Western Union Eyes Stablecoin Card as USDC Activity Varies Across Blockchains

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

Western Union has announced a new stablecoin card to facilitate digital payments, capitalizing on the surging growth of stablecoins like PayPal’s PYUSD and Ripple’s RLUSD, which have seen supplies exceed $1 billion each amid rising demand for dollar-backed assets across blockchains.

-

PYUSD supply on Solana has quadrupled to over $1 billion since early 2025, highlighting rapid adoption in fintech ecosystems.

-

RLUSD’s circulating supply has reached approximately $1.1 billion, driven by increasing interest in stable digital dollars.

-

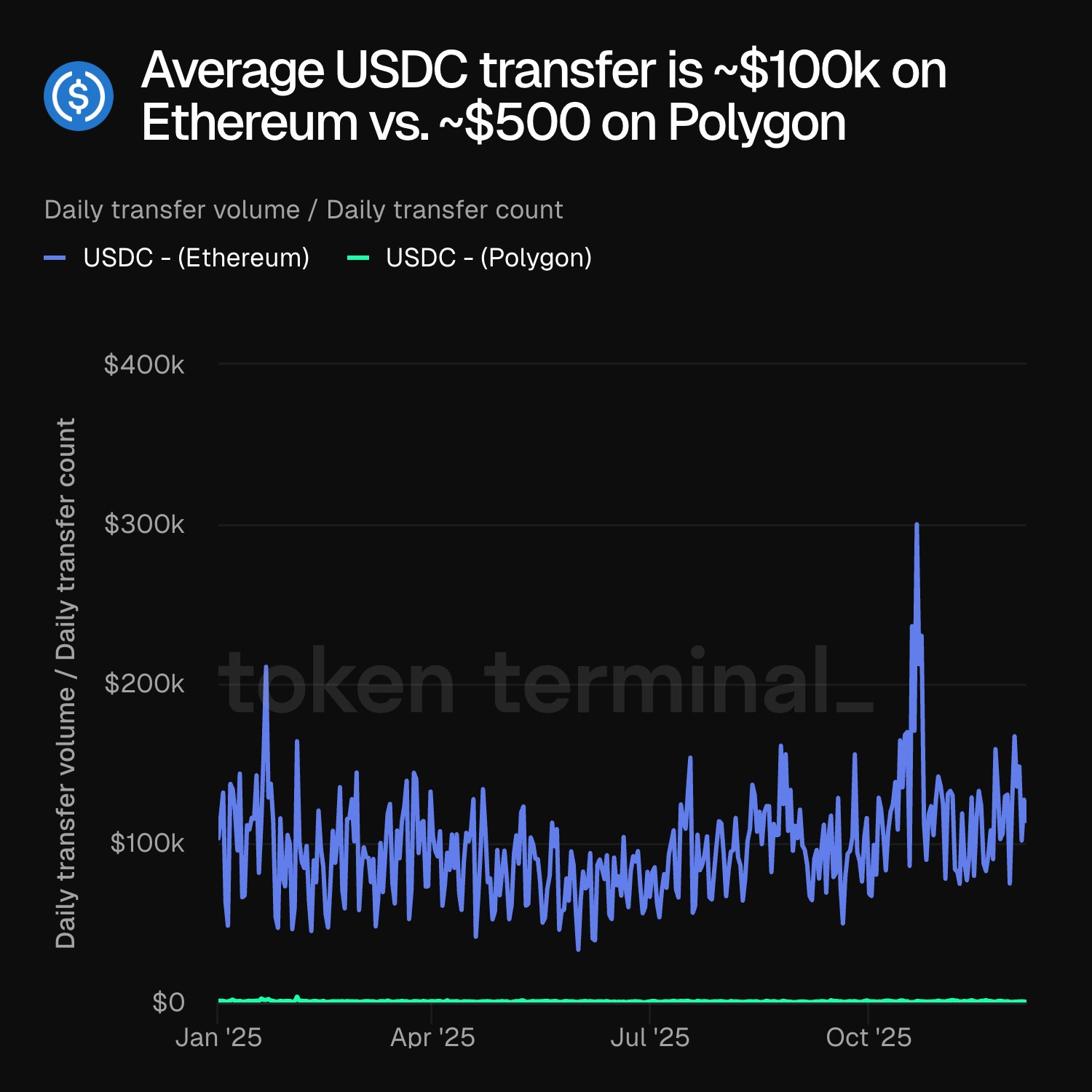

USDC transfer volumes differ significantly by chain, with Ethereum averaging $100,000 per transaction and Polygon around $500, reflecting segmented market uses.

Discover how Western Union’s stablecoin card enters a booming market with PYUSD and RLUSD growth, plus USDC chain disparities. Explore implications for global payments—read now for key insights!

What is Western Union’s new stablecoin card?

Western Union’s stablecoin card is a innovative payment solution designed to integrate stablecoins into everyday transactions, allowing users to spend dollar-pegged digital assets seamlessly at supported merchants worldwide. Launched amid the explosive growth of stablecoins, it aims to bridge traditional finance with blockchain technology by enabling quick, low-cost transfers. This card supports major stablecoins like USDC and PYUSD, providing security through reserves backed by U.S. dollars held in regulated institutions.

The initiative reflects Western Union’s strategy to adapt to the evolving digital economy, where stablecoins now facilitate billions in daily transactions. By offering this card, the company positions itself to serve both institutional and retail users, reducing reliance on volatile cryptocurrencies.

How are stablecoins like PYUSD and RLUSD driving market growth?

Stablecoins such as PayPal’s PYUSD and Ripple’s RLUSD are experiencing unprecedented expansion, underscoring their role in stabilizing the crypto ecosystem. PYUSD’s supply on the Solana blockchain has surged from about $250 million at the beginning of 2025 to more than $1 billion, marking a fourfold increase that demonstrates strong user adoption for fast, scalable payments. This growth is fueled by Solana’s high throughput and low fees, making it ideal for fintech applications.

Source: X

Similarly, Ripple’s RLUSD has achieved a circulating supply of around $1.1 billion, bolstered by its integration into Ripple’s payment networks for cross-border settlements. According to data from blockchain analytics firms like Chainalysis, the total stablecoin market capitalization has surpassed $150 billion in 2025, with U.S. dollar-backed variants comprising over 90% of that figure. This dominance is attributed to their peg stability and regulatory compliance, as noted in reports from the International Monetary Fund (IMF).

The IMF has highlighted potential risks, warning that the rapid proliferation of these stablecoins could lead to significant capital outflows from emerging markets, potentially reaching $1 trillion. Experts like Harvard economist Kenneth Rogoff have emphasized that while stablecoins enhance efficiency, their centralized issuance models—relying on trusted custodians rather than pure decentralization—pose systemic vulnerabilities. “Stablecoins are reshaping global finance, but their concentration in dollar-pegged assets amplifies geopolitical dependencies,” Rogoff stated in a recent economic forum.

This growth is not without challenges. Regulatory scrutiny from bodies like the U.S. Securities and Exchange Commission (SEC) and the European Central Bank (ECB) is intensifying, focusing on reserve transparency and anti-money laundering compliance. Despite these hurdles, adoption continues to accelerate, with projections from Deloitte estimating stablecoin transaction volumes could hit $10 trillion annually by 2028.

Frequently Asked Questions

What impact does Western Union’s stablecoin card have on emerging markets?

Western Union’s stablecoin card offers a lifeline for users in high-inflation countries by providing access to USD-backed digital savings and payments, shielding against local currency devaluation. With over 200 million potential users in regions like Latin America and Africa, it could facilitate remittances worth billions, reducing fees from traditional wires that often exceed 6%, according to World Bank data.

How do blockchain differences affect USDC usage for everyday transactions?

USDC performs distinctly across blockchains, with Ethereum catering to high-value institutional transfers averaging $100,000, while Polygon supports smaller, consumer-oriented transactions around $500. This segmentation allows for efficient micro-payments in daily commerce, making stablecoins versatile for both enterprise and retail applications when spoken aloud in voice searches.

Key Takeaways

- Stablecoin Surge: PYUSD and RLUSD supplies have ballooned beyond $1 billion, signaling robust demand for reliable digital dollars in a volatile market.

- Chain Segmentation: USDC’s varying transfer sizes on Ethereum versus Polygon illustrate how blockchains serve different user segments, from institutions to everyday spenders.

- Innovation Edge: Western Union’s card entry could democratize stablecoin access, urging financial firms to adapt for global, inclusive payment solutions.

Source: X

Conclusion

As Western Union’s stablecoin card joins the fray amid PYUSD and RLUSD’s meteoric rise, the stablecoin market is poised for further transformation, bridging traditional remittances with blockchain efficiency. USDC’s cross-chain dynamics further highlight the need for tailored solutions in this segmented landscape. Financial institutions must prioritize compliance and innovation to harness these opportunities, ensuring stablecoins contribute to a more equitable global economy moving forward.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026