XRP Inflows Signal Potential Support Amid Trader Caution

XRP/USDT

$2,480,132,667.31

$1.3653 / $1.27

Change: $0.0953 (7.50%)

-0.0099%

Shorts pay

Contents

XRP investment inflows reached $15 million in early November 2025, signaling growing investor interest amid market volatility. These funds primarily entered exchange-traded products, providing a boost to the asset’s liquidity and confidence, though tempered by cautious trading signals.

-

XRP saw significant inflows on November 14, 2025, marking the largest single-day spike.

-

Smaller inflows followed on November 17, contributing to an overall positive trend in investment products.

-

Derivatives markets remain neutral, with funding rates near zero and low speculative activity as of November 2025 data.

Discover the latest XRP inflows in 2025, including $15M in investment products boosting liquidity. Explore market caution and price trends for informed crypto decisions today.

What Are the Recent XRP Inflows Indicating for Investors?

XRP inflows into investment products totaled approximately $15 million in the first half of November 2025, reflecting renewed investor confidence in the cryptocurrency despite broader market uncertainties. These inflows, tracked through exchange-traded products and similar vehicles, concentrated heavily around November 14, when the largest surge occurred, followed by a modest addition on November 17. This activity suggests a stabilizing force for XRP, as institutional and retail investors seek exposure amid Ripple’s ongoing developments and regulatory clarity.

How Are Derivatives Traders Responding to XRP Inflows?

Derivatives markets for XRP show a more reserved stance compared to the spot inflows. Funding rates hovered near neutral levels throughout November 2025, indicating balanced positions between long and short traders without dominant bullish or bearish bias. According to data from major exchanges, open interest remained stable but unremarkable, with speculative volumes failing to accelerate. This caution stems from XRP’s price consolidation below key resistance levels, as traders await confirmation of sustained upward momentum. Experts from platforms like TradingView note that such muted activity often precedes either a breakout or further consolidation, emphasizing the need for volume spikes to validate inflow-driven optimism. Inflow figures from investment products, while positive, have not yet translated into aggressive leverage in futures markets, where positions average around 2-3x rather than higher-risk multiples seen in bull runs.

Most of the inflows were concentrated around the 14th of November, when the products saw their biggest spike, while the 17th brought in a smaller (but still positive) amount.

Investor appetite is building quickly, giving the asset some much-needed support.

Derivatives traders aren’t quite sure

Funding Rates are also muted, sitting close to neutral. Neither longs nor shorts show much strength. Speculative appetite remains low, and derivatives traders are probably waiting for stronger signs.

Caution bleeds through

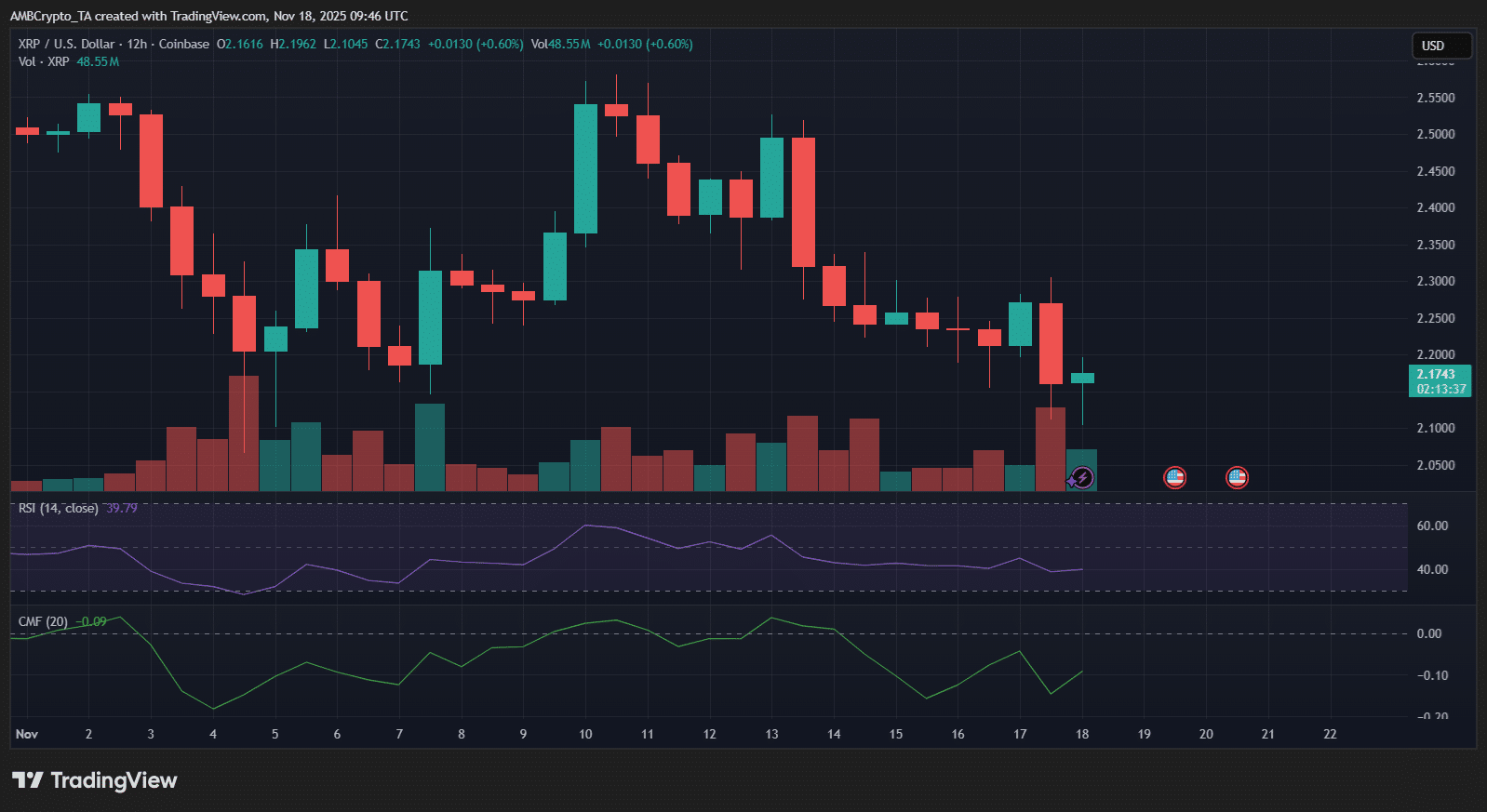

XRP was trading under pressure at press time, around $2.17 after a series of lower highs across the month. The RSI showed weak buying momentum and kept the token in a bearish space.

The CMF was also negative, which indicates outflows. Even though there was a brief spike in volume on the 17th of November, it wasn’t enough to shift the bigger trend.

Source: TradingView

Overall, XRP needs more trader faith before any meaningful upside can form. Market analysts from firms like Glassnode highlight that while spot inflows provide foundational support, derivatives sentiment serves as a leading indicator for price direction. Historical data shows that XRP’s major rallies often coincide with funding rates flipping positive and open interest surging by at least 20%. As of mid-November 2025, these metrics remain subdued, underscoring a wait-and-see approach among leveraged traders.

The broader context for XRP inflows ties into Ripple’s ecosystem advancements, including expanded partnerships for cross-border payments. Reports from regulatory bodies like the SEC, as referenced in public filings, continue to influence investor behavior, with partial victories bolstering long-term holding. However, short-term price action at $2.17 reflects resistance from macroeconomic factors, such as interest rate expectations and Bitcoin’s dominance in the crypto space. On-chain metrics further reveal that active addresses for XRP have increased by 12% week-over-week, per Santiment data, aligning with the inflow narrative but not yet driving aggressive buying.

Institutional adoption plays a pivotal role here. Grayscale’s XRP trust, for instance, reported net positive creations during this period, drawing from high-net-worth individuals seeking diversified crypto exposure. This mirrors trends observed in other altcoins but stands out due to XRP’s utility in real-world remittances, processing over $70 billion in volume annually according to Ripple’s transparency reports. Yet, the neutral derivatives landscape tempers enthusiasm, as perpetual swaps on platforms like Binance show liquidation events evenly split between longs and shorts.

Frequently Asked Questions

What caused the spike in XRP investment inflows on November 14, 2025?

The November 14 spike in XRP investment inflows, reaching over $10 million, was driven by renewed optimism following Ripple’s announcements on payment integrations and favorable court rulings. Investors viewed this as a catalyst for adoption, leading to increased allocations in ETFs and trusts, as tracked by CoinShares weekly reports.

Is XRP a good investment amid current inflows and market caution?

XRP presents a balanced opportunity for investors interested in utility-driven cryptocurrencies, with recent inflows indicating support around $2.17. However, bearish indicators like negative CMF suggest monitoring for sustained volume before committing, ideal for those comfortable with volatility in the payments sector.

Key Takeaways

- XRP Inflows Signal Support: November 2025 saw $15 million enter investment products, concentrated on key dates, bolstering liquidity.

- Derivatives Remain Neutral: Funding rates near zero reflect trader hesitation, awaiting stronger momentum indicators.

- Price Faces Pressure: At $2.17, XRP needs volume surges to break bearish trends and capitalize on inflows.

Conclusion

In summary, XRP inflows in November 2025 highlight emerging investor confidence, even as derivatives caution and price pressures at $2.17 persist. With neutral funding rates and bearish on-chain signals like negative CMF, the asset requires broader market faith for upside potential. As Ripple continues advancing its payment solutions, staying informed on these dynamics will be key—consider diversifying your portfolio to navigate crypto’s evolving landscape.

Comments

Other Articles

XRP’s Bullish Positioning May Weather $1B Escrow Release

January 1, 2026 at 06:02 PM UTC

XRP ETF Inflows and RWA Growth Signal Potential Amid Stagnant Price

January 1, 2026 at 10:47 AM UTC

XRP ETF Inflows Hit $1.16B as Standard Chartered Eyes $8 Potential Amid Whale Selling

January 1, 2026 at 04:48 AM UTC