XRP ETFs Struggle to Boost Price Despite Approvals, Amid On-Chain Selling Pressure

XRP/USDT

$2,480,132,667.31

$1.3653 / $1.27

Change: $0.0953 (7.50%)

-0.0099%

Shorts pay

Contents

XRP ETFs from Franklin Templeton and Grayscale have launched on the NYSE, yet XRP price remains below $2 amid on-chain selling pressure and low holder conviction. This underperformance highlights fading market interest despite positive regulatory developments for Ripple’s native token.

-

XRP supply in profit at 57%, lowest since November 2024, indicating holders are realizing losses rather than accumulating.

-

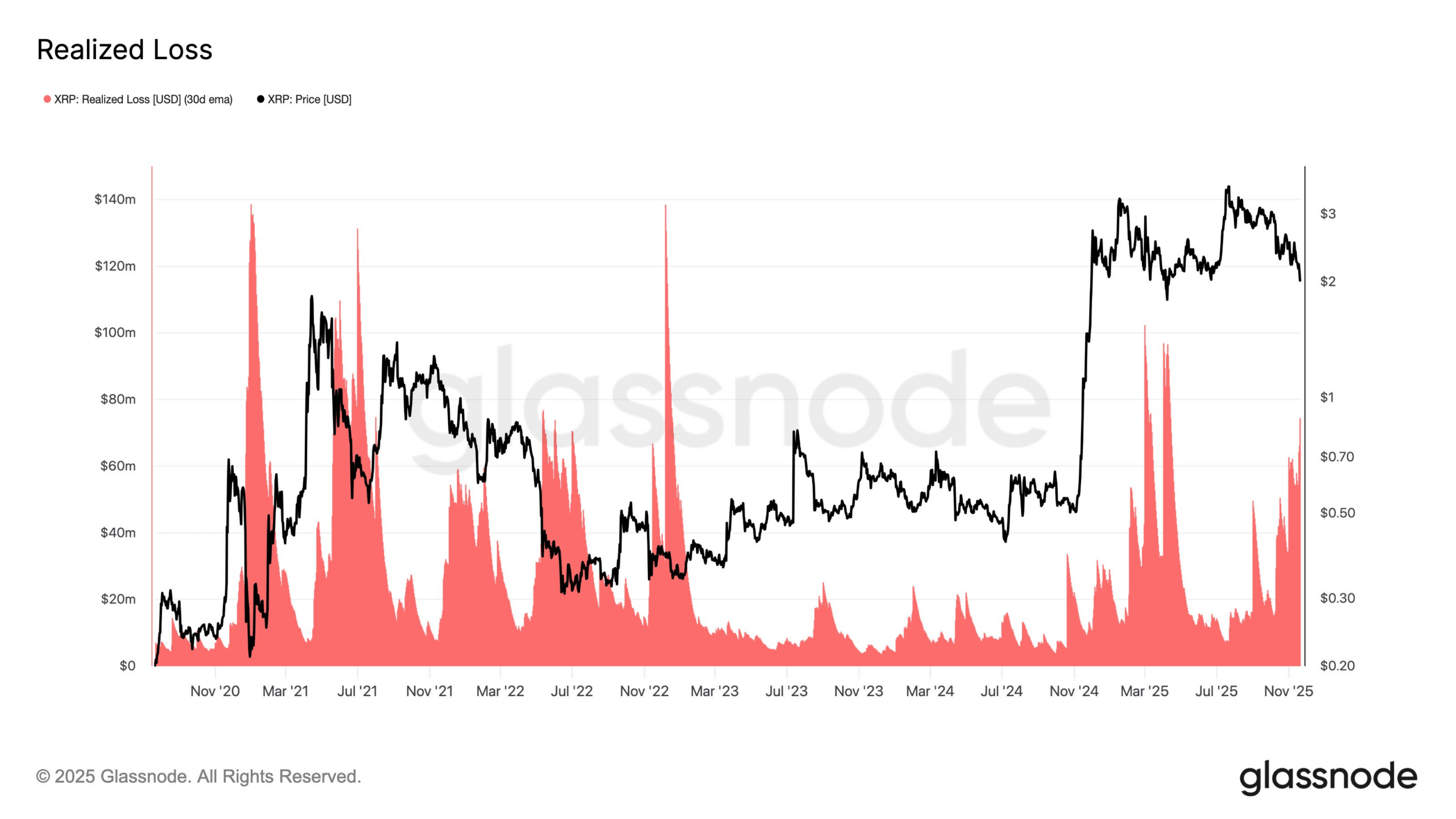

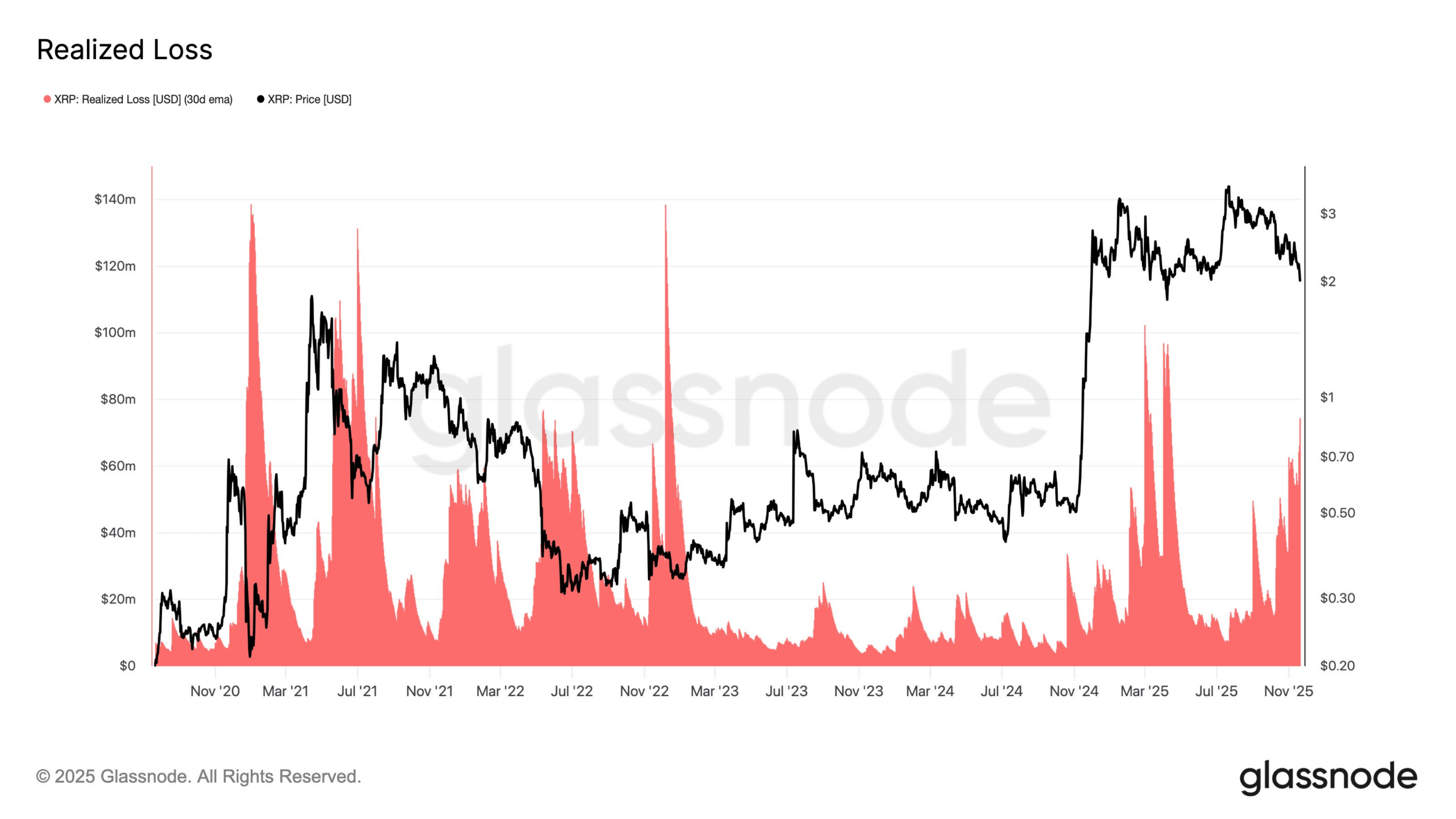

On-chain data reveals surging realized losses at $75 million per day, the highest since April 2025, signaling weak investor confidence.

-

Technically, XRP lags behind Ethereum, failing to reclaim July highs at $3.60, even as broader market corrects.

Discover why XRP ETFs aren’t lifting Ripple’s price despite NYSE approvals. Explore on-chain insights and market dynamics for informed crypto investment decisions. Stay ahead in the volatile XRP market today.

What is causing XRP ETFs to fail in boosting Ripple’s price?

XRP ETFs, including those from Franklin Templeton and Grayscale recently approved on the NYSE, are not driving up Ripple’s token price due to persistent on-chain weakness and diminishing investor conviction. Holders are selling into the news rather than buying, as evidenced by declining profit metrics and rising realized losses. This lack of accumulation, combined with technical underperformance, overshadows the potential institutional inflows from these ETF launches.

Why is on-chain activity showing weakness for XRP holders?

Detailed on-chain analysis reveals that the share of XRP supply held at a profit has fallen to 57%, the lowest level since November 2024 when XRP traded around $0.53. According to Glassnode data, this metric underscores a lack of conviction among long-term holders, who appear to be capitulating amid broader market pressures. Short sentences highlight the trend: daily realized losses have spiked to $75 million, a peak not seen since April 2025. This surge indicates more investors are locking in losses rather than holding for potential upside from ETF approvals. Expert analysts note that such behavior often precedes prolonged consolidation, as seen in historical cycles for major cryptocurrencies. Furthermore, transaction volumes remain subdued, with active addresses failing to rebound despite the regulatory wins for Ripple. In comparison to Ethereum, which has shown resilience by reclaiming prior highs before recent corrections, XRP’s metrics paint a picture of relative underperformance. Statistics from on-chain platforms confirm that whale accumulation has stalled, with large holders distributing supply to retail levels. This dynamic suggests that while ETF launches introduce institutional interest, retail sentiment is dragging the price action lower. Supporting this, network growth indicators like new wallet creations have plateaued, reinforcing the narrative of waning enthusiasm. Overall, these factors contribute to XRP’s current valuation disconnect, where positive news fails to translate into sustained buying pressure.

Zooming out, XRP’s undervaluation thesis starts to gain weight.

Even after back-to-back acquisitions and ETF launches, Ripple [XRP] is still down 35% this quarter. Looking at spot valuations, buying the “dip” could be a no-brainer for outsized future returns.

That said, on-chain data tells a different story. The share of XRP supply in profit has dropped to 57%, the lowest level since November 2024, when XRP was $0.53. In short, HODLers aren’t exactly buying the narrative.

Source: Glassnode

In fact, investor patience seems to be running thin.

Glassnode data shows that with XRP hovering around $2.00, the 30D EMA of daily realized losses has surged to $75 million/day, marking the highest level since April 2025.

This suggests more holders are locking in losses.

And yet, against this bearish setup, both Franklin Templeton and Grayscale XRP ETFs just got the green light on the NYSE. Does this mean that Ripple is hitting Wall Street at the worst possible time?

XRP’s Wall Street moment: Too soon or too weak?

One thing is clear: Investors aren’t treating the Ripple as undervalued.

Why does this matter? Because it shows that Ripple’s ETF launches aren’t failing due to broader market weakness. Instead, they’re failing due to fading conviction. Simply put, the “hype” isn’t translating into bids.

So the issue isn’t “bad timing.” The XRP ETFs didn’t land at the wrong moment. The market just isn’t buying the narrative.

And it shows: Ripple’s on-chain weakness is now bleeding into the charts, with price below $2.

Source: TradingView (XRP/USDT)

Yes, the broader market is bleeding, and plenty of alts are losing support.

But Ripple’s chart looks worse by comparison. Unlike Ethereum [ETH], which managed to reclaim its previous highs before the October drop, XRP hasn’t come close to a similar recovery since its July peak at $3.60.

In essence, XRP is lagging both on-chain and technically, and the ETF headlines aren’t doing much to change the trend. So even if the macro setup were bullish, these ETFs still wouldn’t move the needle for Ripple.

The introduction of XRP ETFs represents a significant milestone for Ripple, potentially opening doors to trillions in institutional capital through traditional finance channels. However, current market dynamics suggest that regulatory clarity alone is insufficient without complementary catalysts like renewed adoption in cross-border payments or partnerships. Ripple’s ongoing efforts in these areas, including recent acquisitions, aim to bolster the ecosystem, but investor response has been muted. Data from on-chain analytics firms like Glassnode and Santiment indicate that exchange inflows have increased post-ETF announcements, pointing to potential selling pressure rather than accumulation. This pattern mirrors historical ETF launches for other assets, where initial hype often gives way to profit-taking if underlying fundamentals do not align. For XRP, the resolution of the long-standing SEC lawsuit has provided a foundation, yet price discovery remains elusive below the $2 mark. Technical indicators, such as the Relative Strength Index (RSI) hovering in oversold territory, suggest a possible rebound, but volume confirmation is lacking. Broader cryptocurrency market sentiment, influenced by macroeconomic factors like interest rate expectations, further complicates the outlook. Despite these challenges, the ETF approvals validate XRP’s legitimacy, potentially attracting long-term holders who view current levels as undervalued based on network utility metrics. As Ripple continues to expand its enterprise solutions, patient investors may find opportunities in this dip, though short-term volatility persists.

Frequently Asked Questions

What impact do Franklin Templeton and Grayscale XRP ETFs have on Ripple’s market performance?

The Franklin Templeton and Grayscale XRP ETFs, approved for NYSE trading, introduce institutional access but have not yet spurred significant price gains for XRP. On-chain metrics show increased selling rather than buying, with realized losses at record highs, limiting immediate upside despite potential long-term inflows estimated in billions.

Are XRP ETF launches timed poorly amid current crypto market conditions?

No, the timing of XRP ETF launches aligns with regulatory progress, but market conviction is low due to on-chain distribution and technical weakness. While the broader crypto sector faces corrections, XRP’s underperformance stems from internal factors like holder capitulation, making it lag peers like Ethereum in recovery efforts.

Key Takeaways

- XRP lacks catalysts beyond ETFs: On-chain weakness shows holders selling into news, not accumulating for growth.

- Ripple underperforms technically: Compared to Ethereum’s highs reclamation, XRP remains distant from its July $3.60 peak.

- Undervaluation potential exists: Down 35% quarterly, spot buying could yield returns if conviction rebuilds.

Conclusion

In summary, while XRP ETFs from major players like Franklin Templeton and Grayscale mark a pivotal step for Ripple’s integration into traditional finance, on-chain weakness and fading investor conviction continue to suppress price action below $2. Technical lags and rising realized losses highlight the need for stronger fundamentals to realize upside. As Ripple advances its secondary focuses like enterprise adoption, forward-looking investors should monitor on-chain improvements for signs of reversal, positioning strategically in this evolving crypto landscape.