XRP Price Signals Potential Head-and-Shoulders Top Amid Bearish Metrics

XRP/USDT

$2,480,132,667.31

$1.3653 / $1.27

Change: $0.0953 (7.50%)

-0.0099%

Shorts pay

Contents

XRP price hovers at $1.86, down 2% amid a 19% trading volume surge to $1.9 billion, indicating bearish divergence from a head-and-shoulders pattern, declining open interest, and negative funding rates.

-

XRP price forms head-and-shoulders top on daily chart, with neckline support at $1.80-$1.85 under pressure.

-

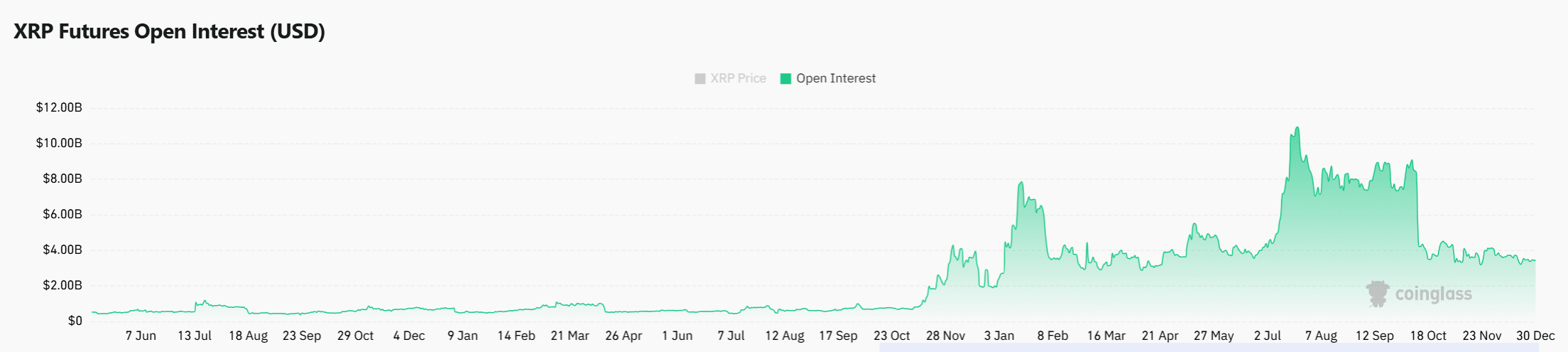

Open interest falls 8.43% to $3.26 billion despite volume rise, showing leverage unwind.

-

Funding rates turn negative at -0.0010%, liquidation clusters below $1.85 signal downside risk.

XRP price struggles despite surging volume, bearish signals from charts and derivatives dominate. Key levels at $1.80 watch closely. Discover insights for informed trading decisions today. (152 characters)

What is the current XRP price analysis signaling?

XRP price trades around $1.86, reflecting a nearly 2% daily decline despite trading volume climbing above $1.9 billion, up 19%. This divergence highlights weakening buyer momentum as sellers defend resistance near $1.95. Data from TradingView and CoinGlass underscore bearish structure and leverage dynamics pressuring the asset lower.

How do XRP price chart patterns indicate downside risk?

The daily chart reveals a classic head-and-shoulders formation for XRP price. The left shoulder peaked near $2.30, the head at $3.00, and the right shoulder failed below $2.50. Price now tests neckline support between $1.85 and $1.80, with bounces growing weaker. TradingView data shows price below the right-shoulder trendline, confirming distribution. A break below $1.80 could target $1.60-$1.50, per standard pattern measurements.

Source: TradingView

Frequently Asked Questions

Why is XRP price showing bearish divergence with high trading volume?

XRP price declines despite 19% volume increase to $1.9 billion because sellers absorb demand at resistance levels around $1.95. This lack of continuation signals fading momentum. CoinGlass metrics show leverage exiting, preventing sustained rallies in 40-50 words of analysis.

What happens if XRP price breaks below $1.80 support level?

If XRP price falls below $1.80, expect accelerated downside from triggered liquidations in dense clusters near $1.77 and $1.60. Negative funding rates support short positions, likely drawing price toward $1.50 amid unwind dynamics, sounding clear for voice search.

Source: CoinGlass

Source: CoinGlass

Key Takeaways

- Bearish Chart Structure: XRP price head-and-shoulders pattern targets below $1.80 on break.

- Leverage Decline: Open interest drops 8.43% to $3.26 billion, favoring caution over dip buys.

- Downside Liquidity: Heatmap shows clusters under $1.85; monitor for liquidation cascades.

Source: CoinGlass

Conclusion

XRP price analysis reveals consistent bearish signals across technical structure, open interest decline to $3.26 billion, negative funding at -0.0010%, and liquidation concentrations below $1.85. Sellers maintain control near $1.95 resistance, with volume rises failing to spur upside. Traders should watch $1.80 closely; a hold may stabilize, but breach invites deeper corrections toward $1.50. Stay vigilant on XRP price developments for strategic positioning.

Comments

Other Articles

XRP’s Bullish Positioning May Weather $1B Escrow Release

January 1, 2026 at 06:02 PM UTC

XRP ETF Inflows and RWA Growth Signal Potential Amid Stagnant Price

January 1, 2026 at 10:47 AM UTC

XRP ETF Inflows Hit $1.16B as Standard Chartered Eyes $8 Potential Amid Whale Selling

January 1, 2026 at 04:48 AM UTC