XRP Shows Signs of Overvaluation as Buying Pressure Declines, Potential Pullback Towards $1.85 Suggested

XRP/USDT

$2,431,226,288.85

$1.4703 / $1.4052

Change: $0.0651 (4.63%)

-0.0145%

Shorts pay

Contents

-

Recent on-chain data indicates that Ripple’s XRP may have entered an overvalued phase, potentially posing risks for short-term investors.

-

Simultaneously, a decline in the Money Flow Index signals waning buying momentum, suggesting a cautious approach for XRP traders.

-

As noted in a COINOTAG analysis, “XRP’s current market dynamics could push the token closer to its Fibonacci retracement levels if bearish trends persist.”

Ripple’s XRP shows signs of overvaluation amidst declining buying pressure, prompting caution among investors as market dynamics shift.

XRP Experiences Overvaluation Amidst Waning Momentum

Ripple’s XRP has demonstrated astounding growth in recent days, climbing as much as 25% before showing signs of plateauing. Evidence from the Network Value to Transaction (NVT) ratio highlights concerns of overvaluation as the token’s market capitalization has expanded more rapidly than its transaction volume. This trend warrants attention for potential shifts in XRP’s price trajectory.

The significant rise in the NVT ratio from 30.68 to 71.65 within just three days emphasizes that XRP’s appeal may be overstated, indicating a potential pause in the bullish trend. Traditionally, an increasing NVT ratio implies that price gains could be unsustainable, urging investors to reevaluate their positions in light of the current market conditions.

XRP Network Value to Transaction Ratio. Source: CryptoQuant

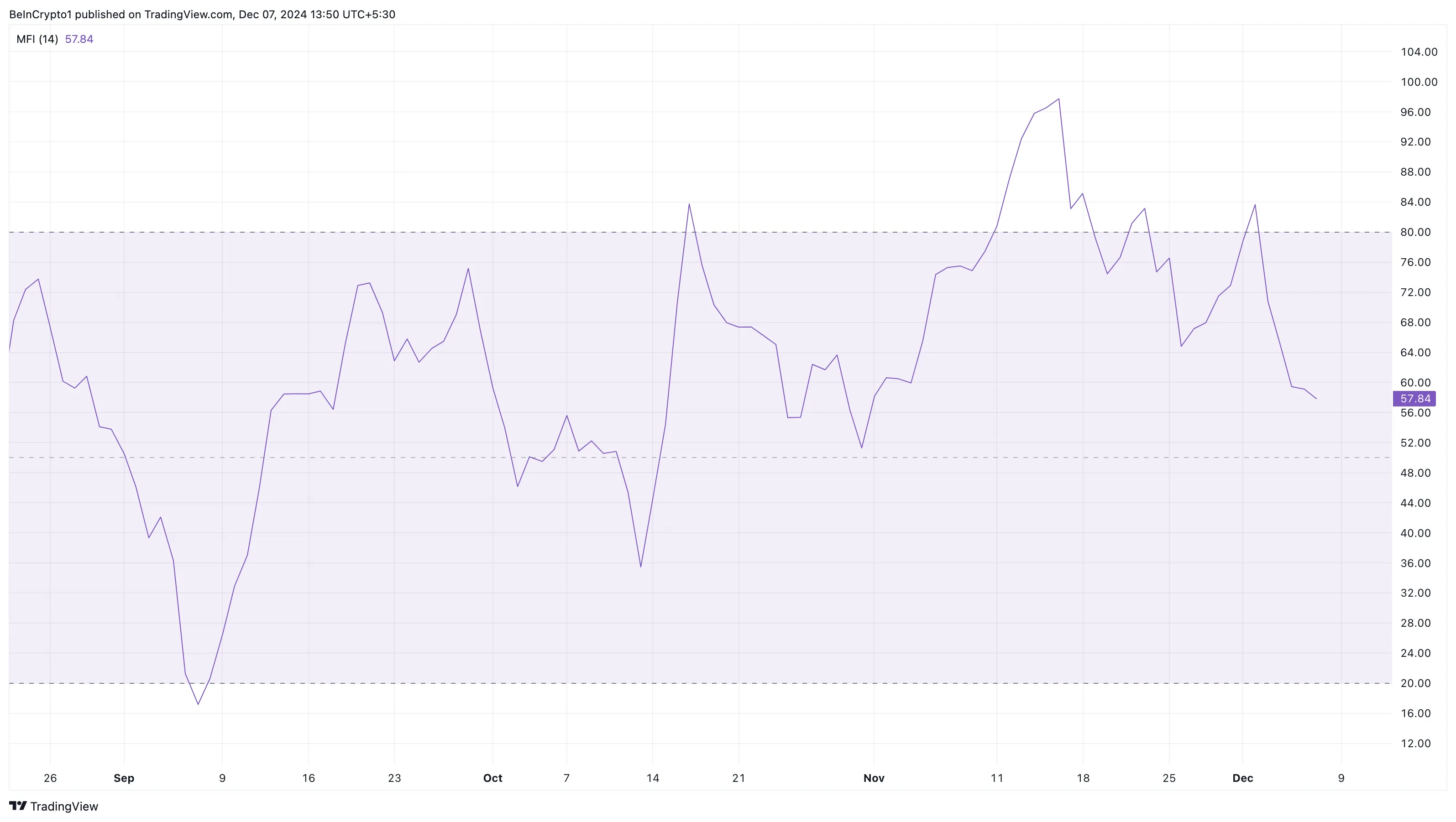

Adding weight to these findings, the Money Flow Index (MFI) has also been in decline, shifting from an overbought status reaching 83.20 back to lower levels. This could exacerbate downward pressure on XRP prices, as declining MFI suggests a lack of buying interest. When the MFI drops below the critical threshold of 20.00, the likelihood of oversold conditions will only amplify.

XRP Money Flow Index. Source: TradingView

XRP’s Price Target: Eyeing Sub-$2 Benchmarks

The current technical outlook suggests that despite XRP finding short-term support at $2.25, trading volume trends indicate a potential retreat. If bearish pressure solidifies in the coming sessions, XRP‘s price could face a decline towards the 23.6% Fibonacci retracement level at approximately $1.85.

In the event of a more pronounced sell-off, the next significant support could materialize around $1.40, aligning with the 38.2% Fib level. Conversely, if buying momentum returns and MFI readings rebound, any potential price forecasts could shift, allowing for a revisit of the $2.90 threshold, or even a challenge of the yearly high at $3.20.

XRP Daily Analysis. Source: TradingView

Conclusion

In summary, while Ripple’s XRP has seen remarkable gains recently, the data signals an urgent need for investors to approach the market with caution. With key indicators pointing towards possible overvaluation and declining buying interest, traders should remain vigilant. The upcoming days could determine whether these indicators result in a price correction or if XRP can sustain its growth and break previous resistance levels.