XRP May Extend Wave 2 Correction Toward $2.03 Amid Whale Accumulation and ETF Interest

XRP/USDT

$2,480,132,667.31

$1.3653 / $1.27

Change: $0.0953 (7.50%)

-0.0099%

Shorts pay

Contents

XRP is undergoing a Wave 2 correction in its price structure, targeting the $2.03 Fibonacci support level while trading below $2.41. This corrective phase involves choppy movements typical of Wave 2 patterns, with whale accumulation and ETF developments sustaining institutional interest amid broader market pressures.

-

XRP’s Wave 2 correction points toward $2.03 macro 0.5 Fibonacci support, aligning with expected overlapping swings.

-

Price action remains below the $2.41 resistance, opening potential for deeper retracements to the $1.65 zone.

-

Whale holdings have surged with over $2.36 billion in XRP accumulated recently, while only 58.5% of supply is profitable, per Santiment data.

XRP Wave 2 correction targets $2.03 amid ETF buzz and whale buys. Stay informed on price swings and institutional moves shaping crypto’s future. Explore key levels and market insights now.

What is XRP’s Wave 2 Correction and Its Target Levels?

XRP’s Wave 2 correction represents a temporary pullback in an overall upward trend, characterized by overlapping price swings that prevent a straight-line decline. Currently trading at $2.13, XRP is approaching the macro 0.5 Fibonacci retracement at $2.03, with the $2.41 level serving as key resistance. Analysts indicate this structure remains intact below $2.41, setting the stage for potential deeper supports like $1.65 before resumption of bullish momentum.

How Do Fibonacci Levels Influence XRP’s Corrective Path?

Fibonacci retracement levels provide critical support zones during XRP’s Wave 2 correction, with the 0.5 level at $2.03 acting as a primary target based on recent price action. Data from on-chain analytics shows relative strength index (RSI) forming a rising trendline despite lower prices, signaling underlying strength in this corrective phase. Experts, including those from Glassnode, highlight that prolonged consolidations in Wave 2 often test the 0.618 level at $1.65, where historical patterns suggest buying interest could emerge to fuel the next expansion.

Frequently Asked Questions

What Factors Are Driving XRP’s Current Price Below $2.41?

XRP’s price staying under $2.41 stems from the ongoing Wave 2 correction, where lower highs and lows align with Fibonacci targets. Institutional factors like ETF filings and whale accumulation provide counterbalance, but supply dynamics show 41.5% of tokens at a loss, per Santiment, adding selling pressure during rebounds.

Is Whale Accumulation Supporting XRP Amid This Correction?

Yes, large holders have accumulated over 9.74 billion XRP, valued at more than $2.36 billion in the past week, according to reports from Steph Is Crypto. This buildup, combined with ETF progress from firms like Franklin Templeton, underscores sustained institutional confidence even as XRP navigates its Wave 2 correction toward $2.03.

Key Takeaways

- XRP Wave 2 Correction Structure: Price targets $2.03 Fibonacci support with choppy swings below $2.41 resistance, maintaining validity for deeper retracements.

- Institutional and On-Chain Signals: Whale accumulation exceeds $2.36 billion recently, while only 58.5% of supply is profitable, indicating potential for rebounds at key levels.

- ETF Developments: Progress in spot XRP ETF filings by Franklin Templeton keeps market focus strong, positioning XRP for post-correction growth.

Conclusion

As XRP’s Wave 2 correction unfolds toward the $2.03 Fibonacci support, the interplay of whale accumulation and ETF advancements highlights resilient institutional interest in this key cryptocurrency. With on-chain data revealing only 58.5% of supply in profit and trading firmly below $2.41, the setup favors a strategic pause before broader upside resumption. Investors should monitor these levels closely for opportunities in the evolving crypto landscape, staying attuned to regulatory and market shifts ahead.

XRP moves within a Wave 2 correction toward $2.03 as price stays under $2.41 while ETFs and whale accumulation keep strong market focus.

- XRP remains in a corrective Wave 2 pattern that may extend toward the $2.03 Fibonacci support.

- Trading stays below $2.41, keeping the path open for deeper targets including the $1.65 zone.

- Whale accumulation and ETF progress maintain strong institutional focus despite market pressure.

XRP continues to move within a corrective pattern, and the broader market structure still points toward the macro 0.5 Fibonacci support at $2.03. The current movement remains choppy because Wave 2 patterns often form through overlapping swings. Analysts note that this path was expected, and the structure remains valid while price stays below the macro 0.382 level at $2.41. At the time of writing, XRP was trading at $2.13.

Corrective Structure Moves Toward Key Fibonacci Levels

According to analysis prepared by Casi Trades, XRP is still likely moving toward the macro 0.5 support at $2.03. The analyst stated that Wave 2 patterns rarely fall in a straight line, and the current choppiness reflects normal corrective behavior. The market formed lower highs and lower lows as the decline progressed, and each move aligned with deeper Fibonacci retracement zones.

🚨 XRP’s Macro Structure Still Points Directly to $2.03! 🚨

XRP is still likely making its way down toward the macro .5 fib support at $2.03, and the way price is moving fits that expectation. This move was never going to be a straight drop. Wave 2’s are corrective! The… pic.twitter.com/EnKgZg4JfU

— CasiTrades 🔥 (@CasiTrades) November 18, 2025

The chart includes the macro 0.382 resistance at $2.41, and this level remains the invalidation point for a deeper drop. Analysts say that XRP continues to trade below this line, and the structure continues to point toward a sweep of $2.03 before a stronger reversal attempt.

The macro 0.618 level at $1.65 also stays valid, and Wave 2 patterns regularly reach this area when consolidation stretches for long periods. Data from on-chain providers shows RSI forming a rising line while price moves lower, and analysts view this as part of the corrective path. The broader structure prepares the market for the next expansion phase once the downward targets complete.

Liquidity Trends and ETF Interest Shape Market Focus

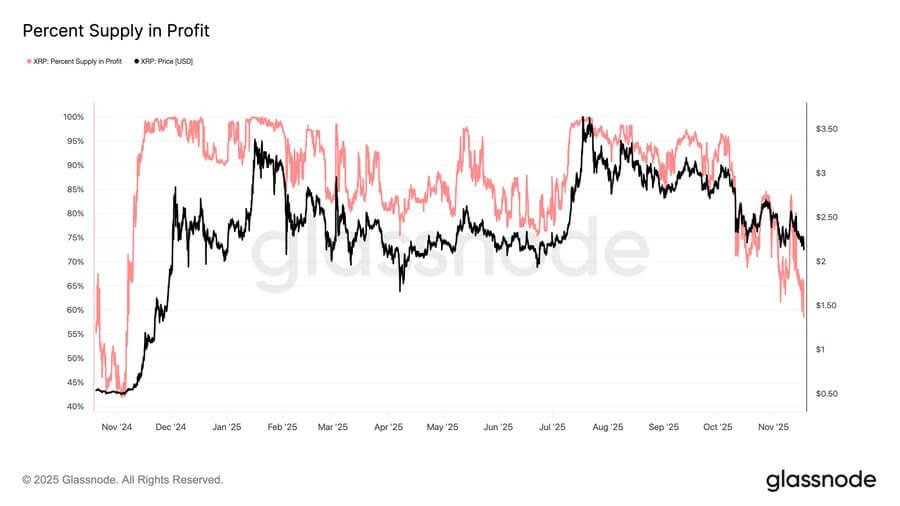

According to data reported by Santiment, only 58.5% of XRP supply is in profit, marking the lowest level in one year. About 41.5% of tokens remain at a loss, which adds pressure during rebounds when holders attempt to reduce exposure.

Source: Glassnode(X)

CoinMarketCap data also shows a slight decrease in circulating supply on exchanges, which may reduce short-term liquidity. Institutional attention continues as Franklin Templeton prepares its spot XRP ETF for launch.

A Bloomberg analyst observed that the structured progress in filings keeps XRP in active discussions among large investors. Whale activity remains strong, and Steph Is Crypto reported that whales accumulated over $2.36 billion worth of XRP in one week, bringing totals to 9.74 billion XRP.