WLFI Addresses Pre-Launch Wallet Breaches with Token Burn Amid US Probe

WLFI/USDT

$83,229,461.44

$0.1130 / $0.1054

Change: $0.007600 (7.21%)

-0.0040%

Shorts pay

Contents

World Liberty Financial (WLFI) blacklisted compromised user wallets holding its token due to pre-launch phishing attacks and leaked seed phrases, unrelated to its systems. The company froze 272 affected wallets, executed an emergency burn of 166.667 million tokens valued at $22.14 million, and implemented KYC checks for secure reallocations.

-

Pre-launch breaches: Attackers exploited phishing and exposed credentials to access a small subset of user wallets before WLFI’s September 1 debut.

-

Response measures: WLFI developed new smart contract logic for bulk reallocations and warned users about fake support accounts and scam recovery services.

-

Impact and recovery: An emergency burn removed stolen tokens from hacker addresses, with verified users set to receive reallocations soon; congressional scrutiny arises over alleged ties to sanctioned entities.

Discover how World Liberty Financial addressed WLFI wallet breaches through token burns and KYC, amid Trump family ties and US Senate probes. Stay informed on crypto security—explore more insights today.

What is the World Liberty Financial Wallet Breach and How Did It Occur?

World Liberty Financial wallet breach involved a limited number of user wallets compromised prior to the WLFI token’s official launch on September 1, 2025, primarily through phishing attacks and leaked seed phrases unrelated to the platform’s infrastructure. The Trump family-affiliated project identified these issues via user reports of suspicious activity and promptly froze the affected accounts to prevent further losses. In response, WLFI enhanced its security protocols, including new smart contract functions for reallocating funds to verified owners.

How Did World Liberty Financial Respond to the Compromised WLFI Wallets?

World Liberty Financial took decisive action by blacklisting and freezing 272 compromised wallets, as detailed in their public statement on X. The company conducted rigorous identity verification through KYC checks to ensure funds were returned only to legitimate owners, addressing vulnerabilities introduced by external factors like the Ethereum Pectra upgrade’s EIP-7702, which attackers exploited to insert malicious contracts. According to WLFI’s announcement, most incidents stemmed from user errors such as exposed private keys, not platform flaws, and they warned the community about proliferating fake support accounts and scam recovery services. This structured approach minimized risks, with reallocations set to begin shortly for compliant users. Expert analysis from blockchain security firms, such as those cited in industry reports, underscores the importance of such proactive measures in decentralized finance, where user education on phishing remains critical—statistics from Chainalysis indicate that phishing accounts for over 80% of crypto thefts annually.

World Liberty Financial identified and blacklisted a group of user wallets holding its WLFI token that were compromised before the token’s official launch, citing phishing attacks, leaked seed phrases, and other security failures unrelated to its own systems.

In an X thread posted on Wednesday, the President Trump family-affiliated company revealed that attackers gained access to wallets through external lapses tied to third-party tools or malicious schemes that tricked users into exposing private keys during its launch on September 1.

The affected wallets were reportedly frozen after users reported suspicious activity, and they were asked to complete identity checks again so the company could confirm ownership and return recovered funds to the correct recipients.

WLFI said it also “built and tested new smart contract logic to handle bulk reallocations,” noting that most of the compromises were caused by phishing and exposed credentials.

WLFI executes emergency burn for reallocation

According to the company’s statement expounding on the source of the breach, the launch of Ethereum’s EIP-7702 Pectra upgrade saw attackers placing malicious contracts into already compromised accounts, later enabling token drains once WLFI went live.

1/ Prior to WLFI’s launch, a relatively small subset of user wallets were compromised via phishing attacks or exposed seed phrases.

Since then, we’ve tested new smart contract logic to safely reallocate user funds and verified users’ identity via KYC checks.

Shortly, users who…— WLFI (@worldlibertyfi) November 19, 2025

World Liberty Financial froze 272 wallets affected by the breach and warned users that fake support accounts and scam recovery services were in circulation at the time. Although the number of impacted users was limited, the company insisted on stringent verification requirements to avoid sending tokens to the wrong parties.

Yesterday, the Web 3 platform executed an emergency contract function that burned 166.667 million WLFI tokens, valued at about $22.14 million, from addresses involved in the hack.

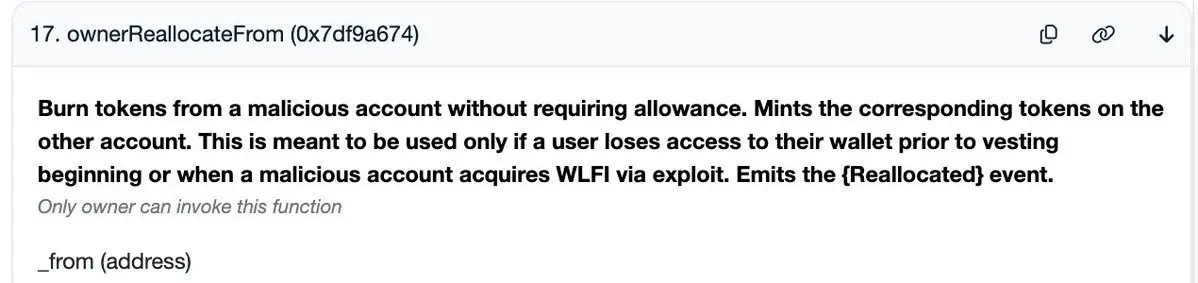

A market watcher going by the username Emmet Gallic shared a photo of the explanation given for the token burn function from the contract, which read:

Image from token burn contract. Source: Emmett Gallic on X.

Image from token burn contract. Source: Emmett Gallic on X.WLFI confirmed from its X post that reallocations will begin shortly for wallets that have completed the required checks. Tokens belonging to users who have not yet contacted the company will be frozen until they go through the verification process, and they can start the procedure through its help center anytime until claims are resolved.

“Thank you to everyone who showed patience and trust throughout this process. We’re proud to protect our community, and ready to keep building,” the platform’s social media team concluded.

World Liberty Financial’s token trading opened on decentralized exchanges, dropping more than 15% shortly after going live and denting the profits of several holders like social media influencer Andrew Tate, Cryptopolitan reported.

At the top of that band, the Trump family’s reported stake of 22.5 billion tokens carried a paper valuation exceeding $6 billion, per the Wall Street Journal’s feature. World Liberty Financial’s website lists Eric Trump, Donald Trump Jr., and Barron Trump as co-founders, while US President Donald Trump is noted as a “Co-Founder Emeritus.”

US President Donald Trump’s ties to WLFI spark congressional probe

A report by the watchdog Accountable.US said the company sold $10,000 worth of WLFI to traders who had interacted with a blockchain address now sanctioned for ties to the North Korean Lazarus hacking group.

Acting on what they perceive as “actionable intel,” two US Senators have asked federal officials to examine World Liberty Financial’s activities. In a letter sent Tuesday, Senators Elizabeth Warren and Jack Reed, both members of the Senate Banking Committee, claimed WLFI is a national security risk with links to bad actors from North Korea, Russia, and Iran.

The lawmakers cited the Accountable.US report, which alleged that WLFI tokens were sold to individuals tied to a sanctioned Russian ruble-based sanctions evasion network, an Iranian crypto exchange, and Tornado Cash, a service the US has sanctioned for money laundering.

World Liberty Financial rejected the allegations in a statement to CNBC, saying:

“There is no conflict of interest between World Liberty Financial. We conducted rigorous AML/KYC checks on every pre-sale purchaser of the $WLFI governance token and turned down millions of dollars from potential purchasers who failed the tests.”

Frequently Asked Questions

What Caused the World Liberty Financial Wallet Compromises?

The WLFI wallet breaches resulted from phishing attacks and exposed seed phrases affecting a small group of users before the token launch. These external security lapses allowed attackers to access private keys via third-party tools and malicious schemes, as confirmed by World Liberty Financial’s investigation. No faults were found in the platform’s own systems.

How Can Affected WLFI Users Recover Their Tokens?

If you’re an affected user with a compromised WLFI wallet, contact World Liberty Financial’s help center to initiate KYC verification. Once confirmed as the rightful owner, reallocations will proceed through secure smart contract functions. Tokens remain frozen until verification to protect against fraud—patience ensures safe recovery.

Key Takeaways

- Proactive Security Measures: World Liberty Financial’s quick freeze of 272 wallets and emergency token burn demonstrate effective breach response, safeguarding user assets from pre-launch exploits.

- Verification Importance: Rigorous KYC and AML checks prevented invalid claims, with the company rejecting millions in failed pre-sale attempts, highlighting robust compliance standards.

- Ongoing Scrutiny: Ties to the Trump family and alleged sanctioned links have prompted a Senate probe—users should monitor developments for potential regulatory impacts on WLFI.

Conclusion

The World Liberty Financial wallet breach underscores vulnerabilities in crypto launches, yet the platform’s swift actions like the WLFI token burn and reallocations reflect strong commitment to user protection. As investigations into ties with sanctioned entities continue, the project reaffirms its focus on secure, compliant DeFi innovation. Investors and users are encouraged to prioritize personal security practices and stay updated on WLFI’s progress for a resilient financial future.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026