XRP Eyes Potential Short-Term Bounce to $2.2 Amid Bearish Momentum

XRP/USDT

$2,480,132,667.31

$1.3653 / $1.27

Change: $0.0953 (7.50%)

-0.0099%

Shorts pay

Contents

XRP’s price has declined toward the $2 level amid a bearish outlook in 2025, with exchange reserves dropping and onchain accumulation rising. The total crypto market cap fell by $141 billion in two days, pushing the Fear and Greed Index to 20, indicating extreme fear that hampers altcoin recovery.

-

XRP exchange reserves continue to decrease, pointing to growing onchain accumulation by holders.

-

The asset struggles to break $2.28 resistance, reinforcing seller dominance in the market.

-

Market-wide fear, with the Fear and Greed Index at 20, is likely to delay XRP’s short-term recovery efforts.

XRP price analysis reveals a bearish trend in 2025, with declining reserves and market fear. Discover key support levels and trading insights to navigate volatility. Stay informed on XRP developments today.

What is driving the XRP price decline in 2025?

XRP price decline in 2025 stems from reduced exchange reserves and persistent bearish sentiment across the crypto market. As reserves drop, onchain accumulation increases, yet the asset faces strong selling pressure, failing to surpass the $2.28 resistance level. This downturn aligns with a broader market correction, where the total capitalization shed $141 billion over two days, according to data from CoinMarketCap.

How does the current market fear impact XRP’s recovery?

The Fear and Greed Index, tracked by CoinMarketCap, currently stands at 20, bordering on extreme fear levels, which typically suppresses altcoin rallies like XRP’s. This sentiment, exacerbated by recent liquidations and a multi-month downtrend, delays buying interest. Expert analysis from TradingView indicators shows moving averages acting as barriers, with the 20 and 50-period lines capping upward moves. Historical data indicates that such fear phases often precede prolonged consolidations, as seen in past cycles where XRP took weeks to stabilize post-dips below $2.

XRP has experienced a steady drop in exchange-held supplies, with reports from onchain analytics platforms highlighting this trend as a sign of long-term holder confidence. Despite this accumulation, the price action remains subdued, reverting toward the $2 support after brief pushes above $2.2. The broader cryptocurrency ecosystem’s contraction, marked by a $141 billion loss in market capitalization within 48 hours, has amplified these pressures. CoinMarketCap’s Fear and Greed Index at 20 underscores the pervasive caution among investors, which could extend challenges for XRP and other altcoins in the near term.

Price pattern analysis

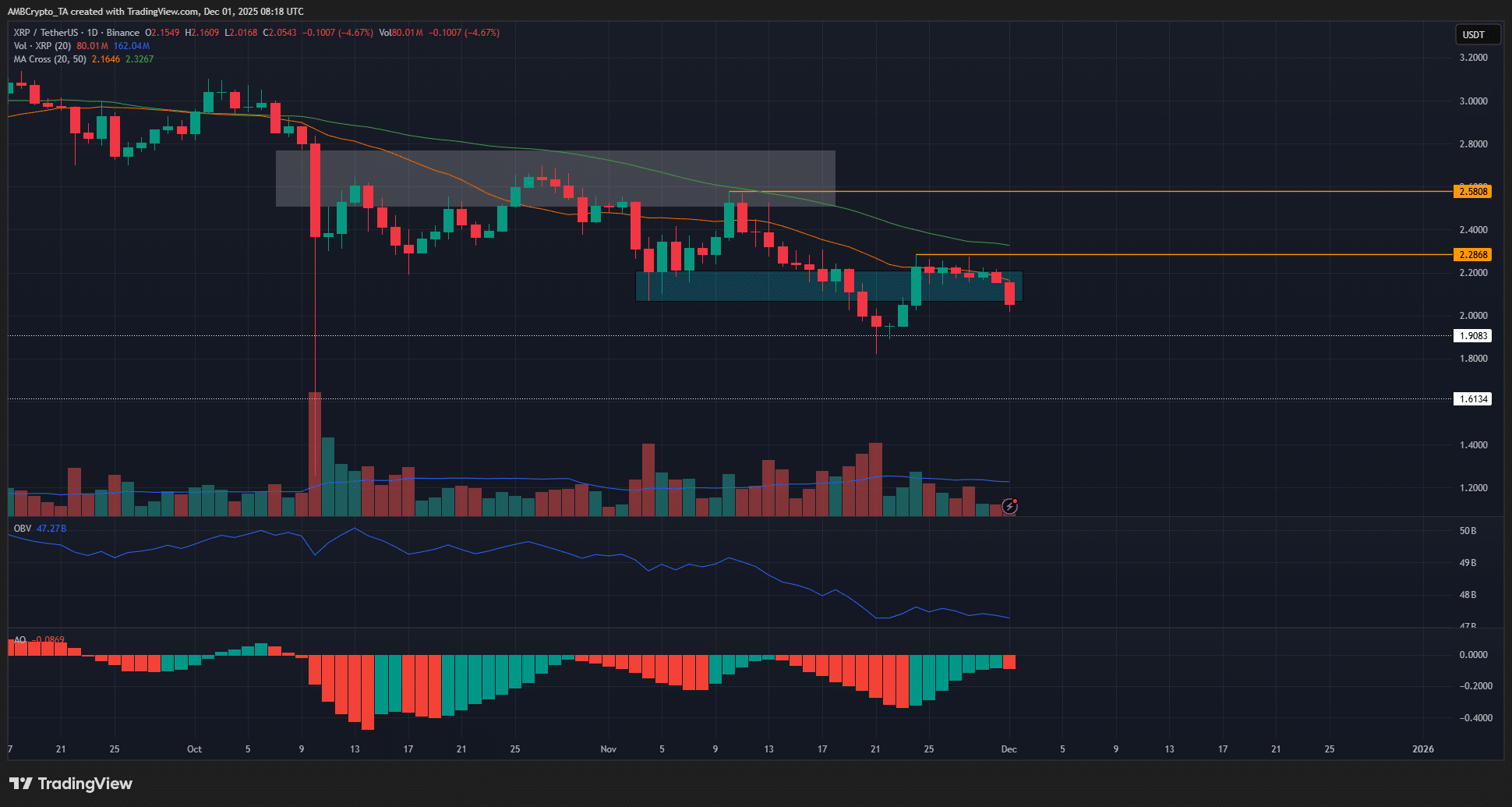

Source: XRP/USDT on TradingView

Recent price movements show XRP testing the $2.2 threshold before retreating, a pattern that underscores the robustness of overhead resistance. When the asset briefly exceeded $2.2, technical setups suggested potential for a temporary rebound to $2.58, but sellers quickly regained control, preventing sustained gains. This rejection highlights the ongoing multi-month downtrend, where new lower lows on the daily chart signal continued bearish control. Key long-term supports at $1.9 and $1.61, derived from historical price action, now come into focus as potential floors if the decline persists. The daily chart illustrates a clear imbalance, with volume profiles indicating reduced buying conviction at higher levels.

Source: XRP/USDT on TradingView

On the shorter 1-hour timeframe, a notable supply zone exists between $2.09 and $2.18, functioning similarly to a fair value gap and attracting sell orders. This overhead imbalance suggests that any upward correction toward $2.2 could present short-selling opportunities for traders. Breaking above $2.21 would require significant volume and a shift in sentiment to turn the bias bullish, though current market conditions make this challenging. The chart’s structure reflects seller dominance, with lower highs forming since the recent peak.

Indicator-based review

Technical indicators across daily and 1-hour charts confirm the bearish momentum for XRP. The 20-period and 50-period moving averages have repeatedly rejected price advances, serving as dynamic resistance points. Selling pressure remains elevated, as evidenced by declining relative strength index readings and negative MACD histograms. A potential short-term rebound to $2.15 is plausible but likely to encounter further downside, potentially testing sub-$2 levels amid ongoing volatility.

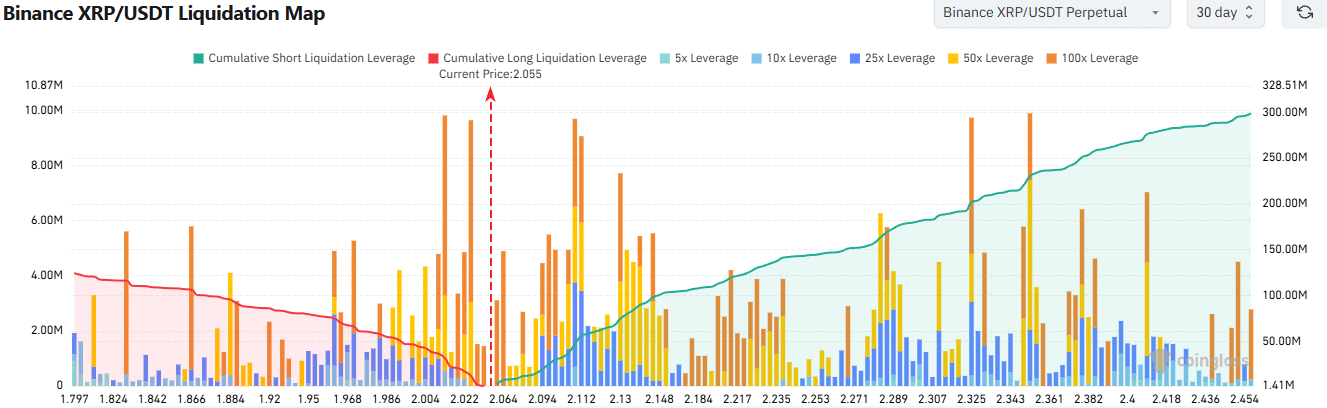

Source: CoinGlass

The liquidation map from CoinGlass further supports this view, revealing a concentration of high-leverage short positions between $2.06 and $2.15. This liquidity pool acts as a magnet for price action, where a brief uptick could trigger stops before resuming the downtrend. Such patterns are common in fearful markets, where cascading liquidations amplify movements. Data from these tools, combined with onchain metrics, provide a comprehensive picture of XRP’s current vulnerability.

Exchange reserve data, as reported by various blockchain analytics firms, continues to trend downward, with XRP moving off centralized platforms at an accelerated rate. This shift to self-custody aligns with accumulation strategies during downturns, yet it hasn’t translated to immediate price support. The bearish bias persists, influenced by macroeconomic factors and sector-wide sentiment. Analysts monitoring these flows note that while long-term holders are positioning for recovery, short-term traders face heightened risks from volatility spikes.

Price hotspots to watch

Critical levels for XRP include the $1.9 and $1.61 supports, which have held firm in prior corrections based on extended price history. In the immediate term, the $2.09-$2.18 zone represents a formidable resistance, where accumulated supply could cap any rebound attempts. Traders should monitor volume at these points for signs of reversal or continuation.

Frequently Asked Questions

Why are XRP exchange reserves declining in 2025?

XRP exchange reserves are declining due to increased onchain transfers to personal wallets, indicating accumulation by long-term investors. This trend, observed through blockchain data, reduces available supply for trading and reflects confidence in future value, though it coincides with price pressure from market fear.

Will XRP recover from its current bearish trend soon?

XRP’s recovery from the bearish trend depends on broader market stabilization and breaking key resistances like $2.21. With the Fear and Greed Index at extreme fear levels, short-term bounces may occur, but sustained upward movement requires improved sentiment and higher demand volumes.

Key Takeaways

- Bearish Continuation: XRP’s downtrend persists with new lows, threatening a drop below $2 amid seller control.

- Trading Opportunities: Watch for rebounds to $2.2 as potential short entries, supported by supply zones on hourly charts.

- Support Monitoring: Focus on $1.9 and $1.61 as vital levels; accumulation may aid long-term holders during fear phases.

Conclusion

In summary, the XRP price decline and bearish bias in 2025 are driven by falling exchange reserves, onchain accumulation, and widespread market fear at levels like the Fear and Greed Index of 20. Key supports at $1.9 and $1.61 offer potential stabilization points, while resistances around $2.09-$2.18 loom for short-term moves. As sentiment evolves, investors should track these developments closely for informed positioning in the volatile crypto landscape.

Final Thoughts

- The multi-month downtrend for XRP continued as the altcoin made a new lower low on the daily timeframe, and threatened to fall below $2 once again.

- Lower timeframe traders can watch out for a minor price bounce toward $2.2, which would likely offer a selling opportunity.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

Comments

Other Articles

XRP’s Bullish Positioning May Weather $1B Escrow Release

January 1, 2026 at 06:02 PM UTC

XRP ETF Inflows and RWA Growth Signal Potential Amid Stagnant Price

January 1, 2026 at 10:47 AM UTC

XRP ETF Inflows Hit $1.16B as Standard Chartered Eyes $8 Potential Amid Whale Selling

January 1, 2026 at 04:48 AM UTC