XRP Open Interest Falls to $504M on Binance, Signaling Potential Decline in Trader Participation

XRP/USDT

$2,480,132,667.31

$1.3653 / $1.27

Change: $0.0953 (7.50%)

-0.0099%

Shorts pay

Contents

XRP Open Interest on Binance has declined to $504 million, the lowest since November 2024, due to reduced trader participation and negative funding rates signaling bearish sentiment. This drop from $1.7 billion reflects liquidity outflows and limited buyer activity amid weakening prices around $2.

-

XRP Open Interest plummeted from $1.7 billion to $504 million on Binance, indicating significant liquidity withdrawal and diminished trading engagement.

-

Negative funding rates persist, showing short sellers dominate as they pay to hold positions while long positions struggle to gain traction.

-

XRP price has weakened to $2, with no signs of institutional accumulation, supported by Binance derivatives data highlighting reduced market momentum.

Discover why XRP Open Interest is declining on Binance to $504M, with negative funding rates and price drops to $2 signaling bearish trends. Explore implications for traders now.

What is causing the decline in XRP Open Interest on Binance?

XRP Open Interest on Binance has sharply declined to $504 million, marking the lowest level since November 2024, primarily due to reduced trader participation and liquidity outflows across derivatives markets. This contraction from peaks above $1.7 billion reflects a broader shift away from sustained positioning, exacerbated by negative funding rates that favor short sellers. As prices hover around $2, the absence of fresh buyer interest prevents any meaningful recovery, underscoring a cautious market environment.

Why are funding rates remaining negative for XRP derivatives?

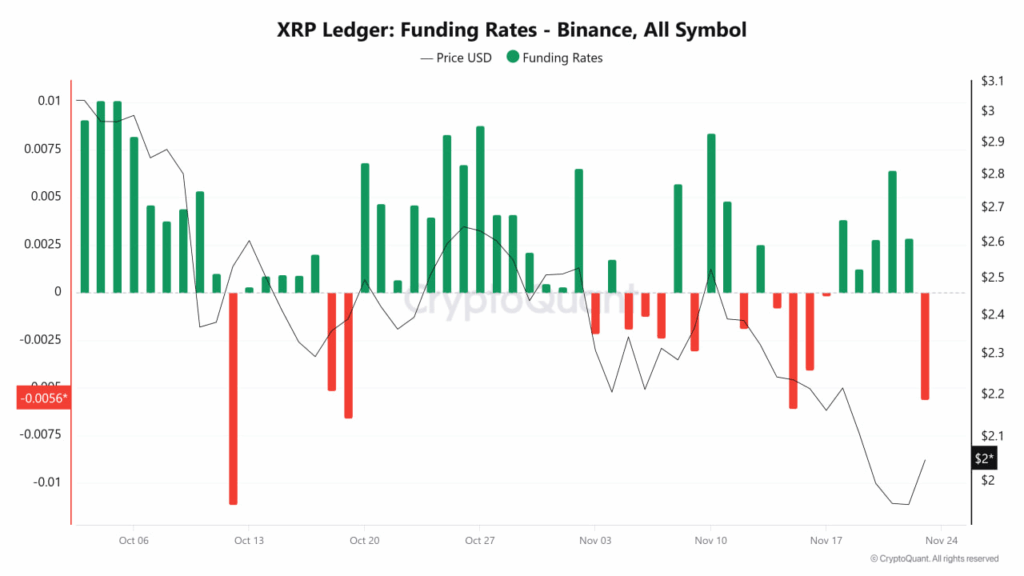

Funding rates for XRP on Binance have frequently dipped into negative territory over the past two months, indicating that short sellers are willing to pay fees to maintain their bearish positions. This dynamic arises when the cost of perpetual contracts tilts toward shorts, as seen in recent Binance derivatives data, which shows limited long-side activity to counterbalance the pressure. Negative rates persist because buyer momentum has not rebuilt sufficiently, allowing sellers to retain dominance and further dampen overall market participation.

According to analysis from CryptoQuant, as referenced in market reports, this funding behavior aligns with broader liquidity challenges, where open interest contractions amplify the bearish tilt. Short sentences highlight the key issue: sellers control the narrative, buyers hesitate, and rates fail to stabilize positively. Expert observers, including insights from Arab Chain, note that such patterns often precede prolonged consolidation phases, backed by historical data showing similar rates correlating with price retreats of up to 20% in comparable assets.

This sustained negativity not only reflects trader sentiment but also deters new entries, as the financial burden on longs discourages aggressive positioning. In fact, Binance figures indicate that funding has averaged -0.01% in recent sessions, a level that reinforces the downward bias without immediate reversal signals.

source: cryproquant

The chart from CryptoQuant illustrates these trends clearly, with funding rate fluctuations underscoring the imbalance. Without a shift in institutional flows, as evidenced by stagnant large trader metrics, recovery remains elusive. This setup, per Arab Chain’s observations, points to a market awaiting clearer catalysts before reversing the decline.

Frequently Asked Questions

What does the drop in XRP Open Interest to $504 million mean for traders?

The decline in XRP Open Interest to $504 million on Binance signals reduced market depth and potential volatility spikes, as fewer positions mean less liquidity to absorb price swings. Traders should monitor for further outflows, which could exacerbate downside risks around $2, based on current derivatives data from Binance, urging caution in leveraging positions without signs of reversal.

How might negative funding rates impact XRP price in the short term?

Negative funding rates for XRP suggest ongoing bearish pressure, likely keeping prices suppressed near $2 as short sellers hold sway and buyers face higher costs. This could lead to gradual declines unless positive catalysts emerge, with voice search queries like this highlighting the need for diversified strategies in volatile crypto environments.

Key Takeaways

- XRP Open Interest Decline Signals Caution: The drop to $504 million from $1.7 billion indicates waning trader commitment, urging investors to reassess exposure in derivatives markets.

- Negative Funding Reinforces Bearish Bias: Persistent short dominance, as shown in Binance data, limits upside potential and highlights the role of liquidity in price stability.

- No Institutional Boost in Sight: Absence of large trader accumulation suggests monitoring broader market trends for entry points into XRP positions.

Conclusion

The decline in XRP Open Interest on Binance to $504 million, coupled with negative funding rates, paints a picture of a derivatives market under strain, with prices weakening to $2 amid reduced participation. As liquidity continues to ebb without institutional inflows, traders face a landscape defined by caution and limited momentum. Looking ahead, watchful eyes on funding stabilization and open interest rebounds could signal shifts, making it essential for market participants to stay informed and adapt strategies accordingly.

XRP Open Interest declines to $504M on Binance, signaling lower trader participation as funding rates remain negative and prices weaken.

XRP Open Interest has recorded its lowest level since November 2024, as fresh Binance data shows deepening pressure across the derivatives market. The steady reduction in participation points to a market that is struggling to sustain directional interest.

Binance derivatives figures show that XRP has moved into a phase defined by weaker trading commitment. Open Interest has fallen from levels above $1.7 billion to nearly $504 million, after briefly touching $473 million. This drop shows that traders are exiting positions on both sides.

The contraction appears at a time when price has retreated to $2. XRP was trading above the $2.5–$3 range in recent weeks. With fewer positions being reopened, the market now moves with reduced conviction.

A recent tweet from Arab Chain noted the sharp withdrawal of liquidity. It pointed to traders avoiding long-term exposure as market pressure increased. This reflects reduced appetite for sustained participation.

Funding Rates across Binance derivatives have often moved into negative territory during the past two months. Negative readings show that short sellers are paying to maintain their positions. This behavior suggests continued preference for downside exposure.

The presence of negative funding also signals that buyers are not stepping in with enough strength to shift the bias. Market conditions remain driven by short-term reactions instead of structured positioning. The absence of improving funding indicates that sellers are keeping control.

Arab Chain’s post reinforced this trend, noting that funding has struggled to stabilize. This pattern, combined with falling price levels, shows reduced confidence among derivatives traders.

Price action around $2 shows no early signs of forming a recovery base. The retreat from recent highs follows a period of shrinking liquidity. With no improvement in Open Interest, the market continues to rely on short-lived activity.

The lower price range also mirrors the broader decline in participation. Without fresh liquidity entering the market, attempts to form upward momentum remain limited. The structure continues to weaken as traders avoid reopening large positions.

According to the shared Binance data, there is no evidence of large traders or institutions adding exposure. The market stays under seller control while derivatives metrics continue pointing toward reduced strength.

Comments

Other Articles

XRP’s Bullish Positioning May Weather $1B Escrow Release

January 1, 2026 at 06:02 PM UTC

XRP ETF Inflows and RWA Growth Signal Potential Amid Stagnant Price

January 1, 2026 at 10:47 AM UTC

XRP ETF Inflows Hit $1.16B as Standard Chartered Eyes $8 Potential Amid Whale Selling

January 1, 2026 at 04:48 AM UTC