Vitalik Buterin on Ethereum’s Potential to Handle Occasional Finality Delays Safely

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

Ethereum’s finality loss refers to a temporary halt in the network’s ability to confirm blocks irreversibly, often due to bugs like the recent Prysm client issue. Vitalik Buterin stated that occasional delays are acceptable as long as the wrong block isn’t finalized, maintaining network security and functionality during such events.

-

Temporary finality loss in Ethereum does not compromise overall blockchain security, as emphasized by co-founder Vitalik Buterin.

-

Experts like Fabrizio Romano Genovese compare it to Bitcoin’s probabilistic finality, noting Ethereum reverts to similar guarantees briefly.

-

Impacts include delayed layer-2 transfers, but no user funds are at risk of reversal; Polygon operations continue normally with minor postponements.

Ethereum finality loss explained: Vitalik Buterin addresses recent Prysm bug risks and expert views on network resilience. Discover impacts on L2s and security. Stay informed on blockchain stability—read now for key insights.

What is Ethereum Finality Loss and Why Does It Happen?

Ethereum finality loss occurs when the network temporarily loses its mechanism to irreversibly confirm blocks, shifting from deterministic to probabilistic finality similar to Bitcoin. This can stem from bugs in client software, such as the recent Prysm Ethereum client issue that nearly disrupted confirmations. Co-founder Vitalik Buterin downplayed the event, noting in a public statement that occasional finality delays are manageable if they prevent finalizing incorrect blocks, ensuring the blockchain continues operating without major interruptions.

The process involves validators failing to achieve the required two-thirds consensus for justification and subsequent finalization after 64 blocks. While this enhances Ethereum’s security post-Merge, rare glitches highlight the protocol’s reliance on diverse client implementations to avoid central points of failure.

How Does Ethereum’s Finality Mechanism Differ from Bitcoin’s?

Ethereum’s proof-of-stake system introduces a robust finalization process absent in Bitcoin’s proof-of-work model. When a block garners over 66% validator votes, it becomes justified; after two epochs—spanning 64 blocks—it achieves finality, rendering it immutable. This deterministic approach provides stronger guarantees against reorganizations compared to Bitcoin, where finality is probabilistic and relies on accumulating the most computational work.

Fabrizio Romano Genovese, a computer science PhD from the University of Oxford and Ethereum protocol expert at blockchain research firm 20squares, elaborated that during finality loss, Ethereum operates akin to Bitcoin, which has functioned without deterministic finality since 2009 without widespread complaints. He noted a similar incident in May 2023 due to a client bug, emphasizing that such events merely suspend deterministic reorg protections temporarily, not undermining core security. Genovese stated, “These incidents do not make the chain insecure; it just means that our guarantees around reorg have temporarily reverted to be probabilistic and not deterministic.”

This distinction underscores Ethereum’s design evolution, prioritizing efficiency and finality through staking incentives, though it introduces vulnerabilities if client diversity falters. Historical data shows Ethereum’s finality uptime exceeds 99.9% annually, per network analytics from sources like Beaconcha.in, reinforcing its reliability for high-value transactions.

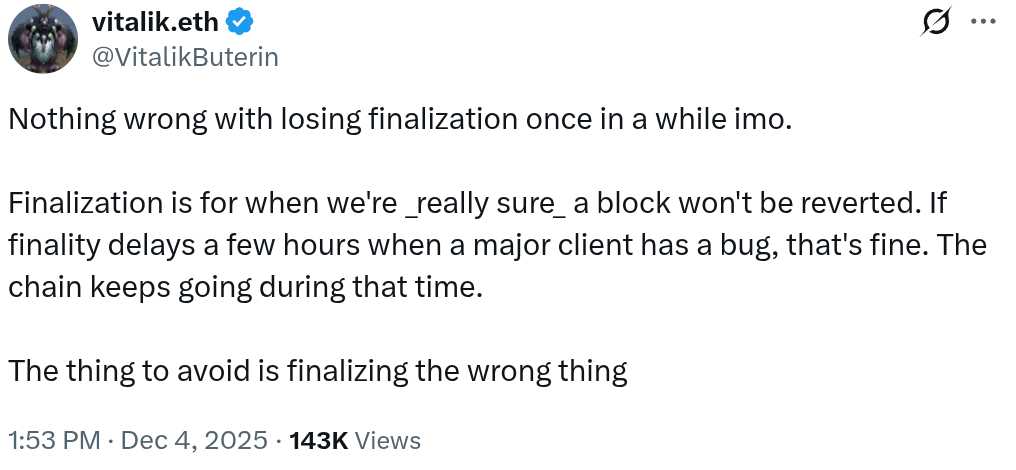

Source: Vitalik Buterin

Buterin’s perspective aligns with this, as he posted on X that “nothing wrong with losing finalization once in a while,” clarifying that finality signifies the network’s certainty against block reversions. He further argued that even hours-long delays from major bugs are tolerable, provided the protocol avoids finalizing erroneous data, allowing seamless continuation of block production and validation.

Frequently Asked Questions

What Causes Ethereum Finality Loss in Client Bugs Like Prysm?

Ethereum finality loss from client bugs, such as the Prysm incident, arises when a software glitch prevents validators from reaching consensus thresholds for block justification. This disrupts the checkpoint mechanism, halting irreversible confirmations. Recovery typically occurs within hours as unaffected clients restore quorum, with no long-term damage reported in past events like the 2023 occurrence.

Is Ethereum Safe During Periods of Finality Loss?

Yes, Ethereum remains safe during finality loss; the network continues producing and validating blocks probabilistically, much like Bitcoin’s model which has proven secure for over a decade. Vitalik Buterin emphasized that the key risk—finalizing incorrect blocks—is averted through protocol safeguards, ensuring transactions proceed without reversal threats beyond minor delays.

Genovese reinforced this by highlighting that probabilistic finality offers comparable security to everyday blockchain operations, with reorg risks diminishing rapidly as more blocks accumulate.

Key Takeaways

- Ethereum’s finality loss is temporary and non-catastrophic: Vitalik Buterin views occasional delays as acceptable, prioritizing avoidance of wrong finalizations to uphold network integrity.

- Comparison to Bitcoin highlights resilience: Expert Fabrizio Romano Genovese notes Ethereum reverts to probabilistic security during lapses, mirroring Bitcoin’s long-standing model without finality complaints.

- Layer-2 impacts are limited to delays: Bridges and sidechains like Polygon experience postponed transfers but guarantee no rollbacks, advising developers to implement fallback mechanisms for robustness.

Conclusion

In summary, Ethereum finality loss, as seen in the recent Prysm client bug, poses no existential threat to the network, with co-founder Vitalik Buterin and experts like Fabrizio Romano Genovese affirming its tolerance for brief probabilistic shifts. This incident underscores the importance of client diversity and protocol maturity in maintaining blockchain stability. As Ethereum evolves, such events serve as reminders for ongoing improvements; developers and users should monitor validator distributions to enhance resilience against future disruptions.

Looking ahead, Ethereum’s commitment to robust finality mechanisms positions it strongly for scaling innovations, ensuring secure and efficient operations in the growing decentralized ecosystem.

Vitalik Buterin downplayed Ethereum’s recent brush with finality loss, saying temporary delays are fine if the wrong block is not finalized, and experts mostly agree.

Ethereum can afford to lose finality from time to time without putting the network at serious risk, according to co-founder Vitalik Buterin, even after a recent client bug came close to disrupting the blockchain’s confirmation mechanism.

Following a recent bug in the Prysm Ethereum client, Buterin said in an X post that there is “nothing wrong with losing finalization once in a while.” He added that finalization indicates the network is “really sure” a block will not be reverted.

Buterin argued that if finality is occasionally delayed for hours due to a major bug, “that’s fine,” and the blockchain keeps working while that happens. The real issue would be something else, he said: “The thing to avoid is finalizing the wrong thing.”

Experts Weigh In on Finalization Loss

Fabrizio Romano Genovese, PhD in computer science at the University of Oxford, England, partner at the blockchain research company 20squares, and an Ethereum protocol expert, agreed with Buterin.

He said that when finality is lost, Ethereum becomes more like Bitcoin (BTC), and pointed out that Bitcoin has had “no finality since 2009 and no one complains.”

A proof-of-work blockchain, such as Bitcoin’s, can branch into multiple chains, with the one that receives the most work (usually the longest) considered valid. Still, if a secondary branch grows enough to overtake the main branch, it invalidates the main branch and the transactions it contained — this is called a reorganization.

This is how Bitcoin operates: its finality is probabilistic, not deterministic, because — while it is almost impossible after enough blocks are added to the main branch — a reorganization can still theoretically occur. Genovese explained how Ethereum is different, with rules setting blocks as “final.” He added:

“Ethereum has a finalization mechanism: When a block receives more than 66% of the validator votes, it becomes ‘justified.’ At this point, if more than two epochs (64 blocks) pass, the block is finalized.”

This is not just theoretical; it happened in May 2023 due to an incident similar to the recent one with the Prysm client. Genovese said that these incidents do not make the chain insecure; instead, “it just means that our guarantees around reorg have temporarily reverted to be probabilistic and not deterministic.”

Consequences for L2s and Bridges

Still, Genovese noted that a lack of finality would affect infrastructure that relies on it, including some inter-blockchain or layer-2 (L2) bridges.

A representative from the Ethereum sidechain Polygon stated that Polygon would continue with normal operations, but transfers from Ethereum to the sidechain “may be delayed while waiting for finality.”

Furthermore, the Polygon spokesperson said that the crosschain settlement layer AggLayer would delay transactions from Ethereum to L2 until finality was reached again. Still, they said that “there is no scenario in which users experience a rollback or message invalidation” due to a loss of finality:

“The practical impact of a delayed finality event is simply that deposits may take longer to appear. Users are not exposed to reorg-driven reversions beyond this delay.”

Genovese shifted the blame for such delays to developers who require finality. “If a bridge builder decides not to implement any fallback mechanism in case of loss of finality, that’s their choice,” he concluded.