Willy Woo: Quantum Risk Threatens BTC Scarcity

BTC/USDT

$25,688,978,986.00

$71,632.08 / $68,176.47

Change: $3,455.61 (5.07%)

-0.0000%

Shorts pay

Contents

BTC Quantum Computing Threat

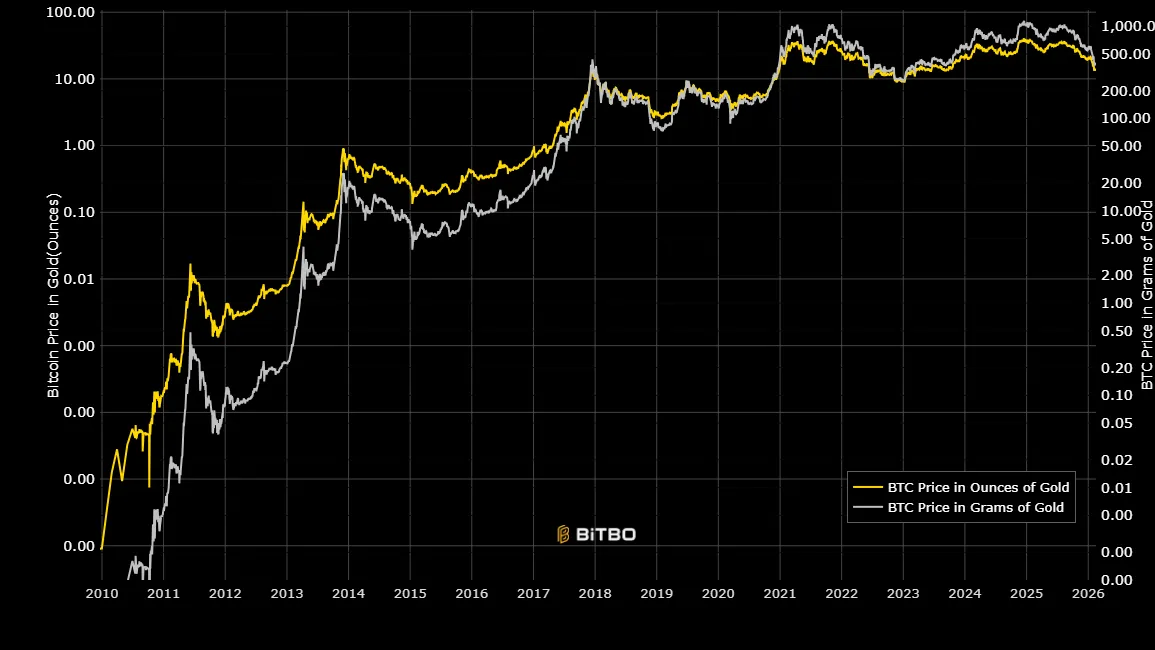

Onchain analyst Willy Woo states that the quantum computing risk is suppressing Bitcoin's long-term value proposition against gold. Markets have begun pricing in the risk of a powerful quantum computer, called “Q-Day,” breaking current public-key cryptography. Approximately 4 million lost BTC —coins considered lost due to lost private keys— could enter circulation derived from public keys and weaken BTC's scarcity narrative. Woo estimates a 25% chance that the Bitcoin network will freeze these coins via a hard fork.

These 4 million coins make up 25-30% of the supply and their public keys are visible on-chain. Developers emphasize that there is no emergency and a phased roadmap for post-quantum migration will be followed. According to Woo, there's a 75% chance the coins will be released, leading to a structural discount in the BTC/gold ratio for 5-15 years. Jefferies strategist Christopher Wood has removed BTC from his portfolio and switched to gold due to the quantum risk.

BTC vs. gold chart price and ratio. Source: Bitbo

BTC Technical Analysis and Support/Resistance Levels

BTC price at 68.744 USD, down -2,39% in 24 hours. RSI 36,65 (oversold), downtrend continues. EMA 20: 73.316 USD. Click for detailed BTC analysis.

- Supports: S1 68.072 USD (⭐ Strong, -1,41%), S2 65.118 USD (⭐ Strong, -5,69%)

- Resistances: R1 70.223 USD (⭐ Strong, +1,71%), R2 78.145 USD (⭐ Strong, +13,18%)

BTC Latest Market Developments

Bitcoin's weekly candlestick chart has turned positive, up 8% from the low (1 day 12 hours to close). NYSE American is listing options for multi-crypto ETFs. BTC futures volume may increase. Quantum risk is being monitored amid market recovery.