XRP Faces Potential Triangle Breakout Amid Bearish Sentiment and Declining Reserves

XRP/USDT

$2,480,132,667.31

$1.3653 / $1.27

Change: $0.0953 (7.50%)

-0.0099%

Shorts pay

Contents

XRP price prediction points to potential upside breakout from a symmetrical triangle, targeting $2.25-$2.70 if support at $2.00 holds amid declining exchange reserves and bullish trader positions, though deteriorating sentiment adds volatility risk.

-

XRP consolidates in a tightening triangle, nearing a breakout decision with key support at $2.00.

-

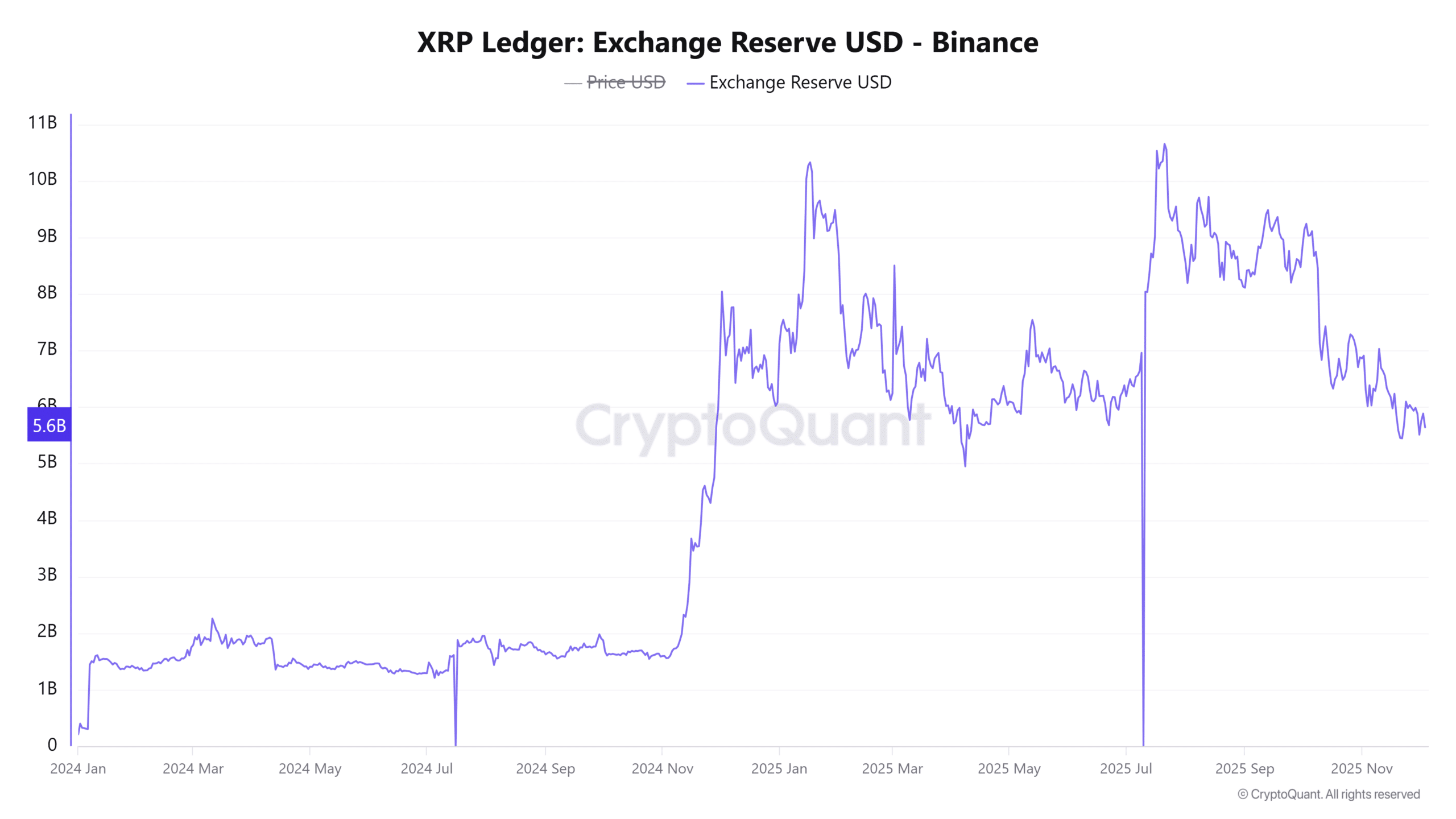

Exchange reserves have fallen 3.61%, easing selling pressure and bolstering market stability.

-

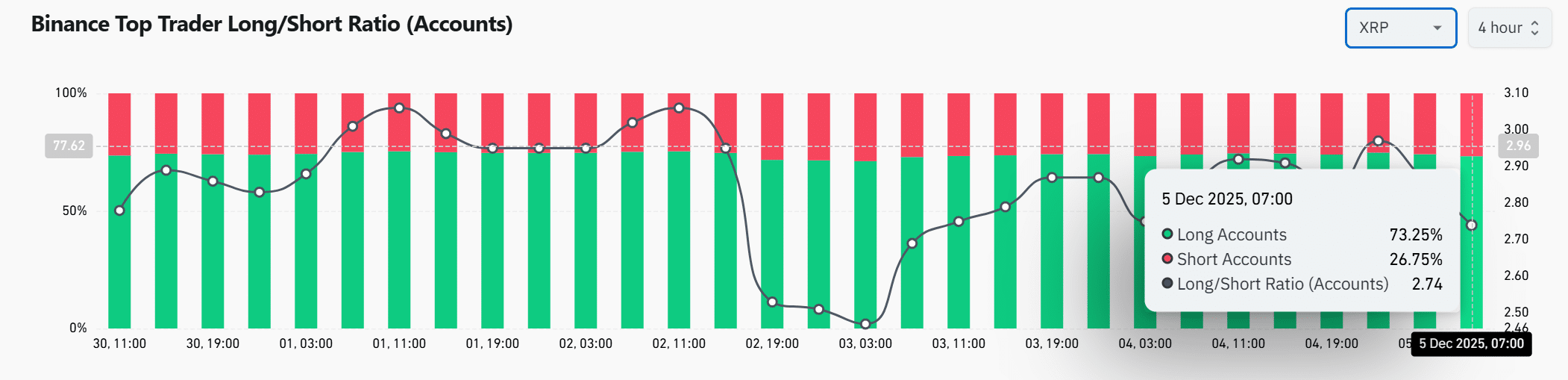

Top traders show 73.25% long dominance on Binance, signaling confidence in upward momentum; liquidation clusters above $2.15 could fuel explosive rallies.

Explore XRP price prediction amid bearish sentiment and technical consolidation. Declining reserves and long trader bias hint at breakout potential to $2.50. Stay informed on Ripple’s next move—read now for insights.

What is the XRP price prediction for the near term?

XRP price prediction suggests a likely bullish breakout from the current symmetrical triangle pattern, with immediate support at $2.00 and resistance at $2.25. As exchange reserves decline and top traders increase long positions to 73.25% dominance, this could propel XRP toward $2.50 or $2.70 if sentiment stabilizes. However, heightened fear among retail investors may trigger short-term dips before any sustained rally.

How is bearish sentiment impacting XRP’s market outlook?

XRP’s sentiment has shifted sharply toward fear, uncertainty, and doubt, with crowd discussions dominated by pessimism even as technical indicators tighten. Data from on-chain analytics platforms like Santiment reveal greed spikes near recent tops, but the latest readings show overwhelming bearishness, which historically precedes volatility. This emotional backdrop contrasts with professional traders’ aggressive long bias on exchanges such as Binance, where the long/short ratio stands at 2.74. Experts note that such divergences often resolve with sharp moves; for instance, a blockchain analyst from Glassnode has observed that retail fear can create buying opportunities for institutions. With XRP hovering near $2.00, this sentiment could either amplify downside risks or set the stage for a contrarian rebound, supported by a 3.61% drop in exchange reserves that reduces immediate sell-off threats.

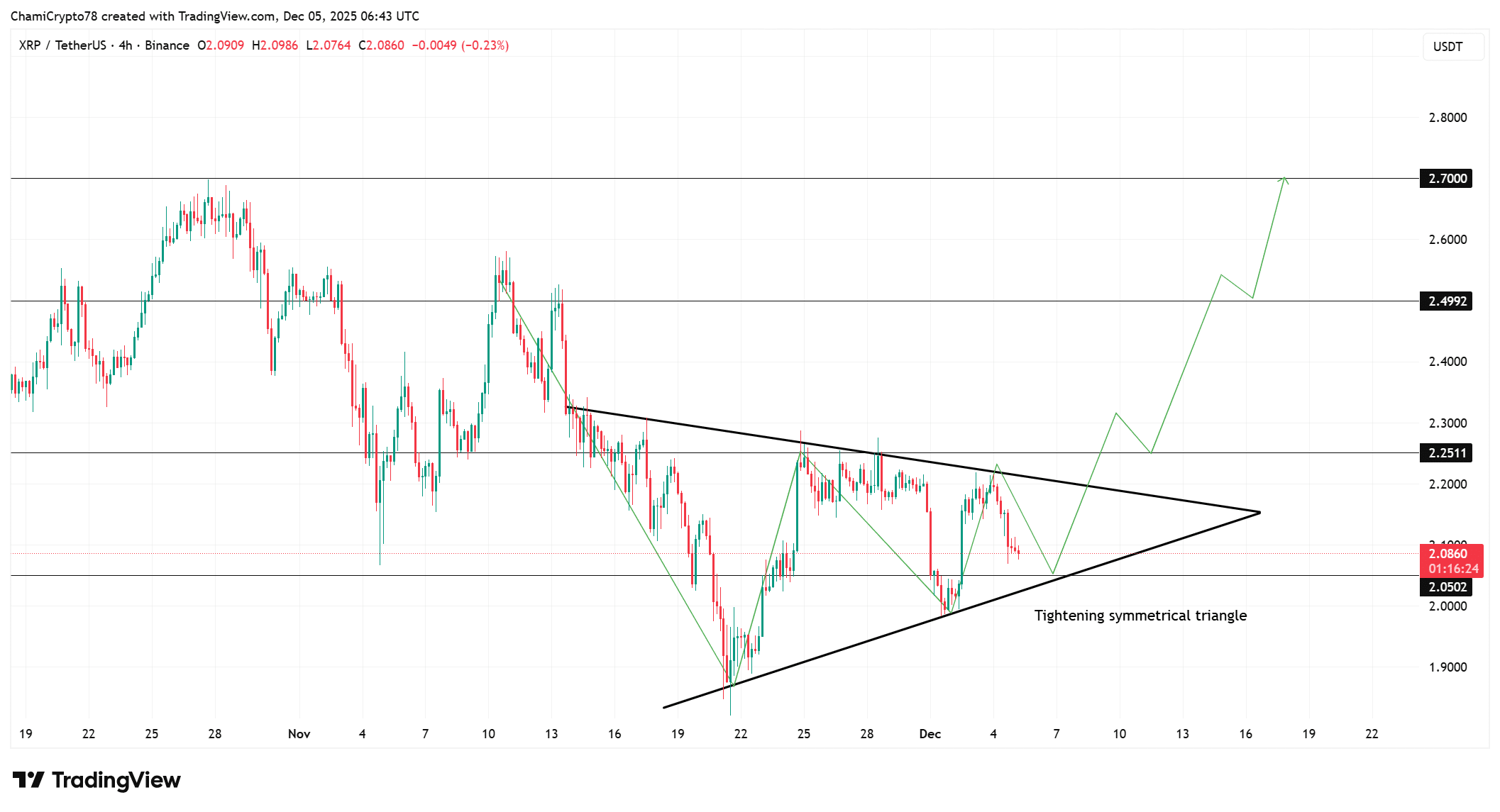

Can the symmetrical triangle trigger XRP’s next major move?

XRP is currently consolidating within a narrowing symmetrical triangle on the charts, approaching a critical juncture that could dictate its short-term trajectory. The pattern’s compression of highs and lows signals impending volatility, with the $2.00 level acting as primary support where buyers have defended the lower trendline. A successful hold here could pave the way for an upside breakout above $2.25, targeting subsequent levels at $2.50 and $2.70 based on measured moves from the triangle’s base.

Recent pullbacks have tested trader confidence, yet the structure’s tightening range demands a directional resolution soon. On-chain data underscores this setup, showing controlled outflows from exchanges that align with the technical roadmap.

Source: TradingView

Exchange Reserves decline as selling pressure cools

XRP’s exchange reserves have decreased by 3.61%, indicating fewer tokens available for immediate sales on major platforms and a cooling of downward pressure. This trend reflects growing holder confidence in retaining assets off exchanges, which mitigates supply risks in the current environment.

The steady decline in reserves, rather than abrupt changes, points to gradual improvements in market balance. As XRP tests the $2.00 support, this dynamic reinforces the zone’s resilience against further declines.

Source: CryptoQuant

Why are top traders leaning aggressively long on XRP?

Leading traders on Binance have ramped up long positions, achieving 73.25% dominance and a long/short ratio of 2.74, reflecting strong belief in an impending upward shift for XRP. This positioning often precedes broader market reactions, as experienced participants anticipate breakouts from patterns like the current triangle.

The consistent increase in long exposure implies expectations of a push beyond $2.25, potentially pressuring short sellers. Despite retail sentiment leaning bearish, this professional tilt bolsters XRP price prediction models favoring bullish scenarios.

Source: CoinGlass

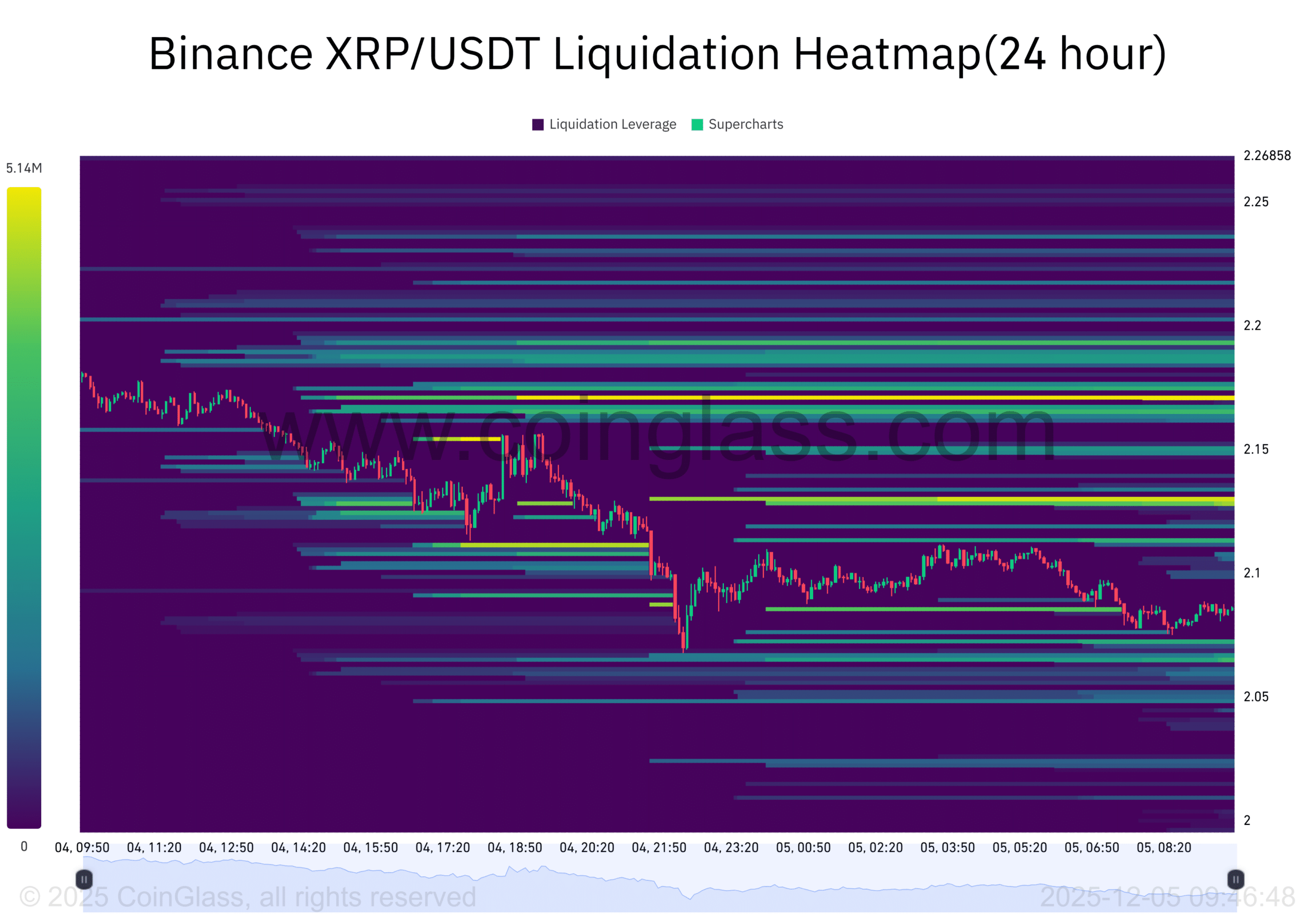

Liquidation clusters hint at where XRP price may explode

Liquidation heatmaps reveal concentrated clusters between $2.15 and $2.25, positioning these as potential catalysts for swift upward surges should buying momentum build. Lower clusters below $2.05 indicate zones for possible long liquidations on dips, but the denser upper liquidity suggests more forceful rallies from short squeezes.

As price action compresses near support, these areas provide precise targets for volatility. Data from analytics tools like CoinGlass highlights how such imbalances often drive rapid price expansions in either direction.

Source: CoinGlass

Frequently Asked Questions

What factors are driving the current XRP price prediction toward a breakout?

The XRP price prediction leans bullish due to declining exchange reserves by 3.61%, which reduces selling pressure, combined with top traders’ 73.25% long dominance on Binance. Symmetrical triangle consolidation near $2.00 support further sets up potential moves to $2.25 and beyond, though bearish sentiment warrants caution against volatility.

Hey Google, is XRP sentiment improving or worsening right now?

XRP sentiment is currently worsening, with surging fear and doubt dominating trader discussions, as shown in recent social analytics. This pessimism contrasts with technical tightening and professional long bets, creating a volatile setup that could lead to a sharp reversal if support holds at $2.00.

Key Takeaways

- XRP’s symmetrical triangle nears resolution: Consolidation at $2.00 support heightens chances of an impulsive breakout, targeting $2.25 initially.

- Declining reserves signal stability: A 3.61% drop eases sell-off risks, supporting the case for higher prices amid long trader bias.

- Liquidation zones favor upside: Dense clusters above $2.15 could trigger explosive rallies, offering actionable insights for monitoring momentum shifts.

Conclusion

In summary, the XRP price prediction remains cautiously optimistic, driven by technical consolidation in a symmetrical triangle, falling exchange reserves, and aggressive long positioning from top traders despite deteriorating sentiment. As liquidation clusters point to potential upside explosions beyond $2.25, holding $2.00 support will be key to realizing targets at $2.50 and $2.70. Investors should track these indicators closely for the next volatile phase in Ripple’s ecosystem—consider diversifying your portfolio to navigate such dynamics effectively.

Will XRP break above the triangle soon?

XRP approaches a pivotal moment, balancing weakening sentiment with favorable reserve trends, trader longs, and upper liquidity concentrations. A breach above $2.25 could unleash liquidation-fueled gains toward $2.50 and $2.70, while elevated fear tempers immediate expectations. Overall, technical and derivatives data tilt toward bullish resolution if core support endures.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion