WLFI Whales Accumulate Amid Recovery Signals, Though Selling Pressure May Emerge

WLFI/USDT

$83,229,461.44

$0.1130 / $0.1054

Change: $0.007600 (7.21%)

-0.0040%

Shorts pay

Contents

Whales are accumulating over 298 million WLFI tokens amid a price recovery, signaling renewed confidence in World Liberty Financial. The token has reclaimed key EMAs, trading at $0.157 with a 12.3% weekly gain, though rising sell pressure poses risks to the rebound.

-

Whale Activity: Two major wallets added nearly 300 million WLFI tokens worth $31.95 million in recent days.

-

Price Momentum: WLFI shows four higher closes, breaking above EMA20 and EMA50 levels for the first time in weeks.

-

Team Moves: The project sold 40.59 million TRX for a $1.4 million profit, potentially funding operations without diluting WLFI supply.

Discover how WLFI whale accumulation and price recovery signal potential reversal in World Liberty Financial. Explore key indicators and risks. Stay informed on crypto trends—read more for insights that matter.

What is Driving the WLFI Whale Accumulation and Price Recovery?

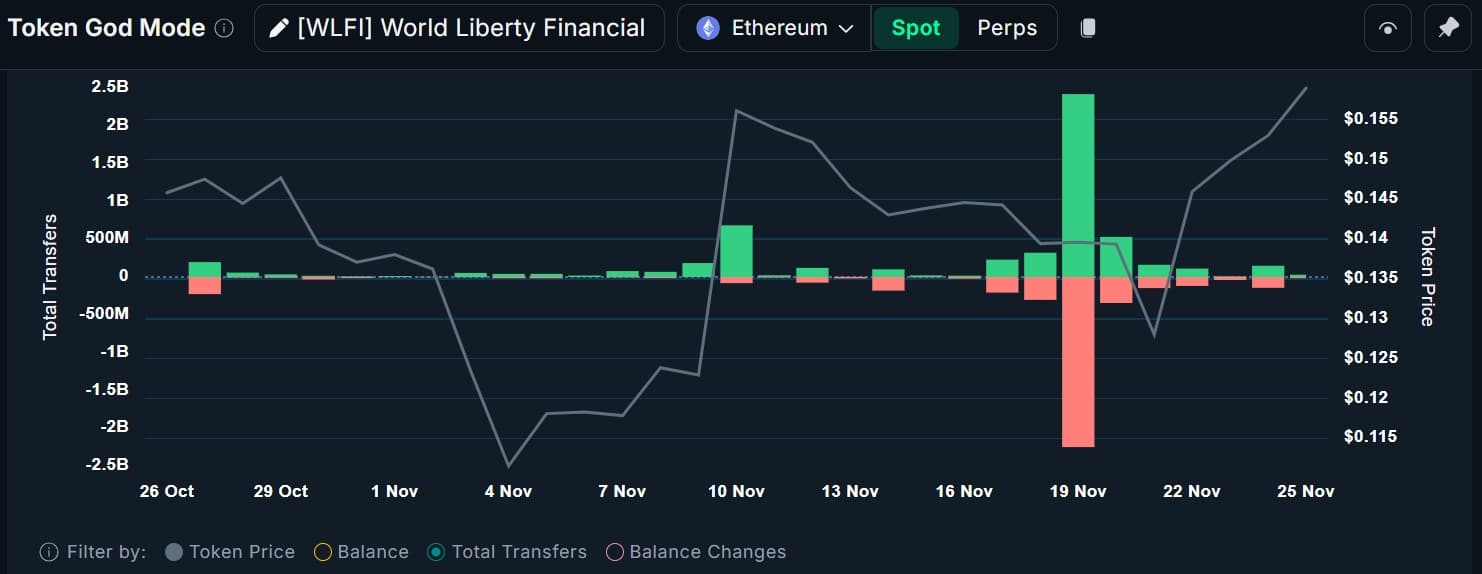

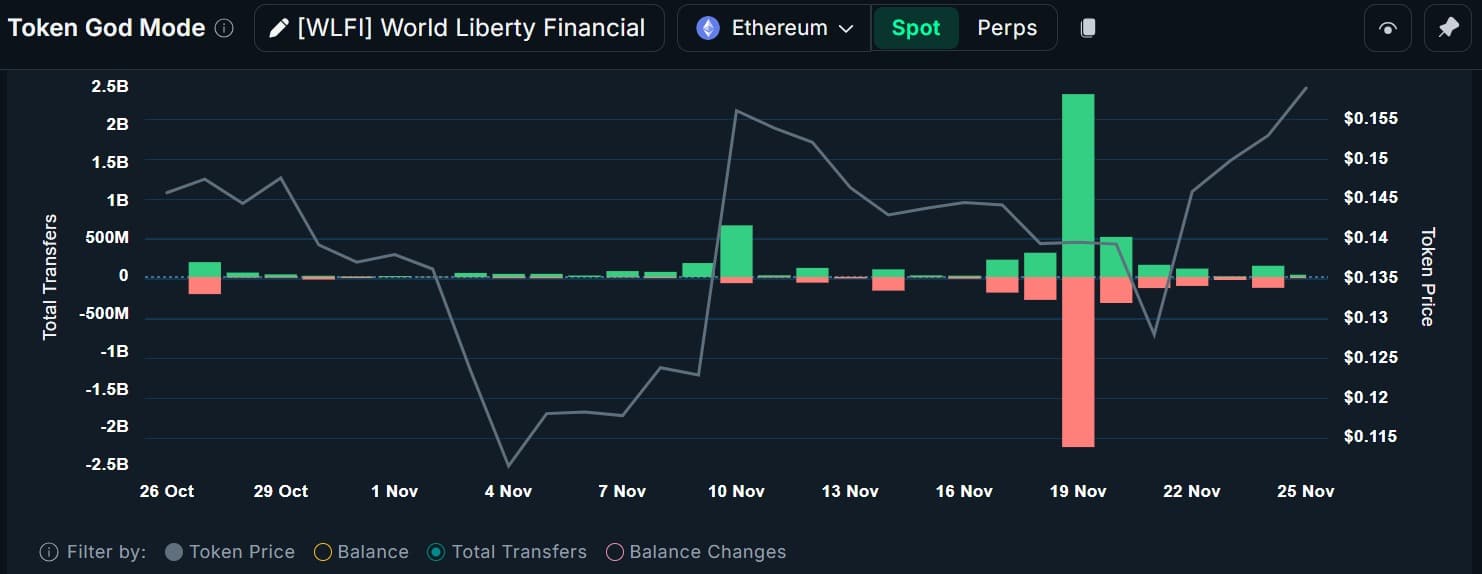

World Liberty Financial (WLFI) is experiencing a notable resurgence, fueled by aggressive whale buying and technical breakouts after weeks of market downturns. Whales have scooped up nearly 300 million tokens, reflecting strong belief in its future amid stabilizing mid-cap trends. This activity coincides with the token’s climb above key moving averages, positioning it for possible upward momentum if support holds.

How Are Whale Inflows Impacting WLFI’s Market Dynamics?

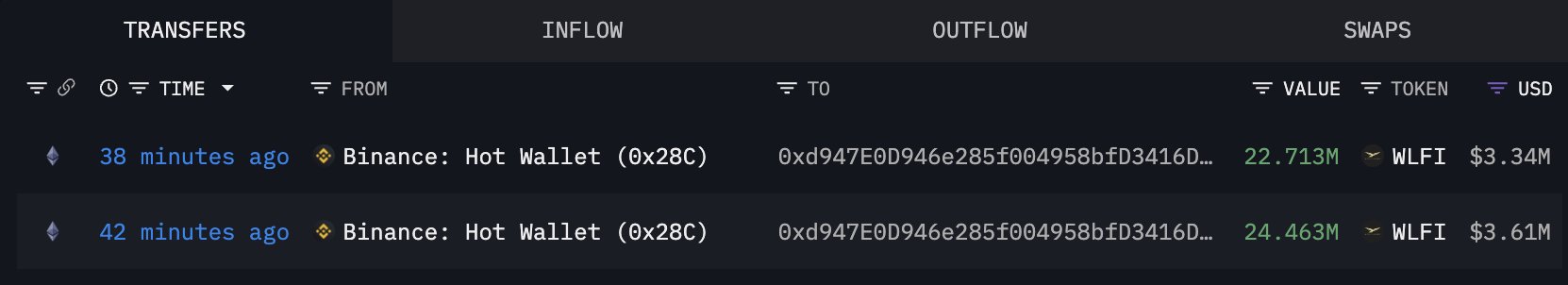

Large investors, often called whales, have ramped up their holdings in World Liberty Financial, with data from on-chain analytics firms like Lookonchain and Nansen highlighting significant transfers. One wallet pulled 47.18 million WLFI, valued at $6.95 million, from a major exchange, while another added 165.79 million tokens worth $25 million over three days. Collectively, this represents $31.95 million in accumulation, tightening supply and historically leading to price appreciation during uncertain periods.

Over the past 24 hours, top holders increased positions by 178 million WLFI, with three-day totals reaching 298 million. Such sustained buying reduces available tokens on the market, creating upward pressure. Experts note that whale confidence often precedes broader rallies, as these players position early for reversals. In WLFI’s case, this influx aligns with easing broader market declines, suggesting a coordinated shift toward recovery.

Frequently Asked Questions

What Recent Transactions Show Whale Interest in World Liberty Financial?

New wallets, such as 0xd947, withdrew substantial WLFI amounts from exchanges like Binance, totaling over 47 million tokens recently. Combined with multi-day buys from other large addresses, this accumulation exceeds 298 million tokens, indicating whales are betting on WLFI’s stabilization and potential growth in the coming weeks.

Is the WLFI Price Recovery Sustainable Amid Current Market Conditions?

Yes, WLFI’s recent four higher closes and EMA reclamations provide a solid base, but sustainability depends on holding above $0.1524. While whale buying supports momentum, positive spot netflow suggests increasing sells, which could test lower supports if not countered by continued inflows.

Key Takeaways

- Renewed Whale Confidence: Accumulation of 298 million WLFI tokens by top holders signals belief in a trend reversal, as prices reclaim critical EMAs.

- Team Liquidity Management: Selling TRX holdings for $1.4 million profit allows funding without impacting WLFI supply, viewed as a bullish sign for holders.

- Price Outlook: Bulls eye $0.18 if EMA50 holds, but watch for pullbacks to $0.1439 amid rising sell pressure from positive netflows.

WLFI Team Sold TRX Holdings

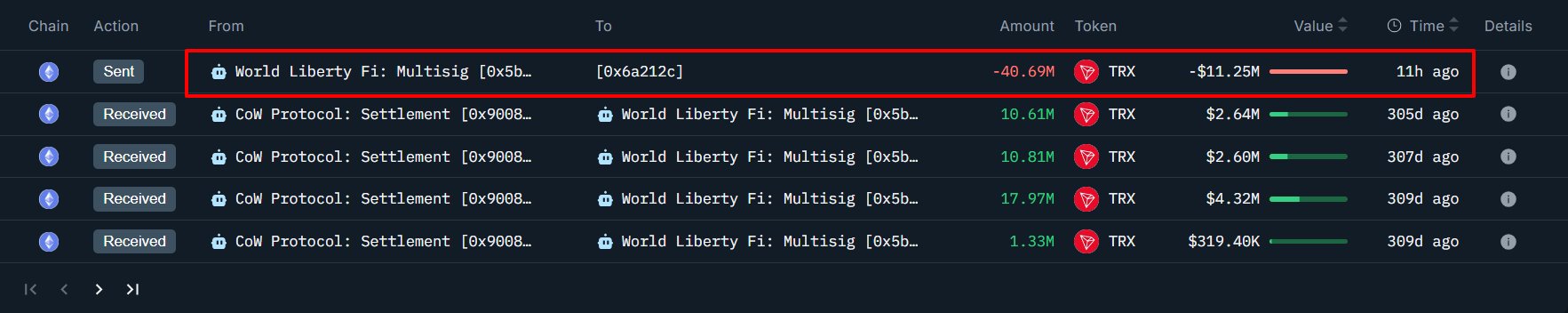

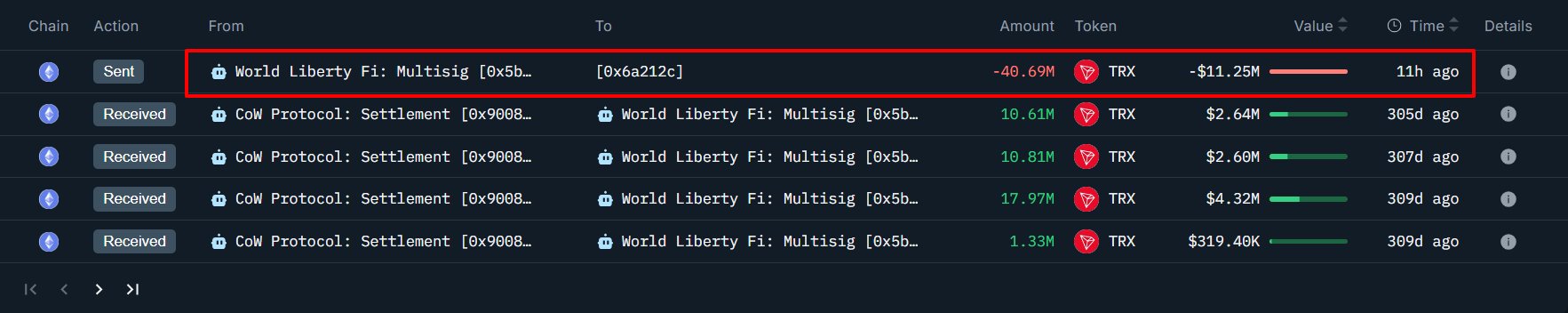

While whales build positions, the World Liberty Financial team has adjusted its portfolio by depositing 40.59 million TRON (TRX) tokens, valued at $11.25 million, into an exchange. Acquired earlier for $9.94 million, this move locks in a $1.4 million gain, per on-chain data from sources like Onchain Lens.

Source: Onchain Lens

This strategy implies prudent liquidity handling, using secondary assets to cover needs rather than offloading native tokens. Analysts view it as a positive for World Liberty Financial, preserving token scarcity and supporting holder sentiment during volatile times.

Price Recovery Meets Resistance Tests

After hitting a low of $0.11, World Liberty Financial has shown resilience with four straight higher daily closes. The token now hovers above the EMA20 and EMA50, bolstering bullish structure at a current price of $0.157—a 0.85% daily increase and 12.3% weekly rise.

Source: TradingView

Technical indicators reinforce this uptick: The Directional Movement Index registered a bullish crossover on November 24, with the positive line at 20.67 surpassing the negative at 15.49. To sustain the rally, a close above the EMA50 of $0.1524 is essential, potentially targeting $0.18 resistance.

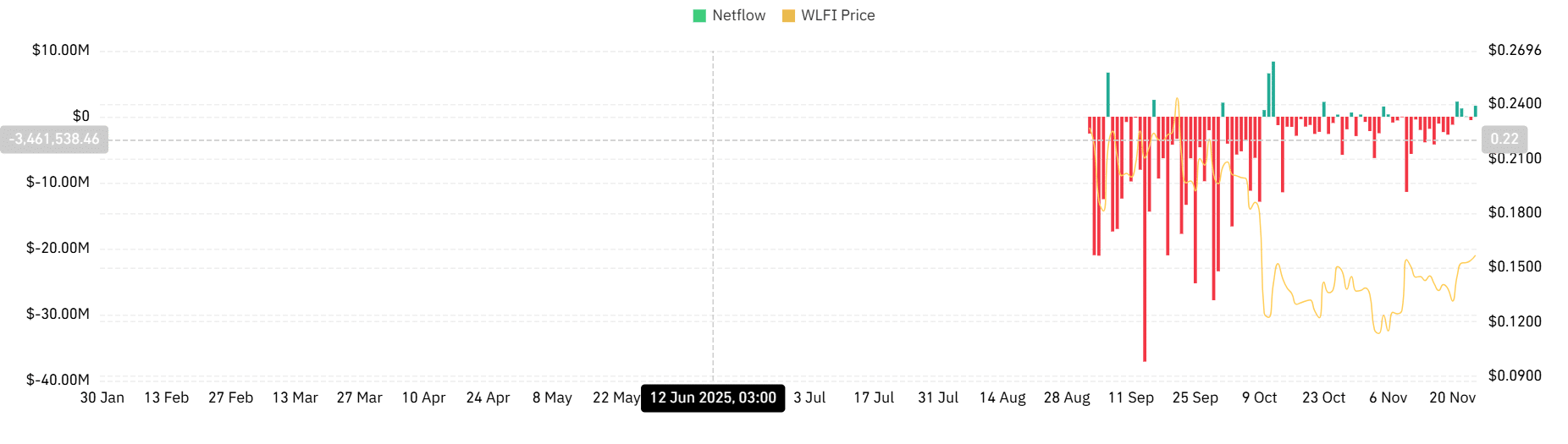

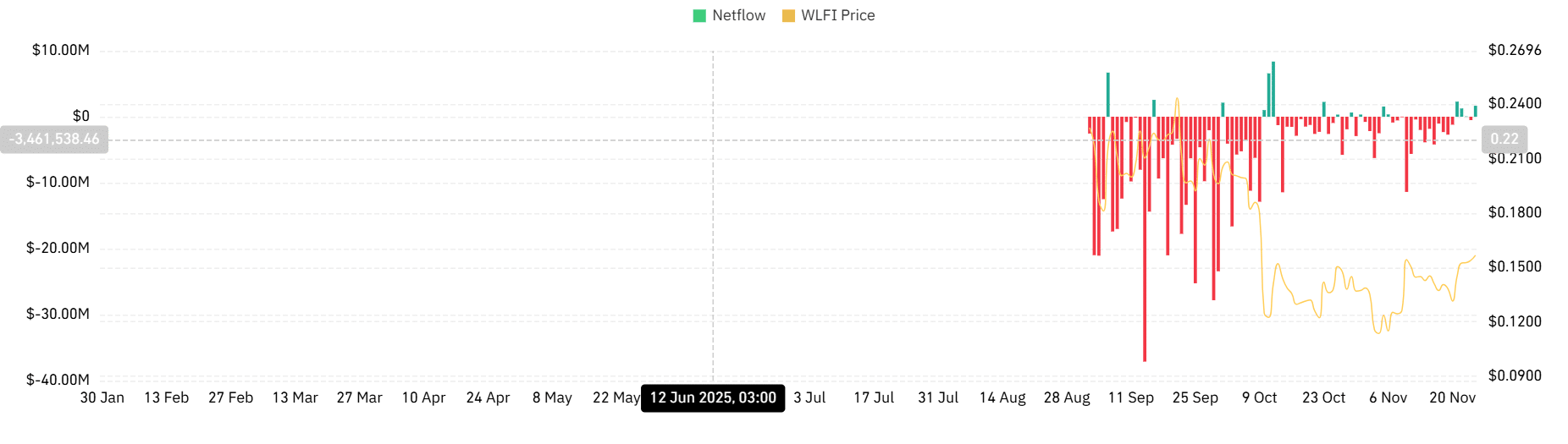

Challenges persist, however. Spot netflow data from CoinGlass indicates growing sell-side activity, shifting from -$500,000 to +$1.66 million in a day. This could pressure prices downward if sellers dominate, possibly retesting EMA20 support at $0.1439.

Source: CoinGlass

Source: Lookonchain

Source: Nansen

Conclusion

World Liberty Financial’s WLFI whale accumulation and price recovery highlight a pivotal moment for the token, with over 298 million units added by major holders amid EMA breakouts and team liquidity strategies. These developments, supported by on-chain insights from firms like Lookonchain and Nansen, underscore growing confidence despite sell pressure risks. As mid-cap stabilization takes hold, WLFI holders should monitor key supports for sustained upside potential—positioning thoughtfully could yield rewards in this evolving crypto landscape.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

3/1/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/28/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/27/2026

DeFi Protocols and Yield Farming Strategies

2/26/2026