XRP Signals Potential Accumulation as Binance Reserves Drop and ETFs Attract Inflows

XRP/USDT

$2,480,132,667.31

$1.3653 / $1.27

Change: $0.0953 (7.50%)

-0.0099%

Shorts pay

Contents

XRP price has surged 22% recently, supported by a 2.7 billion token decline in Binance reserves and steady inflows into U.S. Spot ETFs since November 14, 2025. This indicates strong accumulation and institutional demand, positioning XRP for potential further gains above $2.20.

-

XRP reserves on Binance dropped by 2.7 billion tokens since October 2025, suggesting whale accumulation and reduced selling pressure.

-

XRP Spot ETFs in the U.S. have seen consistent inflows without outflows, reflecting growing Wall Street interest.

-

The token rebounded from key support at $1.85, a level that historically led to gains of 40-70%, with open interest rising 3.09% to $4.11 billion.

Discover why XRP price is rallying amid declining Binance reserves and ETF inflows. Explore key levels and trader sentiment for informed investment decisions in 2025.

What is driving the XRP price surge in 2025?

XRP price has experienced a notable 22% increase over the past five trading sessions, fueled by declining exchange reserves and robust institutional demand. This rebound follows a 40% drop since October 2025, with the token finding solid support at $1.85, a historically significant level. Rising open interest and long positions underscore trader confidence in continued upward momentum.

Why have Binance XRP reserves declined by 2.7 billion tokens?

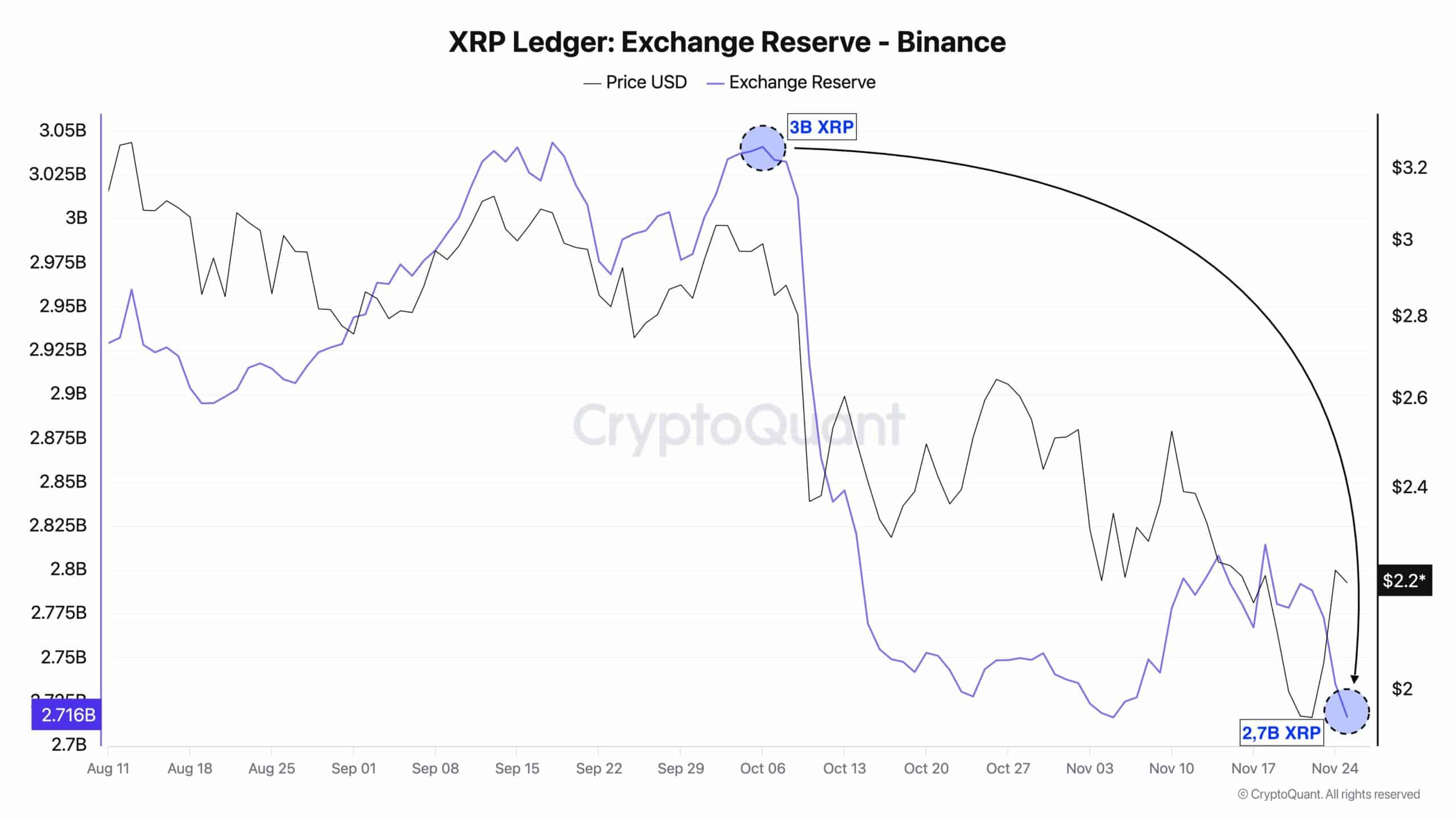

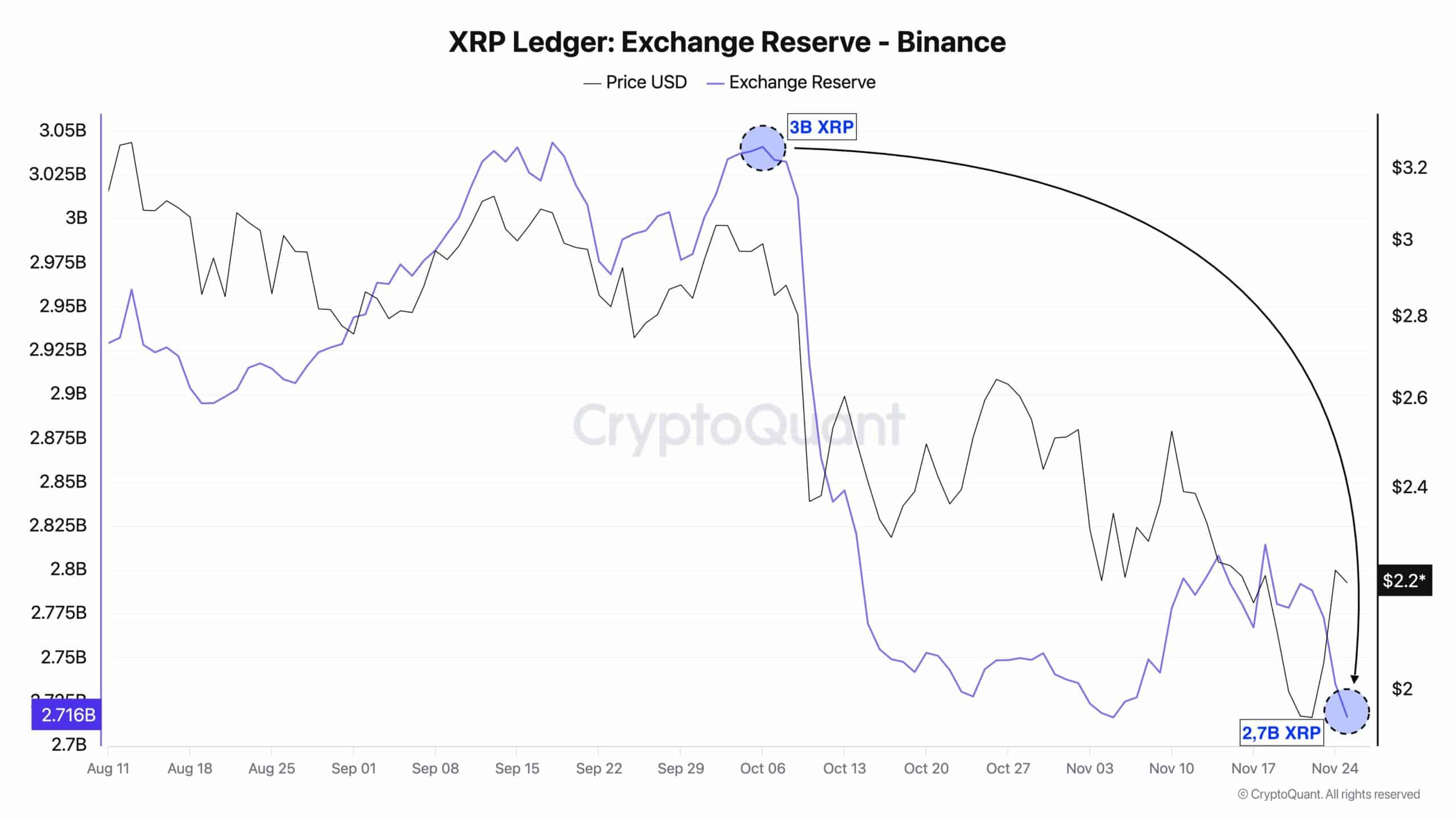

Binance’s XRP reserves have fallen to 2.7 billion tokens, one of the lowest points on record, as reported by on-chain analysts. Since October 6, 2025, approximately 300 million XRP have been withdrawn from the exchange, signaling potential accumulation by large holders. Exchange reserves track token movements in and out of platforms, helping gauge market sentiment; a decline like this often precedes buying pressure as assets move to private wallets.

This trend aligns with XRP’s price recovery, reducing available supply on the exchange and supporting the recent 22% rally. Data from blockchain explorers confirms the steady outflow, which could limit downside risks and encourage further price appreciation if demand persists.

Source: X/Darkfost_Coc

Experts note that such reserve reductions often correlate with bullish phases, as seen in XRP’s historical patterns where low exchange balances preceded significant rallies.

How are XRP Spot ETFs influencing market demand?

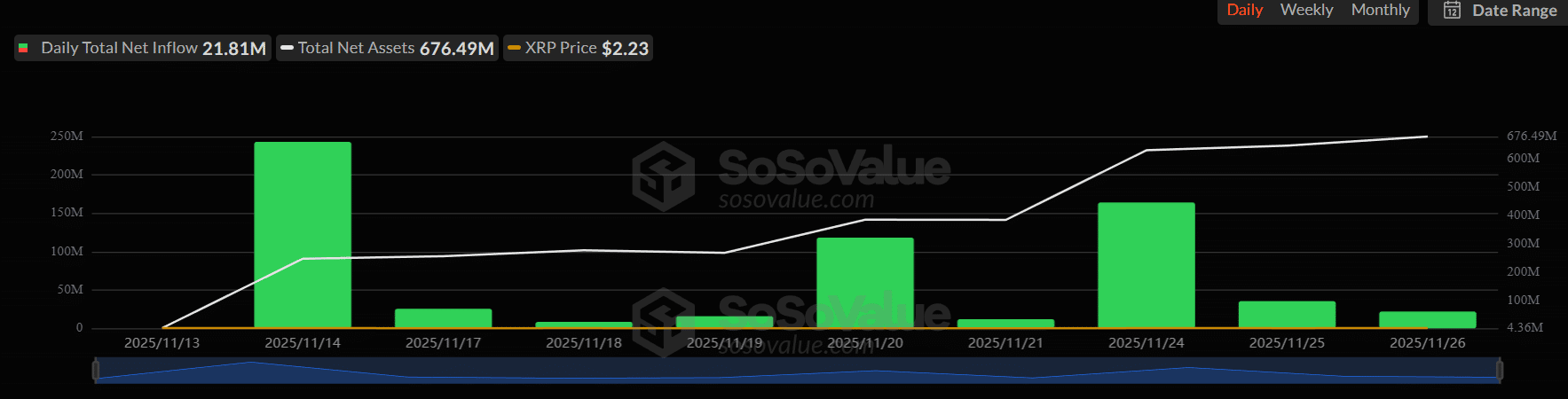

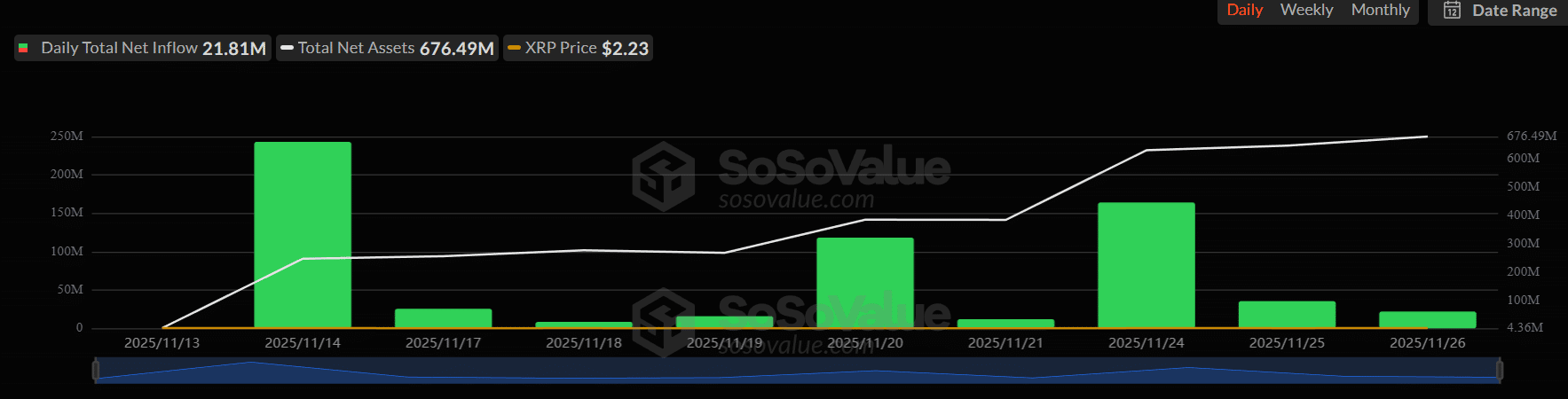

U.S. XRP Spot ETFs, launched on November 14, 2025, have attracted steady capital inflows without any recorded outflows, according to analytics from SoSoValue. This persistent positive netflow demonstrates increasing confidence from traditional investors, who view XRP as a viable asset for portfolio diversification amid broader crypto adoption.

The inflows highlight XRP’s growing appeal on Wall Street, potentially stabilizing the token’s price and encouraging further institutional participation. With no outflows since inception, these products are channeling fresh capital into the ecosystem, supporting the ongoing price recovery.

Source: SoSoValue

As one market analyst observed, “The ETF inflows are a game-changer for XRP, bridging crypto with traditional finance and bolstering long-term price stability.”

What are the key technical levels for XRP price?

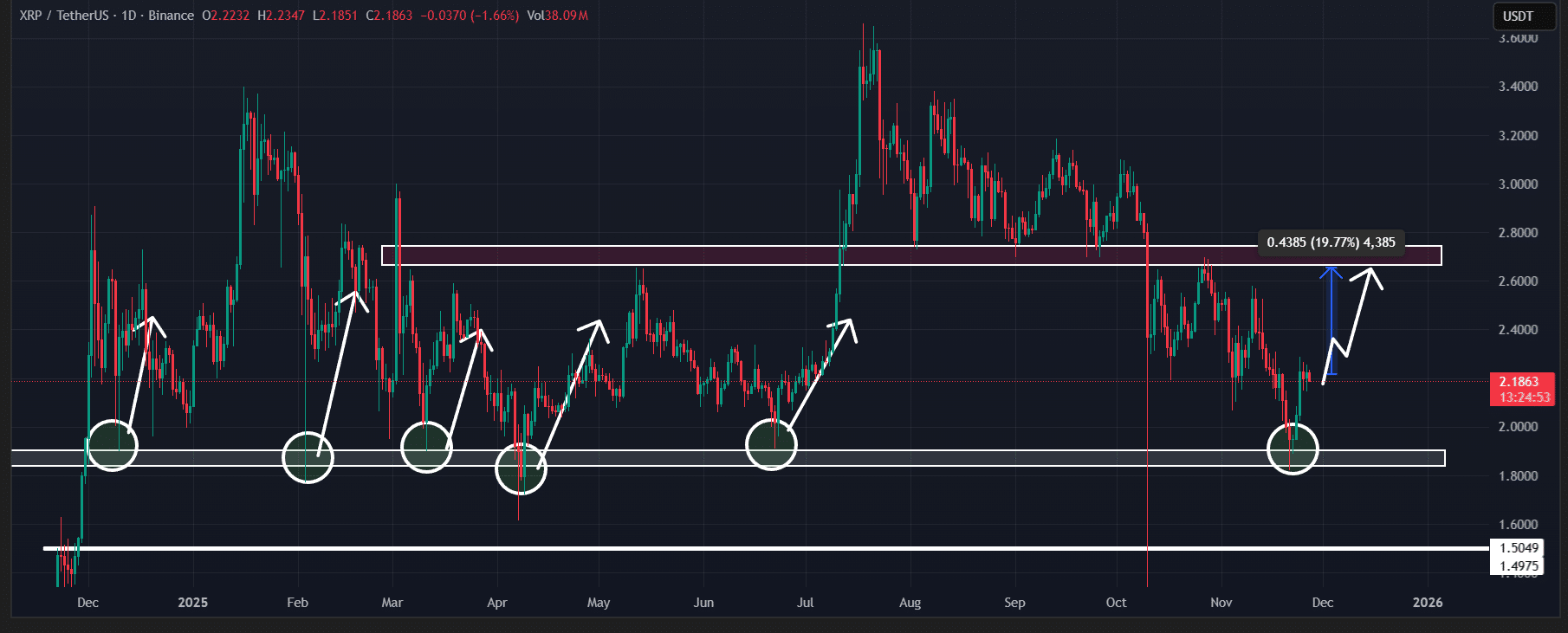

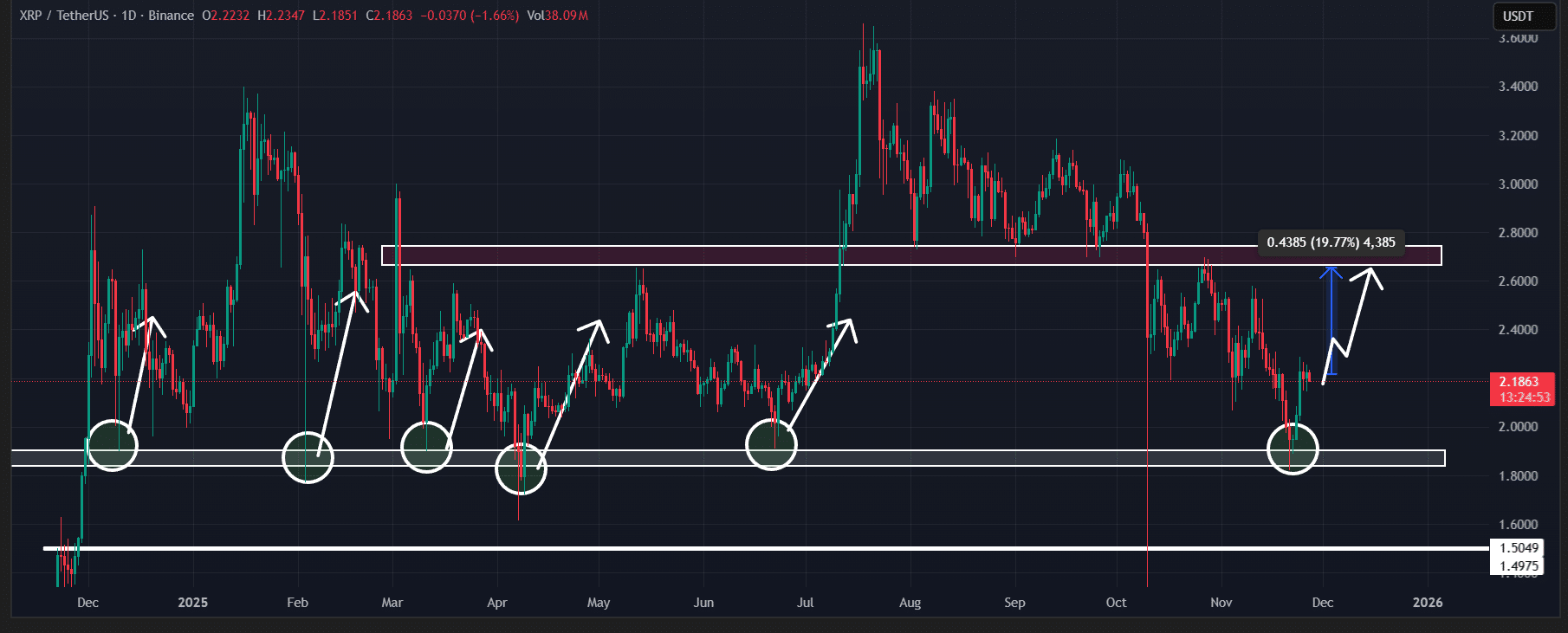

Currently trading at $2.20, up 1.05%, XRP’s open interest has increased 3.09% to $4.11 billion, indicating heightened leveraged trading and potential for volatility. The token has retested support at $1.85 multiple times since December 2024, consistently rebounding with gains ranging from 40% to 70% in prior instances.

This marks the sixth visit to $1.85, reinforcing its role as a strong foundation for upside moves. Technical indicators from platforms like TradingView show bullish patterns, with the recent 20% rebound suggesting sustained momentum if resistance at $2.26 holds.

Source: TradingView

Market participants should monitor these levels closely, as a break above $2.26 could target higher resistances, while a drop below $2.13 might trigger short-term corrections.

Why are traders focusing on long positions for XRP?

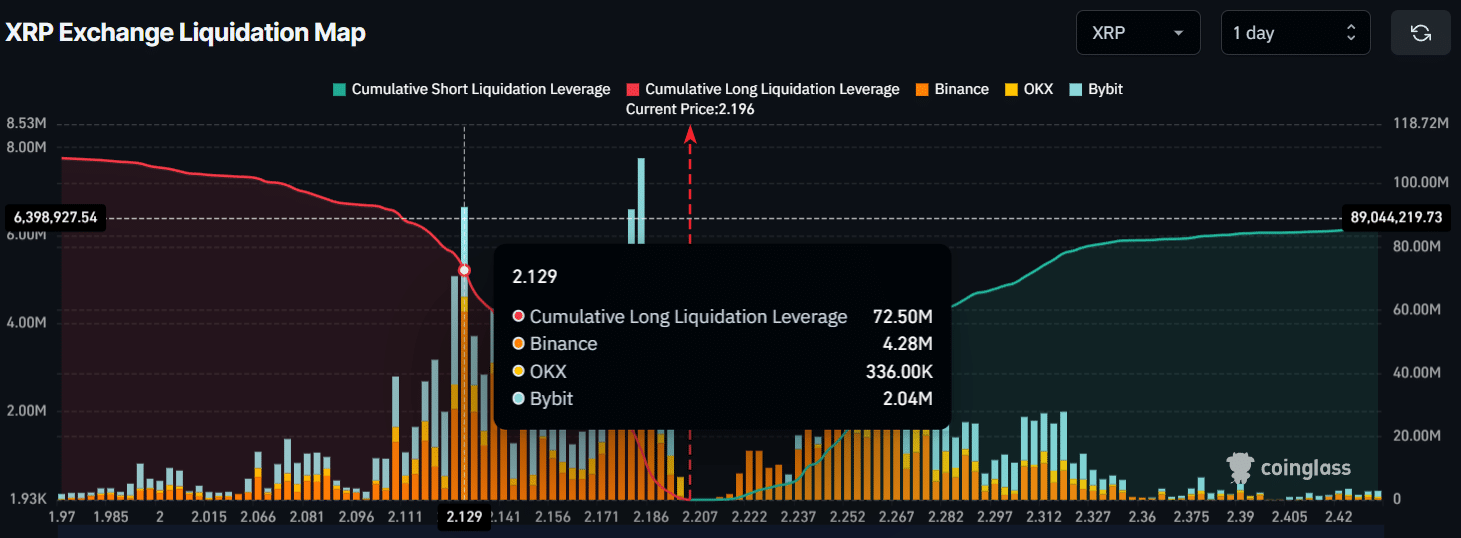

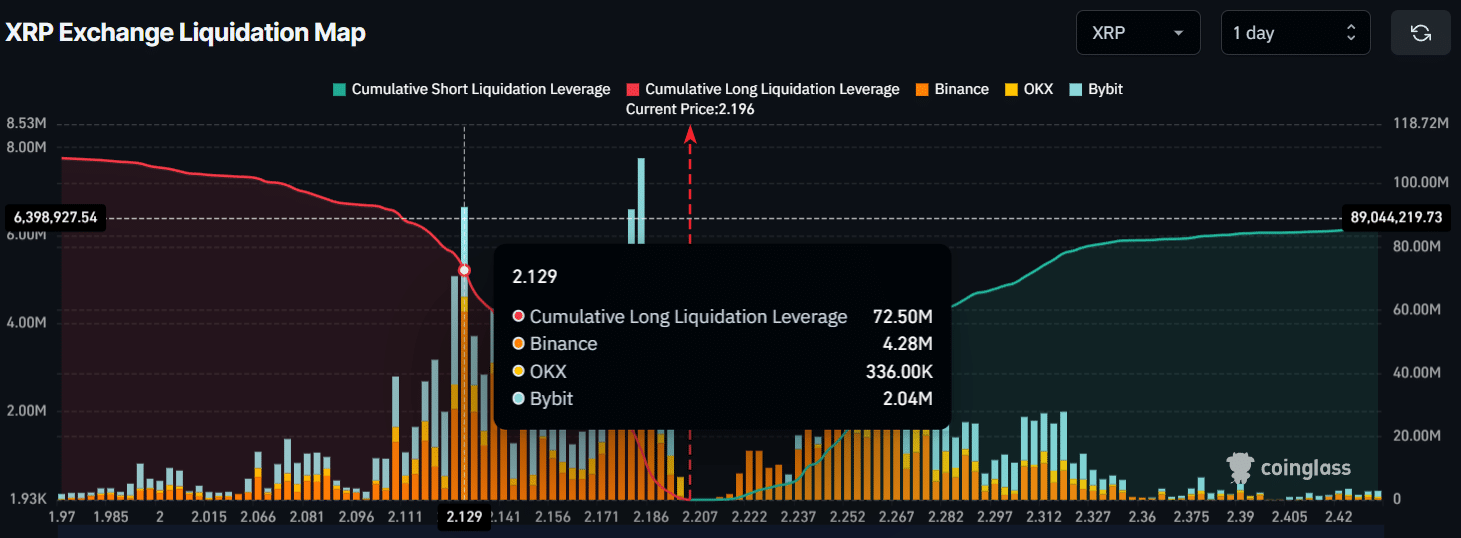

Traders are heavily leaning towards long positions, with $72.50 billion in leverage built around the $2.129 support level, compared to $40.95 billion in shorts at $2.264. Data from CoinGlass reveals this imbalance, pointing to dominant bullish sentiment and expectations that XRP will hold above key supports.

Intraday activity shows strong conviction in upward trends, amplified by the recent reserve declines and ETF demand. This positioning could lead to cascading liquidations if prices move favorably, potentially accelerating gains.

Source: CoinGlass

As derivatives data indicates, the market’s structure favors bulls, with limited risk of sharp declines in the immediate term.

Frequently Asked Questions

Is this a good time to buy XRP?

With Binance reserves down 2.7 billion and XRP Spot ETFs showing consistent inflows, current indicators suggest accumulation and demand growth. The rebound from $1.85 support, a historically bullish level, supports potential upside, though investors should consider market volatility and personal risk tolerance.

Is XRP bullish today?

Yes, XRP displays bullish momentum today, with traders building $72.50 billion in long positions near $2.129 and open interest rising to $4.11 billion. The 22% rally from $1.85 reflects strong sentiment, likely to continue if key supports hold, making it a favorable day for upward trends.

Key Takeaways

- Declining Reserves Signal Accumulation: Binance’s 2.7 billion XRP drop since October 2025 indicates whales are holding, reducing sell pressure and boosting price.

- ETF Inflows Drive Demand: U.S. Spot ETFs have seen no outflows since launch, attracting Wall Street capital and underscoring XRP’s institutional appeal.

- Technical Support Holds Strong: The $1.85 level has triggered rebounds historically; monitor $2.129 for longs to sustain the bullish trend.

Conclusion

The XRP price surge in 2025, driven by declining Binance reserves and robust Spot ETF inflows, positions the token for sustained growth amid favorable technicals. As accumulation trends persist and trader sentiment leans bullish, XRP could test higher levels soon. Investors are encouraged to stay informed on on-chain metrics and market developments for strategic positioning.

Comments

Other Articles

XRP’s Bullish Positioning May Weather $1B Escrow Release

January 1, 2026 at 06:02 PM UTC

XRP ETF Inflows and RWA Growth Signal Potential Amid Stagnant Price

January 1, 2026 at 10:47 AM UTC

XRP ETF Inflows Hit $1.16B as Standard Chartered Eyes $8 Potential Amid Whale Selling

January 1, 2026 at 04:48 AM UTC