Voltage Credit: BTC Lightning Convertible Credit

BTC/USDT

$17,272,160,469.17

$68,476.22 / $66,621.06

Change: $1,855.16 (2.78%)

+0.0011%

Longs pay

Contents

BTC Lightning Payments with Voltage Credit

Bitcoin infrastructure company Voltage announced its programmatic revolving credit line called Voltage Credit. This service enables businesses to send Lightning Network payments with instant precision similar to BTC detailed analysis, while allowing payments from a standard bank account in US dollars or Bitcoin (BTC). According to Cointelegraph, Voltage, which offers regulatory-compliant enterprise solutions, targets the “send now, pay later” flexibility designed for CFOs and treasurers, and does not require holding crypto balances. The product is positioned as the first revolving credit line embedded in Lightning payments.

Voltage, unlike traditional crypto loans, performs risk assessment based on payment flows instead of static BTC collateral and adjusts credit limits according to transaction volume on the platform. The annual 12% interest rate (APY) accrues daily, and a fixed fee model is applied that does not become more expensive as transaction volume increases. The company conducted an enterprise-scale test by supporting the $1 million Lightning Network payment between Secure Digital Markets and Kraken on February 5. Voltage Credit is offered to qualified US-based businesses; it can be used in all states except California, Nevada, North Dakota, Vermont, and Washington D.C. Lightning Network capacity peaked at 5.606 BTC in December 2025, currently at 5.121 BTC.

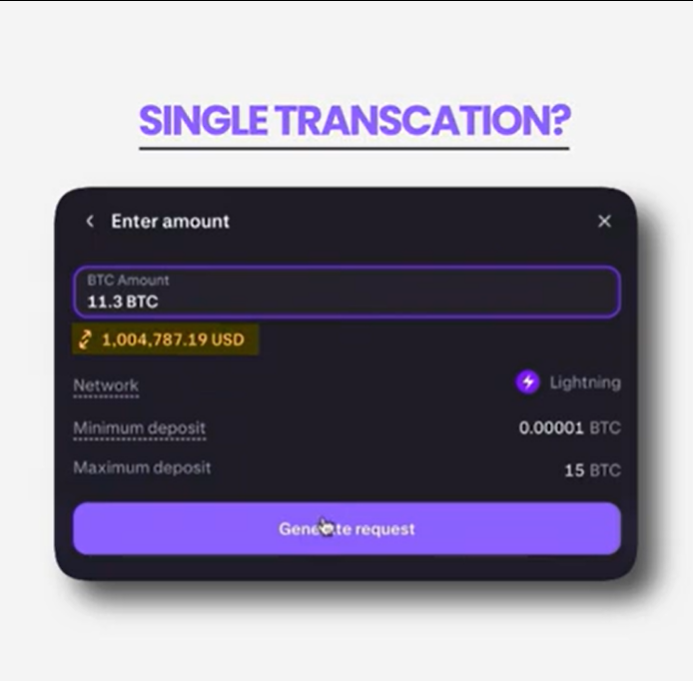

$1 million in a single Lightning transaction. Source: SDM

BTC Technical Outlook and Market Context

BTC price is currently at $65,998.01, 24-hour change -1.72%. RSI at 32.37 in oversold territory, trend downtrend and Supertrend bearish. Supports: S1 $65,143 (strong, 78% score), S2 $62,910. Resistances: R1 $69,657 (70% score). Volatility is high for BTC futures.

As institutional interest increases, Google searches for 'Will Bitcoin go to zero?' are rising, but institutions are accumulating BTC. Hive mining company increased its hash rate despite depreciation losses, infrastructure investments are strengthening.