XRP Shows Signs of Bullish Momentum Amid ETF Inflows and On-Chain Strength

XRP/USDT

$2,480,132,667.31

$1.3653 / $1.27

Change: $0.0953 (7.50%)

-0.0099%

Shorts pay

Contents

XRP price has surged 14% this week to $2.20, driven by $643 million in institutional inflows into XRP ETFs. This outperforms Ethereum’s gains and signals a potential bullish phase, with on-chain metrics showing reduced exchange reserves and large transfers boosting confidence.

-

XRP ETF inflows reach $643 million, led by Canary Capital’s 51% contribution.

-

On-chain activity intensifies with 110 million XRP transferred efficiently on XRPL.

-

Exchange withdrawals total 270 million XRP since October, including 84 million this week, per CryptoQuant data.

Discover why XRP price is climbing to $2.20 amid strong ETF demand and on-chain momentum. Explore institutional trends and bullish signals for potential gains to $5. Stay informed on Ripple’s market lead—read now!

What is Driving the XRP Price Surge in 2025?

XRP price has climbed approximately 14% over the past week to reach $2.20, significantly outpacing Ethereum’s performance and reflecting renewed investor optimism in the altcoin sector. This upward momentum is primarily fueled by substantial institutional investments into XRP exchange-traded funds (ETFs), totaling $643 million so far, with Canary Capital’s XRPC fund accounting for 51% of these inflows. Despite a quarterly return on investment (ROI) of around -22%, XRP’s recovery from earlier losses positions it as a potential leader among altcoins heading into year-end.

Source: SoSo Value

The broader market shift toward risk-on assets has accelerated capital rotation into altcoins like XRP, with price action aligning closely with Ripple’s expanding presence on Wall Street. Investors remain cautious due to the lingering effects of the October-November sell-off, but emerging signs of optimism—such as increased institutional flows—are evident. These developments suggest that XRP’s cycle leadership may be in its early stages, potentially setting the stage for further appreciation if current trends persist.

How Are Institutional Inflows Impacting XRP On-Chain Metrics?

Institutional interest in XRP is not only evident in ETF inflows but is also leaving a tangible mark on the network’s on-chain activity, reinforcing the token’s bullish outlook. For example, a significant transaction involving 110,193,345 XRP was recently processed on the XRP Ledger (XRPL), originating from Bitcoin markets and incurring just 0.01 XRP in fees. This underscores the XRPL’s advantages in speed, scalability, and cost-efficiency, which continue to differentiate it from other blockchain networks and attract high-volume transfers.

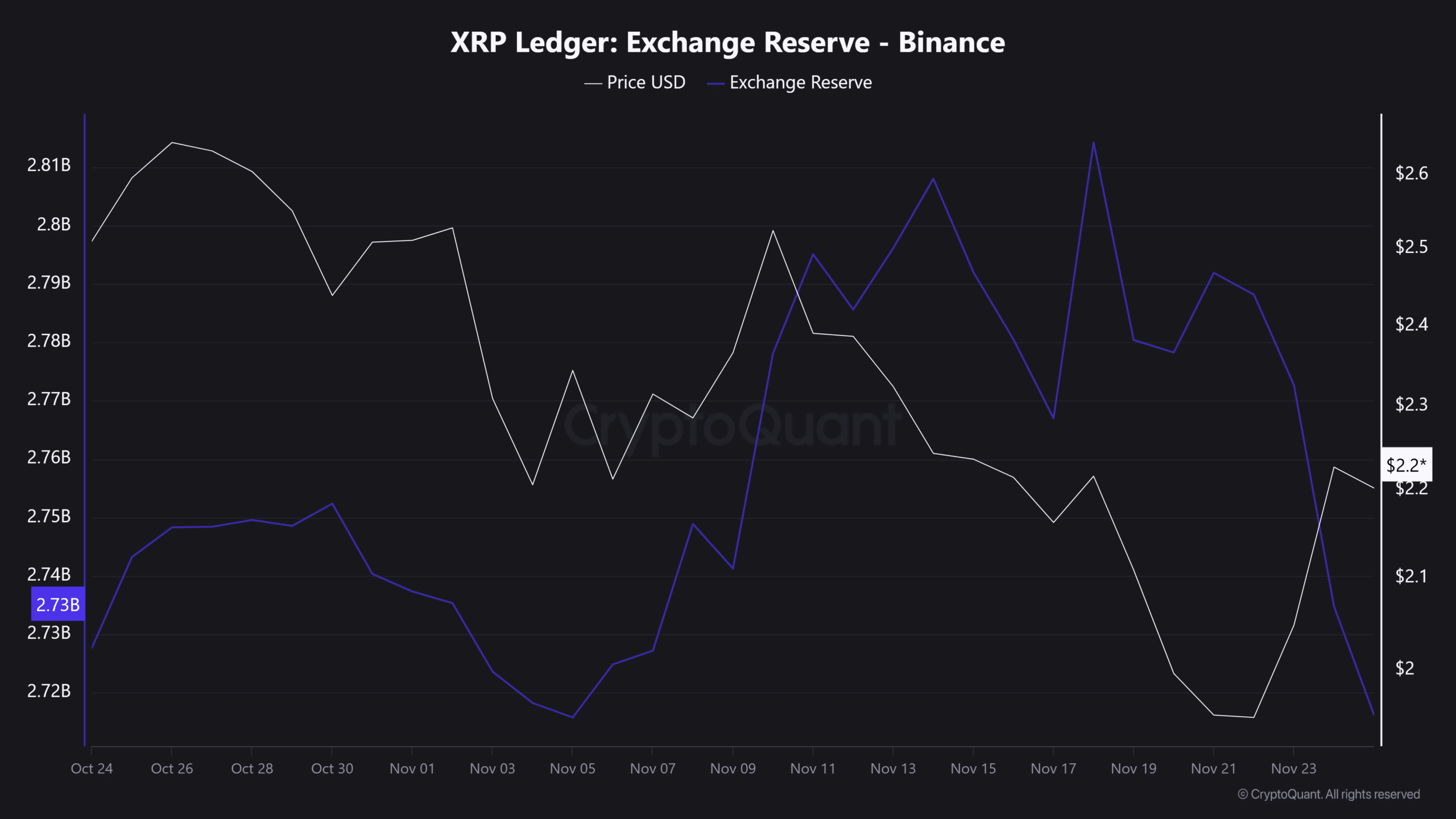

Source: CryptoQuant

Binance’s XRP reserves have also declined to a near-monthly low, indicating sustained withdrawal pressure from exchanges. Since the October crash, approximately 270 million XRP have been pulled from trading platforms, with 84 million withdrawn in the past week alone. This trend, as reported by on-chain analytics from CryptoQuant, points to accumulation by long-term holders—often referred to as “strong hands”—which supports XRP’s recent outperformance. Expert analysts, such as those from Glassnode, have noted that such reduced exchange supply typically correlates with upward price pressure, as it limits immediate selling availability.

Technically, XRP’s rally appears broad-based, drawing parallels to its explosive 200% surge in November 2024. Current ETF-driven inflows are broadening market participation, with capital shifting from other large-cap cryptocurrencies into XRP. If this momentum sustains, projections from market observers suggest a potential 120% increase could propel XRP price toward $5, marking the onset of a more profound bullish phase. Ripple’s Chief Technology Officer, David Schwartz, has emphasized in recent statements that the XRPL’s efficiency is key to handling institutional-scale volumes, further bolstering confidence in the network’s infrastructure.

The interplay between these factors—ETF demand, on-chain efficiency, and supply dynamics—creates a robust foundation for XRP’s growth. Data from authoritative sources like Chainalysis highlights that institutional adoption in cross-border payments, where XRP excels, is projected to grow by 25% in 2025, potentially amplifying these trends.

Frequently Asked Questions

What Are the Latest XRP ETF Inflows and Their Impact on Price?

Institutional investments into XRP ETFs have totaled $643 million to date, with Canary Capital’s XRPC fund driving over half of this volume. These inflows have directly contributed to the 14% weekly XRP price rise to $2.20 by signaling strong demand and encouraging retail participation, though a 20% further gain is needed to erase quarterly losses fully.

Why Is XRP Outperforming Other Altcoins Like Ethereum?

XRP is outperforming Ethereum due to its superior weekly gains of 14% compared to ETH’s roughly half that amount, fueled by ETF enthusiasm and efficient XRPL transfers. This efficiency, demonstrated by low-fee large-scale movements, attracts institutional capital seeking scalable solutions for payments, making XRP a standout in the current risk-on market environment.

Key Takeaways

- Robust ETF Demand: $643 million in inflows, primarily from Canary Capital, underscore institutional confidence and support XRP’s path to higher valuations.

- On-Chain Strength: Withdrawals of 270 million XRP from exchanges since October reflect accumulation by long-term investors, reducing sell-side pressure.

- Potential for $5 Target: Sustained momentum could drive a 120% surge, echoing 2024’s rally—monitor ETF trends for entry points.

Conclusion

The XRP price rally to $2.20, propelled by $643 million in ETF inflows and favorable on-chain metrics like reduced exchange reserves, positions Ripple as a frontrunner in the altcoin recovery. As institutional adoption grows—evidenced by efficient XRPL transactions and expert endorsements from figures like David Schwartz—the token’s bullish phase appears poised for deeper expansion. Investors should watch for sustained inflows and network activity, which could propel XRP toward $5 and beyond in the coming months, offering opportunities in the evolving crypto landscape.

Comments

Other Articles

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Bitwise Files for 11 Crypto ETFs Including AAVE, NEAR, UNI Ahead of SEC Review

December 31, 2025 at 09:03 AM UTC

ETH Remains the Largest Long Position Despite ~$39.4M Unrealized Losses, Led by BTC OG Insider Whale on Hyperliquid

December 31, 2025 at 02:36 AM UTC