XRP ETF Inflows Reach $1.12B as Price Dips, Signaling Possible Institutional Buildup

XRP/USDT

$2,480,132,667.31

$1.3653 / $1.27

Change: $0.0953 (7.50%)

-0.0099%

Shorts pay

Contents

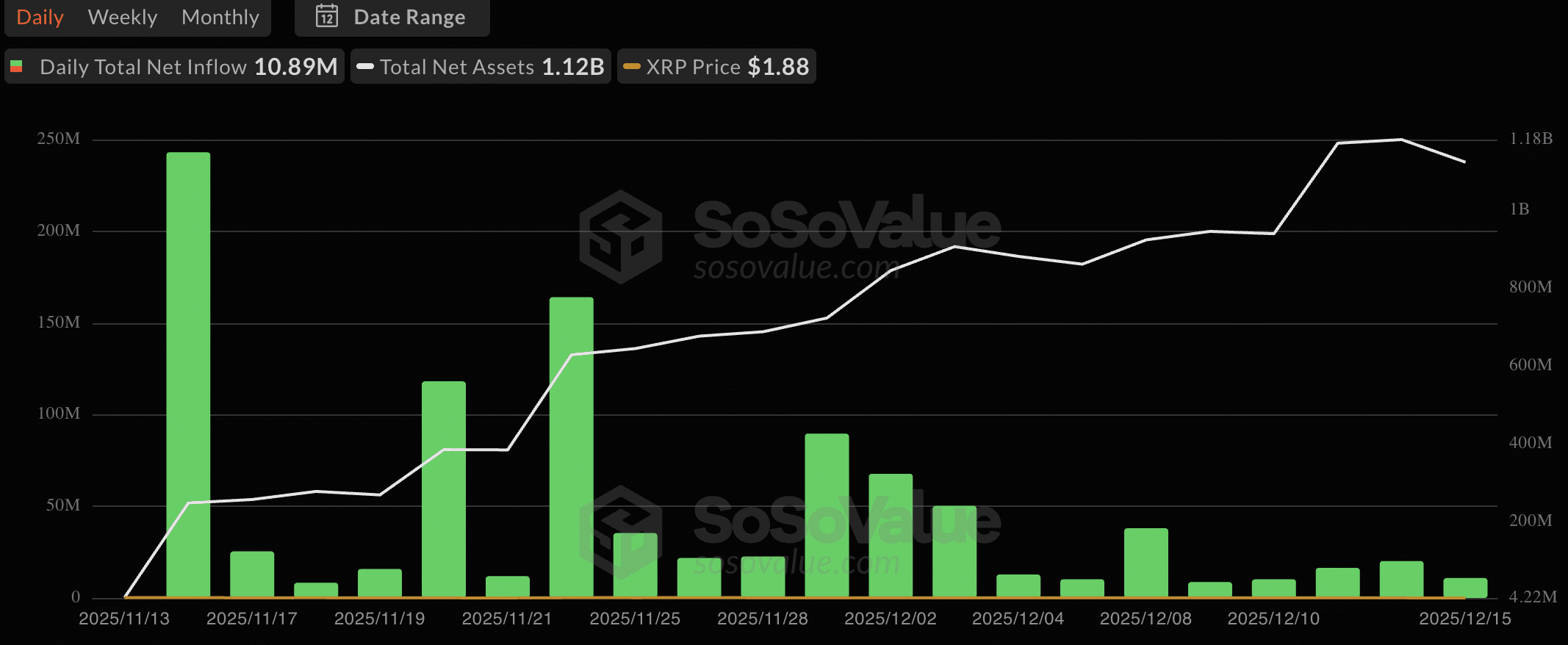

XRP ETF inflows reached $10.89 million on the latest trading day, extending a positive streak since launch and boosting total assets to $1.12 billion, even as XRP’s price dips below $1.92. This institutional buying signals potential accumulation amid market weakness, possibly foreshadowing a price reversal if trends persist.

-

XRP ETF records $10.89 million in daily inflows, marking continued institutional interest.

-

Assets under management climb to $1.12 billion, with no major outflows since product debut.

-

XRP price trends downward by over 40% from yearly highs, yet momentum indicators show bearish exhaustion.

Discover how XRP ETF inflows signal institutional confidence amid price declines. Explore key levels, trends, and what this means for XRP’s future in 2025. Stay informed on crypto market dynamics today.

What Are the Latest XRP ETF Inflows and Their Impact?

XRP ETF inflows have shown remarkable resilience, with the latest data from SoSoValue indicating $10.89 million in net positive flows on the most recent trading session. This extends a consistent streak of inflows that began shortly after the ETF’s launch in mid-November, pushing total assets under management to $1.12 billion. Despite XRP’s spot price continuing to slide, this institutional demand highlights a divergence that could stabilize the asset and set the stage for future gains.

How Do ETF Inflows Compare to XRP’s Current Price Performance?

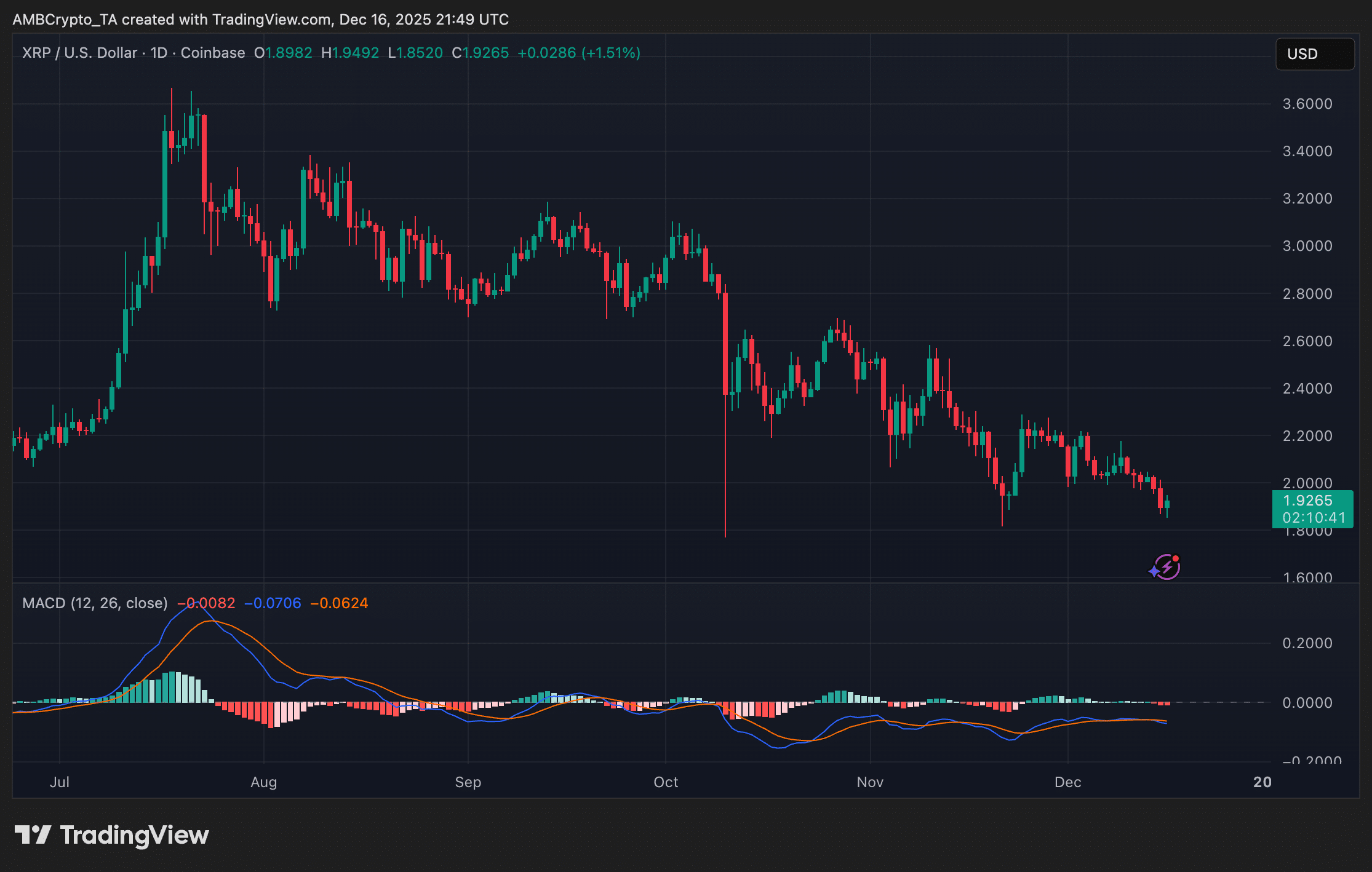

XRP’s price has faced downward pressure, trading near $1.92 after declining more than 40% from its 2025 yearly peak. A persistent downtrend since early November has formed lower lows and highs on daily charts, as observed in TradingView data. However, technical indicators like the MACD show flattening histograms and approaching bullish crossovers, suggesting weakening seller momentum.

According to SoSoValue reports, the ETF has avoided significant outflows, attracting buyers even during market volatility. This pattern mirrors early Bitcoin ETF behavior, where steady inflows provided a floor during corrections. Experts from financial analysis firms note that such divergences often precede price recoveries, as institutions accumulate at discounted levels.

Institutional participation in XRP ETFs, managed by major providers, represents a shift toward regulated exposure for traditional investors. Data from the past month reveals daily inflows averaging over $8 million, with no red days since inception. This contrasts sharply with retail-driven spot market selling, where sentiment remains cautious due to broader crypto market uncertainties.

Source: SoSoValue

The ETF’s role in absorbing supply could eventually influence spot prices upward, especially if inflows surpass $15 million daily. Regulatory approvals have enabled this growth, with oversight from bodies like the SEC ensuring transparency. As one market analyst from a leading crypto research firm stated, “XRP ETFs are bridging the gap between traditional finance and blockchain innovation, fostering long-term adoption.”

Frequently Asked Questions

What Factors Are Driving XRP ETF Inflows in 2025?

XRP ETF inflows in 2025 are primarily driven by institutional interest in Ripple’s cross-border payment technology and regulatory clarity post-SEC resolutions. SoSoValue data shows consistent buying since launch, totaling over $1.12 billion in assets, as investors seek diversified crypto exposure without direct custody risks. This trend persists despite market volatility, reflecting confidence in XRP’s utility.

Will Continued XRP ETF Inflows Reverse the Current Price Downtrend?

Continued XRP ETF inflows could contribute to reversing the downtrend by providing buying support and reducing available supply on spot markets. Momentum indicators like MACD are showing signs of exhaustion in bearish pressure, and historical patterns suggest prices often align with ETF activity after divergences. However, broader market factors and key support levels around $1.85 will determine the timing of any rebound.

Key Takeaways

- XRP ETF Inflows Build Momentum: Daily additions of $10.89 million have elevated assets to $1.12 billion, indicating strong institutional accumulation.

- Price Divergence Signals Opportunity: Despite a 40% yearly drop, technicals point to weakening downtrends, similar to early Bitcoin ETF phases.

- Monitor Critical Levels: Watch $1.85 support and $2.05 resistance for confirmation of reversal, alongside sustained inflows above $15 million daily.

Conclusion

The ongoing XRP ETF inflows amid price weakness underscore a compelling narrative of institutional confidence in XRP’s fundamentals, including its role in efficient global transactions. As assets reach $1.12 billion per SoSoValue, this divergence from spot trends may herald stabilization and potential upside. Investors should track momentum shifts and regulatory developments closely, positioning for what could be a pivotal recovery in the crypto landscape ahead.

Institutional Demand Rises as XRP ETF AUM Climbs

The SoSoValue chart illustrates a robust pattern of growth for the XRP ETF. Consistent inflows appear as green bars since mid-November, with assets steadily surpassing $1.1 billion. Remarkably, there have been no significant outflow days since the product’s introduction, even amidst broader market fluctuations.

This steady appetite from institutional investors suggests they perceive current valuations as attractive for long-term positioning. Financial experts emphasize that such behavior often stabilizes volatile assets, much like observed in other cryptocurrency ETFs. The ETF’s structure allows for compliant exposure, drawing in pension funds and hedge managers who prioritize regulated vehicles.

XRP Price Still Sliding, But Momentum Shows Signs of Exhaustion

XRP’s price action remains challenging, with the asset hovering around $1.92 after a steep 40% retreat from its 2025 peak. TradingView analysis reveals a downtrend intact from early November, characterized by successive lower lows and highs on the daily chart.

That said, the MACD histogram is flattening, and the lines approach a bullish crossover, a classic reversal signal. This indicates diminishing selling intensity, potentially paving the way for consolidation or upside if ETF buying intensifies.

Source: TradingView

Sellers appear active but fatigued, with volume metrics showing reduced participation in recent dips. If this holds, external catalysts like positive Ripple network updates could accelerate a shift.

ETF Inflows vs. Retail Selling: A Familiar Pattern?

Market history reveals that robust ETF inflows during price slumps frequently signal deeper dynamics at play. Institutions often buy at discounts, while retail participants offload amid fear. This has led to bottom formations in assets like Bitcoin and Ethereum during their ETF eras.

For XRP, the setup aligns: funds are steadily accumulating without retreat, retail sentiment lags, and indicators stabilize. Sustained inflows could exert upward pressure on prices, bridging the gap between ETF and spot markets. Analysts from Bloomberg and similar outlets have highlighted this as a bullish undercurrent in diversified portfolios.

Key Levels to Watch

- Support at $1.85: Breach here could test $1.70, intensifying downside risks.

- Resistance at $2.05: Clearing this would validate trend strength and attract more buyers.

- ETF Milestone: Daily inflows exceeding $15 million may catalyze broader market moves.

Final Thoughts

The persistence of XRP ETF inflows creates a divergence worth watching closely, as it points to underlying strength. With momentum easing on the price front, reclaiming pivotal levels could confirm a turnaround. As the crypto sector evolves, these developments position XRP as a key player in institutional adoption narratives.

Comments

Other Articles

XRP’s Bullish Positioning May Weather $1B Escrow Release

January 1, 2026 at 06:02 PM UTC

XRP ETF Inflows and RWA Growth Signal Potential Amid Stagnant Price

January 1, 2026 at 10:47 AM UTC

XRP ETF Inflows Hit $1.16B as Standard Chartered Eyes $8 Potential Amid Whale Selling

January 1, 2026 at 04:48 AM UTC