XRP Dips Below $2 Amid Bitwise ETF Launch and Bitcoin-Led Sell-Off

XRP/USDT

$2,480,132,667.31

$1.3653 / $1.27

Change: $0.0953 (7.50%)

-0.0099%

Shorts pay

Contents

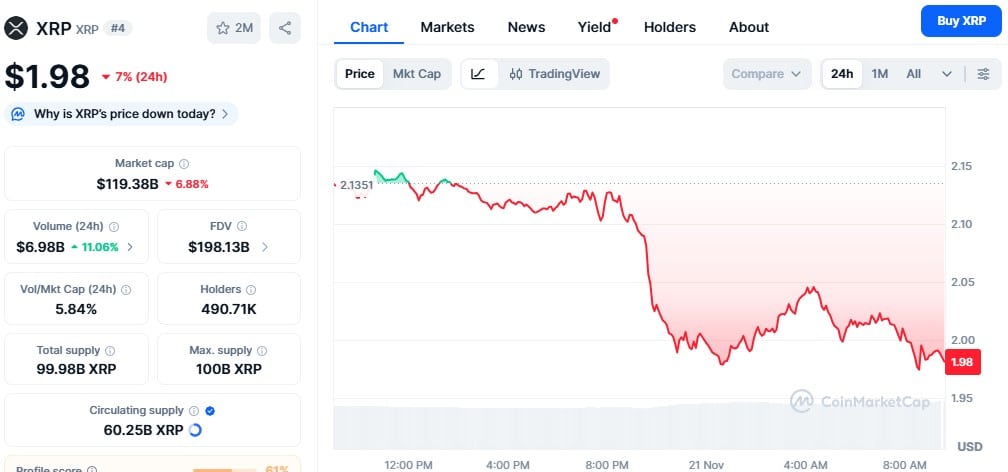

XRP’s price dropped 7% to $1.98 in the last 24 hours amid a broader crypto market sell-off triggered by Bitcoin falling below $87,000, leading to $220 million in long liquidations. Despite this, Bitwise’s new spot XRP ETF launched on the NYSE with $22 million in first-day trading volume.

- XRP fell below $2.00 on the day of Bitwise’s XRP ETF launch, mirroring October’s market correction amid heavy selling pressure.

- The ETF achieved strong initial interest with $22 million in volume, outpacing expectations despite the downturn.

- Whales offloaded 200 million XRP in 48 hours, while on-chain data from Glassnode shows profitability at 58.5%, the lowest since late 2024.

XRP price drops 7% to $1.98 as Bitcoin sell-off hits crypto. Bitwise XRP ETF launches with $22M volume amid volatility. Explore impacts on Ripple ecosystem and future outlook. Stay informed on key developments.

What Caused the Recent XRP Price Drop Despite the ETF Launch?

XRP price experienced a sharp 7% decline to $1.98 within 24 hours, driven by a widespread cryptocurrency market correction after Bitcoin dipped below $86,000, sparking over $220 million in long liquidations. This event overshadowed the positive momentum from Bitwise Asset Management’s spot XRP exchange-traded fund debut on the New York Stock Exchange. Whale selling and reduced profitability further intensified the pressure, pulling XRP back under the crucial $2.00 level last seen in October’s downturn.

How Did the Bitwise XRP ETF Perform on Its Launch Day?

The Bitwise XRP ETF marked a significant entry into the market, generating $22 million in trading volume by late afternoon on November 20, as reported by ETF analyst James Seyffart. This performance came despite the ongoing price slump, with the fund opening on $2.3 million in seed capital from market makers and authorized participants. Featuring a 0.34% management fee—waived for the first month on initial assets up to $500 million—the ETF provides regulated exposure to spot XRP held in a custodial trust. Seyffart described the debut as impressive, especially following Canary Capital’s XRPC ETF a week earlier, which set a high bar for yearly launches.

XRP Price Chart – Source: CoinMarketCap

XRP Price Chart – Source: CoinMarketCapThe launch followed regulatory approvals from the SEC and NYSE certification, enabling live trading and signaling growing institutional interest in XRP’s utility for fast, low-cost payments and asset tokenization. Ripple CEO Brad Garlinghouse highlighted the event as a major step forward for the ecosystem, which has seen over 80% value growth in the past year.

Frequently Asked Questions

What Impact Did Whale Activity Have on XRP During the ETF Launch?

Whale wallets sold approximately 200 million XRP over 48 hours post-launch, contributing to heightened volatility and the 18% weekly decline. On-chain data from Glassnode indicates this selling aligned with a drop in profitable supply to 58.5%—the lowest since November 2024—despite XRP trading four times higher than then. This suggests late-stage buyers are realizing gains amid weakness, pressuring prices further.

Will the Bitwise XRP ETF Lead to Long-Term Price Recovery for XRP?

The Bitwise XRP ETF represents a milestone for mainstream adoption, offering U.S. investors regulated access to XRP without direct custody. While initial inflows show promise, experts like those at Glassnode note that meaningful institutional uptake may take until 2026, similar to Bitcoin and Ethereum ETFs that started slow before attracting billions. For now, macro factors like Bitcoin’s movements continue to dominate short-term trends.

With a bit over ~3 hours left in trading @Bitwise‘s $XRP is almost at $22 million in trading today. Quite impressive for the second product to market a full week after @CanaryFunds‘ $XRPC which is the #1 launch by volume this year. https://t.co/muMjHEQ6gt pic.twitter.com/lGxRMn51Rw

— James Seyffart (@JSeyff) November 20, 2025

Key Takeaways

- Broad Market Correction Dominates: Bitcoin’s fall below $86,000 triggered $220 million in liquidations, dragging XRP down 7% daily and 18% weekly regardless of positive ETF news.

- Strong ETF Debut Amid Volatility: Bitwise’s fund hit $22 million in volume on launch day, underscoring investor interest in XRP exposure despite immediate price weakness.

- Whale Selling Signals Caution: With 200 million XRP offloaded and profitability at multi-month lows, monitor on-chain trends for signs of stabilization before expecting rebounds.

The share of XRP supply in profit has fallen to 58.5%, the lowest since Nov 2024, when price was $0.53.

Today, despite trading ~4× higher ($2.15), 41.5% of supply (~26.5B XRP) sits in loss — a clear sign of a top-heavy and structurally fragile market dominated by late buyers.

📉… https://t.co/CBXPzDalxV pic.twitter.com/UpLNKV7LqD— glassnode (@glassnode) November 17, 2025

The XRP market’s volatility on the Bitwise XRP ETF launch day underscores the separation between structural advancements and short-term trading dynamics. As whale activity and broader crypto sentiment evolve, the ETF could pave the way for sustained growth in the Ripple ecosystem. Investors should watch for institutional inflows in the coming months to gauge XRP price recovery potential heading into 2026.

Conclusion

In summary, the XRP price drop to $1.98 amid the Bitwise XRP ETF launch highlights ongoing market fragility, fueled by Bitcoin’s correction, $220 million in liquidations, and whale sales of 200 million tokens. Yet, the ETF’s robust $22 million debut and on-chain insights from sources like Glassnode and CoinMarketCap point to underlying strength in XRP’s profitability and ecosystem growth. As regulatory milestones continue, this could signal a pivotal shift toward broader adoption—keep an eye on 2026 for potential institutional momentum to drive lasting value.