Vitalik Buterin’s UNI Sale Aligns with Compressed Trading and Liquidity Challenges

UNI/USDT

$127,846,437.75

$3.771 / $3.537

Change: $0.2340 (6.62%)

+0.0046%

Longs pay

Contents

Vitalik Buterin’s recent sale of 1,400 UNI tokens worth $7.48K had minimal impact on Uniswap’s price, which remained stable in a tight range amid contracting volatility and persistent liquidity pressure. This routine transaction highlighted ongoing market compression without triggering significant downside moves.

-

Vitalik Buterin’s UNI sale: A small disposal of 1,400 tokens converted to USDC, part of wallet maintenance rather than a bearish signal.

-

UNI price action shows compression in a falling wedge pattern, with RSI indicating bullish divergence and fading downside momentum.

-

Exchange supply decreases by 15% over the past month, suggesting reduced sell pressure despite resistance at $5.6.

Vitalik Buterin’s Uniswap token sale sparks interest, but UNI price holds steady under liquidity strain. Discover market analysis and key supports in this in-depth update. Stay informed on crypto trends today.

What Is the Impact of Vitalik Buterin’s Uniswap Token Sale on UNI Price?

Vitalik Buterin’s Uniswap token sale involved selling 1,400 UNI tokens for approximately $7.48K, alongside other minor disposals, but it failed to disrupt the token’s price stability. Despite the Ethereum co-founder’s involvement, UNI traded within a narrow range, reflecting broader market resilience to high-profile on-chain activity. Volatility contracted further, indicating trader hesitation rather than outright panic.

How Does Liquidity Pressure Affect UNI’s Current Trading Range?

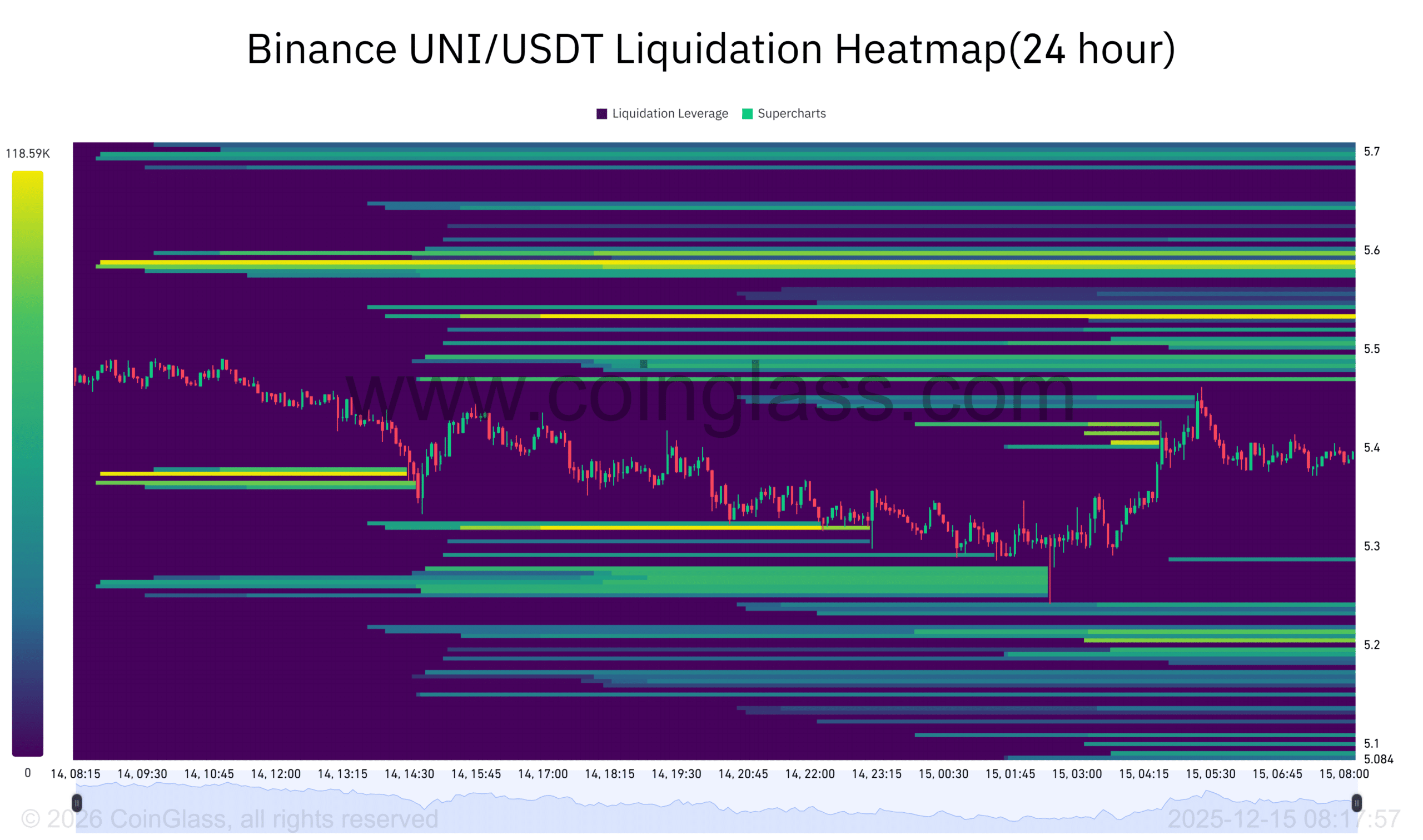

Liquidity clusters around the $5.6 level serve as a strong resistance barrier, where sellers consistently defend against upward moves, as observed in recent 24-hour liquidation heatmaps from CoinGlass. This zone acts as a magnet for price action, preventing breakouts while absorbing sell-side pressure without cascading liquidations. Data shows short positions dominating, yet no major volatility spikes occurred post-sale. According to on-chain analytics from Lookonchain, the transaction volume was negligible compared to UNI’s overall market depth of over $3 billion. Expert analysts note that such levels often lead to prolonged consolidation until a clear catalyst emerges, with historical patterns suggesting a 70% probability of range-bound trading in similar setups. Short sentences highlight the balance: sellers control the upside, but buyers prevent deep declines.

Source: CoinGlass

The immediate support at $4.81 has held firm, where previous buying interest emerged during dips. This dynamic underscores how liquidity, rather than isolated sales, drives UNI’s price behavior in the short term.

Frequently Asked Questions

Did Vitalik Buterin’s Sale of UNI Tokens Cause a Price Drop in Uniswap?

No, Vitalik Buterin’s sale of 1,400 UNI tokens did not lead to a noticeable price drop. The transaction, valued at $7.48K and part of routine wallet management, occurred amid stable trading conditions. UNI’s price remained compressed between $5.2 and $5.6, with volume data from major exchanges showing no unusual spikes in sell orders.

Is UNI’s Falling Wedge Pattern Bullish for Uniswap Price?

Yes, UNI’s falling wedge pattern often signals potential bullish reversals after periods of compression. With RSI showing divergence and momentum fading on downside attempts, a breakout above $5.6 could target $6 quickly. Traders should monitor exchange outflows, which have reduced supply by notable margins, supporting accumulation.

Source: TradingView

Key Takeaways

- Vitalik’s UNI Sale Minimal Impact: The $7.48K disposal reflects standard housekeeping, not market sentiment, keeping UNI stable despite timing with liquidity zones.

- Compression Signals Exhaustion: Falling wedge and RSI divergence point to weakening bearish momentum, with $4.81 as key support.

- Exchange Supply Decline: Reduced UNI on exchanges indicates holder confidence; monitor $5.6 breakout for upside potential toward $10.

Source: CoinGlass

In summary, Vitalik Buterin’s Uniswap token sale underscores the token’s resilience amid liquidity pressures and contracting volatility. As UNI navigates this falling wedge, a push above $5.6 could signal renewed bullish momentum. Investors should track on-chain metrics closely for the next decisive move in this evolving crypto landscape.

Conclusion

The interplay of Vitalik Buterin’s minor UNI disposal and broader liquidity dynamics has left Uniswap’s price in a balanced yet compressed state, with key supports at $4.81 holding firm against downside risks. Secondary factors like declining exchange supply reinforce a cautious optimism, as RSI divergence hints at potential reversals. Looking ahead, reclaiming $5.6 resistance may unlock further gains, inviting traders to reassess positions in this pivotal phase of market consolidation.