Washington Debate: Crypto Inclusion in 401(k)s Could Draw Trillions, Faces Union Resistance

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

Proposed legislation in Washington aims to relax rules for 401(k) retirement accounts, potentially allowing exposure to cryptocurrencies. This could channel trillions into the crypto market, but labor unions strongly oppose it, citing high volatility and risks to workers’ savings. The debate highlights tensions between innovation and financial security.

-

Labor unions like the American Federation of Teachers warn that crypto’s volatility could lead to substantial losses in retirement funds.

-

Crypto industry advocates argue that enhanced regulations would mitigate risks and provide access to high-return assets for pensions.

-

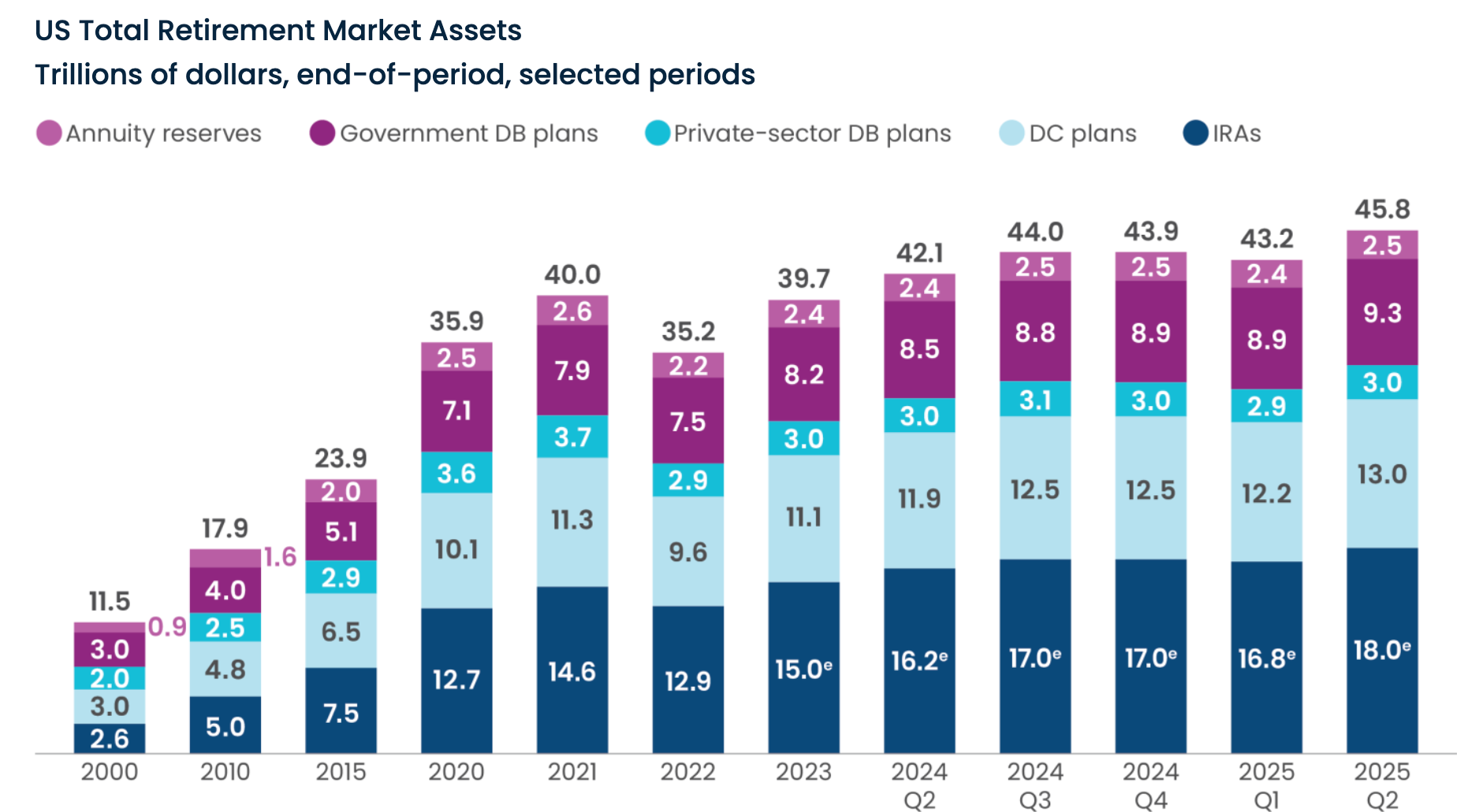

Over $30 trillion sits in U.S. retirement accounts, with potential crypto inclusion drawing significant capital, per Investment Company Institute data.

Explore the heated debate on crypto in retirement funds: unions oppose 401(k) crypto exposure due to risks, while proponents push for regulated access. Stay informed on policy changes shaping your future savings.

What is the debate surrounding cryptocurrencies in 401(k) retirement accounts?

Cryptocurrencies in 401(k) retirement accounts are at the center of a contentious discussion in Washington, D.C., as the cryptocurrency sector pushes for regulatory changes to permit limited exposure in traditional pension plans. Labor unions, including major teachers’ organizations, argue that the inherent volatility of digital assets makes them unsuitable for safeguarding workers’ long-term savings, potentially exposing millions to unpredictable market swings. Industry supporters counter that well-structured oversight could integrate crypto safely, offering diversification and historical growth potential that traditional assets may lack.

The AFT letter to Congress opposes regulatory changes that would allow 401(k) retirement accounts to hold alternative assets, including cryptocurrency. Source: CNBC

The push for inclusion stems from broader market structure bills under consideration in Congress, which seek to clarify how digital assets fit into established financial frameworks. These proposals could unlock substantial inflows from the vast pool of retirement savings, estimated at over $30 trillion across various account types in the United States. However, critics emphasize the need for caution, drawing on historical data showing crypto’s price fluctuations far exceeding those of stocks or bonds.

Recent communications from key stakeholders underscore the divide. On Wednesday, the American Federation of Teachers (AFT) sent a formal letter to the U.S. Senate Banking Committee, expressing deep concerns over easing restrictions. The group highlighted that cryptocurrencies’ speculative nature could jeopardize the stability of pension funds, leading to real financial harm for educators and other public servants relying on these accounts for retirement security.

This stance prompted swift rebuttals from within the crypto community. One prominent investor described the AFT’s position as misguided and poorly informed, pointing to the logical flaws in dismissing regulated crypto integration outright. Such reactions illustrate the growing frustration among proponents who view opposition as rooted in outdated perceptions rather than current market realities.

In direct response, experts like Sean Judge from Castle Island Ventures emphasized the bill’s potential benefits. He noted that stronger regulatory frameworks would not only enhance transparency but also lower overall systemic risks, allowing pension managers to cautiously incorporate crypto as part of a balanced portfolio. Judge stressed the asset class’s track record of delivering robust long-term returns, which could bolster retirement outcomes for savers seeking growth beyond conventional investments.

Funds held in US retirement accounts by type of account plan. Source: ICI

Further commentary came from Bill Hughes, an attorney at Consensys, who suggested that the AFT’s resistance might be influenced by political alignments rather than purely economic analysis. He portrayed the union’s actions as an extension of certain lawmakers’ agendas, potentially overlooking the broader advantages of modernizing retirement investment options to include emerging technologies like blockchain-based assets.

How risky is cryptocurrency exposure for pension funds?

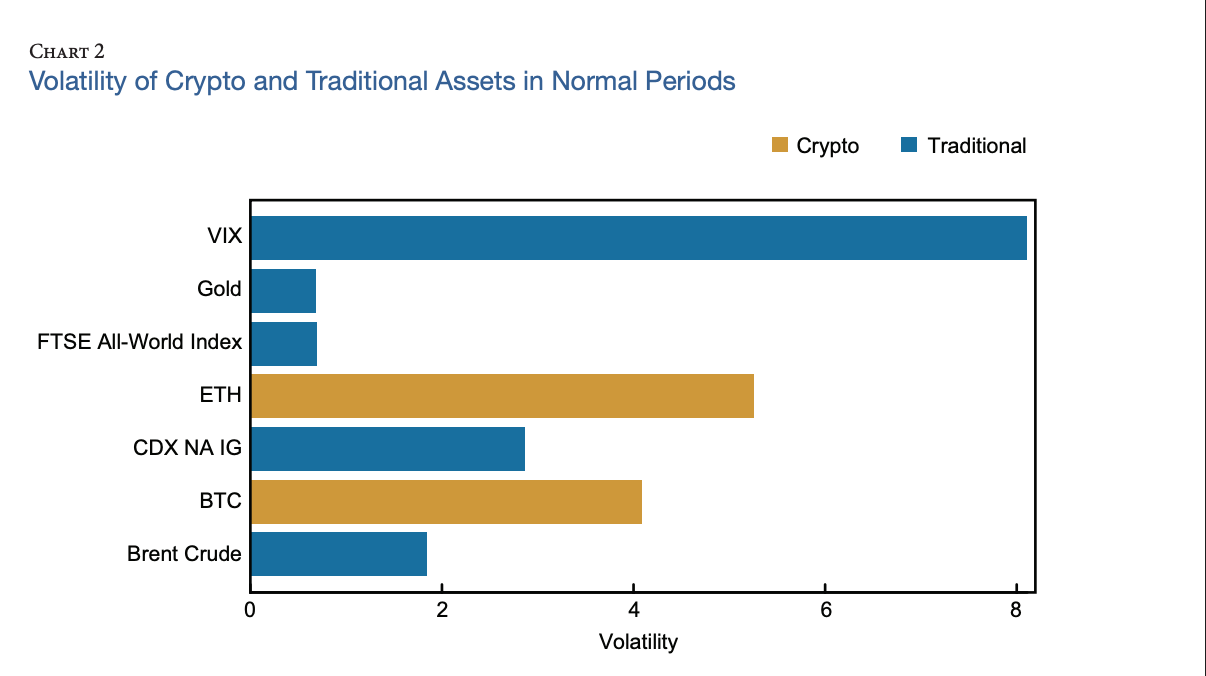

Assessing the risks of cryptocurrency exposure for pension funds requires examining volatility metrics and historical performance data from reliable sources. Cryptocurrencies such as Bitcoin and Ether have exhibited annualized volatility rates often exceeding 50-70% in recent years, compared to the 15-20% typical for major stock indices like the S&P 500, according to analysis from the U.S. Federal Reserve. This disparity can create mismatches for pension investors, who prioritize predictable returns to match long-term liabilities and ensure steady payouts to retirees.

Bitcoin and Ether volatility compared to other asset classes and stock indexes. Source: US Federal Reserve

Nonprofit advocacy group Better Markets has echoed these concerns, stating in reports that digital assets’ price swings introduce unnecessary uncertainty into retirement planning. Their research points to episodes of extreme drawdowns—Bitcoin, for instance, lost over 70% of its value in 2022—highlighting how such events could erode principal balances in conservative portfolios. Experts recommend that any inclusion be limited to a small percentage, perhaps 1-5%, with strict diversification rules to mitigate downside exposure.

Union leaders have amplified these warnings through public statements. AFT President Randi Weingarten remarked on Thursday that unregulated and high-risk investments like crypto do not belong in pension structures, likening the sector to other unproven technologies such as AI in financial contexts. Representing 1.8 million U.S. teachers and education professionals, the AFT’s influence carries weight in policy discussions, urging lawmakers to protect savers from what they term the “wild west” of alternative assets.

The opposition extends beyond the AFT. In October, the American Federation of Labor and Congress of Industrial Organizations (AFL-CIO), the nation’s largest union federation, submitted a similar letter to Congress. They argued that cryptocurrencies pose both individual and systemic threats, with volatility potentially destabilizing the $30 trillion retirement ecosystem and amplifying broader financial vulnerabilities. Drawing on data from regulatory filings, the AFL-CIO noted that unchecked crypto adoption could lead to correlated losses during market stress, impacting everyday workers’ futures.

Proponents, however, frame the debate around opportunity rather than peril. They cite institutional adoption trends, where major pension funds in Europe and Asia have already allocated modestly to crypto with positive results under regulated conditions. U.S. policymakers are urged to follow suit, ensuring compliance with existing securities laws while fostering innovation. This balanced approach could democratize access to high-growth assets, potentially enhancing returns for underfunded pensions amid rising longevity and healthcare costs.

The ongoing rift reflects deeper philosophical divides: unions prioritize preservation of capital, while industry voices advocate for controlled evolution in investment choices. As deliberations continue in the Senate, stakeholders on both sides prepare for further advocacy, with outcomes likely to influence not just crypto markets but the foundational security of American retirement savings.

Frequently Asked Questions

What are the main arguments against allowing crypto in 401(k) accounts?

Labor unions oppose crypto in 401(k) accounts primarily due to extreme volatility, which could result in significant losses for retirement savings. Groups like the AFT and AFL-CIO argue that digital assets lack the stability needed for predictable pension outcomes, potentially exposing workers to speculative risks without adequate safeguards.

Why do crypto advocates support including digital assets in pension plans?

Crypto advocates believe regulated inclusion in pension plans would provide diversification and access to assets with strong historical returns, like Bitcoin’s long-term growth. They argue that clear market structure laws would enhance oversight, reducing risks while allowing retirement funds to benefit from emerging technologies in a controlled manner.

Key Takeaways

- Regulatory Push: Proposed bills could enable trillions in retirement capital to flow into crypto, but face stiff union resistance over volatility concerns.

- Union Stance: Major groups like AFT and AFL-CIO highlight systemic risks, emphasizing protection for workers’ long-term savings.

- Industry Response: Experts urge balanced regulation to integrate crypto safely, promoting innovation and potential growth for pensions.

Conclusion

The debate on cryptocurrencies in 401(k) retirement accounts and broader pension exposure underscores a pivotal moment for financial policy, balancing innovation with risk management. As lawmakers weigh input from unions, investors, and regulators, clearer guidelines could emerge to safely incorporate digital assets. Investors should monitor developments closely, consulting financial advisors to align strategies with evolving opportunities in the crypto landscape.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

3/1/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/28/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/27/2026

DeFi Protocols and Yield Farming Strategies

2/26/2026