XRP Rally Driven by ETF News: Short-Term Gains Possible Despite Bearish Outlook

XRP/USDT

$2,480,132,667.31

$1.3653 / $1.27

Change: $0.0953 (7.50%)

-0.0099%

Shorts pay

Contents

XRP is experiencing a notable rally in late November 2025, driven by Franklin Templeton’s decision to include it in their Crypto Index ETF and the launch of their spot XRP product. This institutional interest has pushed prices toward $2.15, retesting key resistance as support amid reduced exchange reserves signaling potential short squeezes.

-

On-chain data reveals declining exchange reserves, hinting at reduced selling pressure and possible short squeezes fueling the XRP rally.

-

Institutional adoption surges as Franklin Templeton expands its ETF to hold XRP, marking a significant step for broader crypto integration.

-

Technical indicators like OBV show weak buying volume, suggesting the rally may face resistance at $2.55 without stronger momentum.

Discover why XRP is rallying in 2025 amid ETF approvals and institutional moves. Explore price analysis, key levels, and future outlook—stay ahead in crypto investments.

What is causing the current XRP rally?

XRP rally in late November 2025 stems primarily from institutional developments, including Franklin Templeton’s inclusion of XRP in its Franklin Crypto Index ETF following SEC approval of a Cboe rule change. This allows expanded crypto holdings for ETFs, boosting investor confidence. Additionally, the launch of Franklin Templeton’s XRPZ Trust has triggered short-term bullish momentum, pushing prices above previous resistance levels.

Why is institutional interest key to XRP’s price movement?

The SEC’s approval of the Cboe rule enables institutions to diversify their digital asset portfolios beyond initial offerings, directly impacting XRP’s market dynamics. Franklin Templeton, a prominent asset manager, announced plans to incorporate Ripple’s XRP into its ETF, as reported by COINOTAG, to enhance the fund’s scope. This move aligns with broader trends where reduced exchange reserves—down significantly in recent weeks—indicate accumulating interest from large holders. Expert analysts note that such institutional inflows could stabilize XRP, historically volatile due to regulatory uncertainties. For instance, on-chain metrics from platforms like TradingView highlight a 15% drop in exchange balances over the past month, correlating with a 10% price uptick. Short-selling positions remain high, setting the stage for potential squeezes if buying pressure intensifies. However, the On-Balance Volume (OBV) indicator reflects subdued buyer commitment, with volumes not surpassing recent highs, underscoring the need for sustained demand to break higher.

Frequently Asked Questions

What factors are driving the XRP rally in November 2025?

The XRP rally is propelled by Franklin Templeton’s ETF inclusion and XRPZ Trust launch, approved under new SEC rules. These developments have attracted institutional capital, reducing available supply on exchanges and lifting prices from $2.05 to over $2.15 in a single day.

Is the XRP price trend turning bullish long-term?

While short-term gains show promise, the higher timeframe remains bearish until XRP surpasses $2.55 resistance. Daily charts indicate persistent downtrends with heavy selling volumes in early November, advising caution for investors seeking lasting reversals.

Key Takeaways

- XRP Rally Drivers: Institutional actions like Franklin Templeton’s ETF expansion and XRPZ launch have ignited short-term gains by enhancing legitimacy and drawing capital inflows.

- Technical Caution: OBV divergence signals weak volume behind the rally, with $2.55 as a critical level for confirming bullish reversal amid bearish higher-timeframe structures.

- Market Insight: Monitor exchange reserves and short positions for squeeze potential; diversify holdings and track regulatory updates to navigate XRP’s volatility effectively.

These gains are not enough for XRP bulls to celebrate

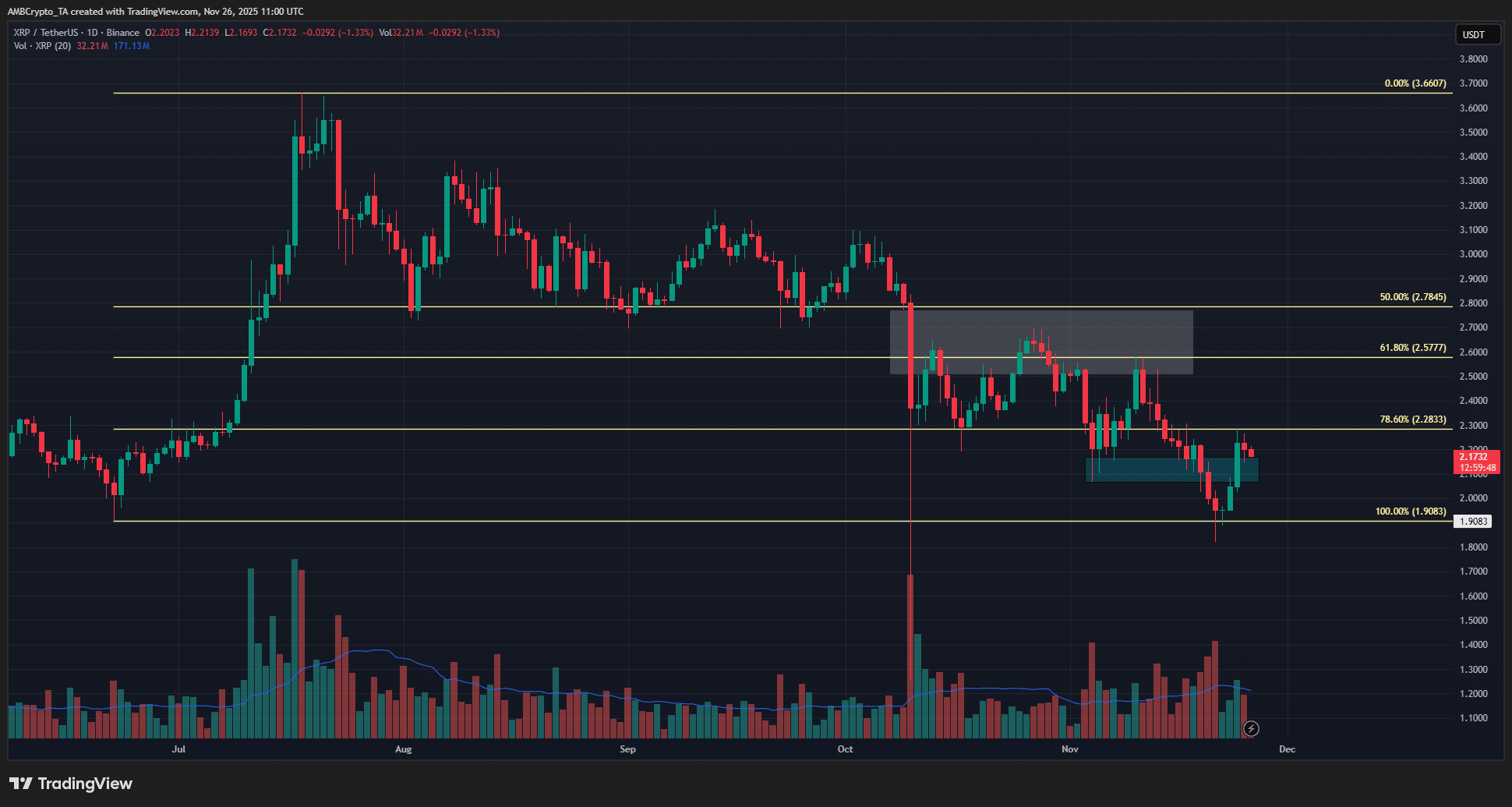

Source: XRP/USDT on TradingView

The 1-day chart illustrates a significant imbalance from the October 10 crash, forming a persistent resistance zone in subsequent weeks. November’s downturn, particularly after November 11, triggered substantial selling pressure, leading to a new swing low and reinforcing the ongoing downtrend on the daily timeframe.

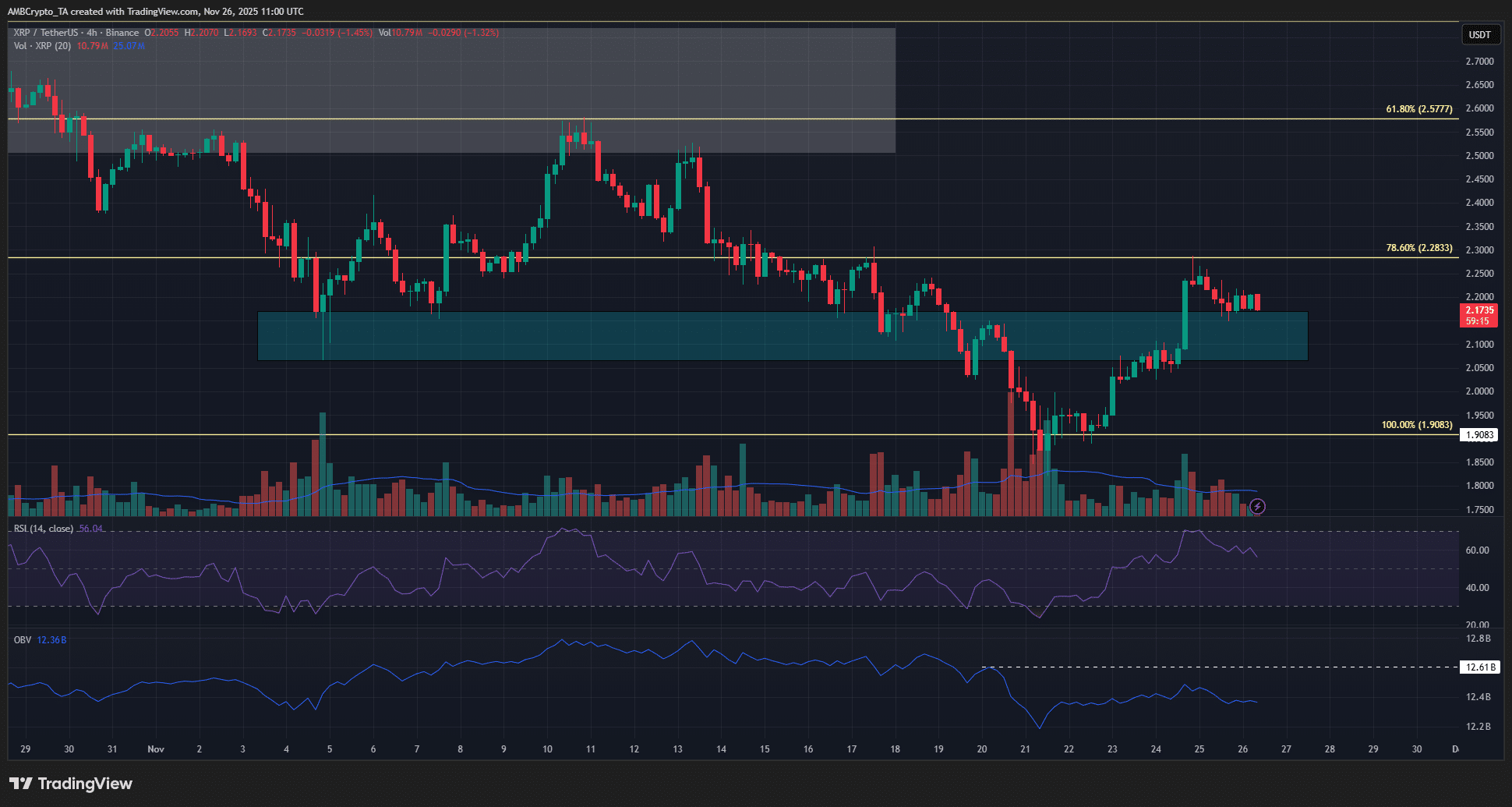

Source: XRP/USDT on TradingView

On the 4-hour chart, bullish internal structure emerges as XRP breaches the November 20 lower high at $2.15. However, OBV fails to exceed its own lower high, indicating insufficient buying volume to sustain upward momentum. Over the past three months, similar breaches have led to rallies toward impulse origins, such as the November 10 peak at $2.55, which subsequently initiated further declines. Thus, while a push to $2.40-$2.50 remains feasible, history suggests potential rejection and renewed downside risks.

Conclusion

The XRP rally in November 2025, fueled by institutional milestones like Franklin Templeton’s ETF integration and product launches, represents a pivotal moment amid ongoing regulatory clarity. Yet, technical bearishness on higher timeframes and volume weaknesses caution against over-optimism regarding long-term XRP price movement. As exchange reserves dwindle and short positions build, investors should watch key levels closely; staying informed on institutional trends will be essential for capitalizing on future opportunities in the evolving crypto landscape.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.