Xapo Bank: Long-Term BTC Collateralized Loans

BTC/USDT

$21,201,579,335.94

$68,086.00 / $64,290.71

Change: $3,795.29 (5.90%)

-0.0009%

Shorts pay

Contents

Xapo Bank 2025 Digital Wealth Report

According to Gibraltar-based Xapo Bank’s 2025 Digital Wealth Report, Bitcoin-collateralized loans are increasingly being used for long-term financial planning rather than short-term liquidity. The report, shared with Cointelegraph, states that 52% of Bitcoin-collateralized loans issued in 2025 had a 365-day term, and many loans remained open despite a slowdown in new loan production toward the end of the year. The bank, primarily serving high-net-worth individual customers, emphasizes that members obtain liquidity by using Bitcoin as collateral while maintaining their long-term positions. The report states that long-term Bitcoin holders continue to keep the majority of their wealth in Bitcoin.

Xapo Bank launched Bitcoin-collateralized USD loans on March 18, 2025, targeting long-term Bitcoin holders seeking liquidity without selling their assets. The product offers a conservative approach with low loan-to-value ratios and terms up to 365 days. 85% of loan volumes come from Europe (56%) and Latin America (29%). Xapo Bank CEO Seamus Rocca states that this trend reflects disciplined private banking-style financial behavior.

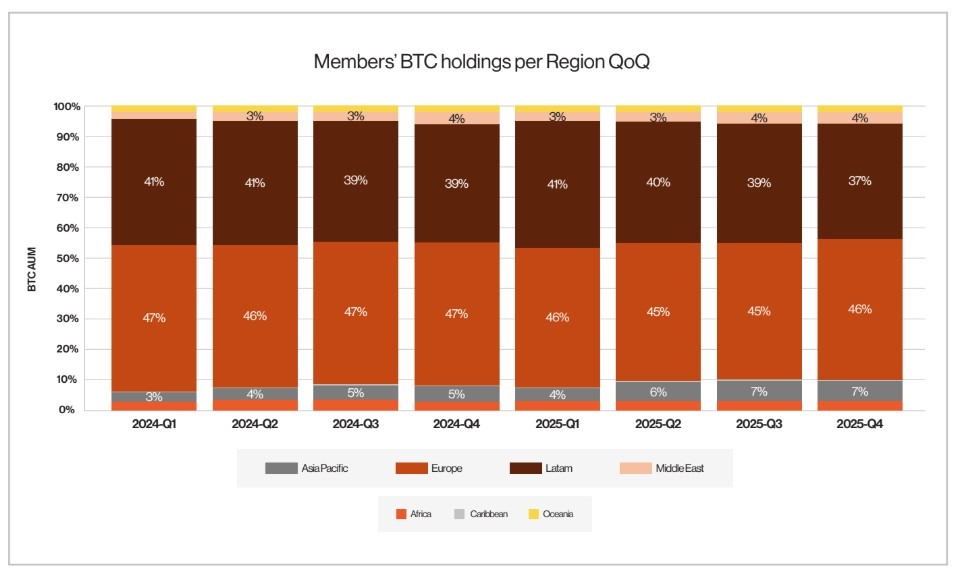

Members’ BTC holdings, per region, quarter-on-quarter. Source: Xapo Bank

BTC Price Declines and Long-Term Holding

In recent developments, Bitcoin fell below MicroStrategy's cost basis (76.037 $) for the first time since October 2023 and dropped below 80,000 dollars in April 2025. Current price at 78.211 $ level (+0.28% 24h), RSI 28.30 in oversold territory. Despite these declines, according to the Xapo report, BTC holders are preferring collateralized loans while maintaining their BTC detailed analysis positions.

BTC Technical Outlook and Supports

- Trend: Downtrend (Supertrend Bearish, EMA20: 85.607$)

- Supports: S1 74.604$ (Strong, -4.41%), S2 77.399$ (Strong, -0.83%)

- Resistances: R1 79.364$ (Strong, +1.69%), R2 82.602$ (+5.83%)

Collateralized loans remain attractive for long-term BTC futures holders. BTC spot analysis oversold signals indicate rebound potential.