ETFs could bridge traditional finance and blockchain assets more securely—investors should monitor SEC updates and consider diversified exposure to stay ahead in the BNB ETF space.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026