WLFI Accumulation Drives Demand but Volatility Risks Persist

WLFI/USDT

$83,229,461.44

$0.1130 / $0.1054

Change: $0.007600 (7.21%)

-0.0040%

Shorts pay

Contents

World Liberty Financial (WLFI) has seen an 8% price rise in the last 24 hours, driven by team and whale accumulations totaling over $39 million, which reduced circulating supply and signaled strong confidence, though balanced liquidations and downside liquidity clusters suggest potential volatility ahead.

-

WLFI team purchased $7.79 million worth of tokens, removing 46.56 million from circulation to boost scarcity.

-

Market maker Wintermute increased its holdings by 505% to $1.01 million, enhancing liquidity and stability.

-

Combined liquidations hit $1.09 million with equal long and short losses of around $444,000 each, indicating fragile market equilibrium and heightened volatility risk.

Discover why World Liberty Financial WLFI is surging amid team buys and whale activity. Explore volatility risks from liquidation data and liquidity clusters in this in-depth analysis. Stay informed on WLFI trends today.

What is driving the recent surge in World Liberty Financial WLFI?

World Liberty Financial WLFI experienced an 8% price increase over the past day due to strategic accumulations by the project team and major market participants. The team invested $7.79 million to acquire 46.56 million WLFI tokens, significantly reducing available supply and fostering scarcity. This move, combined with whale purchases totaling $31.5 million, underscores investor confidence and positions WLFI for potential sustained growth.

How are market makers and whales influencing WLFI demand?

Market dynamics for World Liberty Financial WLFI have been shaped by proactive accumulations from key players. The WLFI team executed a substantial purchase of $7.79 million, equivalent to 46.56 million tokens, directly from the open market, as reported by Arkham Intelligence. This action not only diminishes circulating supply but also signals robust commitment to the project’s future, often encouraging broader investor participation.

In a parallel development, Wintermute, a prominent market maker responsible for liquidity provision and price stabilization, bolstered its WLFI position dramatically. Data from Arkham Intelligence indicates Wintermute acquired approximately $840,000 in tokens, resulting in a 505% portfolio expansion to $1.01 million. Such involvement by established entities like Wintermute helps mitigate extreme price fluctuations, providing a supportive foundation for WLFI’s market presence.

Whale activity has further amplified this trend. Over recent days, large holders collectively scooped up $31.5 million in WLFI, employing tactics that mirror the team’s strategy. These accumulations create a scarcity effect, drawing retail and institutional interest alike. According to Arkham Intelligence, this sustained buying pressure has been evident across multiple sessions, contributing to the token’s recent upward trajectory.

Source: Arkham Intelligence

These developments highlight a coordinated effort to strengthen WLFI’s market position. Expert analysis from blockchain intelligence firms like Arkham Intelligence emphasizes that such on-chain activities often precede price appreciation phases in emerging tokens. By reducing supply and enhancing liquidity, these players are laying groundwork for long-term stability in the World Liberty Financial ecosystem.

Frequently Asked Questions

What recent purchases have boosted World Liberty Financial WLFI demand?

The WLFI team acquired $7.79 million in tokens, while Wintermute added $840,000, and whales bought $31.5 million combined. These moves reduced circulating supply by millions of tokens, signaling confidence and creating scarcity that supports price growth in the short term.

Is volatility a concern for WLFI traders right now?

Yes, equal liquidations of about $444,000 for both longs and shorts, plus negative funding rates at -0.0139%, point to balanced but fragile positioning. Dense downside liquidity could pull prices lower if selling intensifies, so traders should monitor order flow closely for sudden shifts.

Key Takeaways

- Accumulation Drives Demand: Team and whale buys exceeding $39 million have slashed WLFI supply, fostering scarcity and an 8% price uptick.

- Balanced Liquidations Signal Risk: Near-equal long and short losses totaling $1.09 million indicate equilibrium, but any catalyst could spark cascades.

- Monitor Liquidity Clusters: Downside heatmap zones may attract price drops; sustained buying could counter this and propel WLFI higher.

Conclusion

World Liberty Financial WLFI continues to capture market interest through targeted accumulations by its team, market makers like Wintermute, and whales, which have collectively removed substantial tokens from circulation and supported an 8% gain. However, balanced liquidations and clustered downside liquidity introduce volatility risks that warrant caution. As on-chain data from sources like Arkham Intelligence and CoinGlass illustrates, WLFI’s trajectory hinges on whether buying momentum persists. Investors should track these indicators closely for opportunities in this dynamic crypto landscape.

WLFI team adds to demand

There has been a decisive push among investors to drive demand for World Liberty Financial WLFI.

The most recent trigger came from the team itself, which made a significant $7.79 million purchase from the market, removing approximately 46.56 million WLFI from circulation.

Typically, when a project team makes a purchase of this scale, it draws investor attention. Such action creates an element of scarcity and demonstrates long-term confidence in the asset, which is often strong enough to support rising demand.

Volatility ahead?

Despite the growing bullish interest, the recent market developments indicated that WLFI could soon become highly volatile.

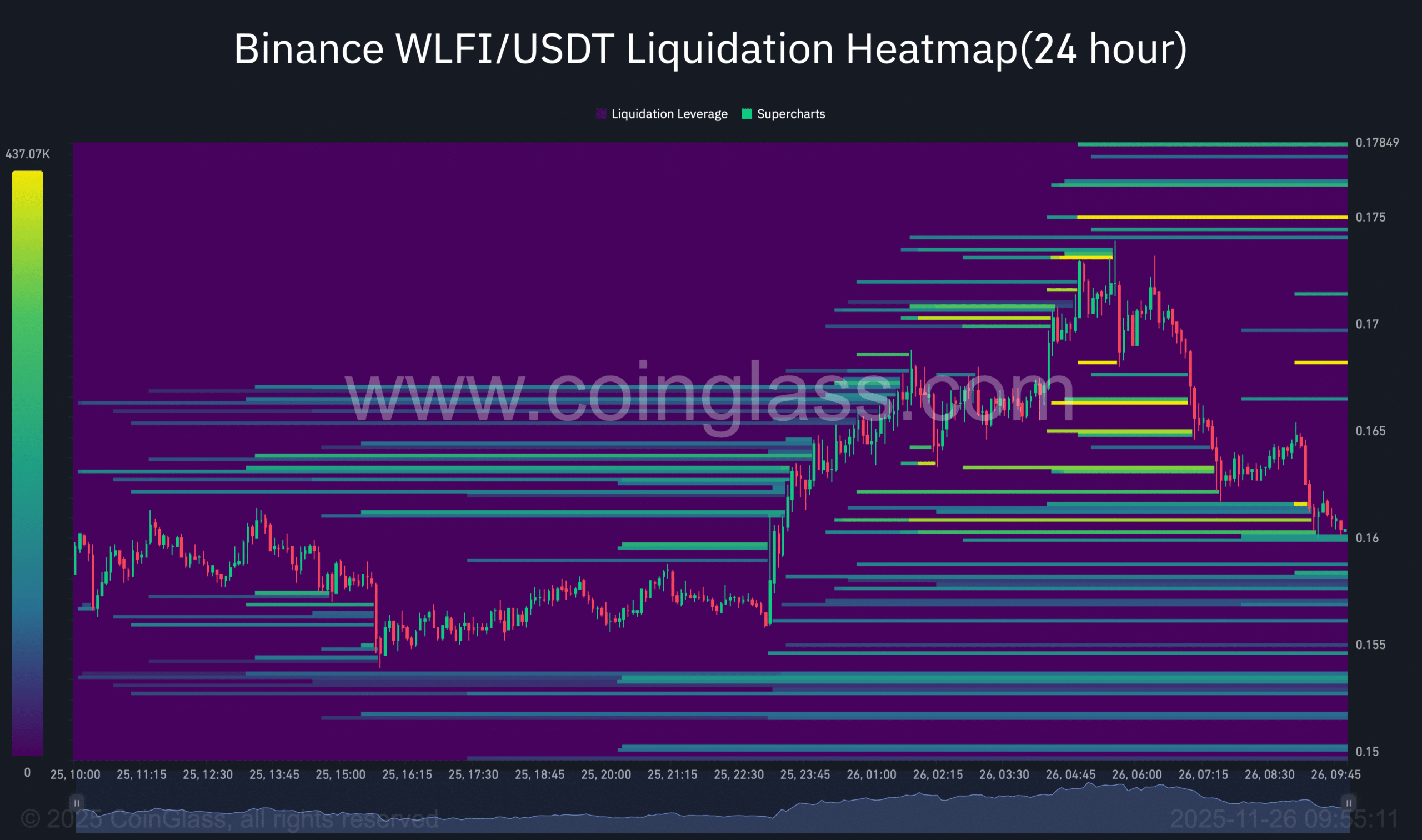

Recent liquidation data showed that both long and short traders in the Perpetual Futures market were being hit at nearly equal levels. The combined liquidations recently reached $1.09 million, although this figure remained incomplete.

More telling insight came from the data on the 25th of November, which showed that short traders lost around $443,120, while long traders suffered nearly identical losses of $444,200.

Source: CoinGlass

That narrow split placed WLFI in a fragile equilibrium. Any sharp move could trigger a liquidation cascade in either direction.

By contrast, Spot and Perpetual sentiment skewed bearish. Retail Spot traders sold $2.6 million worth of WLFI over the past 48 hours.

The Open-Weighted Funding Rate stayed negative at -0.0139%, suggesting traders positioned for downside.

Key tendencies to watch

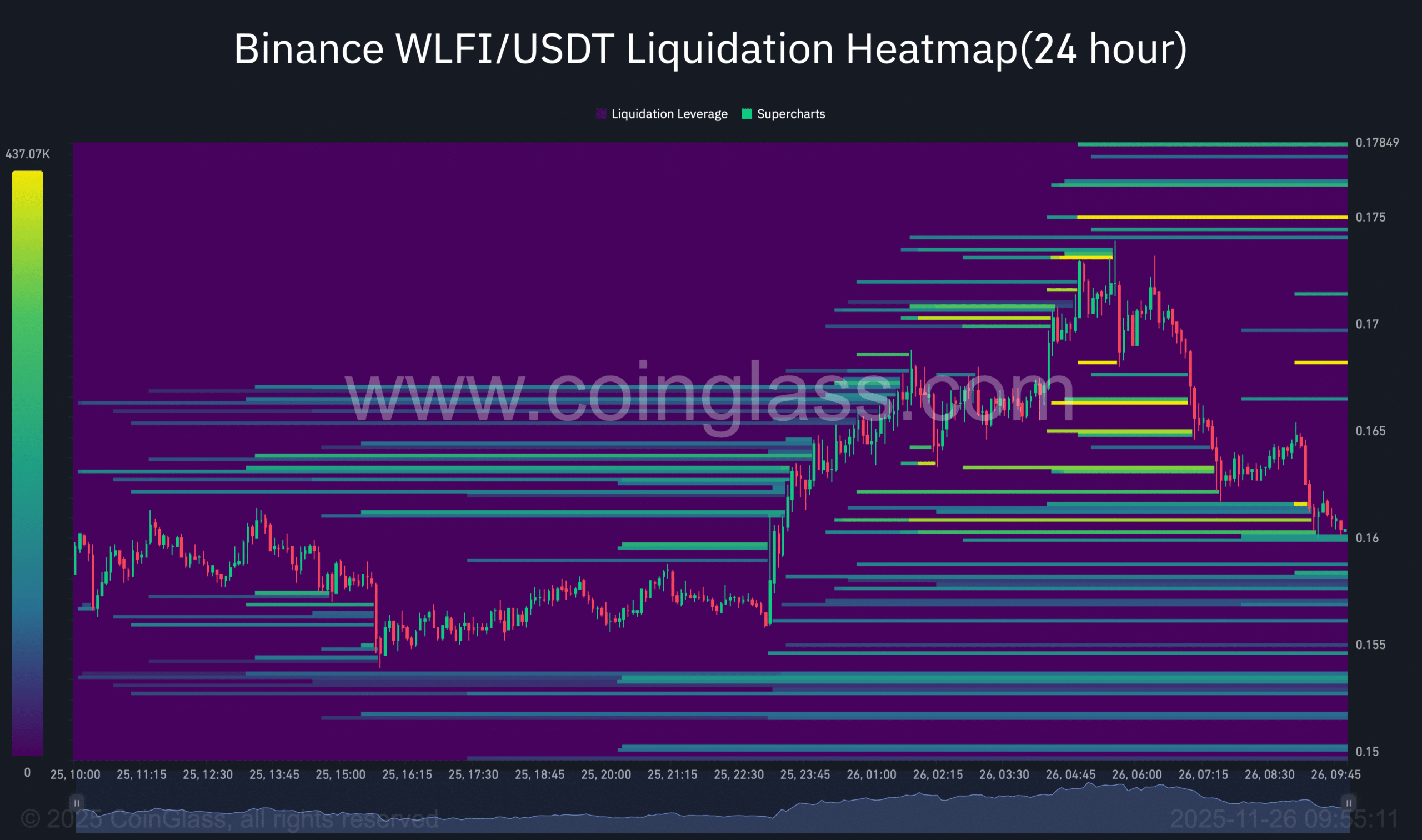

The Liquidation Heatmap highlighted dense liquidity clusters below WLFI’s current price. These zones, packed with resting orders, historically acted as magnets during volatile phases.

Source: CoinGlass

If downward pressure intensifies, these tightly packed levels could attract price movement, increasing the likelihood of a decline in WLFI.

However, this is not a certainty. Continued accumulation from whales and further team purchases could counteract that pull, helping to sustain upward momentum and keep WLFI pushing higher on the chart.